With Alphabet (GOOG) (GOOGL) poised to generate needle-moving revenue from the artificial intelligence revolution and changing hands at a relatively low valuation, the shares are a buy now. Moreover, Warren Buffett’s company, Berkshire Hathaway ((BRK.A) (BRK.B), has given Google its seal of approval, and that development should enable GOOG stock to outperform over the near to medium term. Finally, over the long term, the company could very well get a big boost from its driverless cars.

About Alphabet

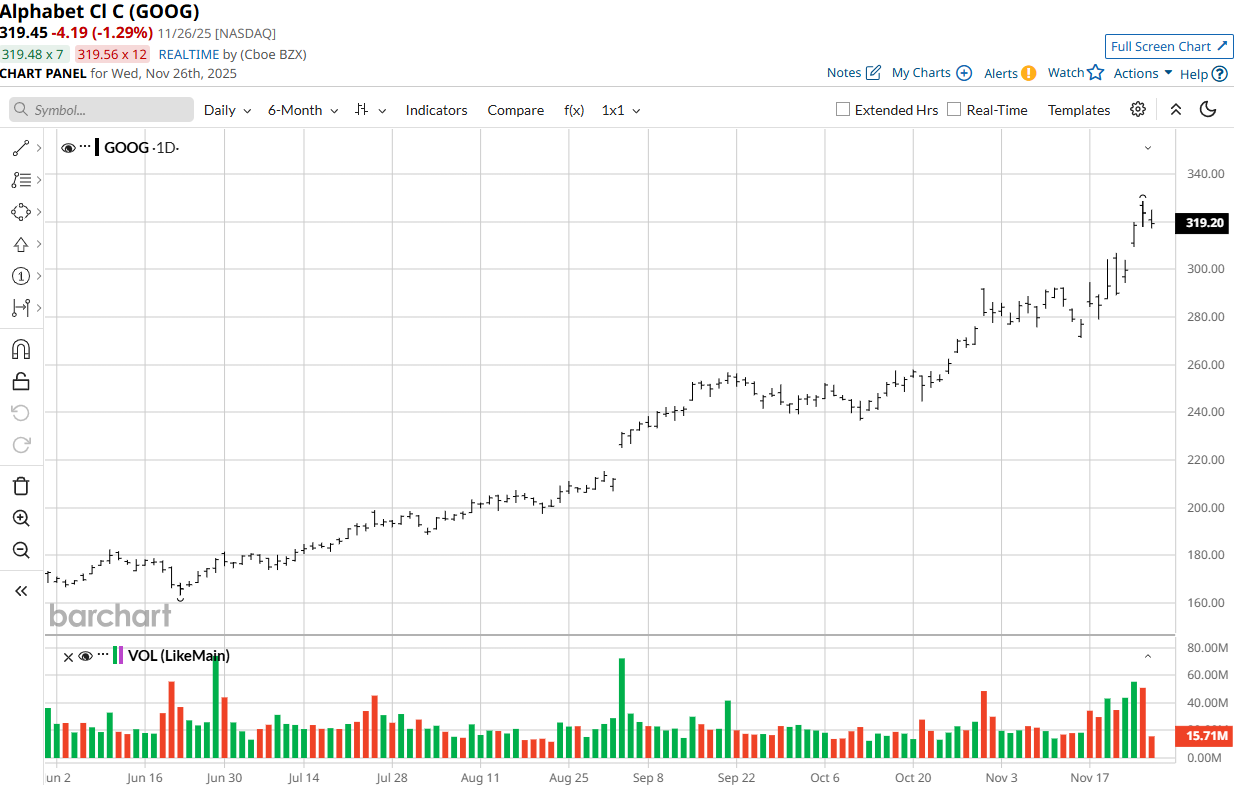

Alphabet has many very popular and valuable digital assets, including its Google search engine, YouTube, the Android ecosystem, Gmail, and Google Cloud. However, the firm currently generates the vast majority of its revenue from advertising. In the month that ended on Nov. 25, the shares had climbed 20.5%, causing the company’s market capitalization to approach $4 trillion.

In the third quarter, the conglomerate’s revenue jumped 16% versus the same period a year earlier to $102.3 billion, while its operating income, excluding a one-time charge, soared 22% year-over-year.

GOOG stock is changing hands at a trailing price-earnings ratio of 31.4 times, while 44 of 55 analysts who cover the shares rate it a “Strong Buy.”

GOOG Is Poised to Get a Lift From Its AI Businesses

Meta (META), which buys a very high number of AI chips, is reportedly considering utilizing Alphabet’s AI chips, according to a recent report. The notion that Meta, a big rival of Google in the digital ad space, is even thinking of buying a sizeable number of chips from its competitor suggests that the processors are high-quality products which are poised to attract significant demand.

Indeed, according to one source, GOOG’s “chips are more cost-effective and power-efficient” than Nvidia’s GPUs. In light of these points, GOOG’s chips could easily attract needle-moving revenue for the firm over the longer term.

Staying in the AI space, the company’s latest AI model, Gemini 3, “won immediate praise for its capabilities in reasoning and coding, as well as niche tasks that have tripped up AI chatbots,” Bloomberg reported. Investors have also been pleased by the tech giant’s partnership with AI startup, Anthropic.

Gemini 3 will also probably boost GOOG’s financial results in the longer term.

Finally, Google Cloud has benefited significantly from the AI revolution and is moving the needle positively from a financial standpoint, as its backlog jumped 82% in Q3 versus the same period a year earlier to $155 billion.

Berkshire’s Purchase of GOOG Stock and the High Potential of Driverless Cars

Berkshire Hathaway acquired 17.8 million shares of GOOGL stock in Q3, showing confidence in the firm’s outlook and making the market much more upbeat on Alphabet. Berkshire’s move is likely to make most investors look at Alphabet favorably for a considerable period of time.

And long-term investors should consider that Alphabet’s driverless car unit, Waymo, could very well be a game changer in the long term. Waymo could boost GOOG’s market capitalization by roughly $4.5 trillion in the not-too-distant future.

The Bottom Line on GOOG

Alphabet has tremendous opportunities in the AI space and in driverless cars, while Berkshire’s endorsement will support the shares in the near to medium term. Consequently, the shares appear to be meaningfully undervalued at this point.

On the date of publication, Larry Ramer did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Cathie Wood Is Buying the Dip in BitMine Immersion Stock. Should You?

- Google Is Getting the AI Spotlight, But Nvidia Says Its GPUs Are a ‘Generation Ahead.’ How Should You Play NVDA Stock Here?

- Can Dell Stock Break Through Its 100-Day Moving Average on Post-Earnings Pop?

- Unusual Activity in Oracle Corp Put Options Highlights ORCL Stock's Value