Cushman & Wakefield (NYSE:CWK) Surprises With Strong Q3

Real estate services firm Cushman & Wakefield (NYSE: CWK) announced better-than-expected revenue in Q3 CY2025, with sales up 11.2% year on year to $2.61 billion. Its non-GAAP profit of $0.29 per share was 4.3% above analysts’ consensus estimates.

Is now the time to buy Cushman & Wakefield? Find out by accessing our full research report, it’s free for active Edge members.

Cushman & Wakefield (CWK) Q3 CY2025 Highlights:

- Revenue: $2.61 billion vs analyst estimates of $2.42 billion (11.2% year-on-year growth, 7.9% beat)

- Adjusted EPS: $0.29 vs analyst estimates of $0.28 (4.3% beat)

- Adjusted EBITDA: $159.6 million vs analyst estimates of $156.1 million (6.1% margin, 2.2% beat)

- Operating Margin: 4.1%, in line with the same quarter last year

- Free Cash Flow Margin: 8.6%, similar to the same quarter last year

- Market Capitalization: $3.83 billion

Company Overview

With expertise in the commercial real estate sector, Cushman & Wakefield (NYSE: CWK) is a global Chicago-based real estate firm offering a comprehensive range of services to clients.

Revenue Growth

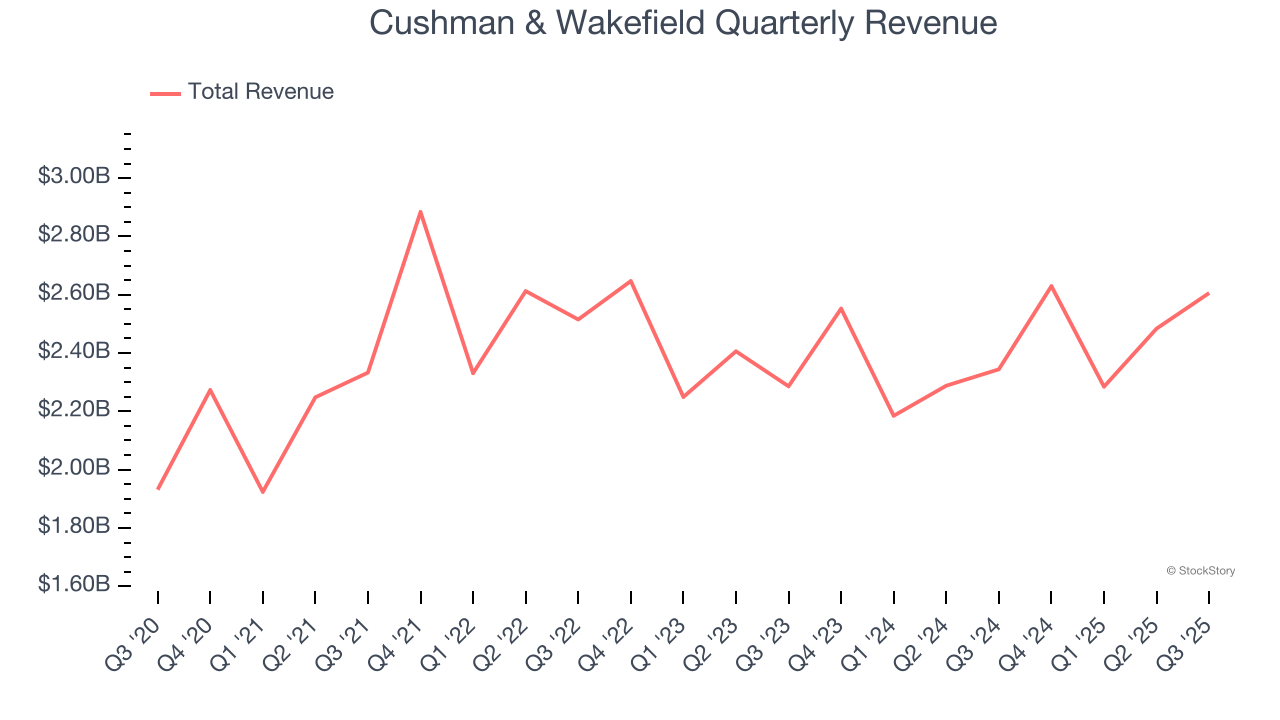

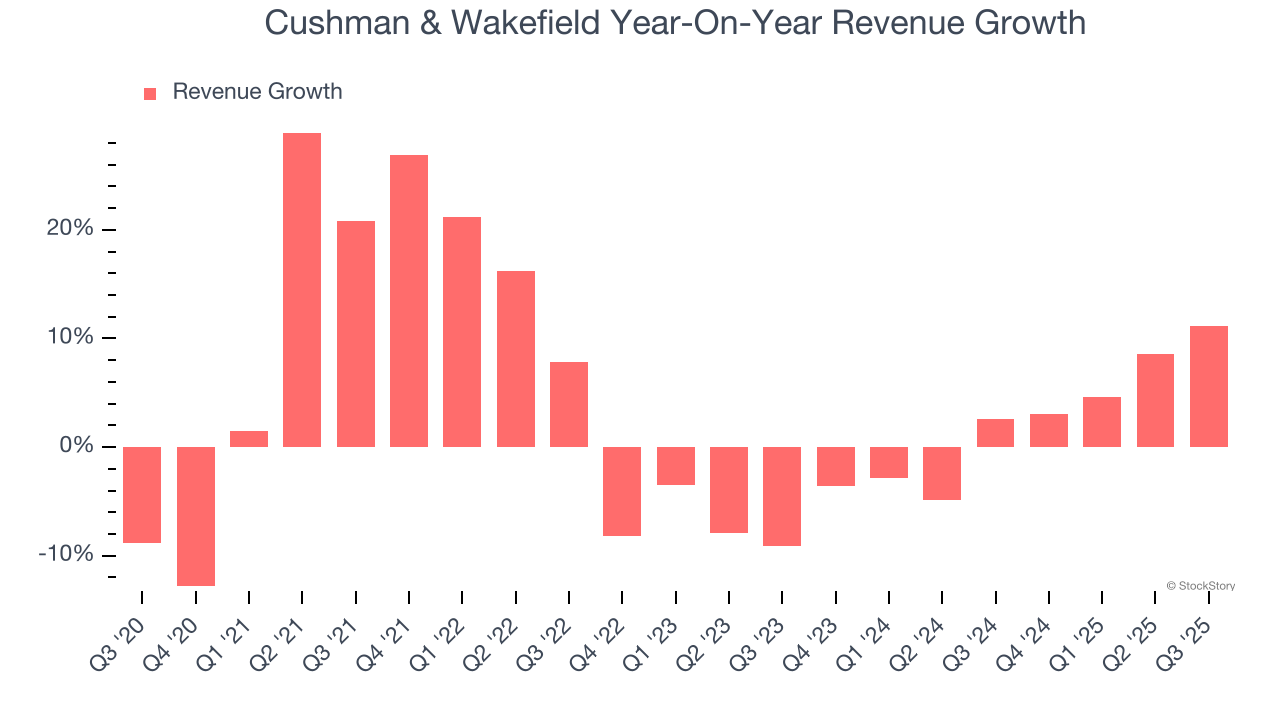

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last five years, Cushman & Wakefield grew its sales at a sluggish 4.1% compounded annual growth rate. This was below our standard for the consumer discretionary sector and is a tough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. Cushman & Wakefield’s recent performance shows its demand has slowed as its annualized revenue growth of 2.1% over the last two years was below its five-year trend.

