Nighthawk Gold Corp. (“Nighthawk” or the “Company”) (TSX: NHK; OTCQX: MIMZF) reports assay results from drilling at the Cass Deposit and Albatross Zone target, which are located within 15 kilometres (“km”) from the Colomac Centre Area.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20230808463764/en/

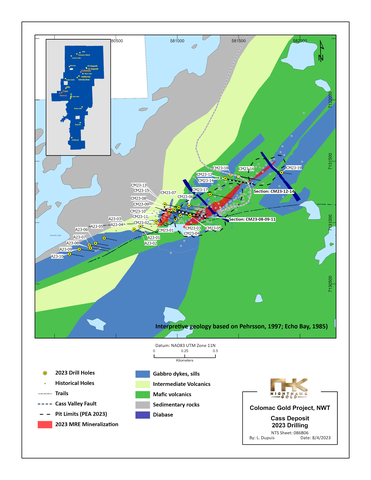

Figure 1 – Cass Deposit and Albatross Target Drilling – Plan View Map (Graphic: Business Wire)

Table 1 – Highlight Drill Assay Results from the Cass Deposit Drilling

Hole ID |

Deposit |

Highlight Assay Result |

CM23-14 |

Cass |

4 ounces per tonne (or 125.00 grams per tonne (“g/t Au”)) over 0.50 metres (“m”) |

CM23-09 |

Cass |

2.48 g/t Au over 13.00 m |

CM23-11 |

Cass |

1.90 g/t Au over 17.50 m (including 4.20 g/t Au over 6.40 m) |

Note: True widths remain undetermined at this stage. All assays are uncut. Further statistical analysis will be required prior to establishing a suitable cut grade.

Nighthawk President & CEO Keyvan Salehi commented, “The results from the Cass Deposit drilling continue to deliver higher-grade mineralization. We tested the potential extensions of known mineralization and intersected high-grade, near-surface mineralization to the northeast, in an area on the other side of a fault structure where there was no data. The deposit remains open in all directions and warrant follow-up drilling.”

Cass Deposit Drilling

The Cass Deposit is located 15 km southwest of the Colomac Centre Area. The deposit is characterized by higher-grade, near-surface mineralization. The Company completed 5,442 m of drilling to test new mineralized zones parallel and along strike from the Cass Deposit. These zones have the potential to significantly expand the open-pit mineralization at the deposit. The target areas were chosen based on a new geological interpretation and structural model, as well as historical trenching and soil anomalies. Drill holes CM23-08, CM23-09 and CM23-11 confirmed the extension of mineralization along strike of a parallel gabbroic intrusion to the northwest of the Cass Deposit. Drill hole CM23-06 confirmed the continuity of mineralization between the Cass Deposit estimated pit-shell bottom (as part of the Colomac Gold Project PEA1) and deeper drillhole intercepts. Drill holes CM23-12 and CM23-14 intercepted narrow high-grade mineralization in a previously untested area between the main Cass Deposit pit-shell and the smaller pit-shell to the east. These mineralized intercepts confirm that mineralization and the host geology continue across structural boundaries identified in the new structural model. Coarse gold samples were intersected in 9 of the 19 drill holes.

_________________________

|

Please refer to Figures 1, 2, 3 and 4 for the Cass Deposit (and Albatross Zone) drilling plan view local map, Cass Deposit isometric view, Cass Deposit cross section #1, and Cass Deposit cross section #2, respectively.

Albatross Zone

The Albatross Zone is a grassroots exploration target to the west of the Cass Deposit. Historical, widely spaced drilling over a 4.6 km trend confirmed the extension of the Cass Deposit mineralization at narrower widths. Nighthawk completed 1,974 m of drilling at the Albatross Zone, confirming the gabbro lithological package with veining and some coarse gold showings. Additional structural mapping and surface work is required to understand the potential of this zone.

Please see Tables 1 and 2 for the Cass Deposit and Albatross Zone Drill Assay Highlights and Summary Table, respectively.

