Purchase, New York-based PepsiCo, Inc. (PEP) manufactures, markets, distributes, and sells a variety of beverages and convenient foods. Valued at $198.9 billion by market cap, the company offers a variety of grain-based snacks, carbonated and non-carbonated beverages, and foods under the brands Lay's, Doritos, Fritos, Tostitos, Cheetos, Life, Pearl Milling Company, Gatorade, Pepsi-Cola, Mountain Dew, Quaker, and more.

Companies worth $10 billion or more are generally described as “large-cap stocks,” and PEP perfectly fits that description, with its market cap exceeding this mark, underscoring its size, influence, and dominance within the beverages - non-alcoholic industry. PepsiCo's strength lies in its diverse brand portfolio, which maintains significant market share across various categories. The company's strong brand image and customer loyalty drive consistent revenue streams, particularly in convenience foods. PepsiCo's integrated business model allows for cost-effective operations and a strong competitive position, enabling the company to drive productivity savings and manage commodity costs effectively.

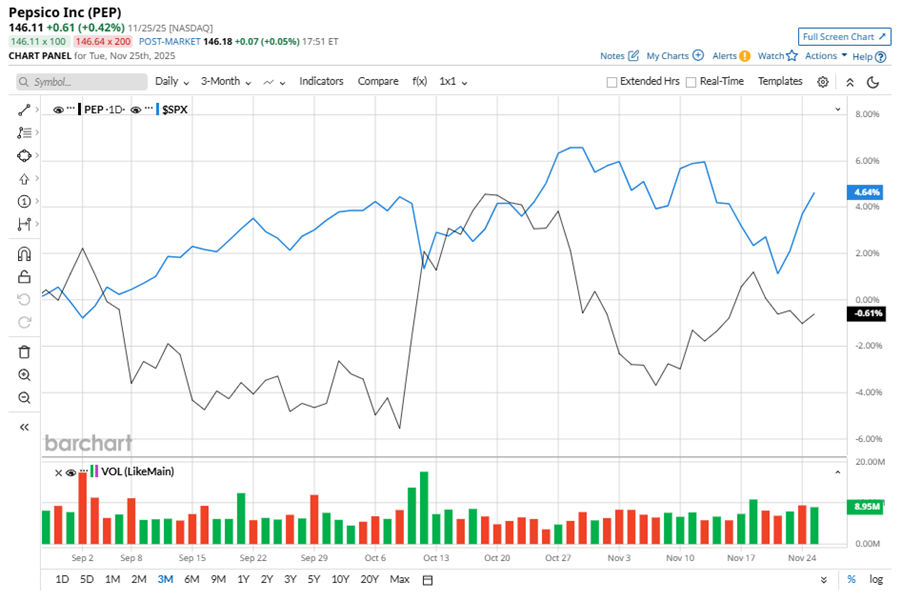

Despite its notable strength, PEP slipped 11.5% from its 52-week high of $165.13, achieved on Nov. 27, 2024. Over the past three months, PEP stock declined 1.4%, underperforming the S&P 500 Index’s ($SPX) 5.1% gains during the same time frame.

In the longer term, shares of PEP fell 3.9% on a YTD basis and dipped 10.4% over the past 52 weeks, underperforming SPX’s YTD gains of 15% and 13% returns over the last year.

To confirm the bullish trend, PEP has been trading above its 50-day and 200-day moving averages since early October, with some fluctuations.

On Oct. 9, PEP shares closed up more than 4% after reporting its Q3 results. Its adjusted EPS of $2.29 exceeded Wall Street expectations of $2.27. The company’s revenue was $23.94 billion, surpassing Wall Street forecasts of $23.88 billion.

In the competitive arena of non-alcoholic beverages, The Coca-Cola Company (KO) has taken the lead over PEP, showing resilience with a 16.6% gain on a YTD basis and a 12.8% uptick over the past 52 weeks.

Wall Street analysts are reasonably bullish on PEP’s prospects. The stock has a consensus “Moderate Buy” rating from the 21 analysts covering it, and the mean price target of $156.05 suggests a potential upside of 6.8% from current price levels.

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- ‘These Chips Will Profoundly Change the World’ and ‘Save Lives.’ Elon Musk Doubles Down on AI Chips as TSLA Stock Stagnates YTD.

- This Undiscovered Biotech Stock Has Quintupled in a Year and Just Hit New Highs

- Oppenheimer Thinks Investors Are Missing Out on IBM Stock

- Wedbush Just Raised Its Fannie Mae Price Target 1,050%. Should You Buy FNMA Stock Here?