How Is Walt Disney's Stock Performance Compared to Other Communication Services Stocks?

Valued at a market cap of $184.4 billion, Burbank, California-based The Walt Disney Company (DIS) is a global entertainment powerhouse with operations spanning film, television, streaming, publishing, and theme parks. It produces and distributes content through well-known brands such as Disney, Pixar, Marvel, Lucasfilm, National Geographic, and ESPN.

Companies valued at $10 billion or more are generally considered “large-cap” stocks, and Walt Disney fits this criterion perfectly. The company also operates popular direct-to-consumer streaming services, including Disney+ and Hulu, alongside its extensive theme parks and resort experiences worldwide.

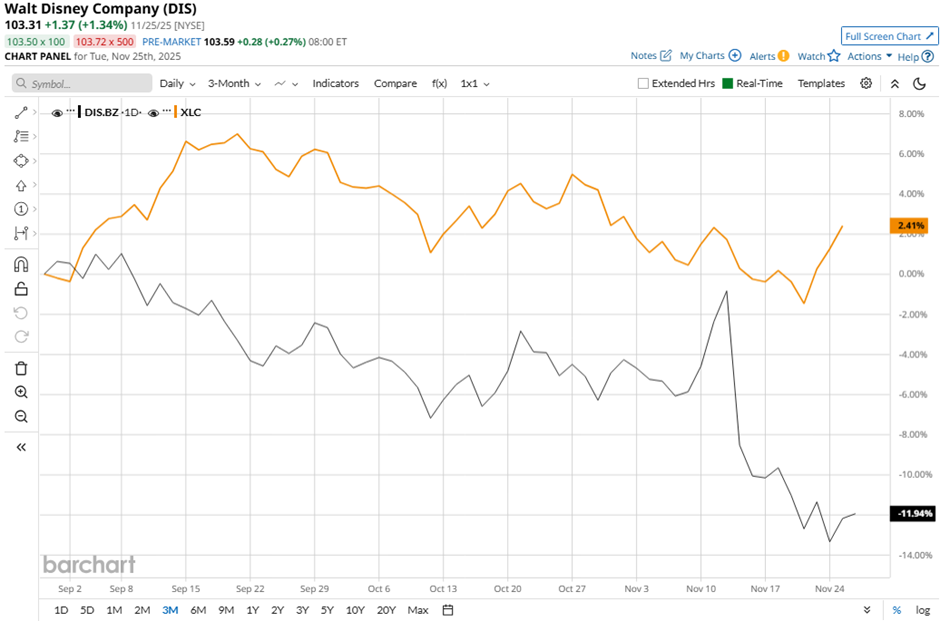

However, shares of the company have fallen 17.3% from its 52-week high of $124.69. Walt Disney shares have declined 12.2% over the past three months, underperforming the broader Communication Services Select Sector SPDR ETF Fund's (XLC) 2.5% rise during the same period.

In the long term, DIS stock has decreased 7.2% on a YTD basis, lagging behind XLC's 18.1% surge over the same period. Moreover, shares of Walt Disney have dropped 10.9% over the past 52 weeks, compared to XLC's 17.4% gain.

The stock has been trading below its 50-day moving average since August.

Despite posting better-than-expected Q4 2025 adjusted EPS of $1.11, Disney shares tumbled 7.8% on Nov. 13 as the company missed revenue expectations with $22.46 billion. Investors were alarmed by the YouTube TV blackout, which threatens a major distribution channel with about 10 million subscribers, and Morgan Stanley estimated a 14-day outage could cost Disney $60 million in revenue.

Ongoing weakness in the traditional TV unit, where profit fell 21% to $391 million, along with a one-third drop in entertainment operating income, overshadowed strength in streaming and parks.

In contrast, rival Netflix, Inc. (NFLX) has outperformed Walt Disney stock. Netflix shares have increased 20.6% over the past 52 weeks and 17.1% on a YTD basis.

Despite DIS' underperformance over the past year, analysts remain moderately optimistic about its prospects. Among the 30 analysts covering the stock, there is a consensus rating of “Moderate Buy,” and the mean price target of $133.73 is a premium of 29.4% to current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Kohl’s Is Soaring After Reporting Earnings. Is Former Meme Stock KSS a Buy Here?

- Tesla Stock Is a ‘Must Own’ Now Before ‘Hundreds of Billions in Value’ Changes Hands, According to This 1 Analyst

- Analysts Like Credo Going Into Earnings — Time to Buy CRDO Stock?

- What Dell’s Q3 Numbers Mean for Your Portfolio: Buy, Sell, or Hold?

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.