Packaged foods company Post (NYSE: POST) met Wall Streets revenue expectations in Q3 CY2025, with sales up 11.8% year on year to $2.25 billion. Its non-GAAP profit of $2.09 per share was 11.4% above analysts’ consensus estimates.

Is now the time to buy Post? Find out by accessing our full research report, it’s free for active Edge members.

Post (POST) Q3 CY2025 Highlights:

- Revenue: $2.25 billion vs analyst estimates of $2.25 billion (11.8% year-on-year growth, in line)

- Adjusted EPS: $2.09 vs analyst estimates of $1.88 (11.4% beat)

- Adjusted EBITDA: $425.4 million vs analyst estimates of $402 million (18.9% margin, 5.8% beat)

- EBITDA guidance for the upcoming financial year 2026 is $1.52 billion at the midpoint, below analyst estimates of $1.56 billion

- Operating Margin: 7.5%, down from 9.5% in the same quarter last year

- Free Cash Flow Margin: 6.7%, up from 4.8% in the same quarter last year

- Market Capitalization: $5.81 billion

Company Overview

Founded in 1895, Post (NYSE: POST) is a packaged food company known for its namesake breakfast cereal and healthier-for-you snacks.

Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

With $8.16 billion in revenue over the past 12 months, Post is one of the larger consumer staples companies and benefits from a well-known brand that influences purchasing decisions.

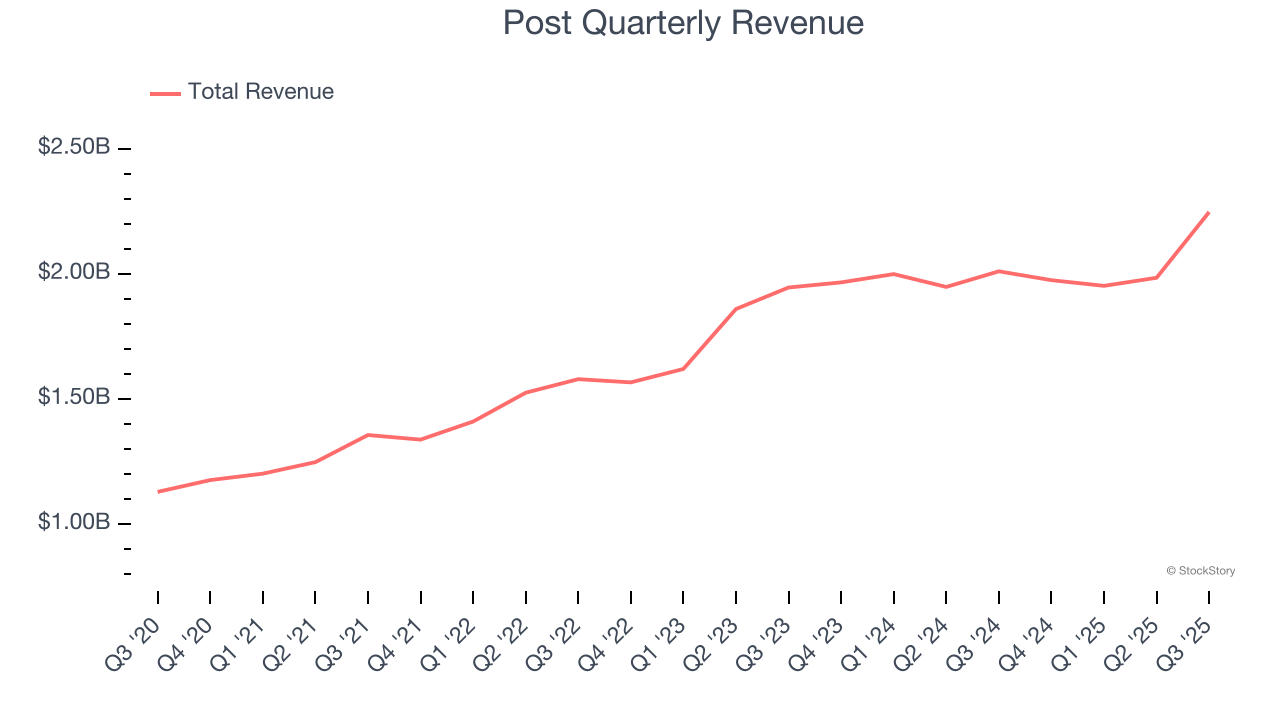

As you can see below, Post grew its sales at a solid 11.7% compounded annual growth rate over the last three years despite consumers buying less of its products. We’ll explore what this means in the "Volume Growth" section.

