Williams-Sonoma’s (NYSE:WSM) Q3 CY2025: Beats On Revenue But Stock Drops

Kitchenware and home goods retailer Williams-Sonoma (NYSE: WSM) beat Wall Street’s revenue expectations in Q3 CY2025, with sales up 4.6% year on year to $1.88 billion. Its GAAP profit of $1.96 per share was 4.7% above analysts’ consensus estimates.

Is now the time to buy Williams-Sonoma? Find out by accessing our full research report, it’s free for active Edge members.

Williams-Sonoma (WSM) Q3 CY2025 Highlights:

- Revenue: $1.88 billion vs analyst estimates of $1.87 billion (4.6% year-on-year growth, 0.6% beat)

- EPS (GAAP): $1.96 vs analyst estimates of $1.87 (4.7% beat)

- Adjusted EBITDA: $406.8 million vs analyst estimates of $368.4 million (21.6% margin, 10.4% beat)

- Operating Margin: 17%, in line with the same quarter last year

- Free Cash Flow Margin: 13.2%, up from 9.4% in the same quarter last year

- Locations: 513 at quarter end, down from 525 in the same quarter last year

- Same-Store Sales rose 4% year on year (-2.9% in the same quarter last year)

- Market Capitalization: $22.01 billion

“We are proud to deliver strong results in the third quarter of 2025 with an accelerating positive top-line comp and continued outperformance in profitability. In Q3, our comp came in above expectations at 4.0%, with another quarter of positive comps in all brands. Operating margin came in at 17.0%, expanding 10 basis points, with earnings per share of $1.96, growing 4.8% year-over-year. We are encouraged by our continued strong performance, and are confident in our outlook for Q4. We are reiterating full year comparable brand revenue growth to be in the range of 2% to 5%, and we are raising our bottom-line guidance to an operating margin of 17.8% to 18.1%,” said Laura Alber, President and Chief Executive Officer.

Company Overview

Started in 1956 as a store specializing in French cookware, Williams-Sonoma (NYSE: WSM) is a specialty retailer of higher-end kitchenware, home goods, and furniture.

