All News about S&P Smallcap 600 Value Ishares ETF

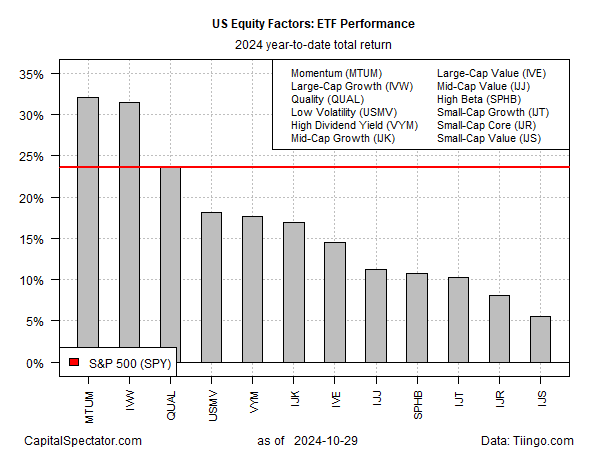

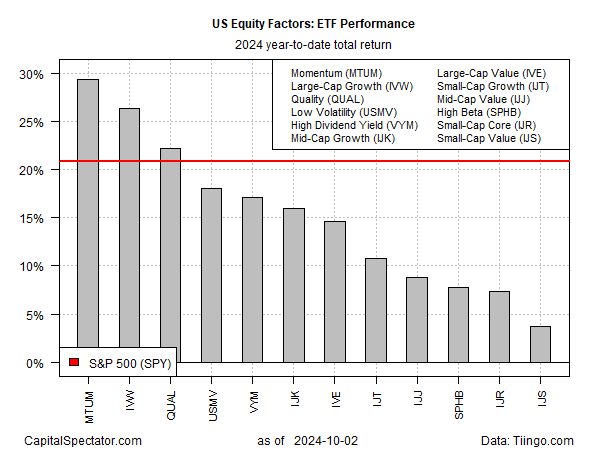

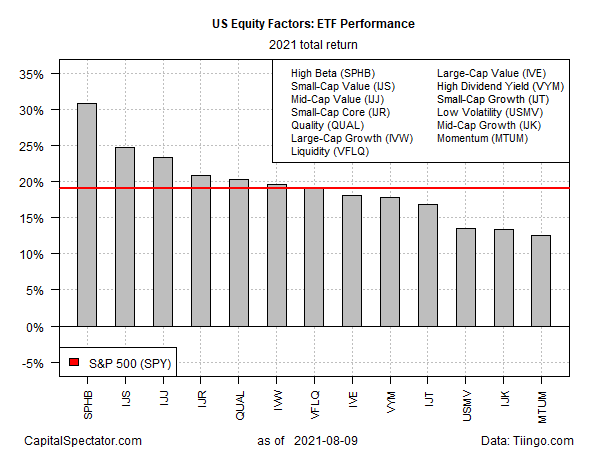

Momentum And Large-Cap Growth Still Lead Equity Factor Returns

August 28, 2024

Via Talk Markets

Topics

ETFs

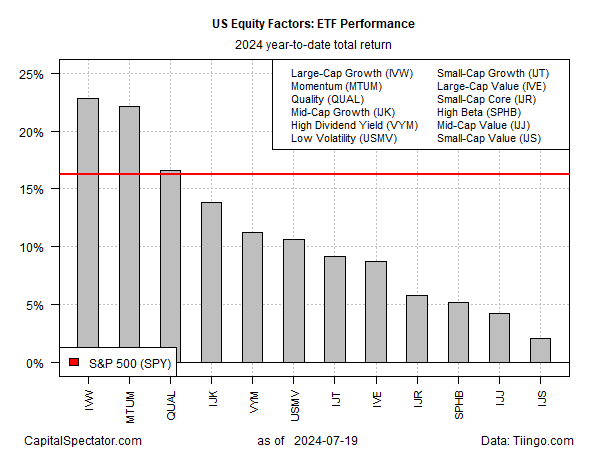

