Is UnitedHealth Group Stock Underperforming the Nasdaq?

With a market cap of $289 billion, UnitedHealth Group Incorporated (UNH) is a diversified health care company operating globally through four main segments: UnitedHealthcare, Optum Health, Optum Insight, and Optum Rx. Its businesses provide health benefit plans, care delivery, data and technology services, and pharmacy care solutions to individuals, employers, government programs, and health systems.

Companies valued at $200 billion or more are generally classified as “mega-cap” stocks, and UnitedHealth Group fits this criterion perfectly. Based in Eden Prairie, Minnesota, the company serves a broad range of consumers and organizations across the health care ecosystem.

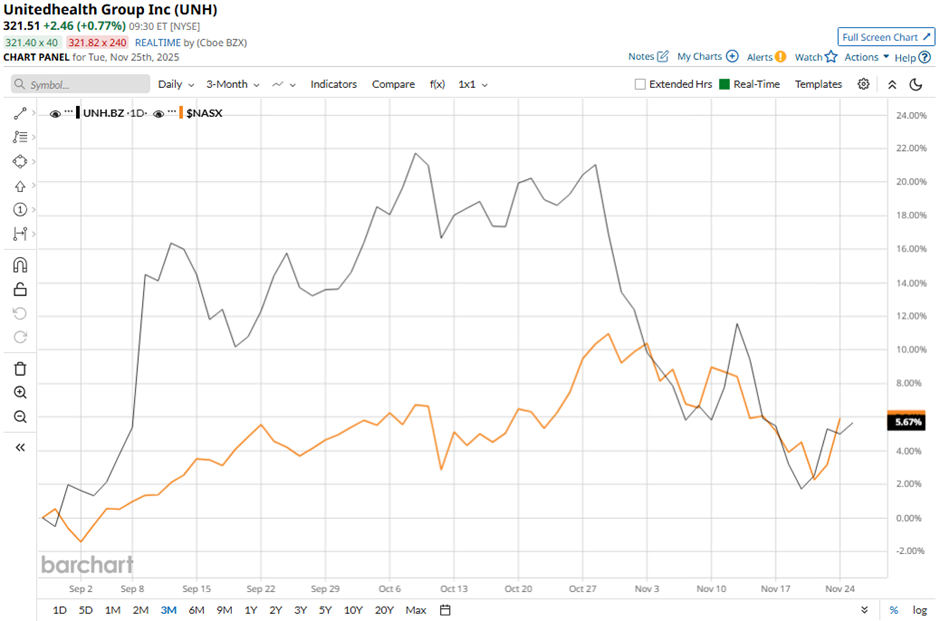

Shares of UnitedHealth Group have slipped 48.6% from its 52-week high of $622.83. The stock has risen 4.9% over the past three months, lagging behind the Nasdaq Composite’s ($NASX) 6.3% gain over the same time frame.

Longer term, UNH stock is down 36.8% on a YTD basis, underperforming NASX’s 18.1% increase. Moreover, shares of the largest U.S. health insurer have decreased 47.2% over the past 52 weeks, compared to NASX’s 19.7% return over the same time frame.

Despite a few fluctuations, the stock has been trading below its 50-day and 200-day moving averages since last year.

Despite reporting weaker-than-expected Q3 2025 revenue of $113.16 billion, shares of UNH rose marginally on Oct. 28 as the company delivered adjusted EPS of $2.92, beating the analyst estimate. Investors also welcomed UnitedHealth’s raised 2025 adjusted profit forecast to at least $16.25 per share, above both its prior outlook and analysts’ expectations. Confidence was further supported by management’s outlook for “durable and accelerating growth” starting in 2026 and its progress in stabilizing costs, including an MCR of 89.9%.

In contrast, rival Eli Lilly and Company (LLY) has outpaced UNH stock. LLY stock has surged 40.5% on a YTD basis and 43.7% over the past 52 weeks.

Despite UNH’s weak performance, analysts remain moderately optimistic about its prospects. The stock has a consensus rating of “Moderate Buy” from 25 analysts in coverage, and the mean price target of $388.64 is a premium of 21.8% to current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Corporate Insiders Have Sold $25 Billion in Stock in Just 60 Days. Before You Panic and Sell Your Shares, Read This.

- Top 100 Stocks to Buy: Argan Moves Up 40 Spots. Time to Buy?

- 3 Oversold Dividend Kings Trading at Rare Discounts Right Now

- Dear BBAI Stock Fans, Mark Your Calendars for December 1

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.