Valley National Bank (VLY): Buy, Sell, or Hold Post Q3 Earnings?

Over the past six months, Valley National Bank has been a great trade, beating the S&P 500 by 14.9%. Its stock price has climbed to $11.42, representing a healthy 28% increase. This performance may have investors wondering how to approach the situation.

Is there a buying opportunity in Valley National Bank, or does it present a risk to your portfolio? See what our analysts have to say in our full research report, it’s free for active Edge members.

Why Do We Think Valley National Bank Will Underperform?

We’re happy investors have made money, but we're sitting this one out for now. Here are three reasons you should be careful with VLY and a stock we'd rather own.

1. Long-Term Revenue Growth Disappoints

In general, banks make money from two primary sources. The first is net interest income, which is interest earned on loans, mortgages, and investments in securities minus interest paid out on deposits. The second source is non-interest income, which can come from bank account, credit card, wealth management, investing banking, and trading fees.

Unfortunately, Valley National Bank’s 9.5% annualized revenue growth over the last five years was mediocre. This fell short of our benchmark for the banking sector.

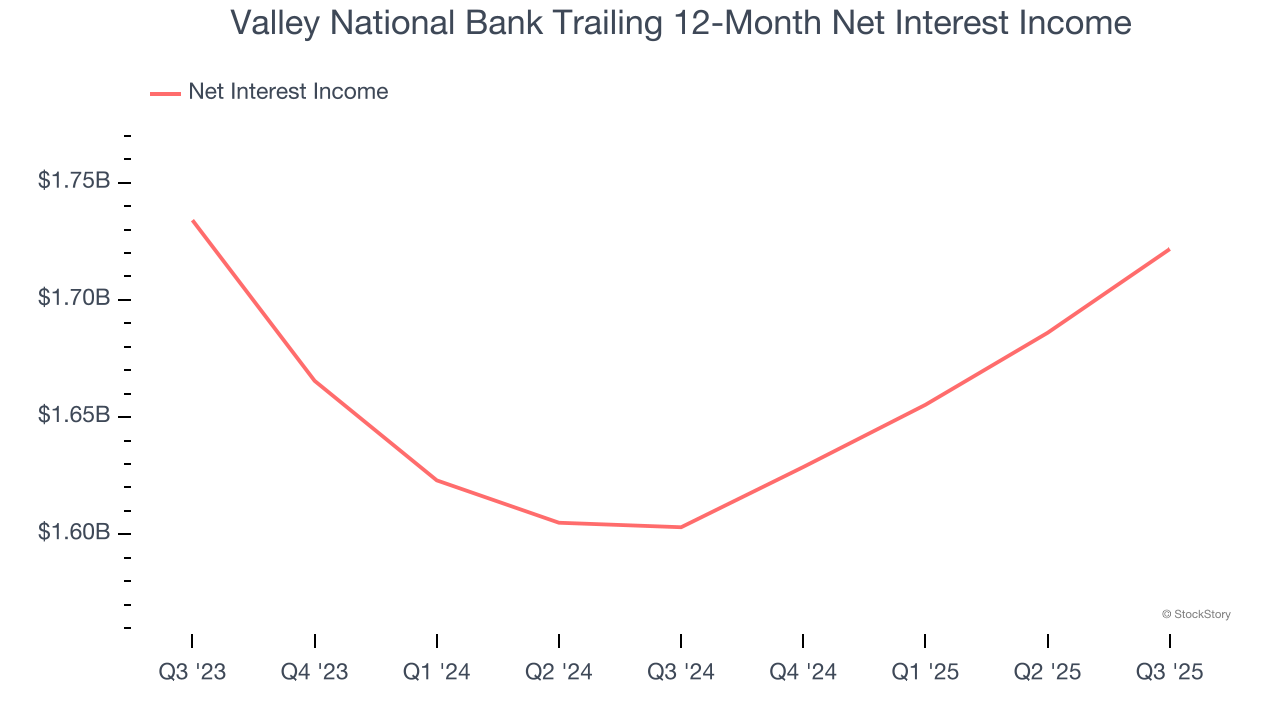

2. Net Interest Income Points to Soft Demand

Net interest income commands greater market attention due to its reliability and consistency, whereas one-time fees are often seen as lower-quality revenue that lacks the same dependable characteristics.