Table 2 – Drill Assay Results Summary – Cass Deposit and Albatross Target

Hole ID |

From |

To |

Interval Core Length (m) |

Au (g/t) |

||

Cass Deposit |

||||||

CM23-01 |

132.50 |

133.00 |

|

0.50 |

|

2.95 |

and |

143.50 |

148.00 |

|

4.50 |

|

1.46 |

and |

172.00 |

173.75 |

|

1.75 |

|

1.50 |

and |

184.75 |

190.50 |

|

5.75 |

|

1.51 |

and |

235.50 |

238.50 |

|

3.00 |

|

1.07 |

CM23-02 |

No Significant Intervals |

|

||||

CM23-03 |

117.50 |

118.50 |

|

1.00 |

|

1.30 |

CM23-04 |

154.50 |

155.50 |

|

1.00 |

|

16.80 |

and |

184.75 |

185.80 |

|

1.05 |

|

1.17 |

CM23-05 |

168.00 |

169.00 |

|

1.00 |

|

1.66 |

CM23-06 |

149.50 |

150.50 |

|

1.00 |

|

2.24 |

and |

274.50 |

290.00 |

|

15.50 |

|

1.05 |

including |

277.50 |

280.40 |

|

2.90 |

|

3.34 |

and |

359.50 |

360.00 |

|

0.50 |

|

18.80 |

CM23-07 |

No Significant Intervals |

|

||||

CM23-08 |

59.00 |

59.75 |

|

0.75 |

|

1.74 |

and |

239.75 |

244.75 |

|

5.00 |

|

3.25 |

CM23-09 |

266.50 |

279.50 |

|

13.00 |

|

2.48 |

CM23-10 |

19.00 |

20.00 |

|

1.00 |

|

1.07 |

|

270.00 |

271.00 |

|

1.00 |

|

1.90 |

CM23-11 |

317.00 |

334.50 |

|

17.50 |

|

1.90 |

including |

321.10 |

327.50 |

|

6.40 |

|

4.20 |

CM23-12 |

218.50 |

219.00 |

|

0.50 |

|

7.00 |

CM23-13 |

32.20 |

33.00 |

|

0.80 |

|

1.12 |

CM23-14 |

223.00 |

223.50 |

|

0.50 |

|

125.00 |

and |

249.10 |

250.10 |

|

1.00 |

|

2.27 |

CM23-15 |

No Significant Intervals |

|

||||

CM23-16 |

No Significant Intervals |

|

||||

CM23-17 |

No Significant Intervals |

|

||||

CM23-18 |

261.45 |

262.50 |

|

1.05 |

|

1.43 |

CM23-19 |

No Significant Intervals |

|

||||

|

||||||

Albatross Target |

||||||

A23-01 |

No Significant Intervals |

|

||||

A23-02 |

33.75 |

34.50 |

|

0.75 |

|

1.69 |

and |

182.00 |

182.50 |

|

0.50 |

|

6.34 |

A23-03 |

No Significant Intervals |

|

||||

A23-04 |

No Significant Intervals |

|

||||

A23-05 |

No Significant Intervals |

|

||||

A23-06 |

No Significant Intervals |

|

||||

A23-07 |

169.50 |

|

170.50 |

|

1.00 |

1.26 |

A23-08 |

No Significant Intervals |

|

||||

A23-09 |

67.50 |

|

68.50 |

|

1.00 |

1.68 |

A23-10 |

No Significant Intervals |

|

||||

Note: True widths remain undetermined at this stage. All assays are uncut. Further statistical analysis will be required prior to establishing a suitable cut grade.

