With a market cap of around $81.8 billion, Marriott International, Inc. (MAR) is one of the world’s largest and most diversified hospitality companies, operating and franchising a massive global portfolio of hotels, resorts, and lodging properties. Headquartered in Bethesda, Maryland, Marriott runs more than 9,400 properties across 144 countries and territories, under dozens of brands ranging from luxury, including The Ritz‑Carlton, JW Marriott, Bulgari Hotels & Resorts, to mid-scale and budget tier like Courtyard by Marriott, Fairfield Inn & Suites, etc., as well as timeshare/residential properties and extended‑stay solutions.

Companies valued at more than $10 billion are generally considered “large-cap” stocks, and Marriott International fits this criterion perfectly. A key strength is its loyalty program, Marriott Bonvoy, which helps drive repeat stays and customer loyalty worldwide.

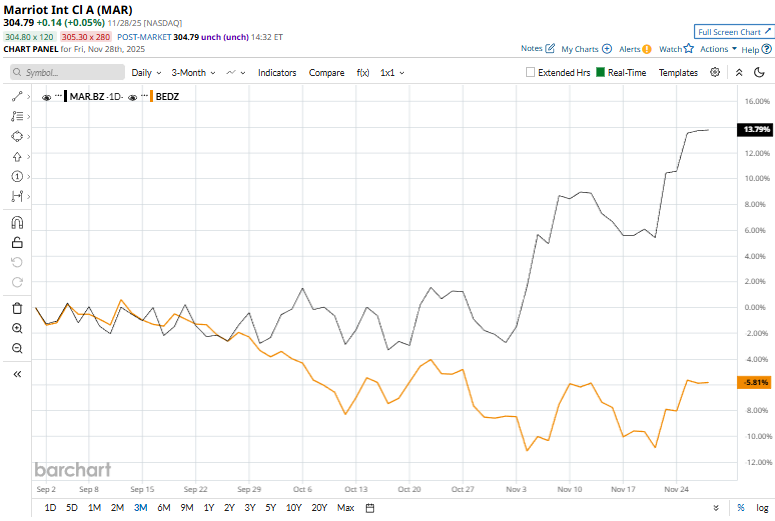

Shares of the hospitality titan currently hover around its 52-week high of $307.52. Marriott’s shares have surged 12.8% over the past three months, surpassing the AdvisorShares Hotel ETF’s (BEDZ) 6.3% fall over the same time frame.

Longer term, MAR stock is up 9.3% on a YTD basis, outperforming BEDZ’s marginal decline. Moreover, shares of the hotel company have gained 6.7% over the past 52 weeks, compared to BEDZ’s 2.1% drop over the same time frame.

Despite a few fluctuations, MAR stock has climbed above its 50-day and 200-day moving averages since late October

Shares of Marriott International jumped 3.2% on Nov. 4 following the release of its stronger-than-expected Q3 earnings. The company reported total revenue of $6.5 billion, up 3.7% year over year, slightly surpassing analyst estimates. Global RevPAR rose 0.5%, led by a 2.6% increase in International RevPAR, while U.S. & Canada RevPAR declined 0.4% amid softer demand in lower-tier hotel segments. Luxury properties, however, continued to excel, supported by robust demand and strong rate performance. On the earnings side, adjusted EPS of $2.47 represented a 9.3% increase from the prior year and exceeded consensus expectations of $2.41.

However, rival Hilton Worldwide Holdings Inc. (HLT) has outpaced MAR stock. Shares of Hilton have climbed 13.8% over the past 52 weeks and 15.3% on a YTD basis.

Given its robust momentum over the past year, analysts remain moderately optimistic about its prospects. MAR stock has a consensus rating of “Moderate Buy” from 26 analysts in coverage, and the stock currently trades above its mean price target of $287.75.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart