Fluence Energy (NASDAQ:FLNC) Misses Q3 CY2025 Revenue Estimates, But Stock Soars 6.7%

Electricity storage and software provider Fluence (NASDAQ: FLNC) missed Wall Street’s revenue expectations in Q3 CY2025, with sales falling 15.2% year on year to $1.04 billion. On the other hand, the company’s full-year revenue guidance of $3.4 billion at the midpoint came in 5% above analysts’ estimates. Its GAAP profit of $0.13 per share was 34.1% below analysts’ consensus estimates.

Is now the time to buy Fluence Energy? Find out by accessing our full research report, it’s free for active Edge members.

Fluence Energy (FLNC) Q3 CY2025 Highlights:

- Revenue: $1.04 billion vs analyst estimates of $1.39 billion (15.2% year-on-year decline, 24.8% miss)

- EPS (GAAP): $0.13 vs analyst expectations of $0.20 (34.1% miss)

- Adjusted EBITDA: $72.19 million vs analyst estimates of $62.89 million (6.9% margin, 14.8% beat)

- EBITDA guidance for the upcoming financial year 2026 is $50 million at the midpoint, below analyst estimates of $57.75 million

- Operating Margin: 4.7%, in line with the same quarter last year

- Free Cash Flow Margin: 24.6%, up from 0.4% in the same quarter last year

- Backlog: $5.3 billion at quarter end, up 17.8% year on year

- Market Capitalization: $2.02 billion

"We believe we are well positioned to capitalize on the accelerating demand for energy storage. We achieved $1.4 billion of new orders for the quarter and 13.7% adjusted gross profit margin for the year, both record results for the Company," said Julian Nebreda, the Company’s President and Chief Executive Officer.

Company Overview

Pioneering the use of lithium-ion batteries for grid storage, Fluence (NASDAQ: FLNC) helps store renewable energy sources with battery systems.

Revenue Growth

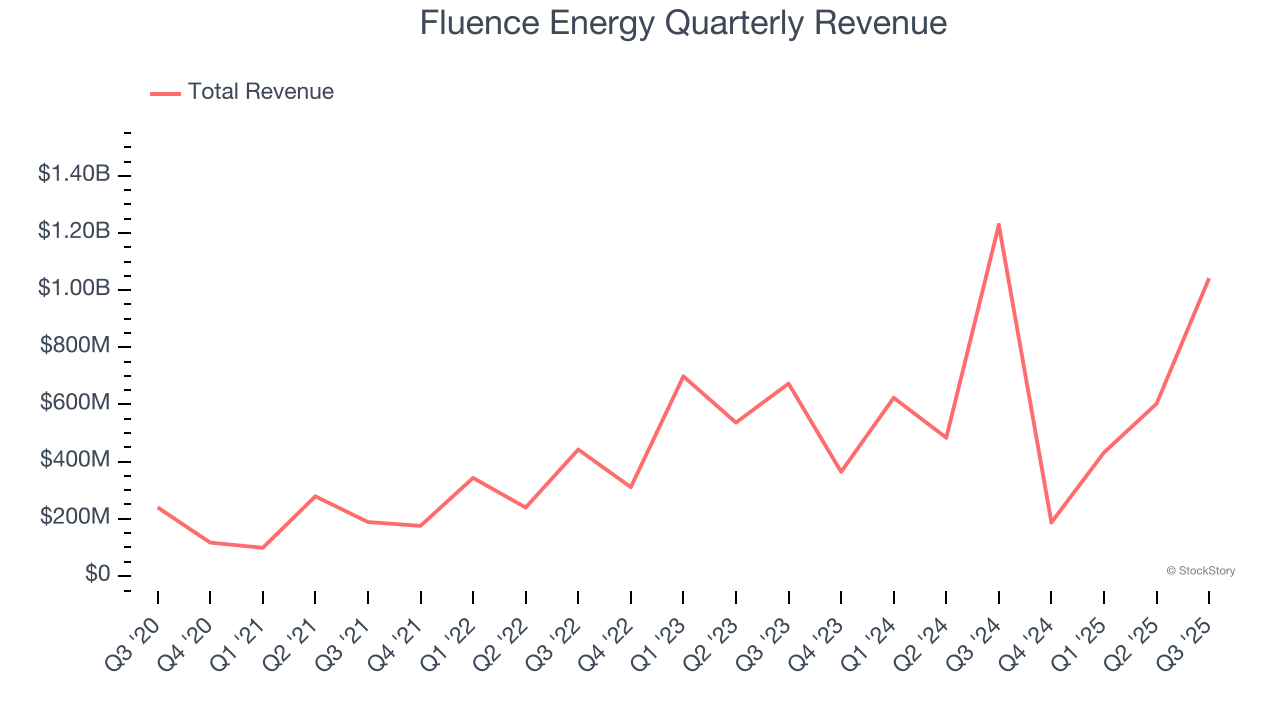

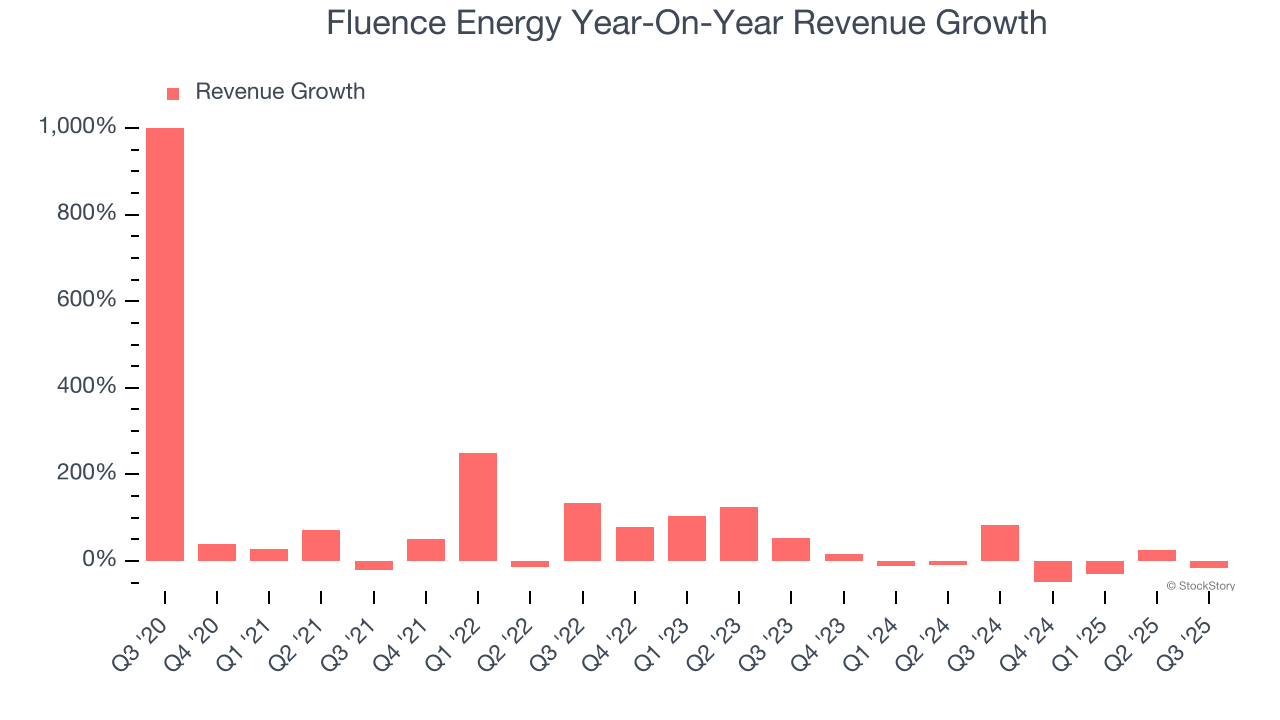

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Thankfully, Fluence Energy’s 32.2% annualized revenue growth over the last five years was incredible. Its growth beat the average industrials company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Fluence Energy’s recent performance shows its demand has slowed significantly as its annualized revenue growth of 1% over the last two years was well below its five-year trend.