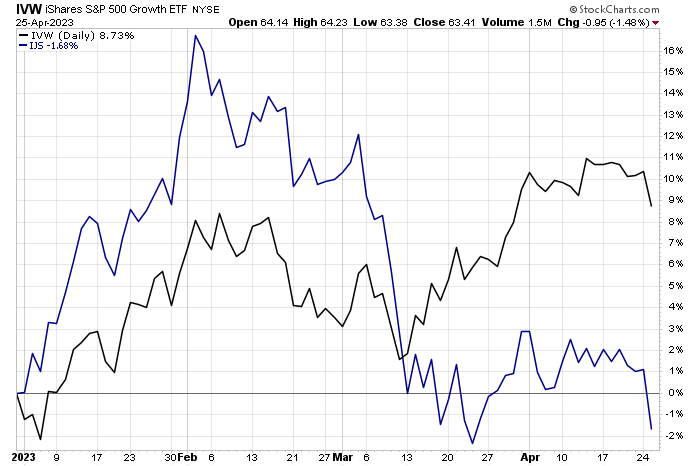

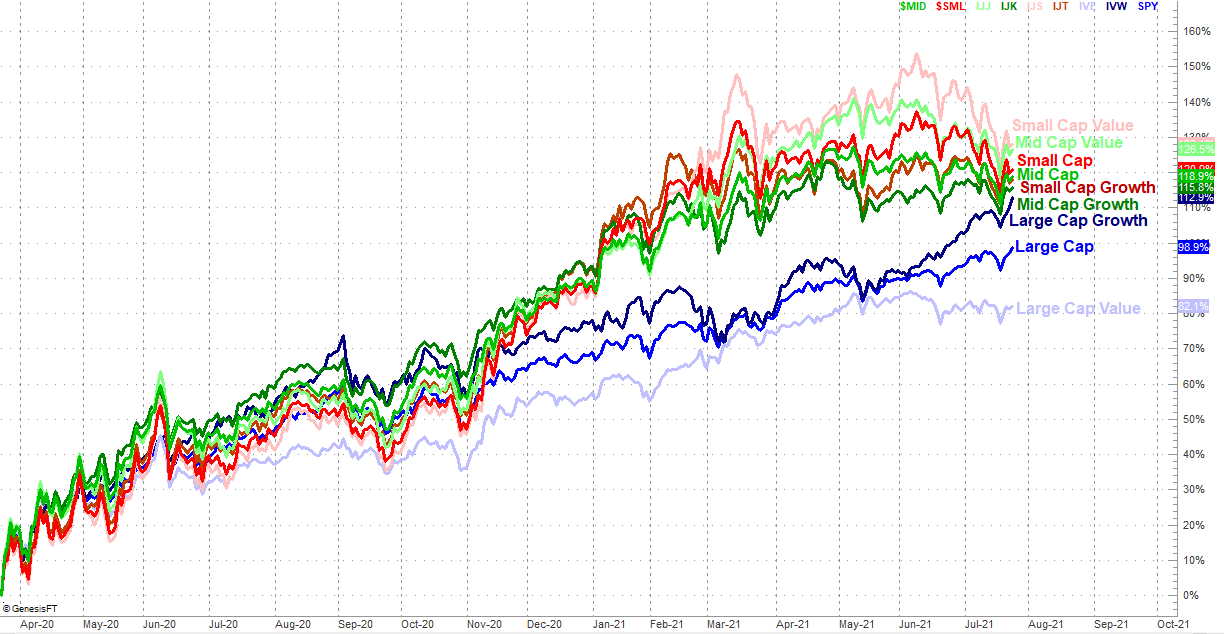

Large-Cap Stocks Continue To Lead US Equity Factors In 2023

October 26, 2023

Via Talk Markets

Topics

ETFs

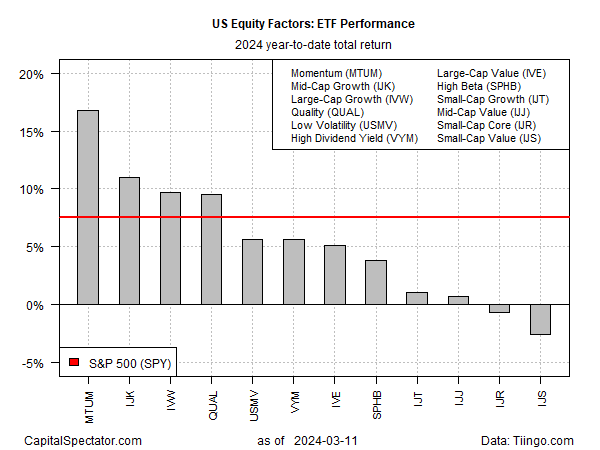

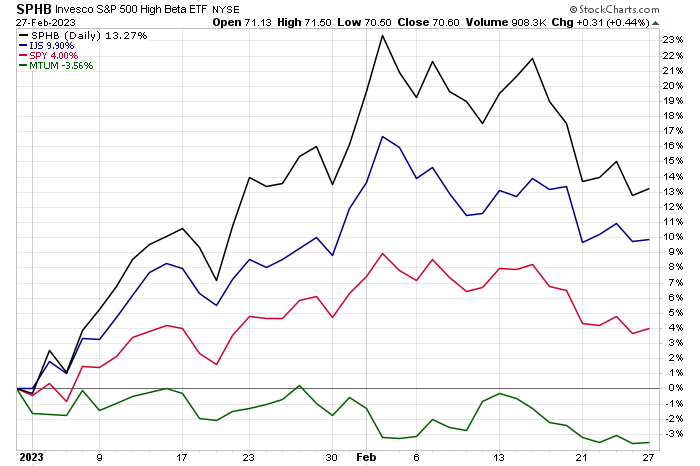

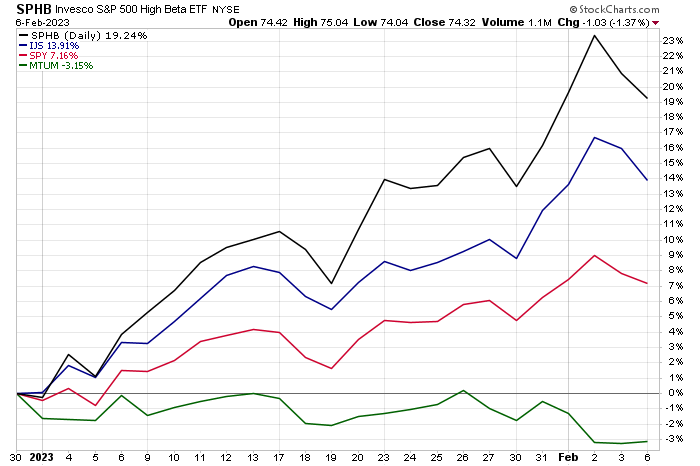