Hole ID |

Easting |

Northing |

Elevation |

Length |

Azimuth |

Dip |

NAD 83 Zone 11 |

(m) |

|||||

Cass Deposit |

||||||

CM23-01 |

580982.11 |

7131026.56 |

332.88 |

300 |

280 |

-60 |

CM23-02 |

580828.9 |

7131008.66 |

331 |

177 |

100 |

-45 |

CM23-03 |

581021.64 |

7131058.4 |

334.57 |

300 |

280 |

-45 |

CM23-04 |

581022.14 |

7131058.34 |

334.66 |

300 |

280 |

-58 |

CM23-05 |

581103.68 |

7131057.11 |

340.23 |

225 |

100 |

-45 |

CM23-06 |

581096.46 |

7131140 |

350.43 |

381 |

100 |

-56 |

CM23-07 |

581011.77 |

7131124.03 |

344.83 |

384 |

100 |

-55 |

CM23-08 |

580975.38 |

7131107.85 |

340.41 |

300 |

100 |

-45 |

CM23-09 |

580975.05 |

7131107.9 |

340.45 |

324 |

100 |

-54 |

CM23-10 |

580935.73 |

7131089.86 |

340.87 |

348 |

100 |

-50 |

CM23-11 |

580935.47 |

7131089.95 |

340.78 |

396 |

100 |

-59 |

CM23-12 |

581389.48 |

7131360.23 |

350.07 |

273 |

100 |

-45 |

CM23-13 |

580907.19 |

7131145.79 |

336.44 |

189 |

100 |

-45 |

CM23-14 |

581389.26 |

7131360.27 |

350.04 |

300 |

100 |

-55 |

CM23-15 |

580906.54 |

7131145.96 |

336.43 |

222 |

100 |

-65 |

CM23-16 |

581501.31 |

7131375.05 |

360.33 |

270 |

100 |

-50 |

CM23-17 |

581271.33 |

7131230.07 |

357.85 |

297 |

100 |

-54 |

CM23-18 |

581439.09 |

7131393.7 |

355.52 |

336 |

100 |

-52 |

CM23-19 |

581853.48 |

7131409.45 |

370.14 |

120 |

100 |

-45 |

A23-01 |

580700.9 |

7130969.89 |

328.25 |

216 |

110 |

-45 |

A23-02 |

580700.24 |

7130970.18 |

328.26 |

240 |

110 |

-65 |

A23-03 |

580647.04 |

7130944.06 |

326.72 |

177 |

110 |

-45 |

A23-04 |

580646.34 |

7130944.28 |

326.69 |

246 |

110 |

-65 |

A23-05 |

580405.04 |

7130874.12 |

322.9 |

150 |

100 |

-45 |

A23-06 |

580336.34 |

7130829.54 |

342.14 |

150 |

100 |

-45 |

A23-07 |

580285.48 |

7130817.67 |

346.36 |

240 |

100 |

-45 |

A23-08 |

580294.51 |

7130791.97 |

351.32 |

210 |

100 |

-45 |

A23-09 |

580205.6 |

7130781.46 |

362.49 |

177 |

100 |

-45 |

A23-10 |

580124.5 |

7130744.5 |

359.1 |

168 |

100 |

-45 |

Technical Information

The pit-shell outlines in Figures 1 to 4 are from the Colomac Gold Project PEA1 and was completed by Ausenco Engineering Canada Inc. Nighthawk has implemented a quality-control program to comply with best practices in the sampling and analysis of drill core. Drill core samples were transported in security-sealed bags for analyses at ALS Global Assay Laboratory in Vancouver, BC (“ALS Global”). ALS Global is an ISO/IEC 17025 accredited laboratory. The halved drill core is stored on site and pulps are returned and stored for record. As part of its QA/QC program, Nighthawk inserts external gold standards (low to high-grade), blanks and duplicates every 20 samples in addition to the standards, blanks, and pulp duplicates inserted by ALS Global.

Qualified Person

John McBride, MSc., P.Geo., Vice President of Exploration for Nighthawk, who is the “Qualified Person” as defined by NI 43-101 for this project, has reviewed and approved of the technical disclosure contained in this news release.

About Nighthawk Gold Corp.

Nighthawk is a Canadian-based gold exploration and development company with control of 947 km2 of District Scale Property located 200 km north of Yellowknife, Northwest Territories, Canada. The Company’s flagship asset is the large-scale, Colomac Gold Project. The 2023 PEA1 demonstrates the Project’s potential for 290,000oz/year operation over 11.2-year conceptual mine life that could generate a C$1.2 billion NPV5% and 35% IRR (after taxes) based on a US$1,600/oz gold price assumption. Nighthawk’s experienced management team, with a track record of successfully advancing projects and operating mines, is working towards rapidly advancing its assets towards a development decision.