This quarter, Fluence Energy missed Wall Street’s estimates and reported a rather uninspiring 15.2% year-on-year revenue decline, generating $1.04 billion of revenue.

Looking ahead, sell-side analysts expect revenue to grow 40.9% over the next 12 months, an improvement versus the last two years. This projection is eye-popping and indicates its newer products and services will catalyze better top-line performance.

While Wall Street chases Nvidia at all-time highs, an under-the-radar semiconductor supplier is dominating a critical AI component these giants can’t build without. Click here to access our free report one of our favorites growth stories.

Operating Margin

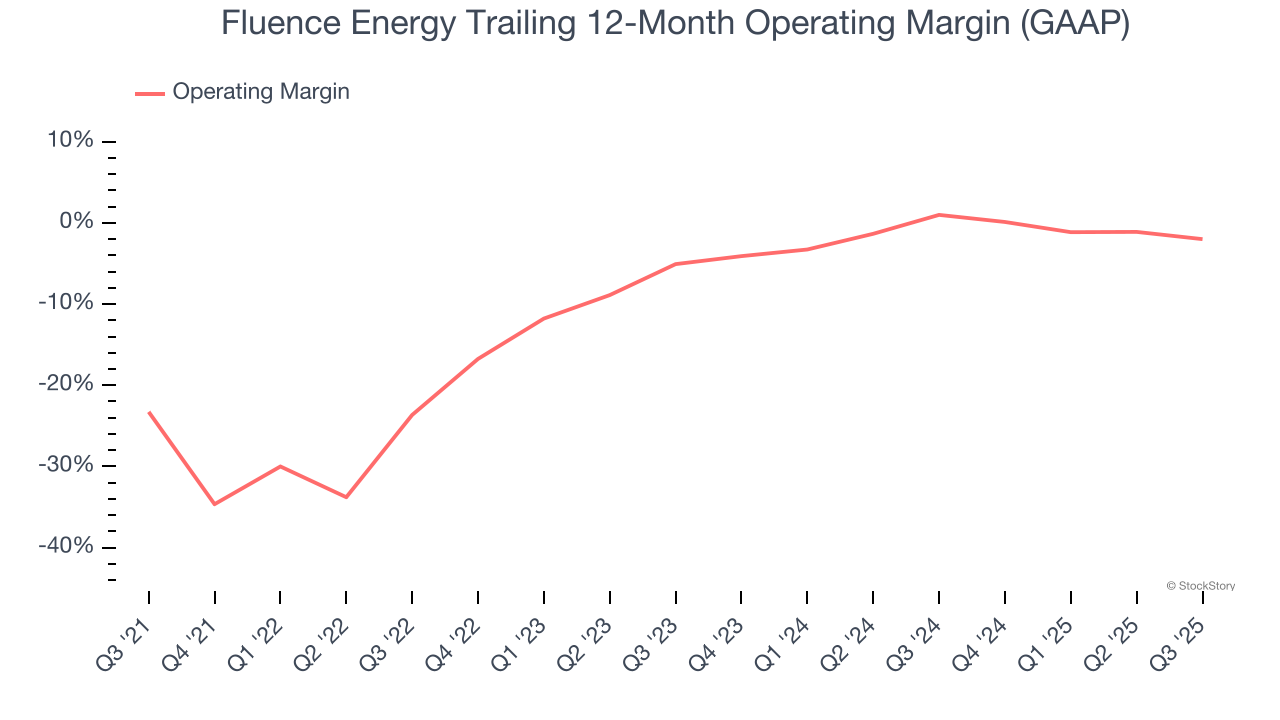

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Although Fluence Energy was profitable this quarter from an operational perspective, it’s generally struggled over a longer time period. Its expensive cost structure has contributed to an average operating margin of negative 6.3% over the last five years. Unprofitable industrials companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

On the plus side, Fluence Energy’s operating margin rose by 21.3 percentage points over the last five years, as its sales growth gave it operating leverage. Still, it will take much more for the company to show consistent profitability.