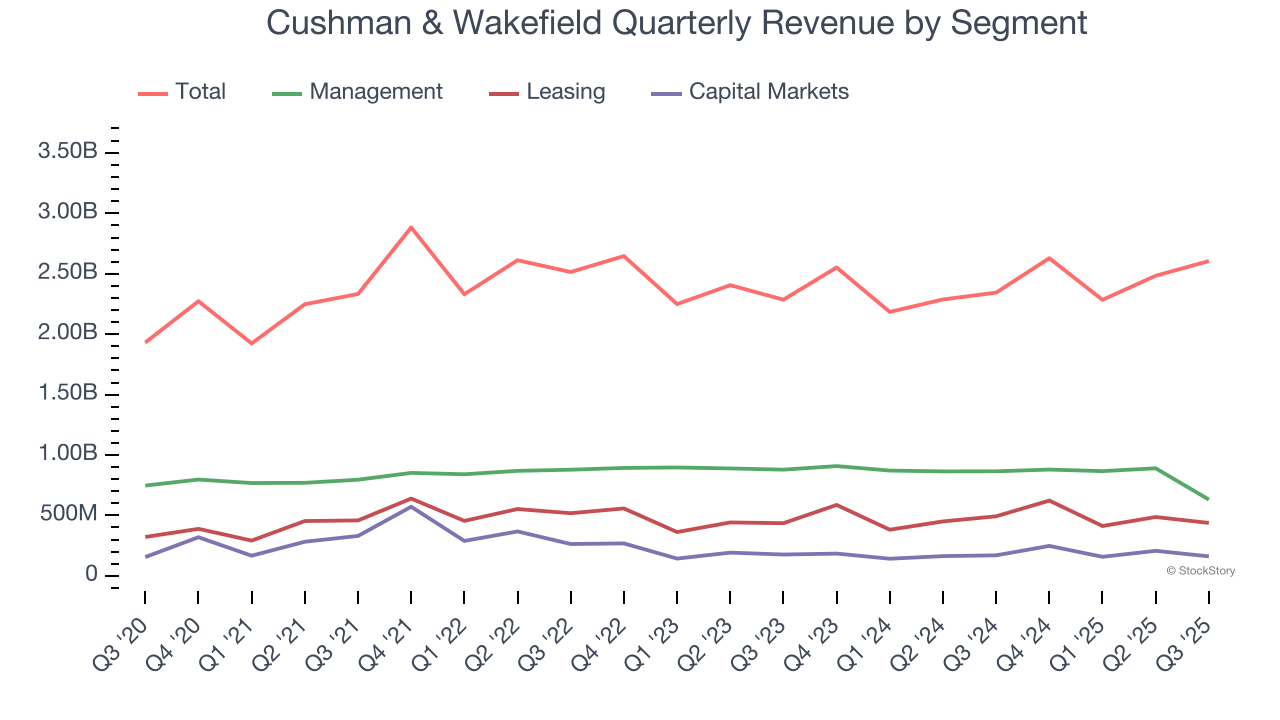

We can dig further into the company’s revenue dynamics by analyzing its three most important segments: Management, Leasing, and Capital Markets, which are 24.2%, 16.8%, and 6.2% of revenue. Over the last two years, Cushman & Wakefield’s Management revenue (property management) averaged 4.1% year-on-year declines, but its Leasing (sourcing tenants) and Capital Markets (financial advisory) revenues averaged 4.6% and 2.1% growth.

This quarter, Cushman & Wakefield reported year-on-year revenue growth of 11.2%, and its $2.61 billion of revenue exceeded Wall Street’s estimates by 7.9%.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months, a slight deceleration versus the last two years. This projection doesn't excite us and indicates its products and services will face some demand challenges.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Operating Margin

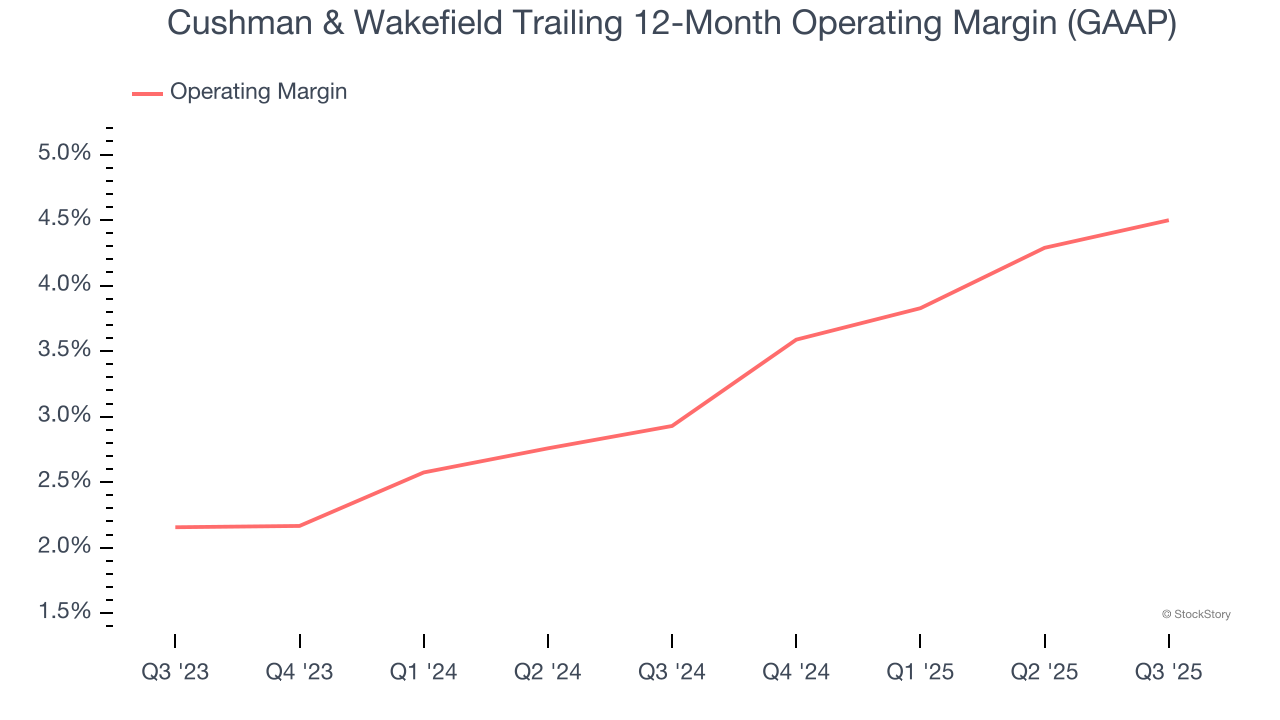

Cushman & Wakefield’s operating margin has been trending up over the last 12 months and averaged 3.7% over the last two years. The company’s higher efficiency is a breath of fresh air, but its suboptimal cost structure means it still sports lousy profitability for a consumer discretionary business.