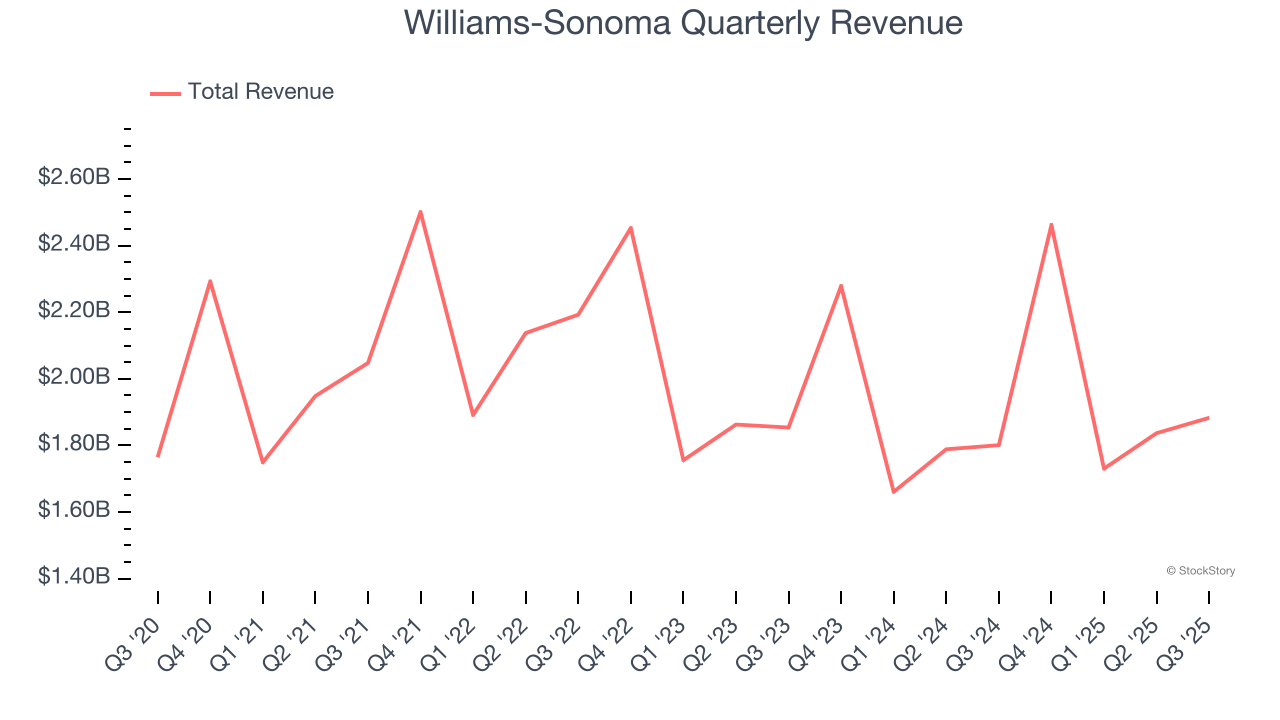

Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

With $7.91 billion in revenue over the past 12 months, Williams-Sonoma is a mid-sized retailer, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale.

As you can see below, Williams-Sonoma’s 5% annualized revenue growth over the last six years (we compare to 2019 to normalize for COVID-19 impacts) was tepid as it closed stores.

This quarter, Williams-Sonoma reported modest year-on-year revenue growth of 4.6% but beat Wall Street’s estimates by 0.6%.

Looking ahead, sell-side analysts expect revenue to grow 1.3% over the next 12 months, a deceleration versus the last six years. This projection is underwhelming and suggests its products will see some demand headwinds.

While Wall Street chases Nvidia at all-time highs, an under-the-radar semiconductor supplier is dominating a critical AI component these giants can’t build without. Click here to access our free report one of our favorites growth stories.

Store Performance

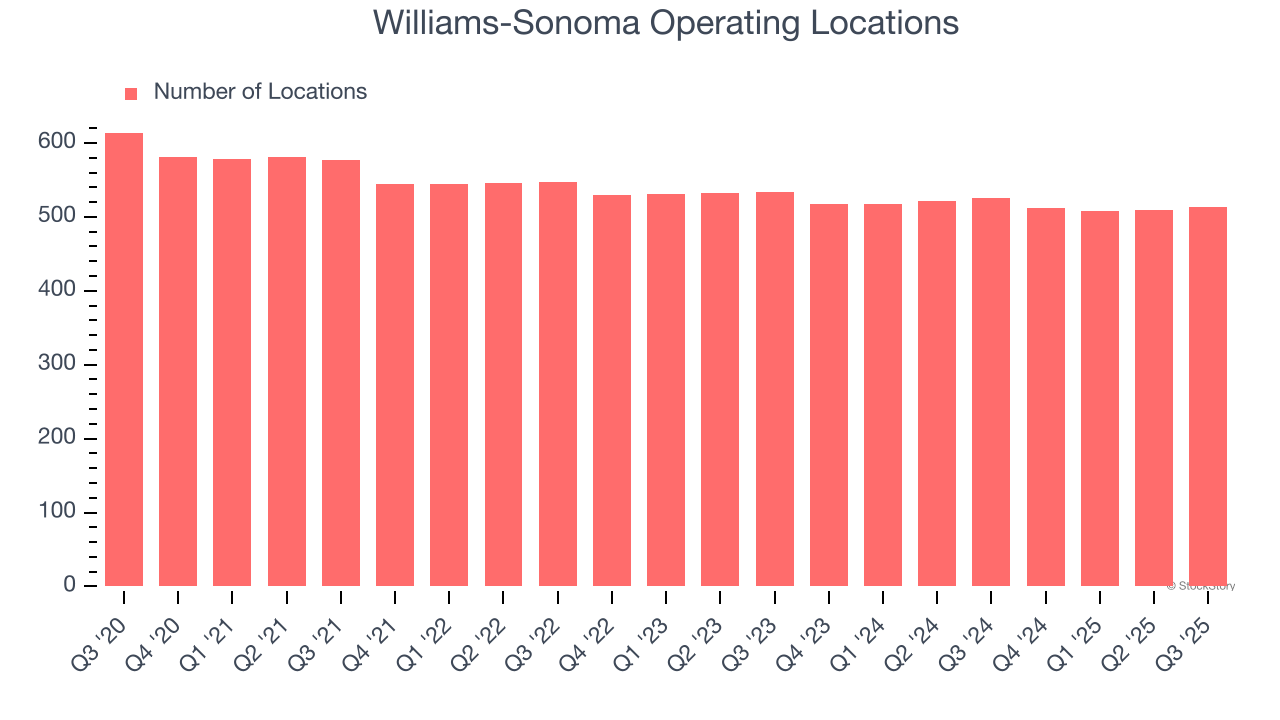

Number of Stores

A retailer’s store count influences how much it can sell and how quickly revenue can grow.