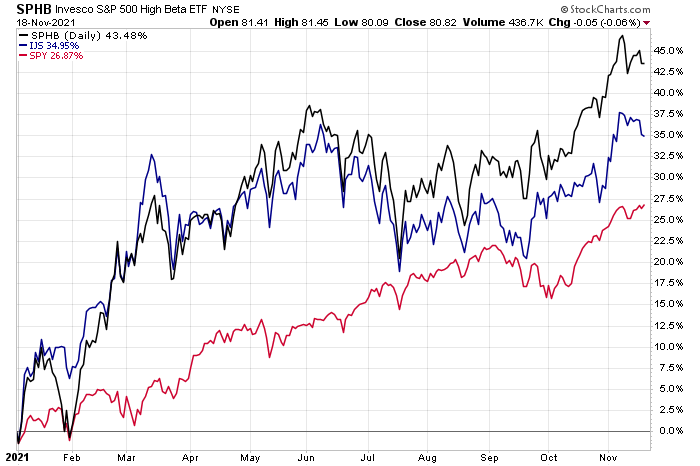

High Beta, Small Cap Value Top US Factor Returns In 2023’s Start

January 17, 2023

Via Talk Markets

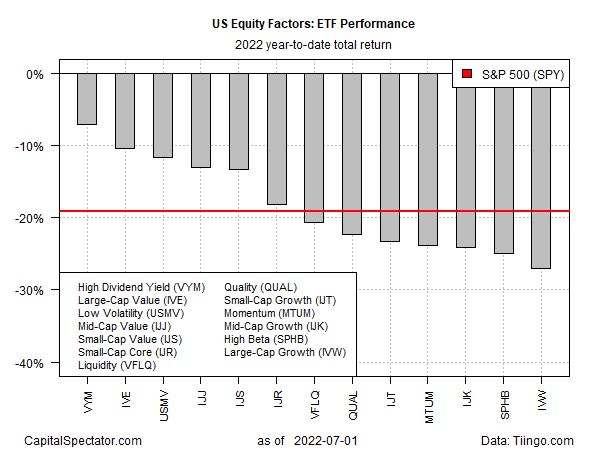

There's Nowhere To Hide From the Market's Carnage... Except Here

October 05, 2021

Via Talk Markets

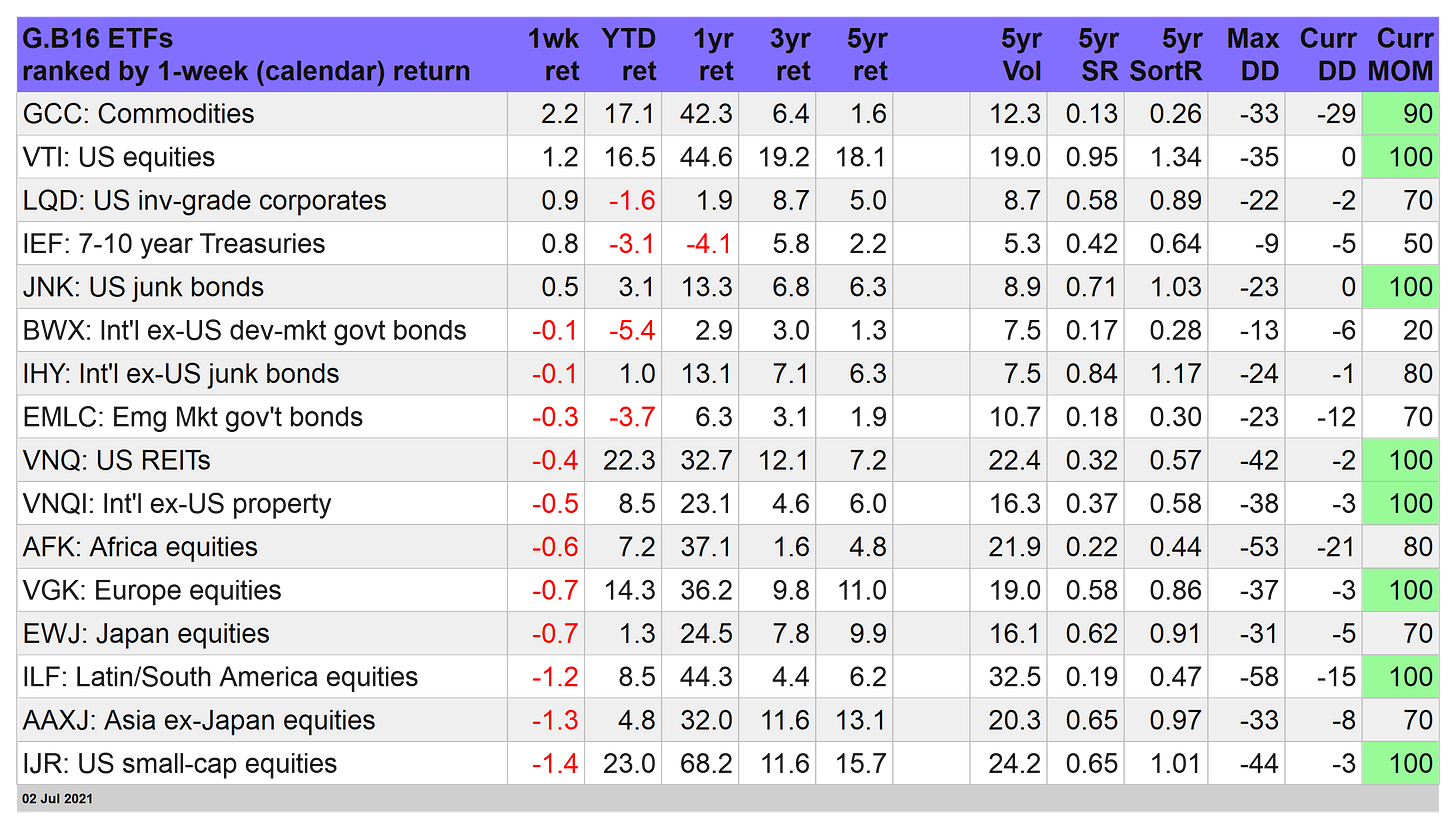

The ETF Portfolio Strategist - Saturday, July 3

July 03, 2021

Via Talk Markets

Data & News supplied by www.cloudquote.io

Stock quotes supplied by Barchart

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms and Conditions.

Stock quotes supplied by Barchart

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms and Conditions.