As the Q1 earnings season comes to a close, it’s time to take stock of this quarter’s best and worst performers in the consumer discretionary industry, including Churchill Downs (NASDAQ: CHDN) and its peers.

This sector includes everything from cable TV services to hotel stays to gym memberships. While diverse, the way people buy and experience these products is being upended by the internet and digitization. Consumer discretionary companies are working to adapt to secular trends such as streaming video, online marketplaces for lodging accommodations, and connected fitness. That discretionary purchases are, by definition, something consumers can give up makes it even more imperative for companies in the space to adapt.

The 24 consumer discretionary stocks we track reported a satisfactory Q1. As a group, revenues beat analysts’ consensus estimates by 1.1% while next quarter’s revenue guidance was in line.

In light of this news, share prices of the companies have held steady. On average, they are relatively unchanged since the latest earnings results.

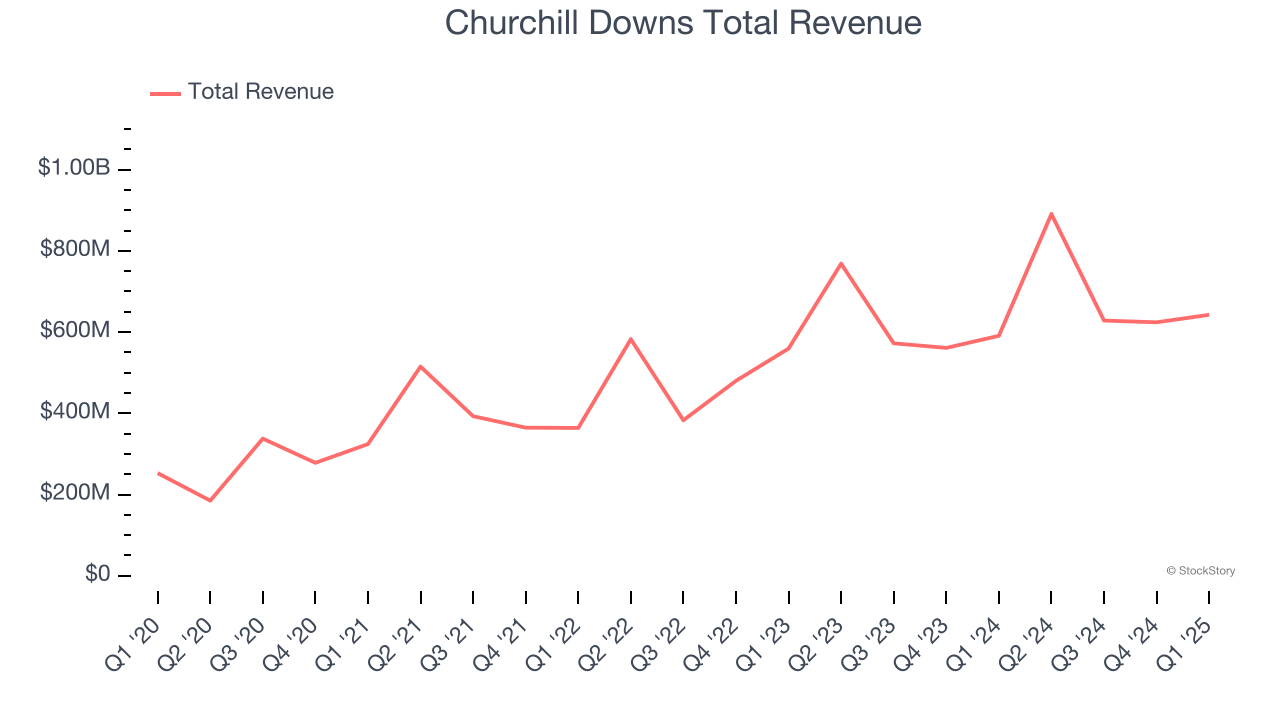

Churchill Downs (NASDAQ: CHDN)

Famous for hosting the Kentucky Derby, Churchill Downs (NASDAQ: CHDN) operates a horse racing, online wagering, and gaming entertainment business in the United States.

Churchill Downs reported revenues of $642.6 million, up 8.7% year on year. This print was in line with analysts’ expectations, but overall, it was a mixed quarter for the company with a decent beat of analysts’ EPS estimates but a miss of analysts’ adjusted operating income estimates.

Unsurprisingly, the stock is down 15% since reporting and currently trades at $89.35.

Read our full report on Churchill Downs here, it’s free.

