San Jose, California-based PayPal Holdings, Inc. (PYPL) is a leading global fintech company that provides digital and mobile payment solutions enabling consumers and merchants to send, receive, and manage money across online and in-person channels. With a market cap of $58.7 billion, PayPal operates a broad payments ecosystem that includes services like Venmo, Braintree, Xoom, and Honey, supporting e-commerce, peer-to-peer transfers, and global transactions.

Companies worth $10 billion or more are generally described as “large-cap stocks.” PayPal fits this bill perfectly. With billions in annual revenue and a large global user base, PayPal plays a key role in powering secure, seamless digital payments in today’s cashless economy.

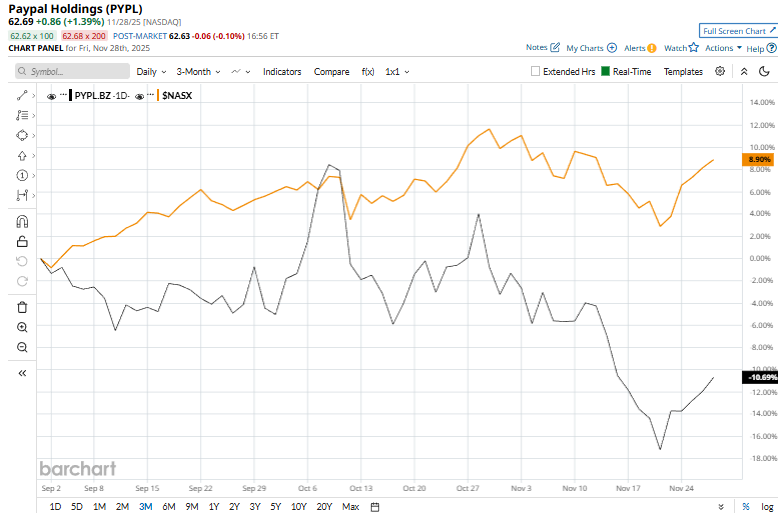

Despite its notable strengths, PYPL stock has tanked 33.1% from its 52-week high of $93.66 touched on Dec. 9, 2024. Meanwhile, over the past three months, PYPL stock has declined 10.5%, notably underperforming the Nasdaq Composite’s ($NASX) 7.7% rise during the same time frame.

PayPal’s performance has remained grim over the longer term as well. PYPL stock has plunged 26.6% on a YTD basis and 27.6% over the past 52 weeks, notably underperforming NASX’s 21% surge in 2025 and 22.6% gains over the past year.

To confirm the bearish trend, PYPL stock has dipped below its 50-day and 200-day moving averages since the end of October.

Shares of PayPal climbed 4.4% on Nov. 21 as investor optimism increased around the possibility of a Federal Reserve interest rate cut in December, following comments from New York Fed President John Williams suggesting rates could be lowered “in the near term.” Market expectations for a December cut jumped from 37% to 70%, driving a broad rally in financial stocks. While lower rates may pressure bank margins, investors often see them as a boost for economic growth, lending activity, and reduced default risk, helping support sentiment around companies like PayPal.

When compared to its peer, PayPal has underperformed Block, Inc.’s (XYZ) 24.8% gains over the past 52 weeks and a 21.4% rise in 2025.

The stock maintains a consensus “Moderate Buy” rating among the 42 analysts covering it. As of writing, PYPL’s mean price target of $80.88 suggests a 29% upside potential from current price levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart