Oppenheimer Thinks Investors Are Missing Out on IBM Stock

Information technology and consulting giant International Business Machines (IBM) might be one of tech’s oldest giants, but it’s proving there’s plenty of life left in legacy. The stock has been grinding higher this year on solid fundamentals and a fresh artificial intelligence (AI) angle that’s catching investors’ attention. Strong Q3 results and a busy pipeline across AI, hybrid cloud, and even quantum computing have fueled renewed excitement.

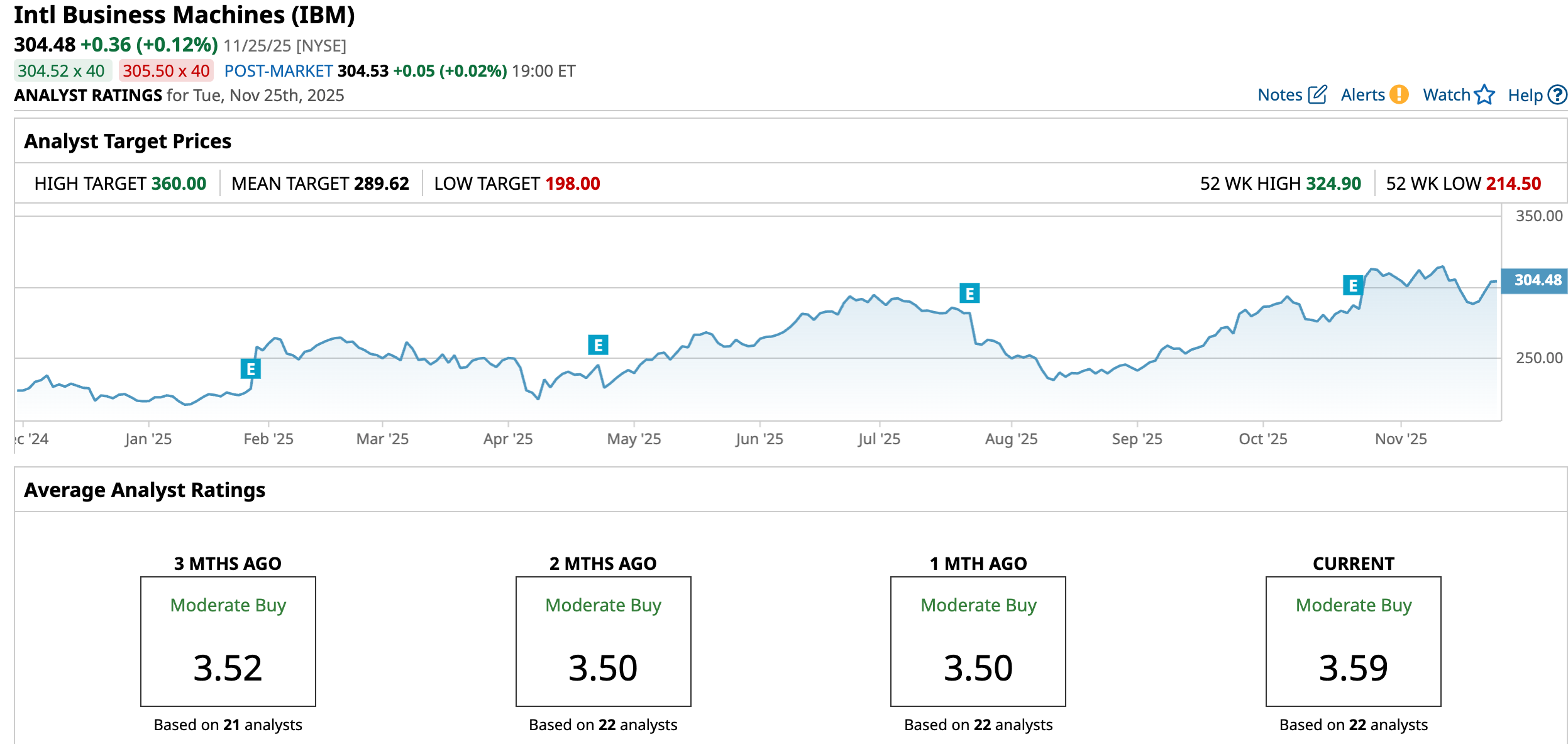

But even with the stock already near its 52-week high, analysts argue more runway is on the horizon. And one of the most bullish voices on Wall Street right now is Oppenheimer, giving an “Outperform” rating and a bold $360 price target, the highest call on Wall Street so far. Analyst Param Singh thinks investors are still stuck looking at IBM as the old-school legacy name.

In his view, the company’s evolution into a software-first business is becoming very real, driven by expected double-digit growth from HashiCorp, the multi-cloud automation leader IBM acquired earlier this year, along with improving traction at Red Hat. But Singh’s biggest confidence boost comes from IBM’s growing push into AI applications and generative AI tools, an area he believes the market hasn’t come close to appreciating yet.

