Morgan Stanley remains bullish on Nvidia (NVDA) stock despite growing concerns about an AI bubble. Analyst Joe Moore raised his price target on the chipmaker to $250 from $235, implying roughly 39% upside from current levels. The price hike comes as prominent investor Michael Burry intensifies his warnings that the AI investment boom mirrors the dot-com crash of the early 2000s.

Burry recently launched a Substack newsletter called "Cassandra Unchained" to detail his bearish AI thesis. He argues that Nvidia today occupies the same precarious position that Cisco (CSCO) held in 1999 and 2000, serving as the key hardware supplier during a massive capital spending cycle built on overly optimistic assumptions.

The "Big Short" investor pointed to parallels between then-Federal Reserve Chair Alan Greenspan's dismissal of housing bubble concerns in 2005 and current Fed Chair Jerome Powell's wave-off of AI bubble fears, noting that AI companies are actually profitable.

The tension escalated when Nvidia circulated a seven-page memo to Wall Street analysts. The memo specifically addressed Burry's claims about stock-based compensation, depreciation schedules, and circular financing. Burry fired back, standing by his analysis while clarifying that he views Nvidia as today's Cisco rather than another Enron.

Moore at Morgan Stanley remains unfazed by the bubble talk, given Nvidia’s leadership position in the AI chip segment. The analyst emphasized that Nvidia continues to offer the best cost and performance for AI workloads, which keeps customers locked into the platform.

Is Nvidia Stock Still a Good Buy?

Nvidia continues to push back against concerns about an AI bubble while making strategic moves to cement its dominance in the rapidly expanding market.

Earlier this week, the AI giant announced a partnership with Synopsys (SNPS). According to the agreement, Nvidia will invest $2 billion in Synopsys with an aim to revolutionize engineering and design across multiple industries.

The collaboration will integrate Synopsys' engineering software with Nvidia's accelerated computing and AI technology to transform how companies design everything from semiconductors to complete systems.

CFO Colette Kress addressed bubble concerns directly, explaining that the market is missing several major transitions happening simultaneously. She emphasized that transitioning existing data center workloads from CPUs to GPUs represents about half of the projected $3 trillion to $4 trillion in AI infrastructure spending by the end of the decade.

This shift has already transformed scientific computing, where GPU-accelerated computing has grown from 10% in 2016 to 90% today, with traditional CPU-only computing now representing just 10% of the market.

The partnership with Synopsys demonstrates Nvidia's strategy of investing heavily in its ecosystem to accelerate the platform shift toward accelerated computing. The Synopsys collaboration could deliver performance improvements ranging from 10x to over 1,000x across core engineering workloads, reducing tasks that previously took weeks to just hours.

Kress pushed back against concerns that Nvidia's competitive position is shrinking. She emphasized that the company's full-stack approach, which combines hardware with the CUDA software platform and extensive libraries. This integration creates advantages that fixed-function ASICs cannot match.

What Is the NVDA Stock Price Target?

On the financial front, Nvidia's massive increase in inventory and purchase commitments signals significant revenue growth ahead. The company's previously disclosed visibility into $500 billion in data center infrastructure revenue between calendar years 2025 and 2026 doesn't even include newer deals like the Anthropic partnership.

With gross margins holding steady in the mid-70s range despite cost pressures, Nvidia remains well-positioned to capitalize on what management views as a fundamental platform shift rather than a speculative bubble.

