Data streaming platform provider Confluent (NASDAQ: CFLT) reported Q3 CY2025 results beating Wall Street’s revenue expectations, with sales up 19.3% year on year to $298.5 million. On the other hand, next quarter’s revenue guidance of $296 million was less impressive, coming in 3% below analysts’ estimates. Its non-GAAP profit of $0.13 per share was 33.6% above analysts’ consensus estimates.

Is now the time to buy Confluent? Find out by accessing our full research report, it’s free for active Edge members.

Confluent (CFLT) Q3 CY2025 Highlights:

- Revenue: $298.5 million vs analyst estimates of $292.5 million (19.3% year-on-year growth, 2.1% beat)

- Adjusted EPS: $0.13 vs analyst estimates of $0.10 (33.6% beat)

- Adjusted Operating Income: $29.07 million vs analyst estimates of $20.72 million (9.7% margin, 40.3% beat)

- Revenue Guidance for Q4 CY2025 is $296 million at the midpoint, below analyst estimates of $305 million

- Adjusted EPS guidance for Q4 CY2025 is $0.10 at the midpoint, above analyst estimates of $0.09

- Operating Margin: -27.9%, up from -37.4% in the same quarter last year

- Free Cash Flow Margin: 8.2%, up from 3.9% in the previous quarter

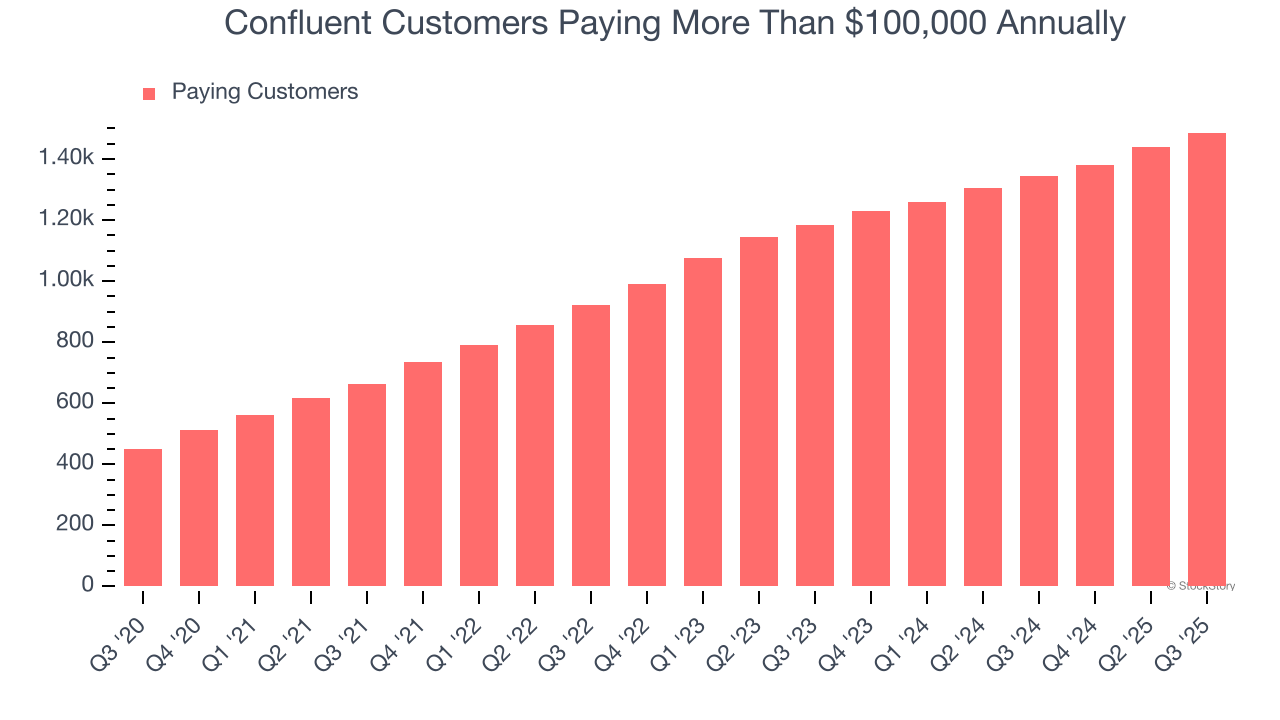

- Customers: 1,487 customers paying more than $100,000 annually

- Market Capitalization: $7.86 billion

Company Overview

Built by the original creators of Apache Kafka, the popular open-source messaging system, Confluent (NASDAQ: CFLT) provides a data infrastructure platform that enables organizations to connect their applications, systems, and data layers around real-time data streams.