So, with analysts calling out underestimated potential, IBM’s stock may be poised for a stronger move higher.

About IBM Stock

Founded in 1911, IBM is a major force in hybrid cloud, AI, and business services, supporting clients in more than 175 countries. Its technology helps organizations tap into their data, streamline operations, lower costs, and stay competitive. Government agencies and leading companies across critical industries such as finance, telecom, and healthcare rely on IBM’s hybrid cloud platform and Red Hat OpenShift for secure, efficient digital transformation.

With ongoing innovation in AI, quantum computing, and industry-specific cloud tools, IBM offers flexible solutions that meet evolving enterprise technology needs. So far this year, shares of this New York-based tech giant have posted a 38.51% return, outperforming the broader S&P 500 Index ($SPX), which has gained roughly 15.03% in 2025. The stock hit a fresh 52-week high of $324.90 on Nov. 12 and is only down about 6.71% from that peak. The company’s market capitalization currently stands at roughly $284 billion.

Alongside its steady price gains, IBM continues to deliver value to income-focused investors. Since 1916, the company has consistently paid quarterly dividends. And with a remarkable 30 consecutive years of dividend increases under its belt, the company proudly holds the coveted Dividend Aristocrat status.

Most recently, on Oct. 22, IBM announced a quarterly dividend of $1.68 per share, payable on Dec. 10. That brings its forward annualized payout to $6.72 per share, translating to a healthy 2.26% yield. The company also returned approximately $1.6 billion to shareholders via dividends during the third quarter.

Key Highlights From IBM’s Q3 Earnings Report

On Oct. 22, IBM released its fiscal 2025 third-quarter earnings report, which delivered a clean beat against Wall Street forecasts. Revenue came in at about $16.3 billion, up 9% year-over-year (YOY), marking the fastest growth in several years and beating the consensus estimate of $16.1 billion. Profitability showed an even greater improvement.

During the quarter, the company reported net income of $1.74 billion, or $1.84 per share, a notable turnaround from the $330 million loss, or $0.36 per share, reported a year ago. On an adjusted basis, EPS of $2.65 climbed 15.2% YOY and comfortably surpassed Wall Street’s estimates of $2.44. A closer look shows that growth was spread across all major segments.

Software revenue totaled about $7.2 billion, up roughly 10%, powered by automation tools and continued momentum at Red Hat/OpenShift. Infrastructure posted a stronger 17% YOY increase to $3.6 billion, driven by IBM Z mainframes surging well over 50%. Meanwhile, Consulting returned to growth with low single-digit gains to roughly $5.3 billion after quieter quarters. Cash flow trends also moved in the right direction.

IBM reported $3.1 billion in net cash from operating activities, up $200 million YOY. Free cash flow climbed to $2.4 billion, an increase of $300 million from last year. IBM ended the quarter with $14.9 billion in cash, restricted cash, and marketable securities, an improvement of $100 million compared to the end of 2024.

While reflecting on the Q3 performance, CEO Arvind Krishna highlighted strong customer adoption, noting, “Clients globally continue to leverage our technology and domain expertise to drive productivity in their operations and deliver real business value with AI.” The CEO also revealed that the company’s AI book of business now exceeds $9.5 billion, up from $7.5 billion just a quarter ago.

Thanks to the firm’s strong momentum, IBM raised its full-year 2025 guidance. The company now expects revenue growth of more than 5%, compared to the prior outlook of at least 5%. Management also sees free cash flow reaching $14 billion for the year, up from its earlier estimate of $13.5 billion.

How Are Analysts Viewing IBM Stock

Overall, Wall Street is still upbeat about IBM. The broader consensus sits at a “Moderate Buy.” Out of 22 analysts covering the stock, eight call it a “Strong Buy,” one rates it a “Moderate Buy,” 11 say “Hold,” and two recommend “Strong Sell.” Even though IBM has already pushed past the Street’s average price target of $289.62, Oppenheimer still sees plenty of room for upside.

The firm’s $360 Street-high target suggests the stock could rally another 18.23% from current levels. With software becoming a bigger driver of the business and margins continuing to improve, Oppenheimer believes IBM is on the verge of a valuation reset, especially as more investors recognize just how far the company’s transformation has come.

On the date of publication, Anushka Mukherji did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Why Is Everyone Worried About Nvidia’s Days Sales Outstanding? What That Means, and Why It Matters for NVDA Stock.

- ‘These Chips Will Profoundly Change the World’ and ‘Save Lives.’ Elon Musk Doubles Down on AI Chips as TSLA Stock Stagnates YTD.

- This Undiscovered Biotech Stock Has Quintupled in a Year and Just Hit New Highs

- Oppenheimer Thinks Investors Are Missing Out on IBM Stock

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.