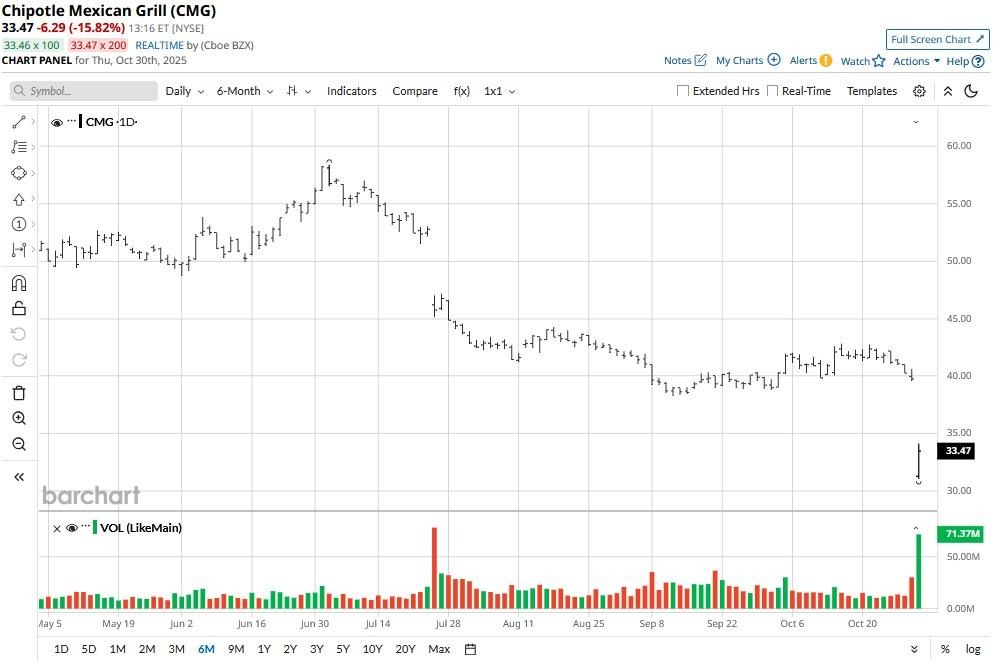

Chipotle (CMG) stock opened more than 20% down today after the chain of fast-casual restaurants reported in-line earnings and weaker-than-expected revenue for its third financial quarter (Q3).

Investors are bailing on CMG also because the company’s chief executive, Scott Boatwright, said same-store sales haven’t improved in October and are now seen coming down by roughly 5% in 2025.

Following the post-earnings plunge, Chipotle stock is down some 45% versus the start of this year.

Is It Worth Buying Chipotle Stock Today?

According to BTIG analyst Pete Saleh, investors must tread with caution on CMG shares following the company’s Q3 earnings as affordability concerns alone weren’t “the main driver” of weakness here.

In his research note, Saleh agreed that a traffic slowdown in the third quarter was broadly expected, but said “we were surprised by the magnitude that was reported and the resulting deleverage this produced.”

The stock is being hammered this morning because it’s the third straight quarter of lowered outlook, indicating the firm is grappling with a broad-based decline in visitors across all income cohorts.

Note that Chipotle stock does not pay a dividend to incentivize buying on the pullback either.

CMG Shares May Not Have Bottomed Yet

Despite its massive year-to-date decline, CMG stock remains unattractive in terms of valuation as well. At writing, it’s going for a forward price-earnings ratio of nearly 34x, well above the industry average.

More importantly, the NYSE-listed giant may not have hit the bottom still, according to Citi analyst Jon Tower.

“It’s difficult to call a bottom for sales given the multitude of factors weighing on demand” he told clients in a research note on Thursday morning.

A string of macroeconomic headwinds like unemployment, muted inflation-adjusted growth in real wages, and increased student loan repayment could also make it more difficult for Chipotle shares to recover in the near term.

How Wall Street Recommends Playing Chipotle

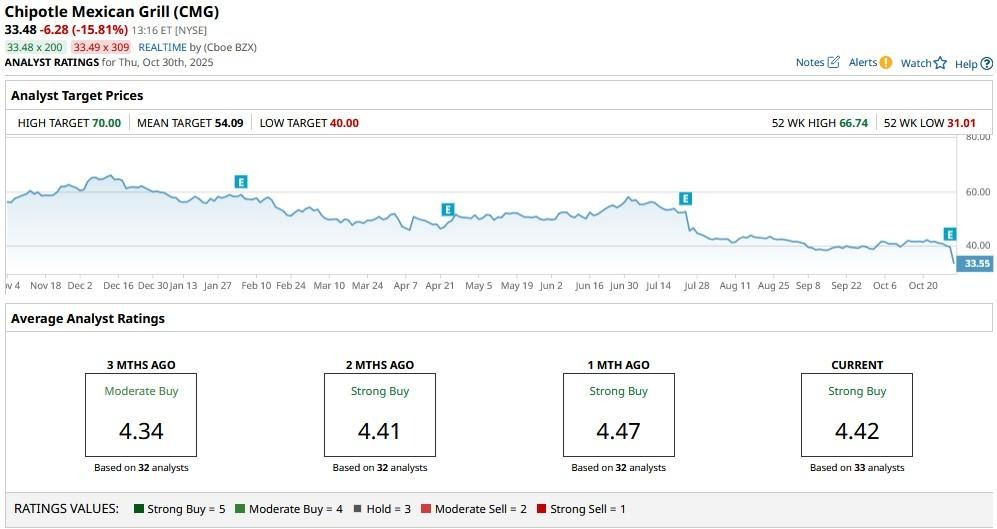

While at least five Wall Street firms reduced their price target on CMG shares after the company’s Q3 earnings, the mean target continues to signal meaningful upside from current levels.

The consensus rating on Chipotle stock remains at “Strong Buy” with the average price target of about $54 calling for nearly 70% upside from here.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Fiserv Stock’s 44% Single-Day Plunge Proves That Stop Orders Don’t Work, But This Option Strategy Could Have Prevented the Carnage

- 1 Fintech Stock Under $400 to Buy and Hold Forever

- 'Our GPUs Are Everywhere’ According to CEO Jensen Huang as Nvidia Doubles Down on AI, Quantum, and 6G

- Chipotle Stock Is Plunging. Should You Buy the Dip Today?