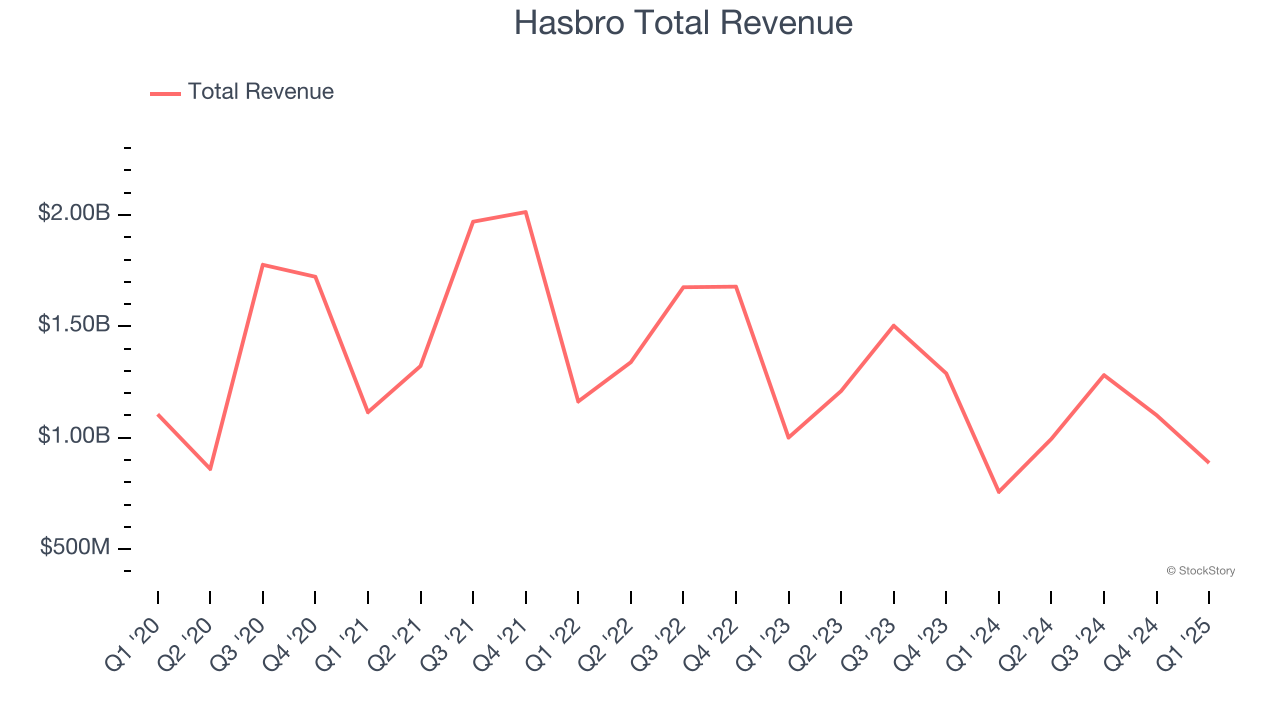

Best Q1: Hasbro (NASDAQ: HAS)

Credited with the creation of toys such as Mr. Potato Head and the Rubik’s Cube, Hasbro (NASDAQ: HAS) is a global entertainment company offering a diverse range of toys, games, and multimedia experiences for children and families.

Hasbro reported revenues of $887.1 million, up 17.1% year on year, outperforming analysts’ expectations by 14.8%. The business had an incredible quarter with a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ EBITDA estimates.

Hasbro pulled off the biggest analyst estimates beat and fastest revenue growth among its peers. The market seems happy with the results as the stock is up 16.1% since reporting. It currently trades at $61.12.

Is now the time to buy Hasbro? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: LKQ (NASDAQ: LKQ)

A global distributor of vehicle parts and accessories, LKQ (NASDAQ: LKQ) offers its customers a comprehensive selection of high-quality, affordably priced automobile products.

LKQ reported revenues of $3.46 billion, down 6.5% year on year, falling short of analysts’ expectations by 4.1%. It was a slower quarter as it posted full-year EBITDA guidance missing analysts’ expectations.

LKQ delivered the weakest performance against analyst estimates in the group. As expected, the stock is down 11.3% since the results and currently trades at $37.39.

Read our full analysis of LKQ’s results here.

Delta (NYSE: DAL)

One of the ‘Big Four’ airlines in the US, Delta Air Lines (NYSE: DAL) is a major global air carrier that serves both business and leisure travelers through its domestic and international flights.

Delta reported revenues of $14.04 billion, up 2.1% year on year. This number topped analysts’ expectations by 1.1%. Taking a step back, it was a mixed quarter as it also logged revenue guidance for next quarter topping analysts’ expectations but a miss of analysts’ EPS estimates.

The stock is up 16.6% since reporting and currently trades at $41.88.

Read our full, actionable report on Delta here, it’s free.

Boyd Gaming (NYSE: BYD)

Run by the Boyd family, Boyd Gaming (NYSE: BYD) is a diversified operator of gaming entertainment properties across the United States, offering casino games, hotel accommodations, and dining.

Boyd Gaming reported revenues of $991.6 million, up 3.2% year on year. This print beat analysts’ expectations by 2.1%. Zooming out, it was a mixed quarter as it also recorded a decent beat of analysts’ EPS estimates but a miss of analysts’ adjusted operating income estimates.

The stock is up 3.3% since reporting and currently trades at $68.14.

Read our full, actionable report on Boyd Gaming here, it’s free.

Market Update

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September 2024, a quarter in November) have propped up markets, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there’s still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.