Looking back on online marketplace stocks’ Q3 earnings, we examine this quarter’s best and worst performers, including The RealReal (NASDAQ: REAL) and its peers.

Marketplaces have existed for centuries. Where once it was a main street in a small town or a mall in the suburbs, sellers benefitted from proximity to one another because they could draw customers by offering convenience and selection. Today, a myriad of online marketplaces fulfill that same role, aggregating large customer bases, which attracts commission-paying sellers, generating flywheel scale effects that feed back into further customer acquisition.

The 16 online marketplace stocks we track reported a mixed Q3. As a group, revenues beat analysts’ consensus estimates by 1.8% while next quarter’s revenue guidance was 1% above.

Luckily, online marketplace stocks have performed well with share prices up 13.5% on average since the latest earnings results.

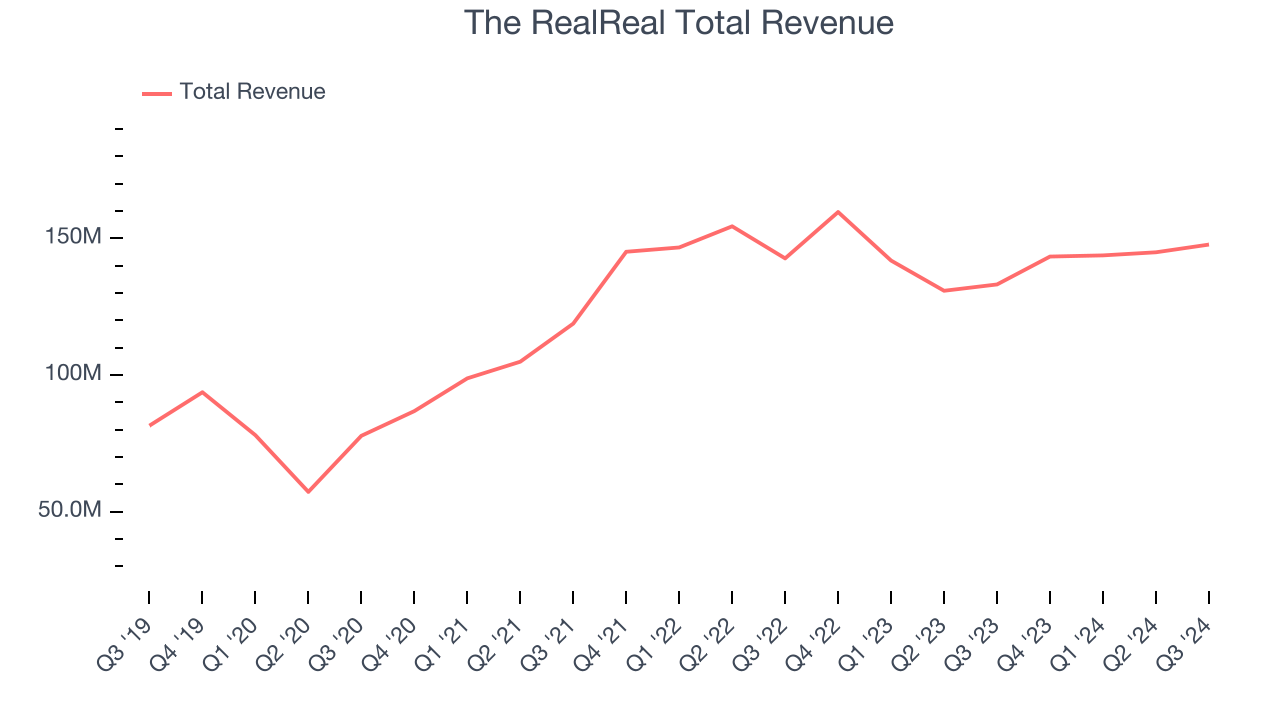

The RealReal (NASDAQ: REAL)

Founded by consignment store aficionado Julie Wainwright, The RealReal (NASDAQ: REAL) is an online marketplace for buying and selling secondhand luxury goods.

The RealReal reported revenues of $147.8 million, up 11% year on year. This print exceeded analysts’ expectations by 3.2%. Overall, it was a strong quarter for the company with an impressive beat of analysts’ EBITDA estimates.

“I am pleased to report strong results for the third quarter, and I am encouraged by the continued strength in supply trends as we enter the fourth quarter," said Rati Levesque, Chief Executive Officer of The RealReal.

The RealReal scored the highest full-year guidance raise of the whole group. The company reported 389,000 users, up 6.9% year on year. Unsurprisingly, the stock is up 44.4% since reporting and currently trades at $4.41.