Valley National Bank’s net interest income has grown at a 10% annualized rate over the last five years, slightly worse than the broader banking industry and in line with its total revenue.

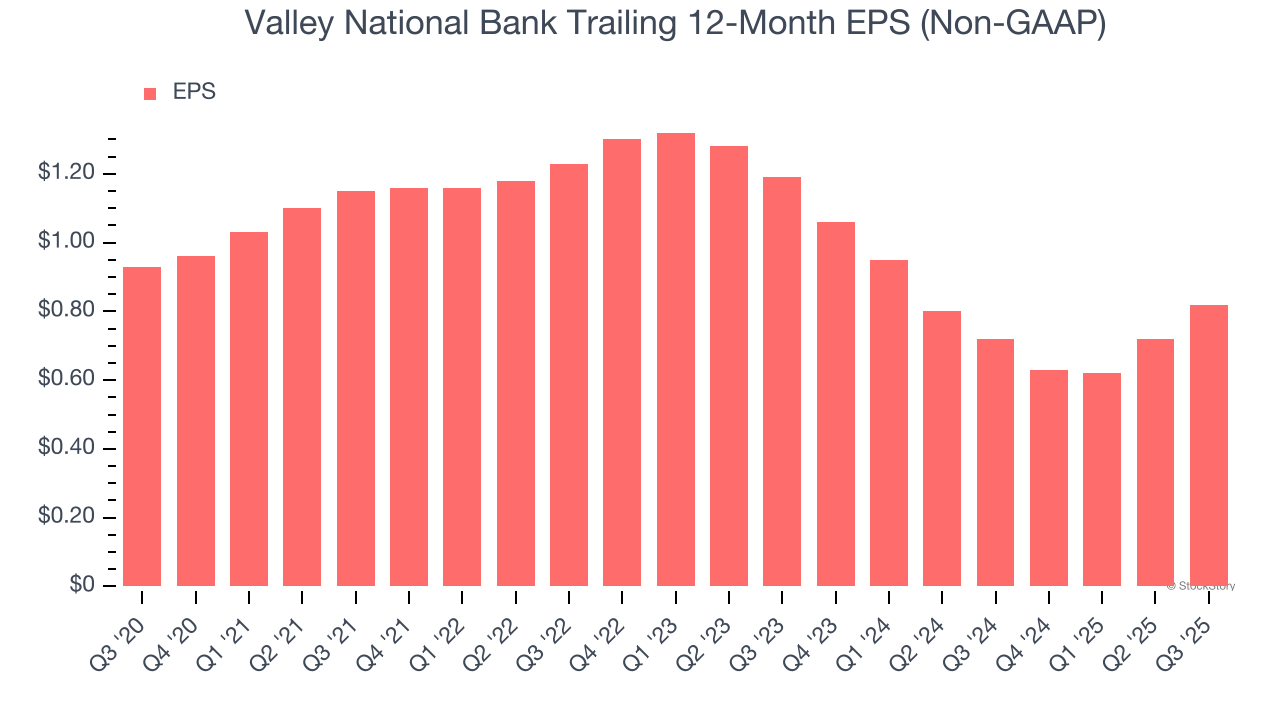

3. EPS Trending Down

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Sadly for Valley National Bank, its EPS declined by 2.5% annually over the last five years while its revenue grew by 9.5%. This tells us the company became less profitable on a per-share basis as it expanded.

Final Judgment

We cheer for all companies supporting the economy, but in the case of Valley National Bank, we’ll be cheering from the sidelines. With its shares topping the market in recent months, the stock trades at 0.8× forward P/B (or $11.42 per share). While this valuation is reasonable, we don’t see a big opportunity at the moment. There are better investments elsewhere. Let us point you toward a safe-and-steady industrials business benefiting from an upgrade cycle.

Stocks We Would Buy Instead of Valley National Bank

If your portfolio success hinges on just 4 stocks, your wealth is built on fragile ground. You have a small window to secure high-quality assets before the market widens and these prices disappear.

Don’t wait for the next volatility shock. Check out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.