The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s take a look at how analog semiconductors stocks fared in Q1, starting with Skyworks Solutions (NASDAQ: SWKS).

Demand for analog chips is generally linked to the overall level of economic growth, as analog chips serve as the building blocks of most electronic goods and equipment. Unlike digital chip designers, analog chip makers tend to produce the majority of their own chips, as analog chip production does not require expensive leading edge nodes. Less dependent on major secular growth drivers, analog product cycles are much longer, often 5-7 years.

The 15 analog semiconductors stocks we track reported a strong Q1. As a group, revenues beat analysts’ consensus estimates by 2.2% while next quarter’s revenue guidance was 0.9% above.

Luckily, analog semiconductors stocks have performed well with share prices up 19.8% on average since the latest earnings results.

Skyworks Solutions (NASDAQ: SWKS)

Result of a merger of Alpha Industries and the wireless communications division of Conexant, Skyworks Solutions (NASDAQ: SWKS) is a designer and manufacturer of chips used in smartphones, autos, and industrial applications to amplify, filter, and process wireless signals.

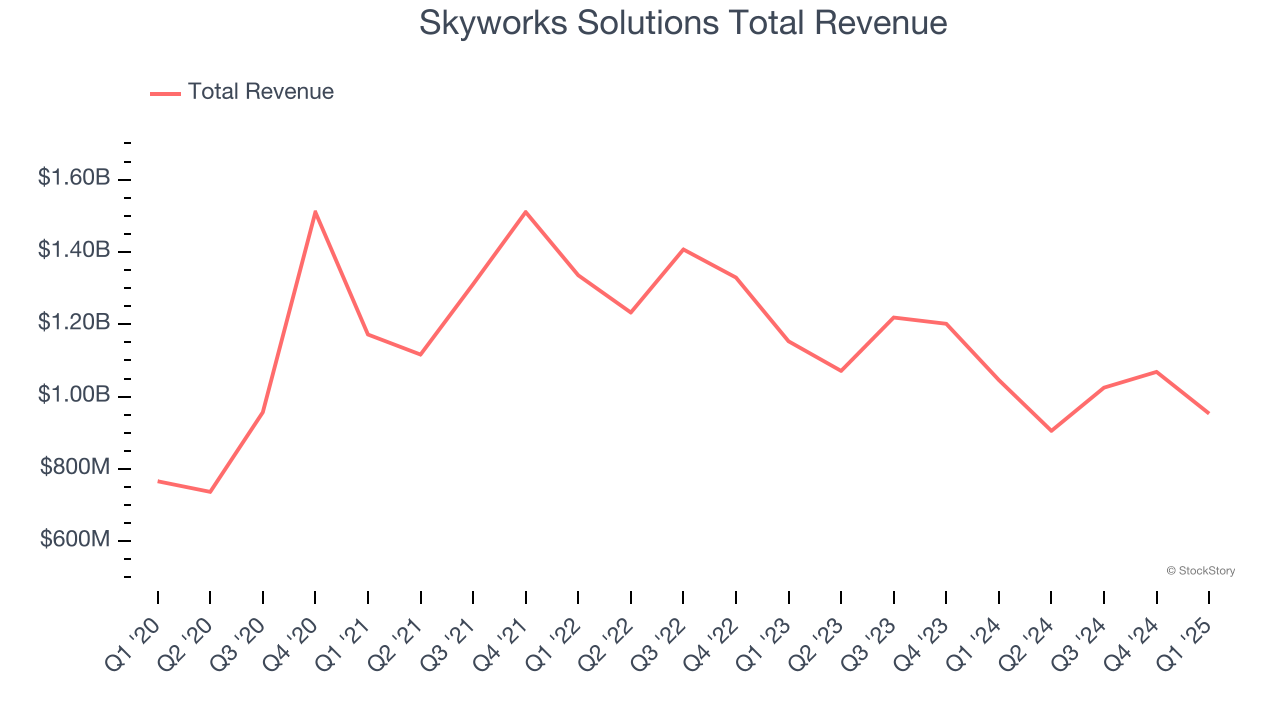

Skyworks Solutions reported revenues of $953.2 million, down 8.9% year on year. This print was in line with analysts’ expectations, and overall, it was a satisfactory quarter for the company with a solid beat of analysts’ adjusted operating income estimates but an increase in its inventory levels.

The stock is up 8.7% since reporting and currently trades at $72.71.

Is now the time to buy Skyworks Solutions? Access our full analysis of the earnings results here, it’s free.

Best Q1: Himax (NASDAQ: HIMX)

Taiwan-based Himax Technologies (NASDAQ: HIMX) is a leading manufacturer of display driver chips and timing controllers used in TVs, laptops, and mobile phones.