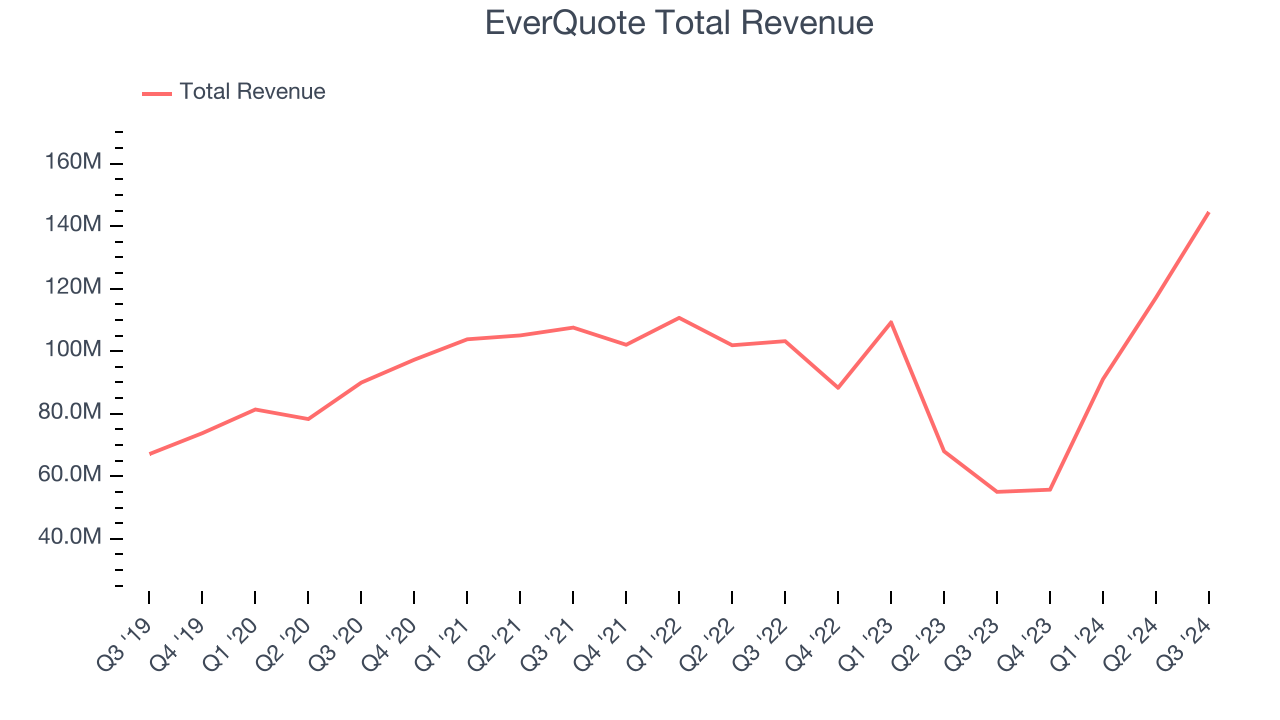

Best Q3: EverQuote (NASDAQ: EVER)

Aiming to simplify a once complicated process, EverQuote (NASDAQ: EVER) is an online insurance marketplace where consumers can compare and purchase various types of insurance from different providers

EverQuote reported revenues of $144.5 million, up 163% year on year, outperforming analysts’ expectations by 3%. The business had a stunning quarter with EBITDA guidance for next quarter exceeding analysts’ expectations and an impressive beat of analysts’ EBITDA estimates.

EverQuote achieved the fastest revenue growth among its peers. The market seems happy with the results as the stock is up 14% since reporting. It currently trades at $19.76.

Is now the time to buy EverQuote? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: Robinhood (NASDAQ: HOOD)

With a mission to democratize finance, Robinhood (NASDAQ: HOOD) is an online consumer finance platform known for its commission-free stock and crypto trading.

Robinhood reported revenues of $637 million, up 36.4% year on year, falling short of analysts’ expectations by 3.2%. It was a softer quarter as it posted a slight miss of analysts’ number of funded customers estimates. In addition, EBITDA fell below analysts' estimates.

Interestingly, the stock is up 25.9% since the results and currently trades at $35.55.

Read our full analysis of Robinhood’s results here.

LegalZoom (NASDAQ: LZ)

Founded by famous lawyer Robert Shapiro, LegalZoom (NASDAQ: LZ) offers online legal services and documentation assistance for individuals and businesses.

LegalZoom reported revenues of $168.6 million, flat year on year. This print surpassed analysts’ expectations by 0.5%. More broadly, it was a satisfactory quarter as it also produced an impressive beat of analysts’ EBITDA estimates.

The company reported 1.72 million users, up 9.5% year on year. The stock is down 6.6% since reporting and currently trades at $7.60.

Read our full, actionable report on LegalZoom here, it’s free.

ACV Auctions (NASDAQ: ACVA)

Founded in 2014, ACV Auctions (NASDAQ: ACVA) is an online auction marketplace for car dealers and wholesalers to buy and sell used cars.

ACV Auctions reported revenues of $171.3 million, up 44% year on year. This result topped analysts’ expectations by 6.8%. Overall, it was a strong quarter as it also produced a solid beat of analysts’ EBITDA estimates.

ACV Auctions achieved the biggest analyst estimates beat among its peers. The company reported 198,354 units sold, up 32.2% year on year. The stock is up 9.4% since reporting and currently trades at $21.35.

Read our full, actionable report on ACV Auctions here, it’s free.

Market Update

As a result of the Fed's rate hikes in 2022 and 2023, inflation has come down from frothy levels post-pandemic. The general rise in the price of goods and services is trending towards the Fed's 2% goal as of late, which is good news. The higher rates that fought inflation also didn't slow economic activity enough to catalyze a recession. So far, soft landing. This, combined with recent rate cuts (half a percent in September 2024 and a quarter percent in November 2024) have led to strong stock market performance in 2024. The icing on the cake for 2024 returns was Donald Trump's victory in the US Presidential Election in early November, sending major indices to all-time highs in the week following the election. Still, debates around the health of the economy and the impact of potential tariffs and corporate tax cuts remain. Said differently, there's still much uncertainty around 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.