Wrapping up Q4 earnings, we look at the numbers and key takeaways for the energy products and services stocks, including FTAI Infrastructure (NASDAQ: FIP) and its peers.

Areas like the energy transition and emission reduction are thematic and front of mind today. This can be a double-edged sword for the energy products and services industry. Those who innovate and build new expertise can jolt demand while those who cling to legacy technologies or fall behind in the trending areas could see their market shares diminish. Bigger picture, energy products and services companies are still at the whim of construction and infrastructure project volumes, which tend to be cyclical and can be impacted heavily by economic factors such as interest rates.

The 4 energy products and services stocks we track reported a softer Q4. As a group, revenues missed analysts’ consensus estimates by 11.7%.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 19.7% since the latest earnings results.

FTAI Infrastructure (NASDAQ: FIP)

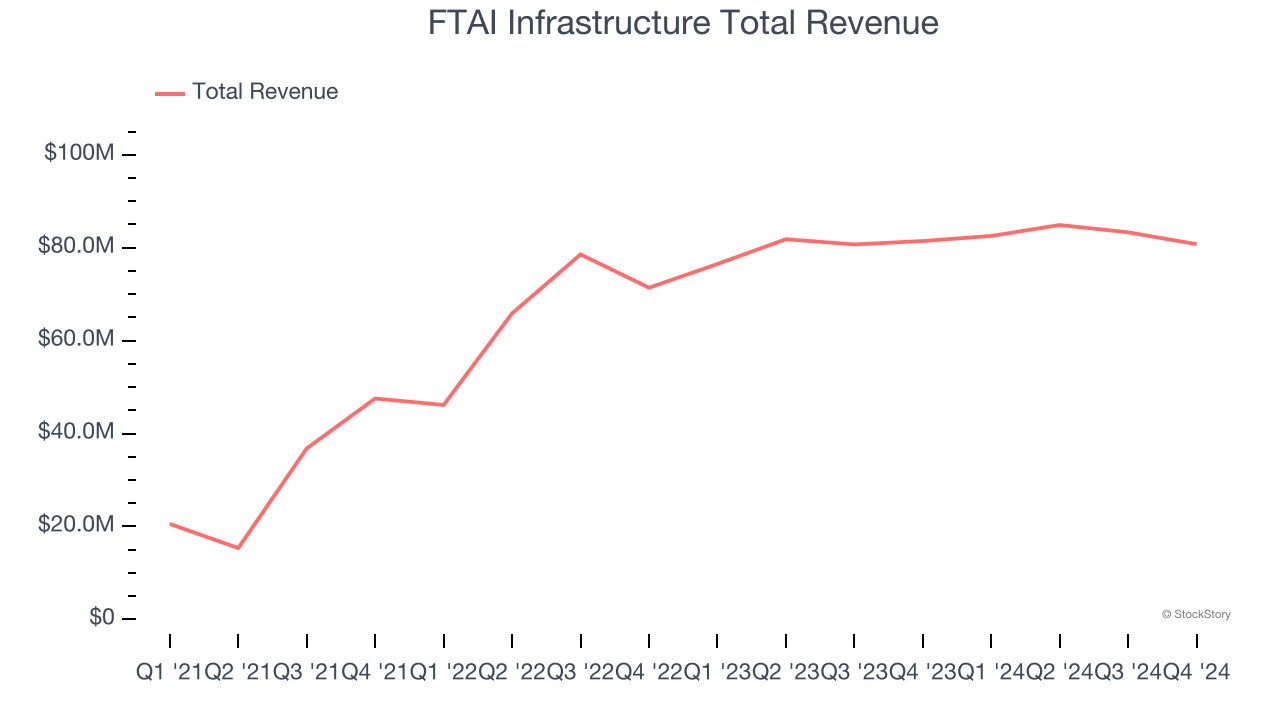

Spun off from FTAI Aviation in 2021, FTAI Infrastructure (NASDAQ: FIP) invests in and operates infrastructure and related assets across the transportation and energy sectors.

FTAI Infrastructure reported revenues of $80.76 million, flat year on year. This print fell short of analysts’ expectations by 14.8%. Overall, it was a disappointing quarter for the company with a significant miss of analysts’ EPS estimates.

Unsurprisingly, the stock is down 28.6% since reporting and currently trades at $4.06.

Read our full report on FTAI Infrastructure here, it’s free.

