IT solutions provider ePlus (NASDAQ: PLUS) beat Wall Street’s revenue expectations in Q4 CY2025, with sales up 20.3% year on year to $614.8 million. Its non-GAAP profit of $1.45 per share was 43.6% above analysts’ consensus estimates.

Is now the time to buy ePlus? Find out by accessing our full research report, it’s free.

ePlus (PLUS) Q4 CY2025 Highlights:

- Revenue: $614.8 million vs analyst estimates of $551.8 million (20.3% year-on-year growth, 11.4% beat)

- Adjusted EPS: $1.45 vs analyst estimates of $1.01 (43.6% beat)

- Adjusted EBITDA: $53.38 billion vs analyst estimates of $41.1 million (8,683% margin, significant beat)

- Operating Margin: 7.1%, up from 5.6% in the same quarter last year

- Market Capitalization: $2.22 billion

Company Overview

Starting as a financing company in 1990 before evolving into a full-service technology provider, ePlus (NASDAQ: PLUS) provides comprehensive IT solutions, professional services, and financing options to help organizations optimize their technology infrastructure and supply chain processes.

Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

With $2.36 billion in revenue over the past 12 months, ePlus is a mid-sized business services company, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale. On the bright side, it can still flex high growth rates because it’s working from a smaller revenue base.