In Q3, Cushman & Wakefield generated an operating margin profit margin of 4.1%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

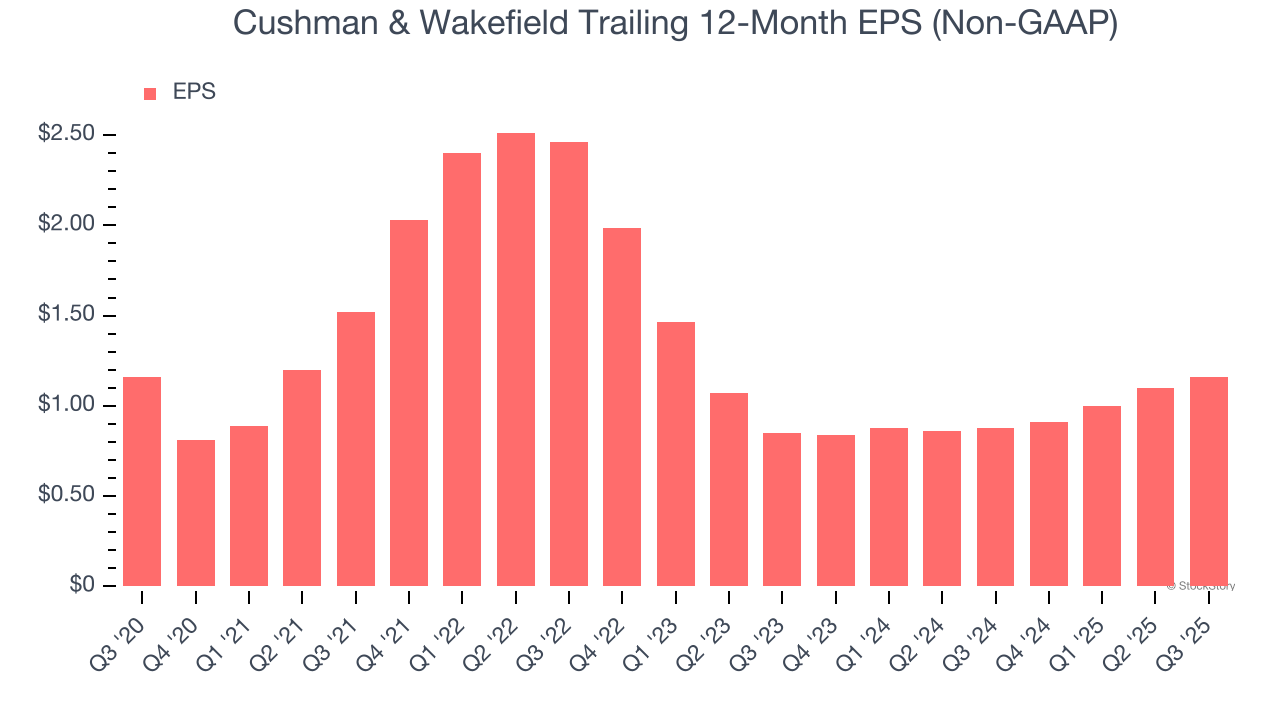

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Cushman & Wakefield’s flat EPS over the last five years was below its 4.1% annualized revenue growth. However, its operating margin actually improved during this time, telling us that non-fundamental factors such as interest expenses and taxes affected its ultimate earnings.

In Q3, Cushman & Wakefield reported adjusted EPS of $0.29, up from $0.23 in the same quarter last year. This print beat analysts’ estimates by 4.3%. Over the next 12 months, Wall Street expects Cushman & Wakefield’s full-year EPS of $1.16 to grow 15.9%.

Key Takeaways from Cushman & Wakefield’s Q3 Results

We enjoyed seeing Cushman & Wakefield beat analysts’ revenue expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. Overall, we think this was a decent quarter with some key metrics above expectations. The stock traded up 1.5% to $16.80 immediately following the results.

Cushman & Wakefield put up rock-solid earnings, but one quarter doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.