Private equity firm Carlyle Group (NASDAQ: CG) fell short of the markets revenue expectations in Q3 CY2025, with sales falling 12.6% year on year to $782.5 million. Its GAAP loss of $0 per share decreased from $0.95 in the same quarter last year.

Is now the time to buy Carlyle? Find out by accessing our full research report, it’s free for active Edge members.

Carlyle (CG) Q3 CY2025 Highlights:

- Assets Under Management: $474 billion vs analyst estimates of $447.3 billion (5.9% year-on-year growth, 6% beat)

- Revenue: $782.5 million vs analyst estimates of $987.3 million (12.6% year-on-year decline, 20.7% miss)

- Fee-Related Earnings: $311.9 million vs analyst estimates of $314.8 million (0.9% miss)

- Market Capitalization: $20.46 billion

Company Overview

Founded in 1987 with just $5 million in capital and named after the iconic New York hotel where the founders first met, The Carlyle Group (NASDAQ: CG) is a global investment firm that raises, manages, and deploys capital across private equity, credit, and investment solutions.

Revenue Growth

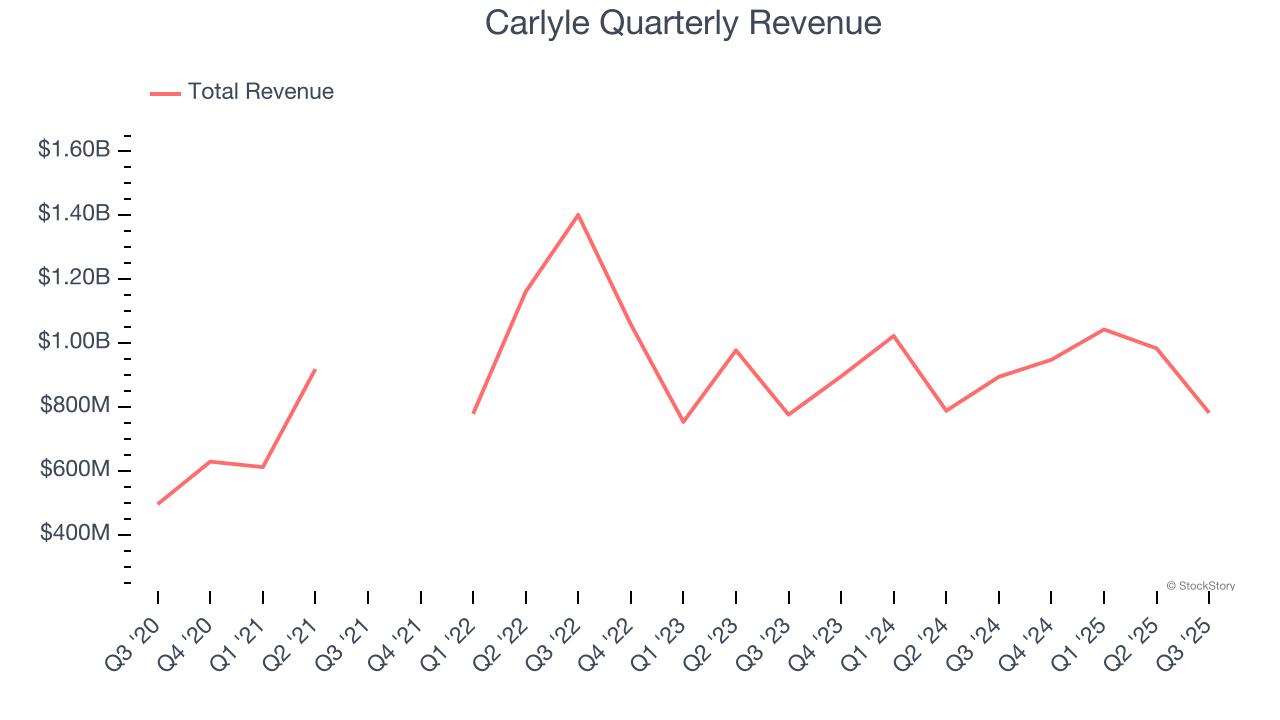

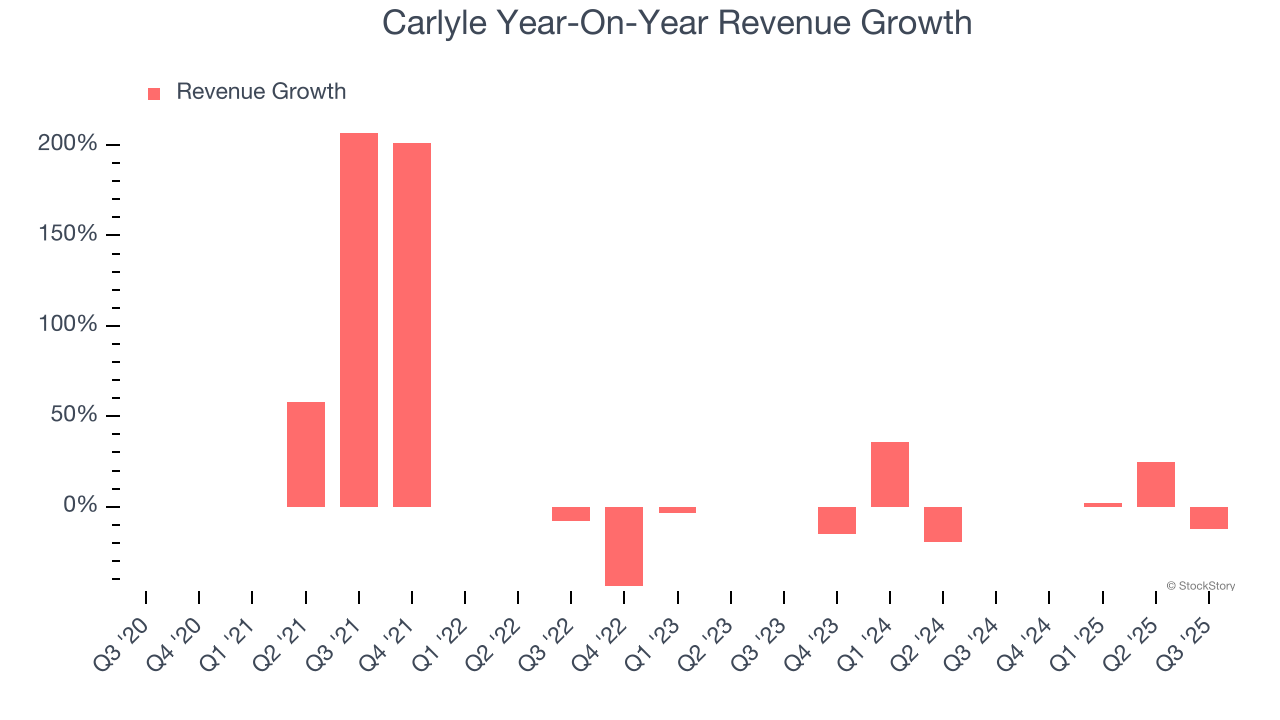

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Luckily, Carlyle’s revenue grew at a decent 10.9% compounded annual growth rate over the last five years. Its growth was slightly above the average financials company and shows its offerings resonate with customers.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.We at StockStory place the most emphasis on long-term growth, but within financials, a half-decade historical view may miss recent interest rate changes, market returns, and industry trends. Carlyle’s recent performance shows its demand has slowed as its annualized revenue growth of 2.6% over the last two years was below its five-year trend.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Carlyle missed Wall Street’s estimates and reported a rather uninspiring 12.6% year-on-year revenue decline, generating $782.5 million of revenue.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Assets Under Management (AUM)