Best Q4: Quanta (NYSE: PWR)

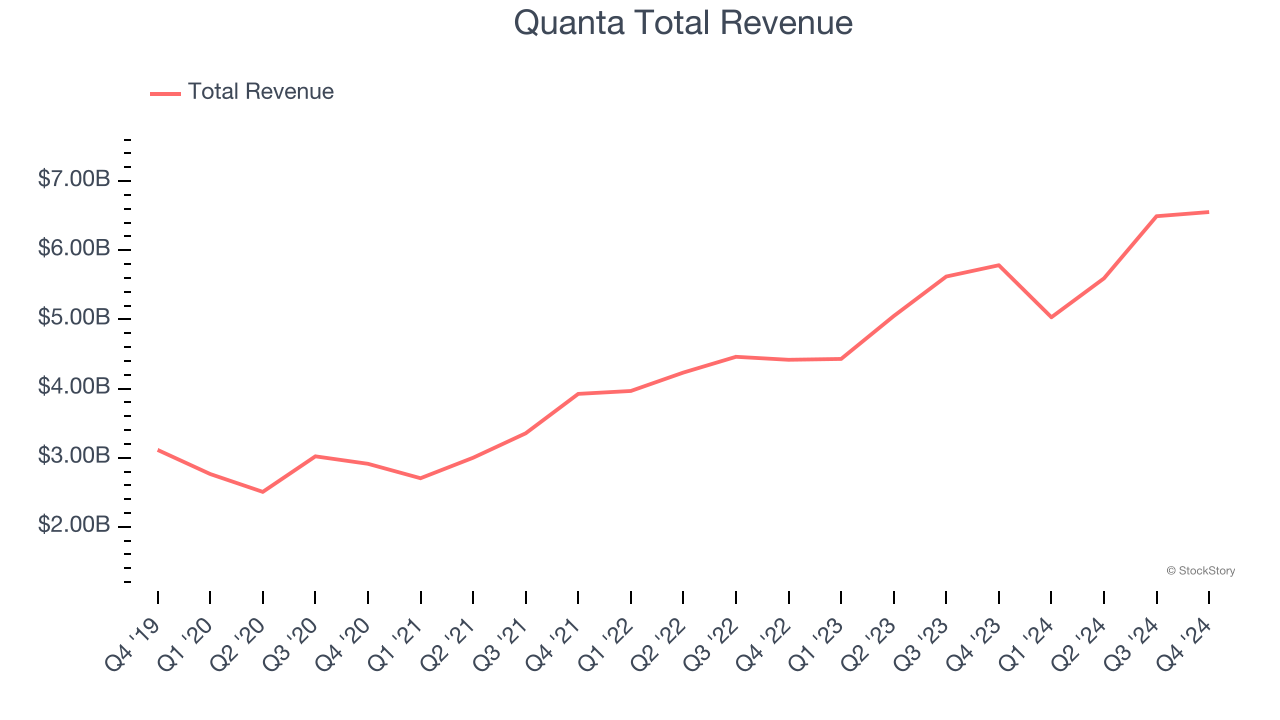

A construction engineering services company, Quanta (NYSE: PWR) provides infrastructure solutions to a variety of sectors, including energy and communications.

Quanta reported revenues of $6.55 billion, up 13.3% year on year, falling short of analysts’ expectations by 1%. However, the business still had a very strong quarter with a solid beat of analysts’ EBITDA estimates.

Quanta pulled off the highest full-year guidance raise among its peers. The market seems unhappy with the results as the stock is down 2.2% since reporting. It currently trades at $285.42.

Is now the time to buy Quanta? Access our full analysis of the earnings results here, it’s free.

MDU Resources (NYSE: MDU)

Founded to provide electricity to towns in Minnesota, MDU Resources (NYSE: MDU) provides products and services in the utilities and construction materials industries.

MDU Resources reported revenues of $535.5 million, down 52.8% year on year, falling short of analysts’ expectations by 32.3%. It was a disappointing quarter as it posted full-year EPS guidance missing analysts’ expectations.

MDU Resources delivered the weakest performance against analyst estimates and slowest revenue growth in the group. As expected, the stock is down 5.6% since the results and currently trades at $16.95.

Read our full analysis of MDU Resources’s results here.

Ameresco (NYSE: AMRC)

Having played a role in upgrading the energy solutions of Alcatraz Island, Ameresco (NYSE: AMRC) provides energy and renewable energy solutions for various sectors.

Ameresco reported revenues of $532.7 million, up 20.7% year on year. This result beat analysts’ expectations by 1.1%. Zooming out, it was a slower quarter as it recorded full-year EBITDA guidance missing analysts’ expectations.

Ameresco scored the biggest analyst estimates beat and fastest revenue growth, but had the weakest full-year guidance update among its peers. The stock is down 42.5% since reporting and currently trades at $10.51.

Read our full, actionable report on Ameresco here, it’s free.

Market Update

Thanks to the Fed’s series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% in November), and a notable surge followed Donald Trump’s presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by potential trade policy changes and corporate tax discussions, which could impact business confidence and growth. The path forward holds both optimism and caution as new policies take shape.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.