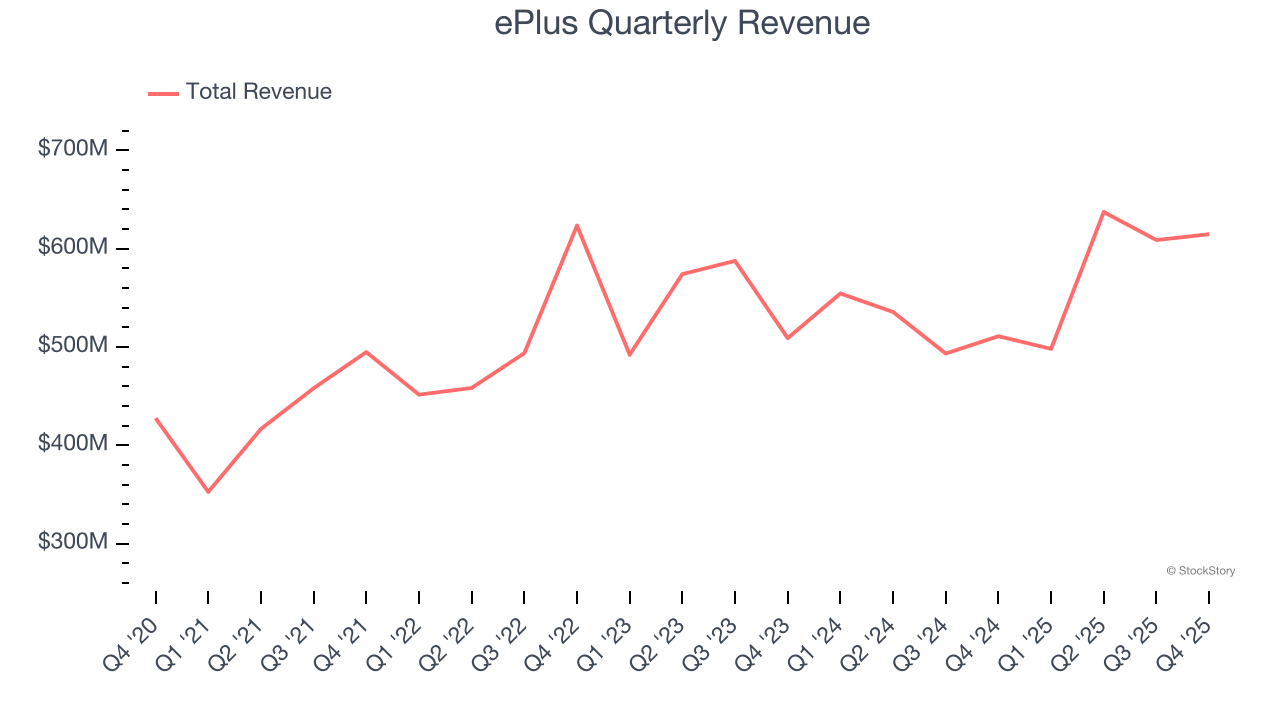

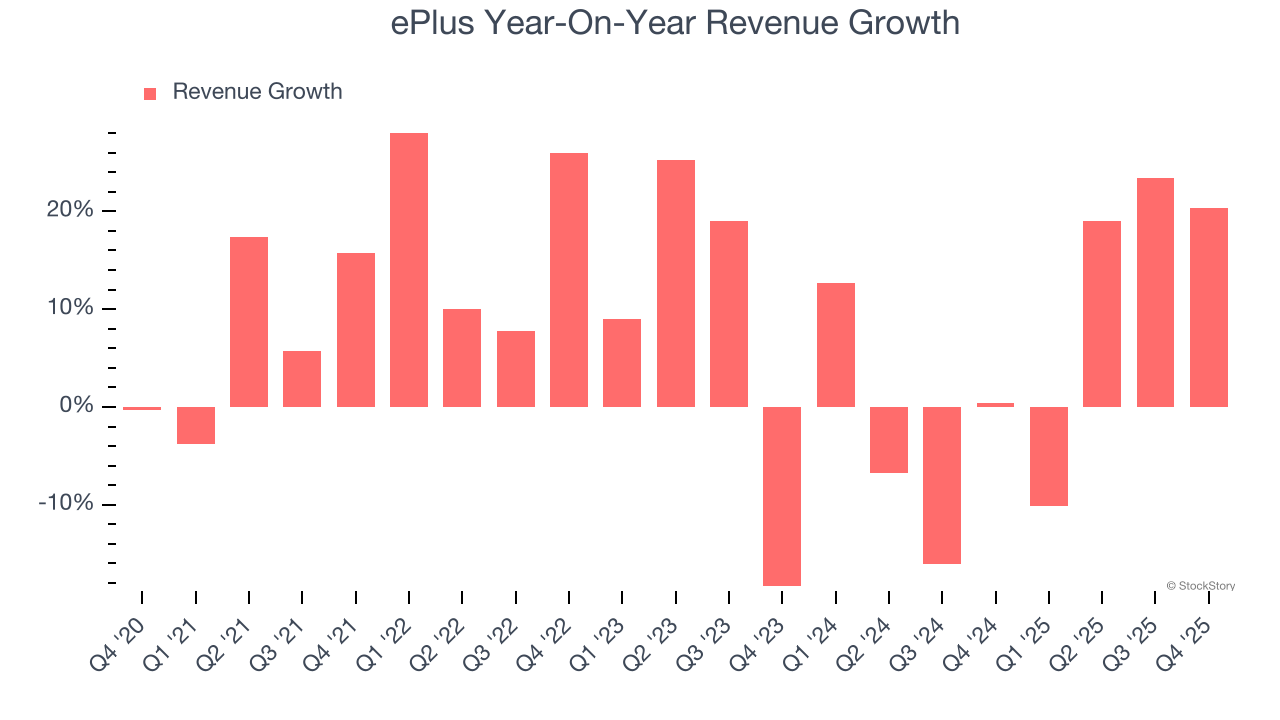

As you can see below, ePlus’s sales grew at a solid 8.3% compounded annual growth rate over the last five years. This shows it had high demand, a useful starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within business services, a half-decade historical view may miss recent innovations or disruptive industry trends. ePlus’s recent performance shows its demand has slowed as its annualized revenue growth of 4.4% over the last two years was below its five-year trend.

This quarter, ePlus reported robust year-on-year revenue growth of 20.3%, and its $614.8 million of revenue topped Wall Street estimates by 11.4%.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and implies its products and services will face some demand challenges.

The 1999 book Gorilla Game predicted Microsoft and Apple would dominate tech before it happened. Its thesis? Identify the platform winners early. Today, enterprise software companies embedding generative AI are becoming the new gorillas. a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Operating Margin