This quarter, Fluence Energy generated an operating margin profit margin of 4.7%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

Earnings Per Share

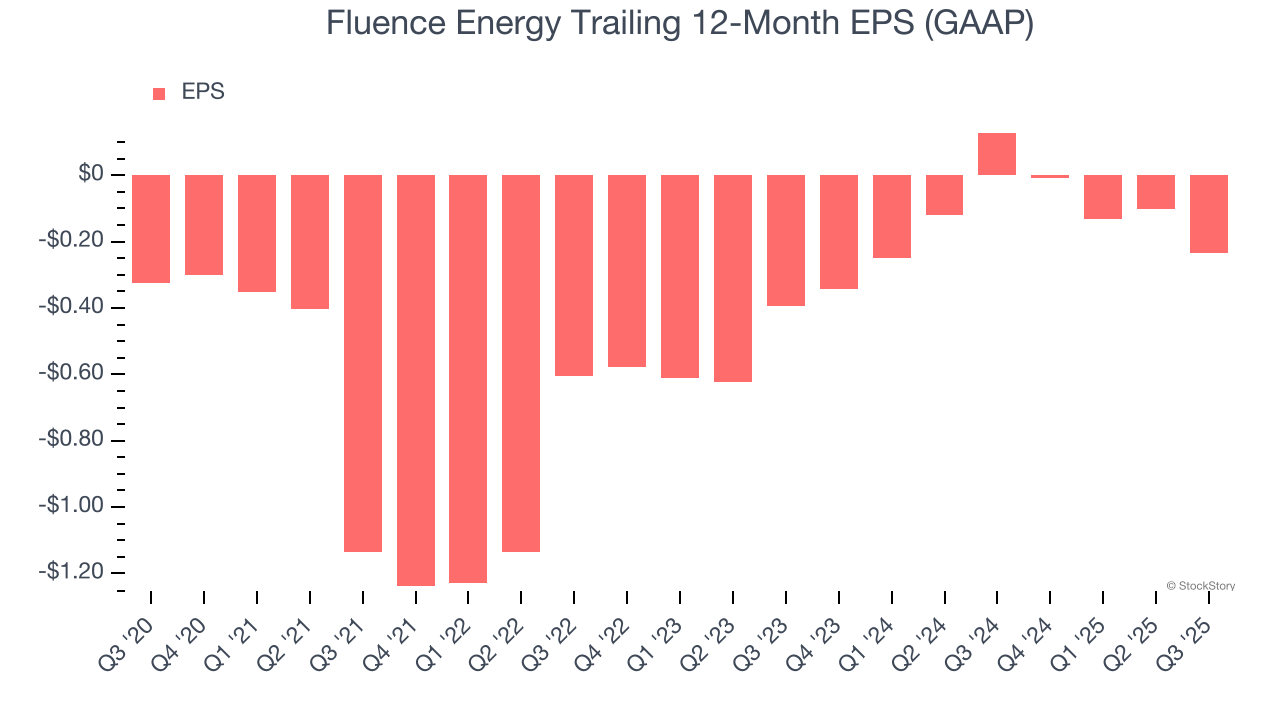

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Although Fluence Energy’s full-year earnings are still negative, it reduced its losses and improved its EPS by 6.2% annually over the last five years. The next few quarters will be critical for assessing its long-term profitability. We hope to see an inflection point soon.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Fluence Energy, its two-year annual EPS growth of 22.7% was higher than its five-year trend. Its improving earnings is an encouraging data point, but a caveat is that its EPS is still in the red.

In Q3, Fluence Energy reported EPS of $0.13, down from $0.26 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street expects Fluence Energy to improve its earnings losses. Analysts forecast its full-year EPS of negative $0.23 will advance to negative $0.06.

Key Takeaways from Fluence Energy’s Q3 Results

We were impressed by how significantly Fluence Energy blew past analysts’ EBITDA expectations this quarter. We were also glad its full-year revenue guidance trumped Wall Street’s estimates. On the other hand, its full-year EBITDA guidance missed and its revenue fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded up 6.7% to $16.98 immediately after reporting.

Big picture, is Fluence Energy a buy here and now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.