Williams-Sonoma listed 513 locations in the latest quarter and has generally closed its stores over the last two years, averaging 2% annual declines.

When a retailer shutters stores, it usually means that brick-and-mortar demand is less than supply, and it is responding by closing underperforming locations to improve profitability.

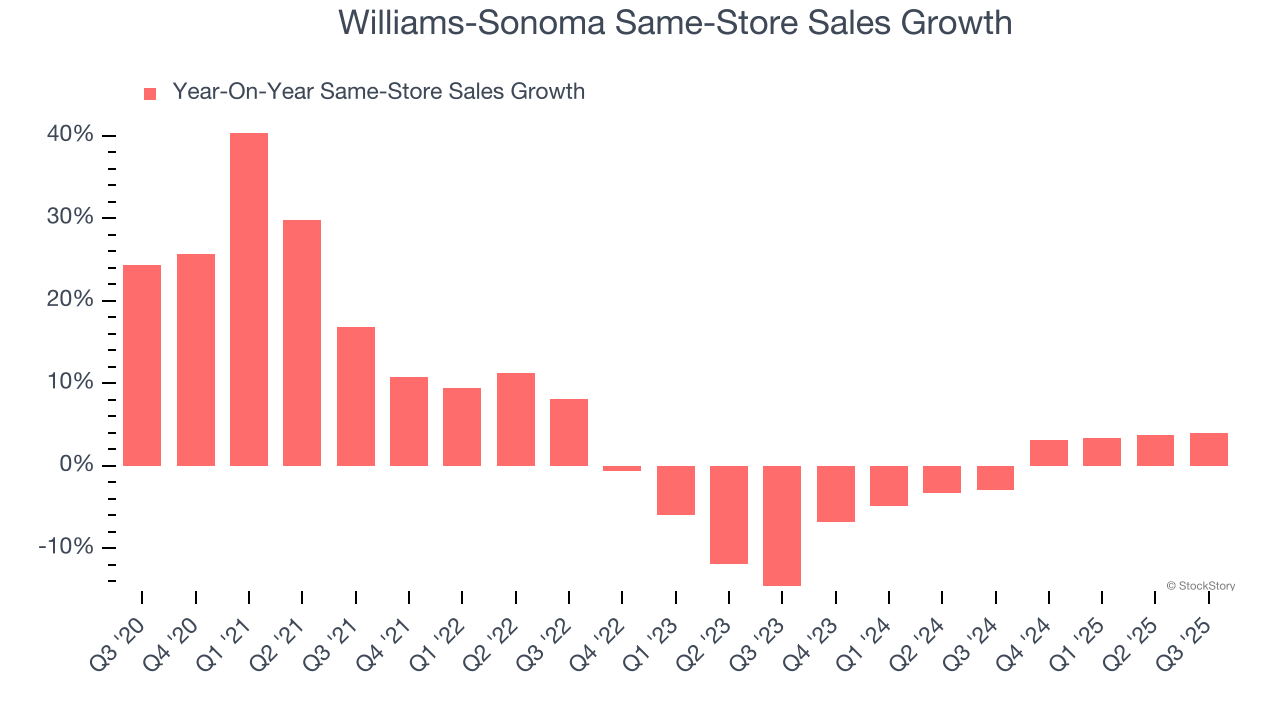

Same-Store Sales

The change in a company's store base only tells one side of the story. The other is the performance of its existing locations and e-commerce sales, which informs management teams whether they should expand or downsize their physical footprints. Same-store sales provides a deeper understanding of this issue because it measures organic growth at brick-and-mortar shops for at least a year.

Williams-Sonoma’s demand within its existing locations has barely increased over the last two years as its same-store sales were flat. This performance isn’t ideal, and Williams-Sonoma is attempting to boost same-store sales by closing stores (fewer locations sometimes lead to higher same-store sales).

In the latest quarter, Williams-Sonoma’s same-store sales rose 4% year on year. This growth was a well-appreciated turnaround from its historical levels, showing the business is regaining momentum.

Key Takeaways from Williams-Sonoma’s Q3 Results

We were impressed by how significantly Williams-Sonoma blew past analysts’ EBITDA expectations this quarter. We were also glad its gross margin outperformed Wall Street’s estimates. Overall, we think this was a decent quarter with some key metrics above expectations. Investors were likely hoping for more, and shares traded down 6.5% to $169 immediately following the results.

Is Williams-Sonoma an attractive investment opportunity right now? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.