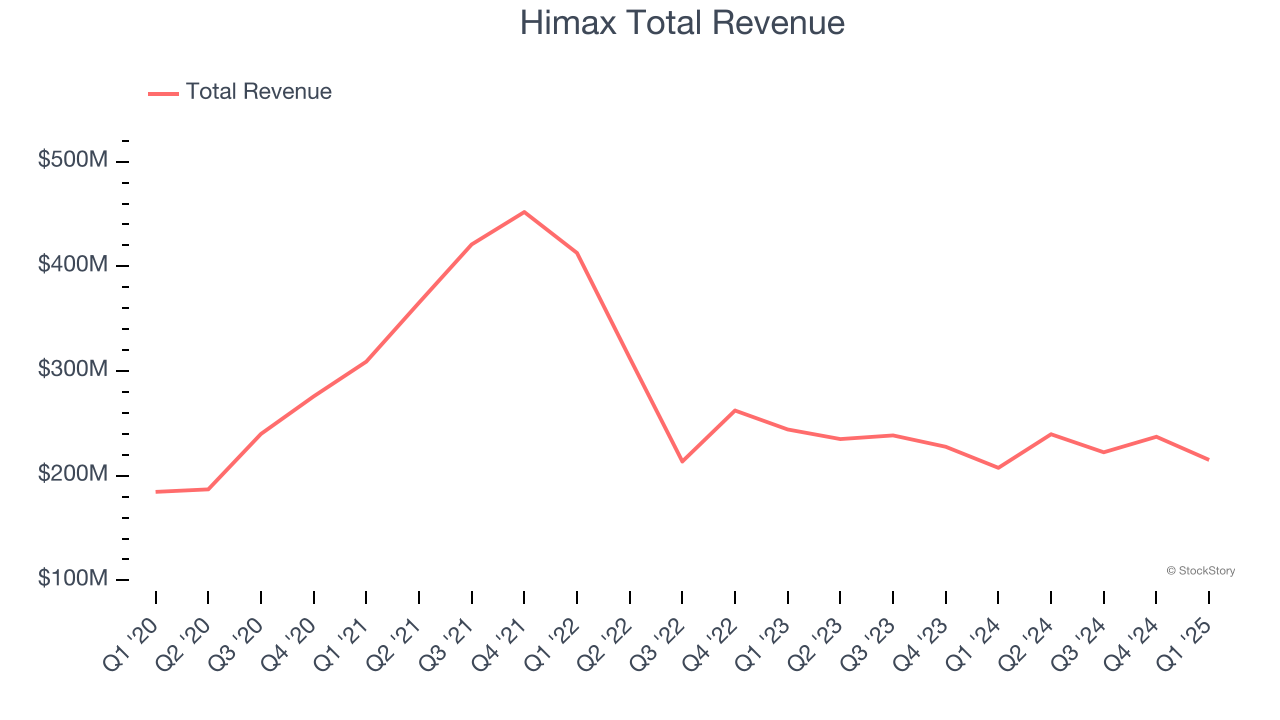

Himax reported revenues of $215.1 million, up 3.7% year on year, outperforming analysts’ expectations by 2.4%. The business had an exceptional quarter with a solid beat of analysts’ EPS estimates and revenue guidance for next quarter exceeding analysts’ expectations.

The market seems happy with the results as the stock is up 22.9% since reporting. It currently trades at $9.17.

Is now the time to buy Himax? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: Vishay Intertechnology (NYSE: VSH)

Named after the founder's ancestral village in present-day Lithuania, Vishay Intertechnology (NYSE: VSH) manufactures simple chips and electronic components that are building blocks of virtually all types of electronic devices.

Vishay Intertechnology reported revenues of $715.2 million, down 4.2% year on year, falling short of analysts’ expectations by 0.6%. It was a slower quarter as it posted a significant miss of analysts’ EPS estimates.

Vishay Intertechnology delivered the weakest performance against analyst estimates in the group. Interestingly, the stock is up 18.4% since the results and currently trades at $15.90.

Read our full analysis of Vishay Intertechnology’s results here.

Texas Instruments (NASDAQ: TXN)

Headquartered in Dallas, Texas since the 1950s, Texas Instruments (NASDAQ: TXN) is the world’s largest producer of analog semiconductors.

Texas Instruments reported revenues of $4.07 billion, up 11.1% year on year. This result beat analysts’ expectations by 4.1%. It was a very strong quarter as it also logged a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ adjusted operating income estimates.

The stock is up 31.7% since reporting and currently trades at $200.

Read our full, actionable report on Texas Instruments here, it’s free.

Impinj (NASDAQ: PI)

Founded by Caltech professor Carver Mead and one of his students Chris Diorio, Impinj (NASDAQ: PI) is a maker of radio-frequency identification (RFID) hardware and software.

Impinj reported revenues of $74.28 million, down 3.3% year on year. This print topped analysts’ expectations by 3.7%. Overall, it was a strong quarter as it also put up a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ adjusted operating income estimates.

The stock is up 45.1% since reporting and currently trades at $111.83.

Read our full, actionable report on Impinj here, it’s free.

Market Update

Thanks to the Fed’s series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% in November), and a notable surge followed Donald Trump’s presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by potential trade policy changes and corporate tax discussions, which could impact business confidence and growth. The path forward holds both optimism and caution as new policies take shape.

Want to invest in winners with rock-solid fundamentals? Check out our 9 Best Market-Beating Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.