Wrapping up Q3 earnings, we look at the numbers and key takeaways for the diversified financial services stocks, including WEX (NYSE: WEX) and its peers.

Diversified financial services encompass specialized offerings outside traditional categories. These firms benefit from identifying niche market opportunities, developing tailored financial products, and often facing less direct competition. Challenges include scale limitations, regulatory classification uncertainties, and the need to continuously innovate to maintain market differentiation against larger competitors expanding their offerings.

The 10 diversified financial services stocks we track reported a strong Q3. As a group, revenues beat analysts’ consensus estimates by 3% while next quarter’s revenue guidance was in line.

In light of this news, share prices of the companies have held steady as they are up 1.7% on average since the latest earnings results.

WEX (NYSE: WEX)

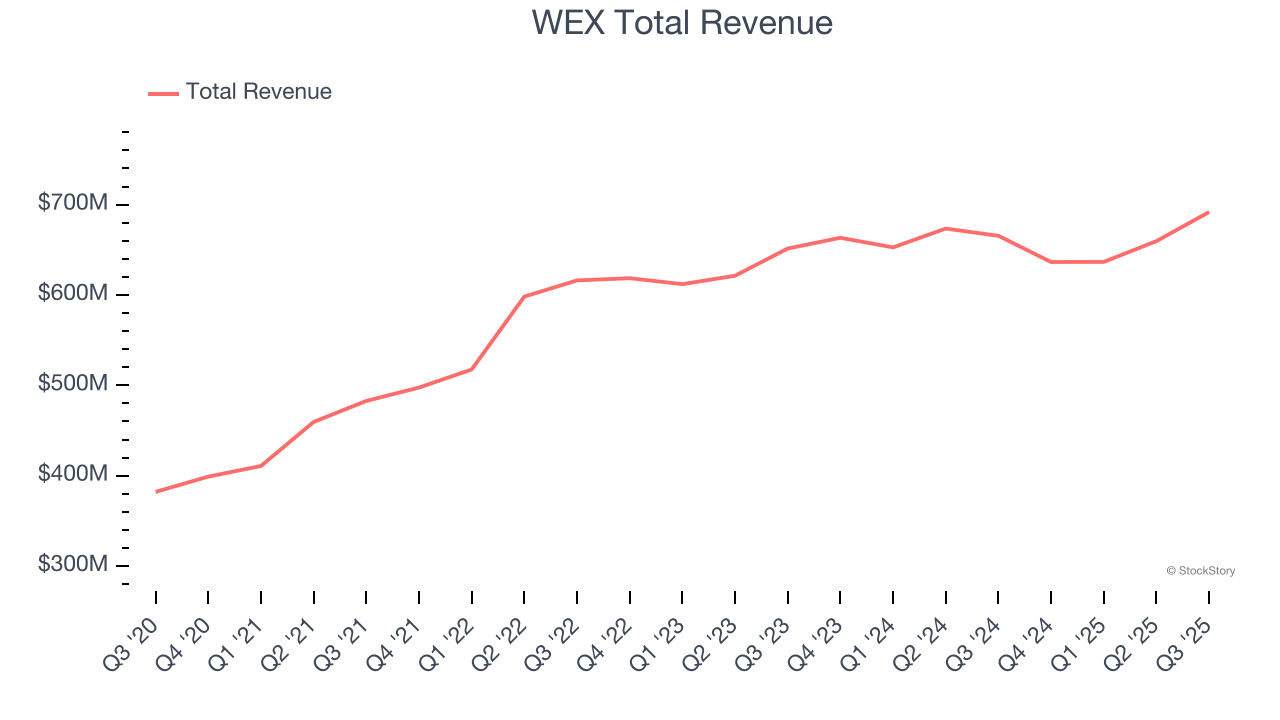

Originally founded in 1983 as Wright Express to serve the fleet card market, WEX (NYSE: WEX) provides payment processing and business solutions across fleet management, employee benefits, and corporate payments sectors.

WEX reported revenues of $691.8 million, up 4% year on year. This print exceeded analysts’ expectations by 1.5%. Overall, it was a satisfactory quarter for the company with a solid beat of analysts’ Account Servicing segment estimates but a slight miss of analysts’ Payment Processing segment estimates.

“Our strategy to return to revenue growth was demonstrated in the third quarter with both revenue and earnings exceeding the high end of our guidance ranges,” said Melissa Smith, WEX’s Chair, Chief Executive Officer, and President.

Unsurprisingly, the stock is down 2.9% since reporting and currently trades at $149.61.

Is now the time to buy WEX? Access our full analysis of the earnings results here, it’s free for active Edge members.

Best Q3: Paymentus (NYSE: PAY)

