Netflix, Inc. (NFLX), headquartered in Los Gatos, California, operates as a subscription streaming service and production company, offering entertainment services in approximately 190 countries. Valued at $442.4 billion by market cap, the company provides a wide range of TV series, documentaries, feature films, and games across different genres and languages.

Companies worth $200 billion or more are generally described as “mega-cap stocks,” and NFLX definitely fits that description, with its market cap exceeding this threshold, reflecting its substantial size, influence, and dominance in the entertainment industry. NFLX’s strong brand, extensive content library, and commitment to original productions, including award-winning films and series, set it apart from competitors. The platform has garnered critical acclaim, with its original productions being nominated for 120 awards and winning an impressive 30 Emmy trophies in 2025.

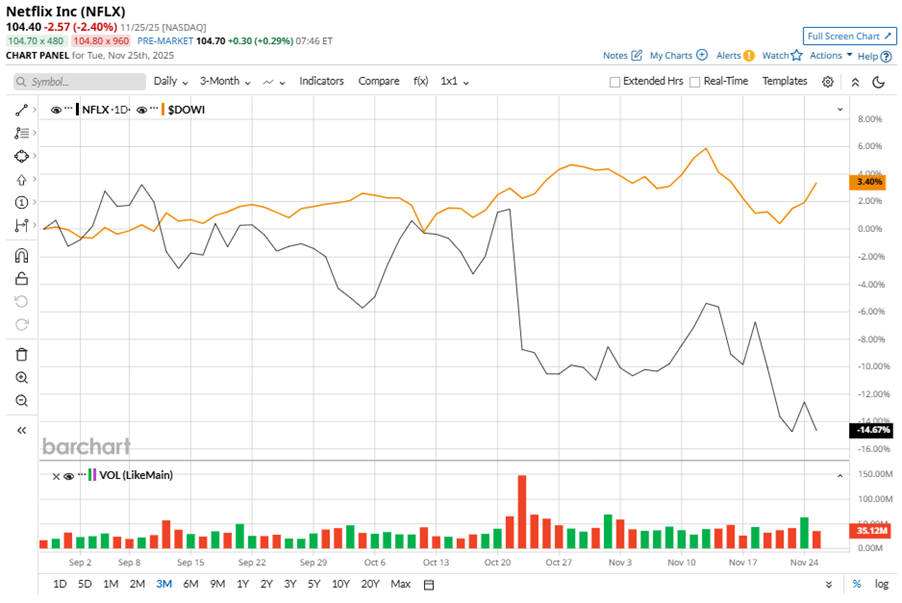

Despite its notable strength, NFLX slipped 22.2% from its 52-week high of $134.12, achieved on Jun. 30. Over the past three months, NFLX stock fell 14.3%, underperforming the Dow Jones Industrials Average’s ($DOWI) 4% gains during the same time frame.

In the longer term, shares of NFLX rose 17.1% on a YTD basis and climbed 20.6% over the past 52 weeks, outperforming DOWI’s YTD gains of 10.7% and 5.3% returns over the last year.

To confirm the bearish trend, NFLX has been trading below its 200-day moving average since late October, with some fluctuations. The stock is trading below its 50-day moving average since mid-July, with slight fluctuations.

NFLX's strong performance was driven by record ad sales, engagement, and hit content like K-pop Demon Hunters. The U.S. (8.6%) and U.K. (9.4%) viewing shares hit records. Management cites ongoing subscriber growth, ad business expansion, and a robust content pipeline for 2025 and 2026. The company’s investments in tech, content, and ads are driving engagement and retention.

On Oct. 21, NFLX reported its Q3 results, and its shares closed down more than 10% in the following trading session. Its EPS of $5.87 fell short of Wall Street expectations of $6.89. The company’s revenue was $11.51 billion, falling short of Wall Street's $11.52 billion forecast.

NFLX’s rival, Roku, Inc. (ROKU) shares have taken the lead over the stock, with a 27.6% gain on a YTD basis and a 39.1% uptick over the past 52 weeks.

Wall Street analysts are reasonably bullish on NFLX’s prospects. The stock has a consensus “Moderate Buy” rating from the 47 analysts covering it, and the mean price target of $136.38 suggests a notable potential upside of 30.6% from current price levels.

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- ‘These Chips Will Profoundly Change the World’ and ‘Save Lives.’ Elon Musk Doubles Down on AI Chips as TSLA Stock Stagnates YTD.

- This Undiscovered Biotech Stock Has Quintupled in a Year and Just Hit New Highs

- Oppenheimer Thinks Investors Are Missing Out on IBM Stock

- Wedbush Just Raised Its Fannie Mae Price Target 1,050%. Should You Buy FNMA Stock Here?