Coca-Cola Stock: Is KO Outperforming the Consumer Staples Sector?

The Coca-Cola Company (KO), headquartered in Atlanta, Georgia, is a beverage company that manufactures, markets, and sells various nonalcoholic beverages worldwide. With a market cap of $312.3 billion, the company also distributes and markets juice and juice-drink products to retailers and wholesalers worldwide.

Companies worth $200 billion or more are generally described as “mega-cap stocks,” and KO definitely fits that description, with its market cap exceeding this threshold, reflecting its substantial size, influence, and dominance in the beverages - non-alcoholic industry. KO's iconic brand recognition and diverse product portfolio give it a competitive edge. With a vast distribution network, its products are widely available, catering to varied consumer tastes and preferences globally.

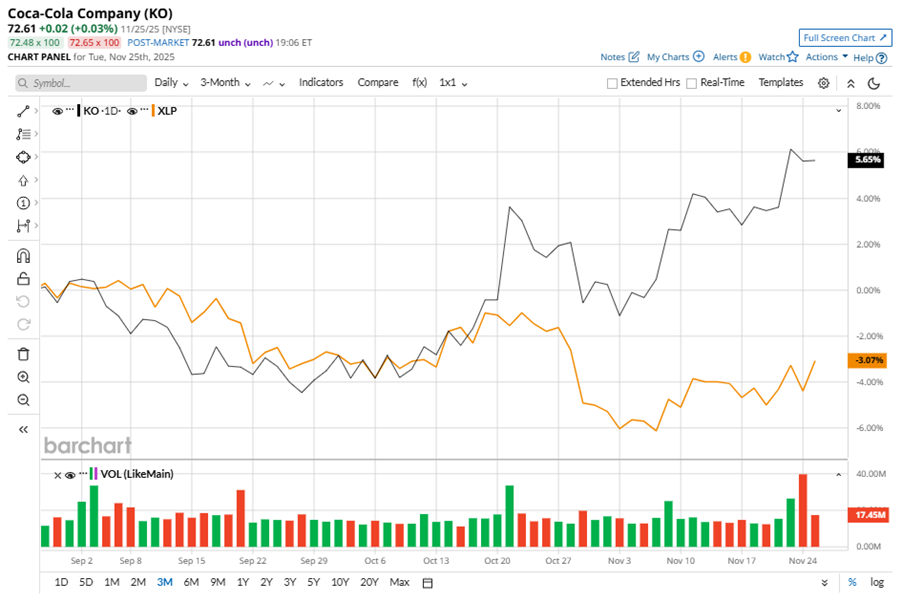

Despite its notable strength, KO slipped 2.4% from its 52-week high of $74.38, achieved on Apr. 22. Over the past three months, KO stock gained 5.3%, outperforming the Consumer Staples Select Sector SPDR Fund’s (XLP) 3.7% decline during the same time frame.

In the longer term, shares of KO rose 16.6% on a YTD basis and climbed 12.8% over the past 52 weeks, outperforming XLP’s YTD marginal dip and 5.1% losses over the last year.

To confirm the bullish trend, KO has been trading above its 50-day and 200-day moving averages since mid-October, with some fluctuations.

On Oct. 21, KO shares closed up more than 4% after reporting its Q3 results. Its adjusted revenue stood at $12.4 billion, up 3.9% year over year. The company’s adjusted EPS increased 6.5% from the prior-year quarter to $0.82.

In the competitive arena of non-alcoholic beverages, PepsiCo, Inc. (PEP) has lagged behind the stock, showing resilience with a 3.9% loss on a YTD basis and a 10.4% downtick over the past 52 weeks.

Wall Street analysts are bullish on KO’s prospects. The stock has a consensus “Strong Buy” rating from the 24 analysts covering it, and the mean price target of $80.17 suggests a potential upside of 10.4% from current price levels.

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- This Undiscovered Biotech Stock Has Quintupled in a Year and Just Hit New Highs

- Oppenheimer Thinks Investors Are Missing Out on IBM Stock

- Wedbush Just Raised Its Fannie Mae Price Target 1,050%. Should You Buy FNMA Stock Here?

- 3 Stocks at Fresh 52-Week AND Record Highs to Buy Now

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.