Revenue Growth

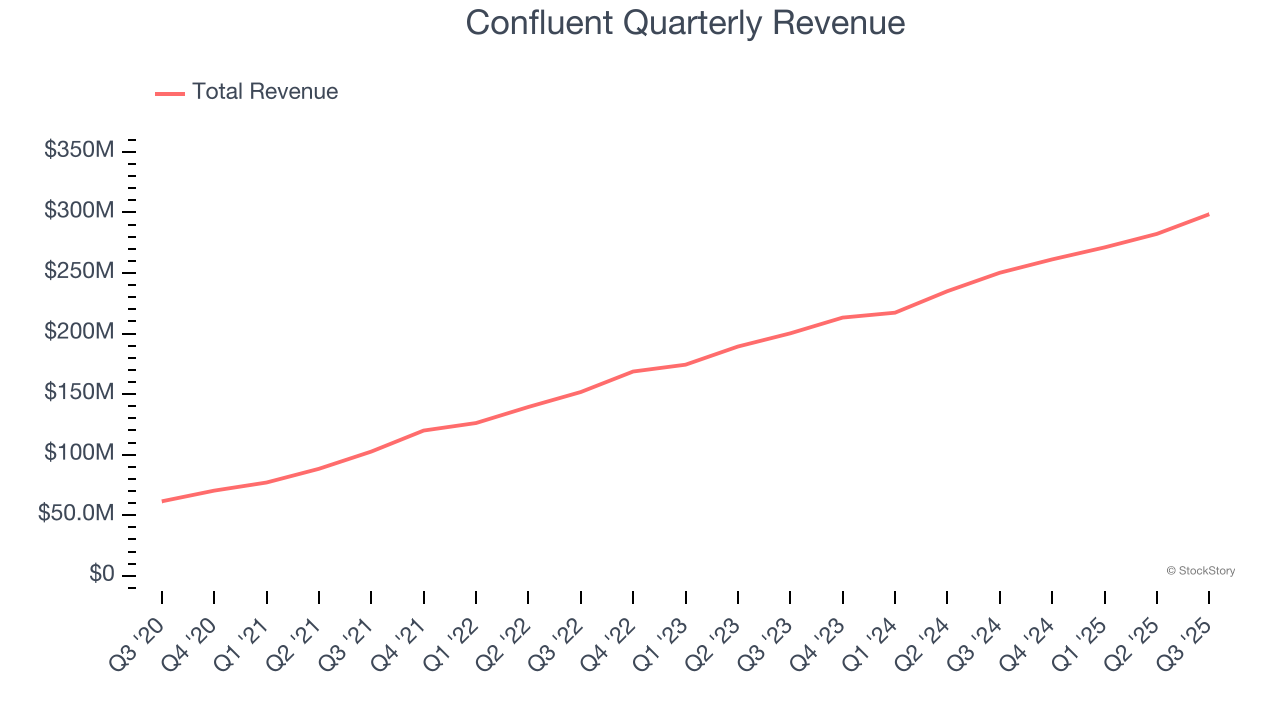

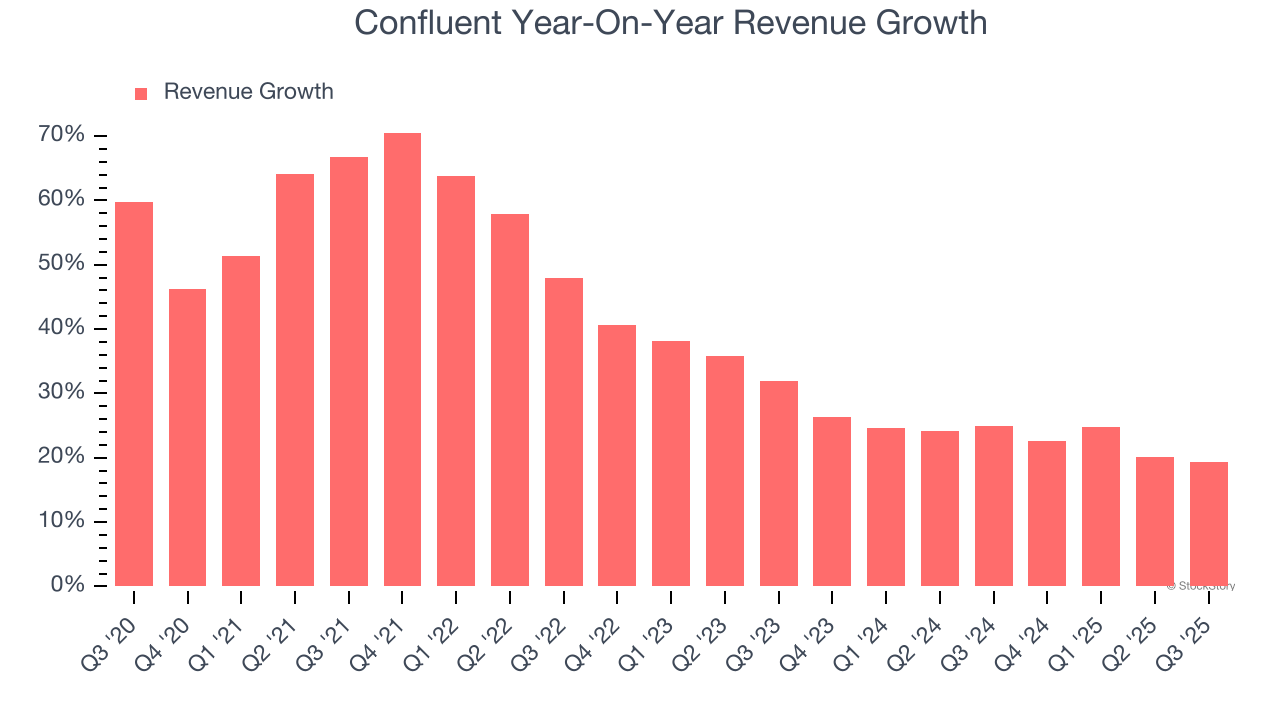

A company’s long-term sales performance can indicate its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, Confluent grew its sales at an exceptional 39% compounded annual growth rate. Its growth beat the average software company and shows its offerings resonate with customers, a helpful starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within software, a half-decade historical view may miss recent innovations or disruptive industry trends. Confluent’s annualized revenue growth of 23.3% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

This quarter, Confluent reported year-on-year revenue growth of 19.3%, and its $298.5 million of revenue exceeded Wall Street’s estimates by 2.1%. Company management is currently guiding for a 13.3% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 15.5% over the next 12 months, a deceleration versus the last two years. Still, this projection is above average for the sector and implies the market is baking in some success for its newer products and services.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Enterprise Customer Base

This quarter, Confluent reported 1,487 enterprise customers paying more than $100,000 annually, an increase of 48 from the previous quarter. That’s fewer contract wins than last quarter and quite a bit below what we’ve observed over the previous year, suggesting its sales momentum with new enterprise customers is slowing. It also implies that Confluent will likely need to upsell its existing large customers or move down market to accelerate its top-line growth.

Key Takeaways from Confluent’s Q3 Results

Revenue, adjusted operating income, and adjusted EPS all beat expectations. It was also good to see Confluent provide EPS guidance for next quarter that slightly beat analysts’ expectations. On the other hand, its revenue guidance for next quarter fell short of Wall Street’s estimates. Overall, this quarter was mixed, but the market seems willing to forgive the revenue guidance. The stock traded up 8.8% to $24 immediately after reporting.

Should you buy the stock or not? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.