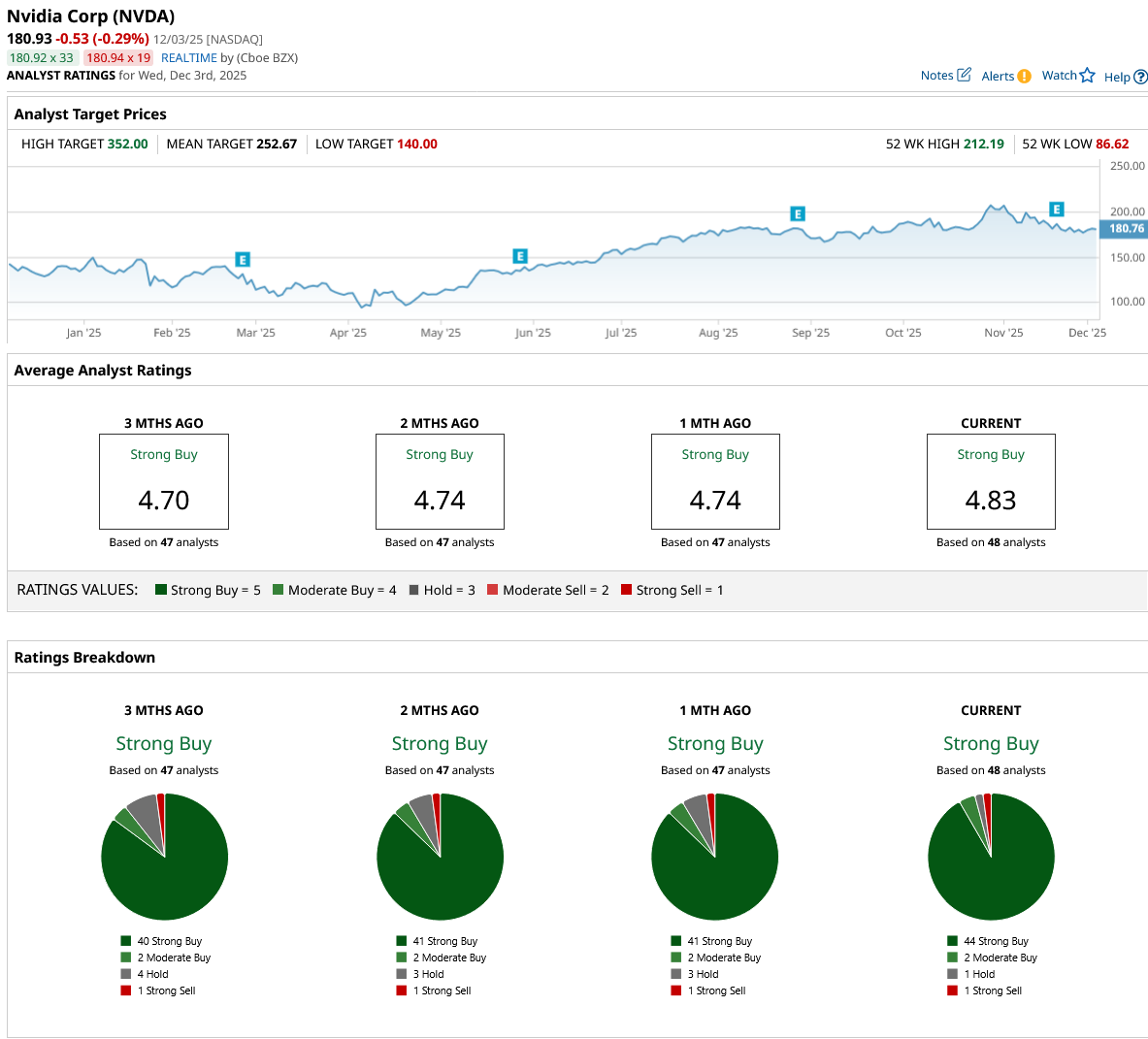

Out of the 48 analysts covering NVDA stock, 44 recommend “Strong Buy,” two recommend “Moderate Buy,” one recommends “Hold,” and one recommends “Strong Sell.” The average NVDA stock price target is $252.67, which is about 40% above the current price.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Cathie Wood Is Selling Palantir Stock. Should You?

- Netflix Stock Breaks Below 20-Day Moving Average Amid Selloff. Should You Buy the Dip?

- Michael Burry Says Tesla Is ‘Ridiculously Overvalued.’ Should You Ditch TSLA Stock Here?

- Why Is Michael Burry So Bullish on Lululemon Stock? And Should You Be, Too?