Lincolnshire, Illinois-based Zebra Technologies Corporation (ZBRA) provides enterprise asset intelligence solutions in the automatic identification and data capture solutions industry worldwide. Valued at $11.7 billion by market cap, Zebra operates through Asset Intelligence & Tracking and Enterprise Visibility & Mobility segments.

Zebra Technologies has significantly underperformed the broader market over the past year. ZBRA stock has tanked 40.6% over the past 52 weeks and 40.9% on a YTD basis, compared to the S&P 500 Index’s ($SPX) 10.5% gains over the past year and 11.2% returns in 2025.

Narrowing the focus, Zebra has also underperformed the sector-focused Technology Select Sector SPDR Fund’s (XLK) 17.8% surge over the past 52 weeks and 17% gains on a YTD basis.

Despite reporting better-than-expected financials, Zebra Technologies’ stock price dropped 11.7% in the trading session following the release of its Q3 results on Oct. 28. The company’s organic sales for the quarter observed a notable increase, leading to a solid 5.2% year-over-year growth in net sales to $1.3 billion, beating the Street’s expectations by 71 bps. Further, its adjusted EPS increased 11.2% year-over-year to $3.88, surpassing the consensus estimates by 3.5%.

However, the company’s Q4 sales outlook significantly dampened investor confidence. Zebra expects its Q4 sales to grow by 8% to 11% year-over-year. However, this includes an 8.5% favorable impact from acquisitions and foreign currency translation.

For the full fiscal 2025, ending in December, analysts expect ZBRA to deliver an adjusted EPS of $15.83, up 17.1% year-over-year. The company has a solid earnings surprise history. It has surpassed the Street’s bottom-line estimates in each of the past four quarters.

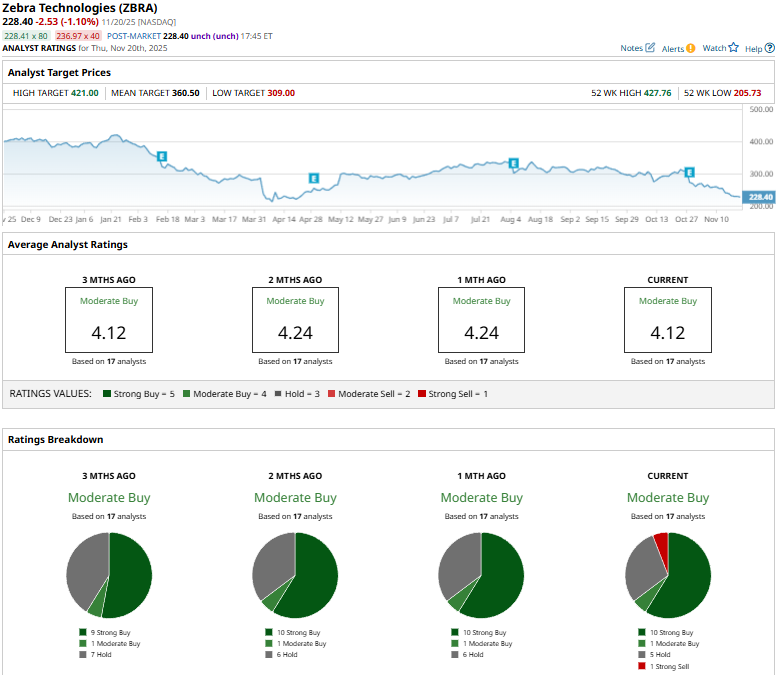

Among the 17 analysts covering the ZBRA stock, the consensus rating is a “Moderate Buy.” That’s based on 10 “Strong Buys,” one “Moderate Buy,” five “Holds,” and one “Strong Sell.”

This configuration is slightly less optimistic than a month ago, when none of the analysts covering ZBRA gave “Strong Sell” recommendations on the stock.

On Oct. 29, Truist Securities analyst Jamie Cook reiterated a “Hold” rating on ZBRA and lowered the price target from $350 to $331.

As of writing, ZBRA’s mean price target of $360.50 represents a 57.8% premium to current price levels. While the street-high target of $421 suggests a staggering 84.3% upside potential.

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- This Stock’s Dividend Has Risen 1.5X in 2 Years. Is It a Buy Here?

- Wall Street Sees a ‘Buying Opportunity’ in This Rare Earths Stock. Should You Snap Up Shares Now?

- Billionaire Gina Rinehart Is Now the Top Investor in MP Materials. Should You Follow the Money and Buy MP Stock Too?

- Can Nvidia Stock Test Wall Street’s Price Target of $350?