|

Keyvan Salehi President & CEO

|

Salvatore Curcio CFO |

Allan Candelario VP, Investor Relations & Corporate Development |

|

Forward-Looking Information

This news release contains "forward-looking information" within the meaning of applicable Canadian securities legislation. Forward-looking information includes, but is not limited to, information with respect to the Company’s Mineral Resource Estimates, PEA and the potential extractability of the open pit and underground mineralization, the potential expansion of Mineral Resource Estimates, the potential for the economics of the Project to be realized and to improve, the potential for higher-grade assay results, the potential of the Project to be developed, the large-scale and robust nature of the Project PEA, the advancement of the PEA towards a higher-level economic study, the continued exploration and drilling initiatives and having the necessary funding required to complete these initiatives, the prospectivity of exploration targets, the potential economic viability of the assets, and the advancement of projects towards a development decision. Generally, forward-looking information can be identified by the use of forward-looking terminology such as “add” or “additional”, “advancing”, “anticipates” or “does not anticipate”, “appears”, “believes”, “can be”, “conceptual”, “confidence”, “continue”, “convert” or “conversion”, “deliver”, “demonstrating”, “estimates”, “encouraging”, “expand” or “expanding” or “expansion”, “expect” or “expectations”, “forecasts”, “forward”, “goal”, “improves”, “increase”, “intends”, “justification”, “plans”, “potential” or “potentially”, “promise”, “prospective”, “prioritize”, “reflects”, “scheduled”, “suggesting”, “support”, “updating”, “upside”, “will be” or “will consider”, “work towards”, or variations of such words and phrases or state that certain actions, events or results “may”, “could”, “would”, “might”, or “will be taken”, “occur”, or “be achieved”.

Forward-looking information is based on the opinions and estimates of management at the date the information is made, and is based on a number of assumptions and is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of Nighthawk to be materially different from those expressed or implied by such forward-looking information, including risks associated with required regulatory approvals, the exploration, development and mining such as economic factors as they effect exploration, future commodity prices, changes in foreign exchange and interest rates, actual results of current exploration activities, government regulation, political or economic developments, the ongoing wars and their effect on supply chains, environmental risks, COVID-19 and other pandemic risks, permitting timelines, capex, operating or technical difficulties in connection with development activities, employee relations, the speculative nature of gold exploration and development, including the risks of diminishing quantities of grades of reserves, contests over title to properties, and changes in project parameters as plans continue to be refined as well as those risk factors discussed in Nighthawk's annual information form for the year ended December 31, 2022, available on www.sedar.com. Although Nighthawk has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information. Accordingly, readers should not place undue reliance on forward-looking information. Nighthawk does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

Cautionary Statement regarding the PEA

The reader is advised that the PEA referenced in this press release is only a conceptual study of the potential viability of the Project's mineral resource estimates, and the economic and technical viability of the Project and its estimated mineral resources has not been demonstrated. The PEA is preliminary in nature and provides only an initial, high-level review of the Project's potential and design options; there is no certainty that the PEA will be realized. The PEA conceptual LOM plan and economic model include numerous assumptions and mineral resource estimates including Inferred mineral resource estimates. Inferred mineral resource estimates are too speculative geologically to have any economic considerations applied to such estimates. There is no guarantee that Inferred mineral resource estimates will be converted to Indicated or Measured mineral resources, or that Indicated or Measured resources can be converted to mineral reserves. Mineral resources that are not mineral reserves do not have demonstrated economic viability, and as such there is no guarantee the Project economics described herein will be achieved. Mineral resource estimates may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant risks, uncertainties, and other factors, as more particularly described in the Cautionary Statements at the end of this news release.

View source version on businesswire.com: https://www.businesswire.com/news/home/20230808463764/en/

The results from the Cass Deposit drilling continue to deliver higher-grade mineralization. We tested the potential extensions of known mineralization and intersected high-grade, near-surface mineralization in an area on the other side of a fault structure

Contacts

FOR FURTHER INFORMATION PLEASE CONTACT:

NIGHTHAWK GOLD CORP.

Tel: +1 (416) 863-2105; Email: info@nighthawkgold.com

Website: www.nighthawkgold.com