Up 130% In a Year, How High Can Broadcom Stock Go?

Broadcom (AVGO) stock has gained about 130% over the past year, driven by a solid demand environment. The company specializes in application-specific integrated circuits (ASICs), highly sophisticated custom chips designed for artificial intelligence (AI) and high-performance computing. As global demand for AI technology continues to soar, Broadcom is poised to benefit from rising spending on AI infrastructure.

Broadcom also generates steady, recurring revenue from its infrastructure software business. The recurring software revenue combined with the explosive growth of its AI chip segment has translated into consistently strong financial performance, pushing AVGO stock higher.

Another significant tailwind is its strategic partnerships with the biggest names in tech. Broadcom recently struck a notable agreement with OpenAI to develop custom AI accelerators, solidifying its position as a key partner to top hyperscalers driving AI innovation.

As companies continue ramping up their capital spending on AI data centers and next-generation computing, Broadcom could continue to deliver strong growth, providing a boost to Broadcom’s business. However, the main caution for investors is valuation. After such a strong rally, AVGO stock isn’t cheap. While long-term growth prospects remain compelling, future gains may depend on Broadcom proving it can continue to deliver exceptional performance.

Strong Demand to Accelerate Broadcom’s Growth

Broadcom is consistently delivering strong financials led by soaring demand for AI-focused semiconductors and continued expansion from VMware, the cloud company Broadcom acquired in 2023.

In the third quarter of fiscal 2025, Broadcom posted $16 billion in revenue, a 22% jump from the prior year. This growth was driven by the ongoing momentum in its AI-focused semiconductor segment, which is experiencing a surge in demand from cloud providers and hyperscale customers racing to build out computing infrastructure.

Semiconductor revenue alone reached $9.2 billion, up 26% year-over-year, with AI chip sales soaring 63% to $5.2 billion. The company has consistently delivered strong AI revenue growth, and this growth is likely to accelerate in the coming quarters.

A significant portion of Broadcom’s AI revenue growth is driven by its custom accelerator business, or XPUs, which now accounts for 65% of its AI revenue. With its customers pouring billions into AI infrastructure, demand for tailor-made silicon is expected to accelerate.

Its strategic partnership with OpenAI strengthens its position in the custom AI space. The two companies are co-developing next-generation custom compute and networking solutions, a collaboration backed by chip orders worth billions. Together with ongoing business from other major hyperscalers, this OpenAI partnership gives Broadcom a robust pipeline that is expected to materially boost AI-related revenue throughout 2026.

The growth is further reflected in Broadcom’s record consolidated backlog of $110 billion, an indicator of locked-in business that provides multi-year revenue visibility. Looking ahead, management expects AI semiconductor revenue to climb to approximately $6.2 billion in the fourth quarter of 2025, representing a robust 66% year-over-year increase. If these trends persist, AI will remain the company’s most powerful growth catalyst.

Broadcom’s story is not solely about chips. Nearly half of the business now stems from infrastructure software, a segment that has strengthened significantly since the acquisition of VMware. In Q3, the software segment delivered $6.8 billion in revenue, up 17% year-over-year, while maintaining exceptional profitability. Gross margins for the segment reached 93%, and operating margins expanded to 77%. This high-margin software engine provides a strong counterbalance to the capital-intensive semiconductor business, supporting recurring cash flow and strengthening the company’s ability to return capital to shareholders.

How High Could Broadcom Stock Go?

With a record backlog, rising demand for custom accelerators, and improving margins, Broadcom appears well-positioned to deliver continued growth.

Even so, Broadcom’s stock price already reflects much of that optimism. Shares currently trade at a forward price-earnings multiple of 44.5x, which suggests the valuation is relatively in line with expectations for its projected 41.7% increase in earnings during fiscal 2026. In other words, the market seems to be pricing the company’s strong performance fairly efficiently.

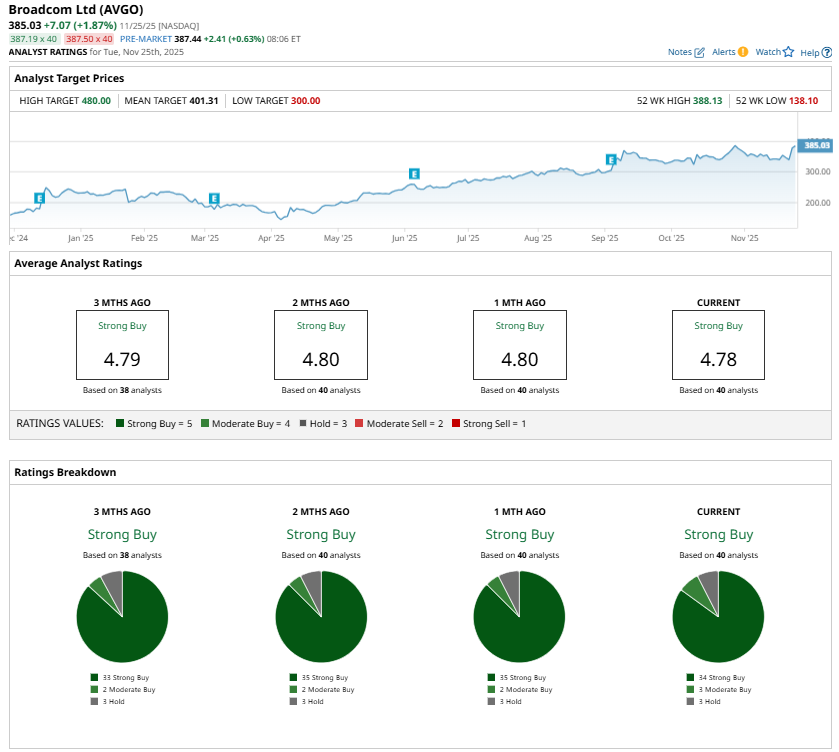

While Wall Street analysts are bullish on Broadcom stock, the average price target is $401.31, suggesting modest upside of about 4% over the next 12 months. However, the highest price target of $480 implies a potential 25% gain over the next year.

On the date of publication, Sneha Nahata did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Oppenheimer Thinks Investors Are Missing Out on IBM Stock

- Wedbush Just Raised Its Fannie Mae Price Target 1,050%. Should You Buy FNMA Stock Here?

- 3 Stocks at Fresh 52-Week AND Record Highs to Buy Now

- 900 Reasons to Buy Amazon Stock Now

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.