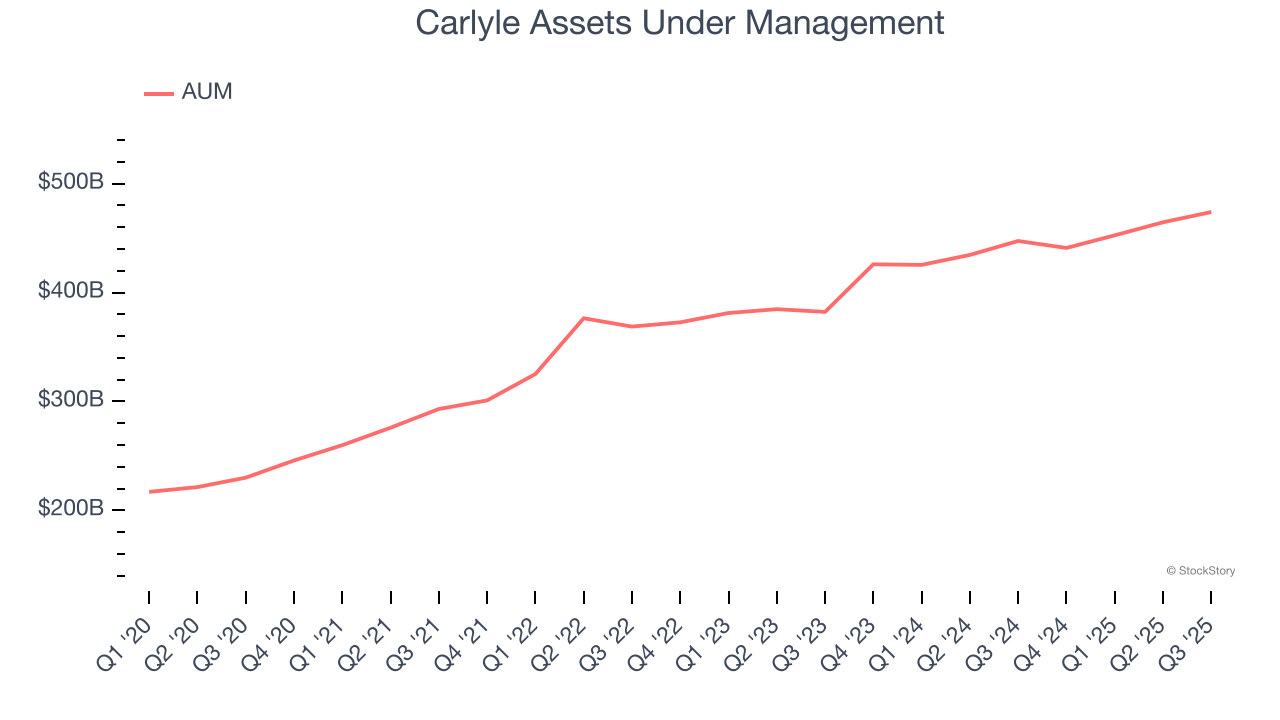

Assets Under Management (AUM) encompasses all client funds under a firm's investment management umbrella. The recurring fee structure on these assets provides consistent revenue generation, offering financial stability even during periods of poor investment returns, though sustained underperformance can impact future asset flows.

Carlyle’s AUM has grown at an annual rate of 14.3% over the last four years, a step above the broader financials industry. When analyzing Carlyle’s AUM over the last two years, we can see that growth decelerated to 9.8% annually. Fundraising or short-term investment performance were net contributors for the company over this shorter period since assets grew faster than total revenue. Just remember that while assets are relevant to watch, we don't place too much emphasis on them because they ebb and flow with the market.

In Q3, Carlyle’s AUM was $474 billion, beating analysts’ expectations by 6%. This print was 5.9% higher than the same quarter last year.

Key Takeaways from Carlyle’s Q3 Results

We were impressed by how significantly Carlyle blew past analysts’ AUM expectations this quarter. On the other hand, its revenue missed and its fee-related earnings fell slightly short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded down 2.7% to $55.04 immediately following the results.

Carlyle didn’t show it’s best hand this quarter, but does that create an opportunity to buy the stock right now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.