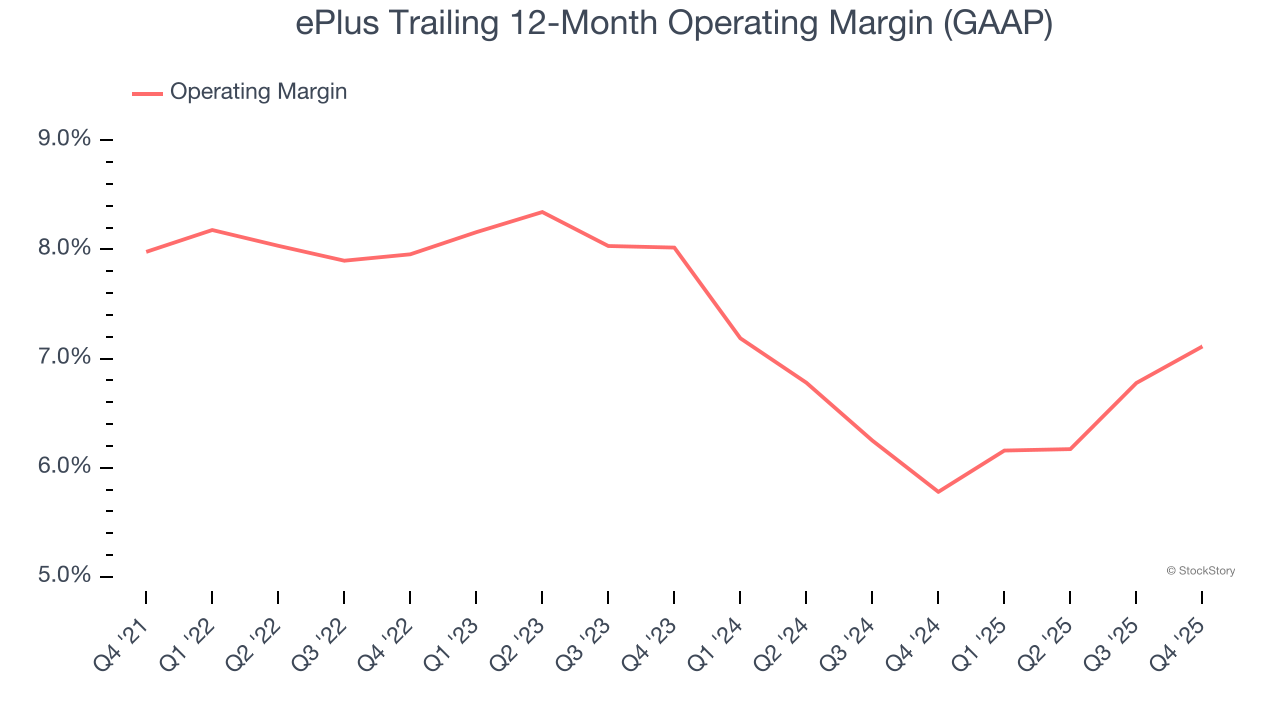

ePlus’s operating margin has been trending up over the last 12 months and averaged 7.3% over the last five years. The company’s higher efficiency is a breath of fresh air, but its suboptimal cost structure means it still sports paltry profitability for a business services business.

Analyzing the trend in its profitability, ePlus’s operating margin might fluctuated slightly but has generally stayed the same over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, ePlus generated an operating margin profit margin of 7.1%, up 1.5 percentage points year on year. This increase was a welcome development and shows it was more efficient.

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

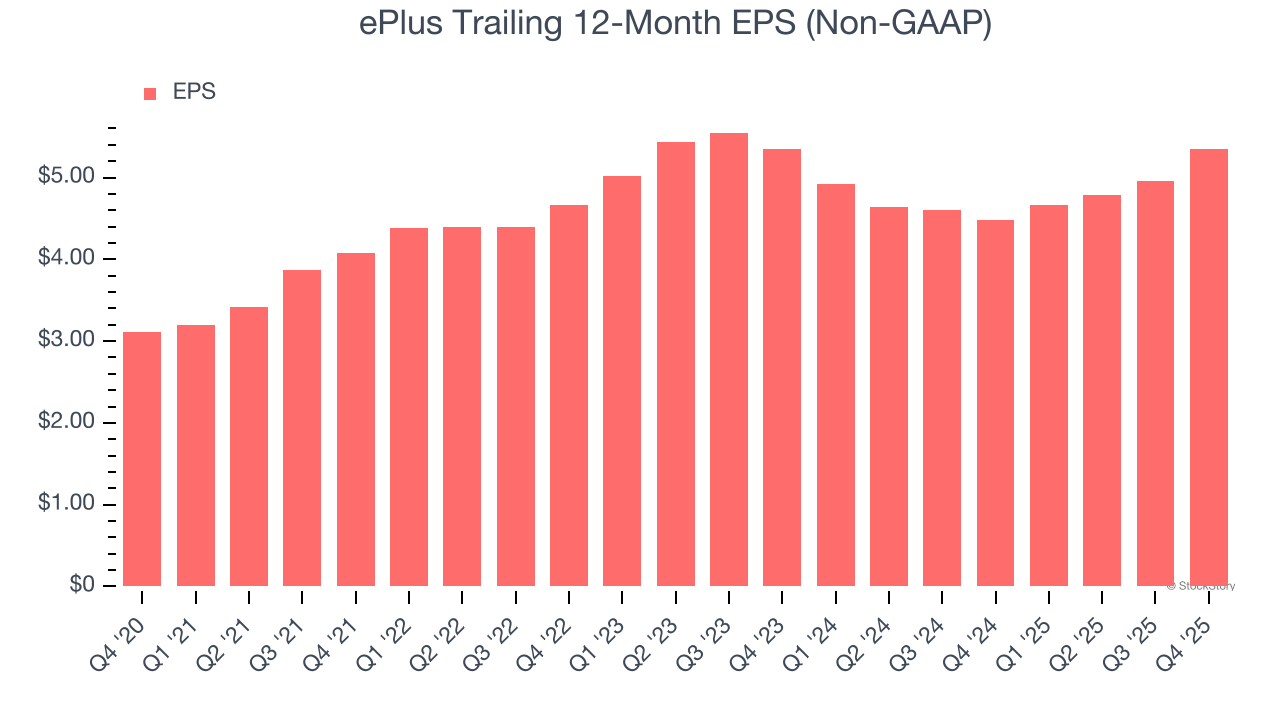

ePlus’s EPS grew at a remarkable 11.5% compounded annual growth rate over the last five years, higher than its 8.3% annualized revenue growth. However, this alone doesn’t tell us much about its business quality because its operating margin didn’t improve.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For ePlus, EPS didn’t budge over the last two years, a regression from its five-year trend. We hope it can revert to earnings growth in the coming years.

In Q4, ePlus reported adjusted EPS of $1.45, up from $1.06 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects ePlus’s full-year EPS of $5.35 to shrink by 5%.

Key Takeaways from ePlus’s Q4 Results

It was good to see ePlus beat analysts’ EPS expectations this quarter. We were also excited its revenue outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this quarter featured some important positives. The stock traded up 3% to $88.67 immediately following the results.

Indeed, ePlus had a rock-solid quarterly earnings result, but is this stock a good investment here? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here (it’s free).