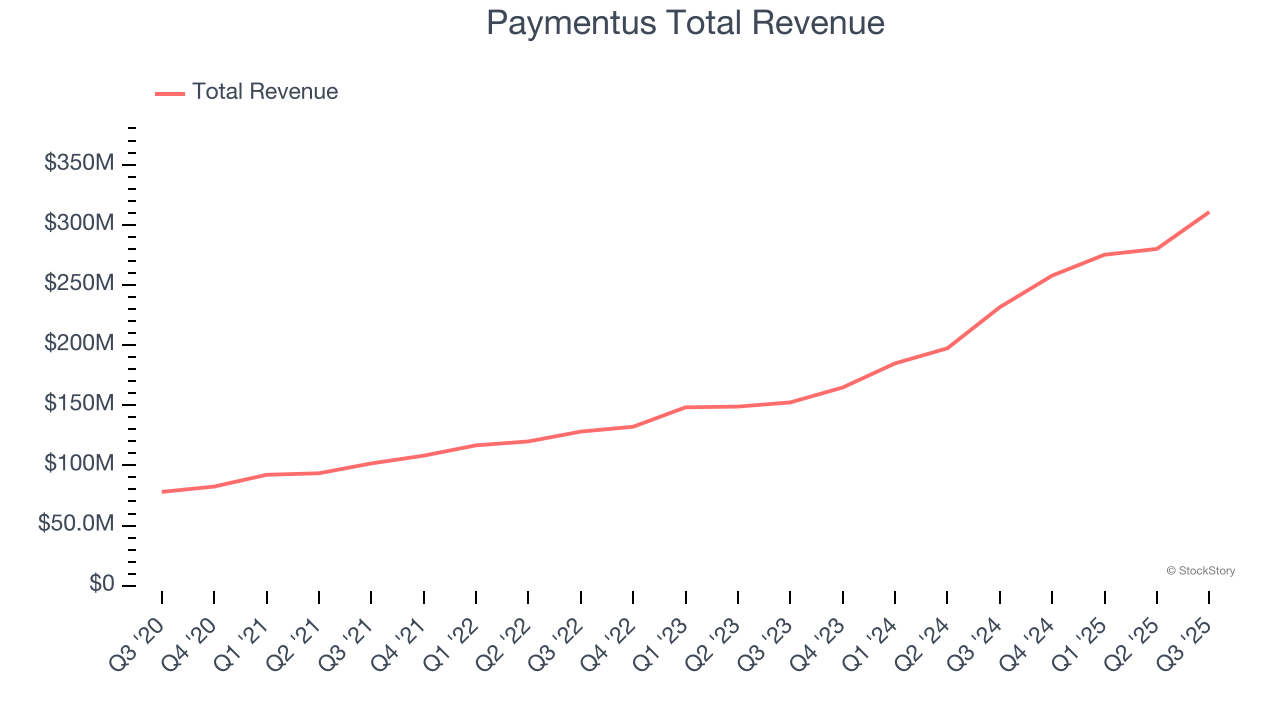

Founded in 2004 to simplify the complex world of bill payments, Paymentus (NYSE: PAY) provides a cloud-based platform that helps utilities, municipalities, and service providers automate billing and payment processes.

Paymentus reported revenues of $310.7 million, up 34.2% year on year, outperforming analysts’ expectations by 10.7%. The business had a stunning quarter with an impressive beat of analysts’ revenue estimates and a solid beat of analysts’ EBITDA estimates.

Paymentus pulled off the fastest revenue growth among its peers. The market seems happy with the results as the stock is up 19.8% since reporting. It currently trades at $34.27.

Is now the time to buy Paymentus? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q3: NCR Atleos (NYSE: NATL)

Spun off from NCR Voyix in 2023 to focus exclusively on self-service banking technology, NCR Atleos (NYSE: NATL) provides self-directed banking solutions including ATM and interactive teller machine technology, software, services, and a surcharge-free ATM network for financial institutions and retailers.

NCR Atleos reported revenues of $1.12 billion, up 4.5% year on year, exceeding analysts’ expectations by 0.6%. Still, it was a softer quarter as it posted a significant miss of analysts’ EPS estimates.

As expected, the stock is down 2.5% since the results and currently trades at $36.89.

Read our full analysis of NCR Atleos’s results here.

Western Union (NYSE: WU)

With a history dating back to 1851 when it began as a telegraph company, Western Union (NYSE: WU) is a global money transfer service that enables consumers and businesses to send funds across borders and currencies, typically within minutes.

Western Union reported revenues of $1.03 billion, flat year on year. This number topped analysts’ expectations by 1%. It was a strong quarter as it also recorded a beat of analysts’ EPS estimates and full-year revenue guidance slightly topping analysts’ expectations.

Western Union achieved the highest full-year guidance raise among its peers. The stock is up 5.8% since reporting and currently trades at $8.61.

Read our full, actionable report on Western Union here, it’s free for active Edge members.

Payoneer (NASDAQ: PAYO)

Founded during the early days of global e-commerce in 2005 to solve international payment challenges, Payoneer (NASDAQ: PAYO) provides financial technology services that enable small and medium-sized businesses to send and receive payments globally across borders.

Payoneer reported revenues of $270.9 million, up 9.1% year on year. This result beat analysts’ expectations by 2.9%. Aside from that, it was a mixed quarter as it also logged a solid beat of analysts’ yield estimates but EPS in line with analysts’ estimates.

The stock is down 2% since reporting and currently trades at $5.68.

Read our full, actionable report on Payoneer here, it’s free for active Edge members.

Market Update

As a result of the Fed’s rate hikes in 2022 and 2023, inflation has come down from frothy levels post-pandemic. The general rise in the price of goods and services is trending towards the Fed’s 2% goal as of late, which is good news. The higher rates that fought inflation also didn't slow economic activity enough to catalyze a recession. So far, soft landing. This, combined with recent rate cuts (half a percent in September 2024 and a quarter percent in November 2024) have led to strong stock market performance in 2024. The icing on the cake for 2024 returns was Donald Trump’s victory in the U.S. Presidential Election in early November, sending major indices to all-time highs in the week following the election. Still, debates around the health of the economy and the impact of potential tariffs and corporate tax cuts remain, leaving much uncertainty around 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.