All News about Vaneck JPM EM Local Currency Bond ETF

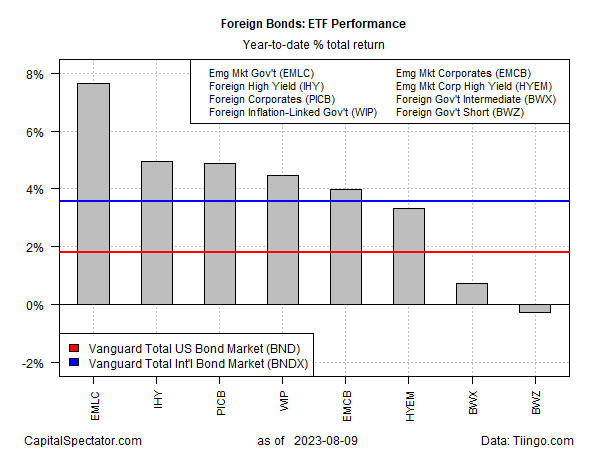

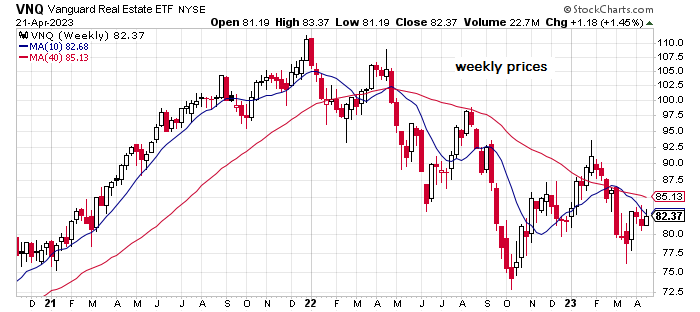

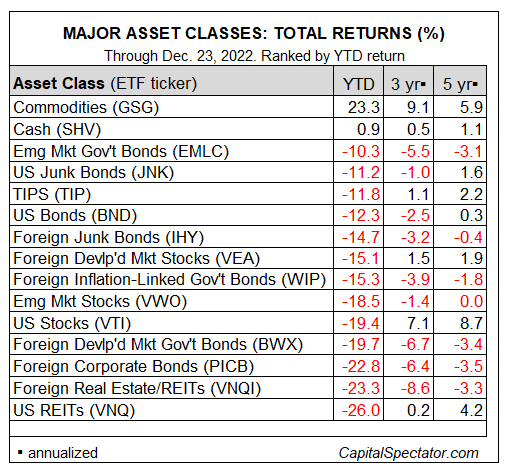

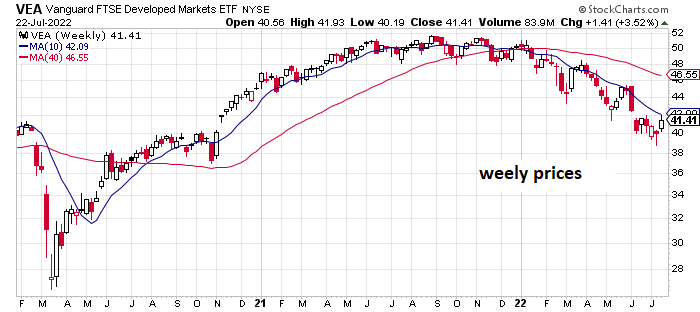

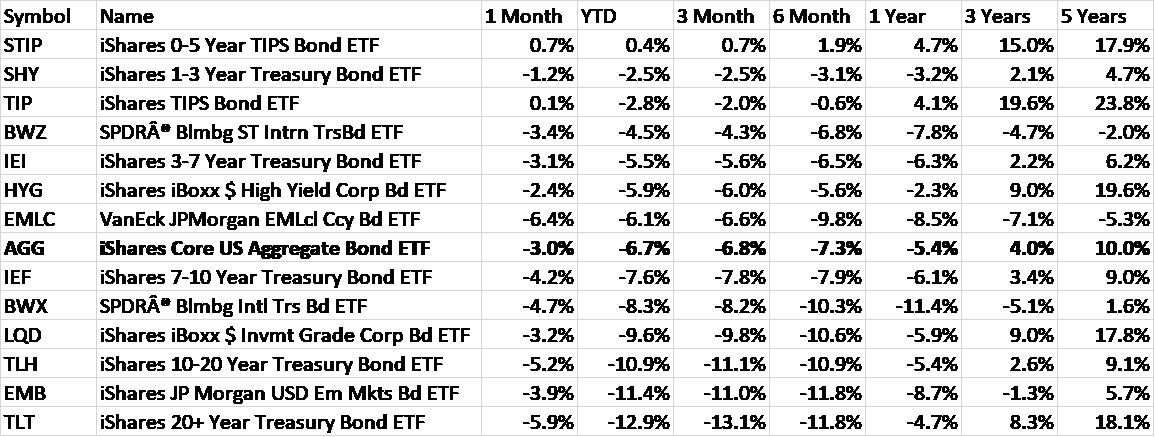

Major Asset Classes Performance Review - March 2024

April 01, 2024

Via Talk Markets

Topics

Bonds

Exposures

Debt Markets

Stock Market SPX Bollinger Band Squeeze Pattern Complete

January 21, 2024

Via Talk Markets

Topics

Stocks

Exposures

US Equities

Data & News supplied by www.cloudquote.io

Stock quotes supplied by Barchart

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms and Conditions.

Stock quotes supplied by Barchart

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms and Conditions.