This quarter, Post’s year-on-year revenue growth was 11.8%, and its $2.25 billion of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 5.9% over the next 12 months, a deceleration versus the last three years. Still, this projection is above average for the sector and suggests the market is baking in some success for its newer products.

Microsoft, Alphabet, Coca-Cola, Monster Beverage—all began as under-the-radar growth stories riding a massive trend. We’ve identified the next one: a profitable AI semiconductor play Wall Street is still overlooking. Go here for access to our full report.

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

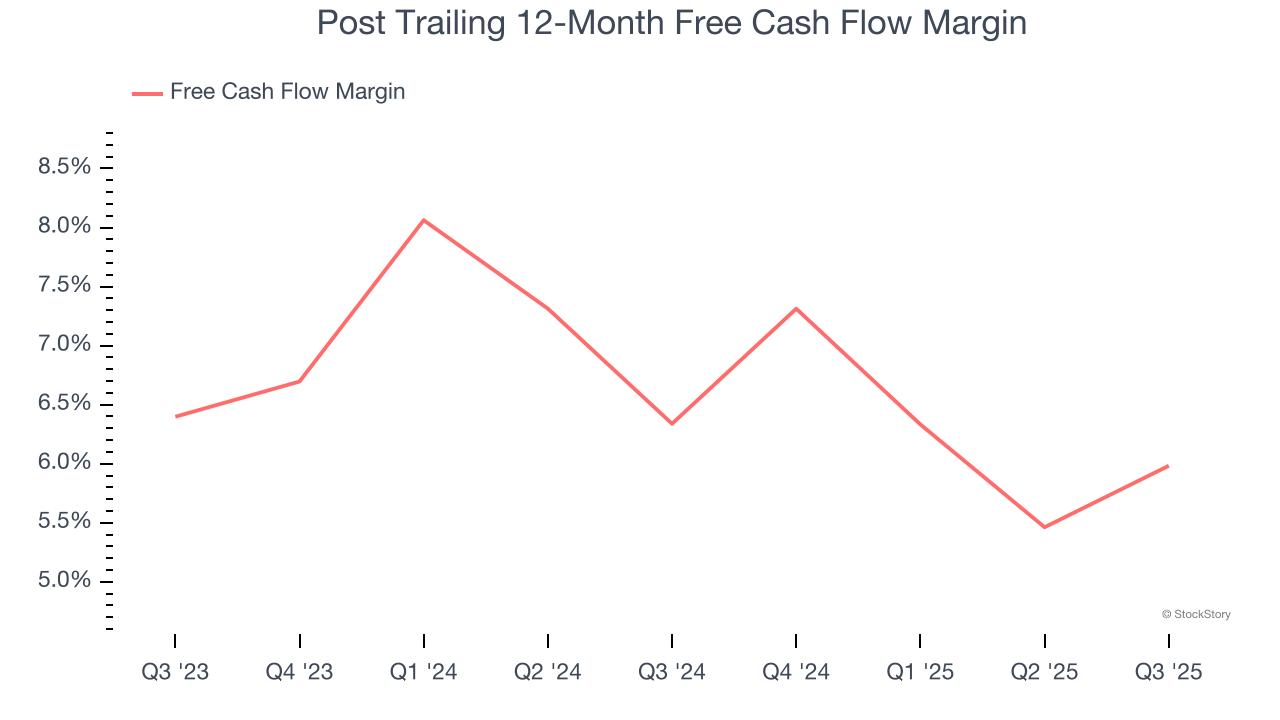

Post has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 6.2% over the last two years, slightly better than the broader consumer staples sector.

Post’s free cash flow clocked in at $151.6 million in Q3, equivalent to a 6.7% margin. This result was good as its margin was 2 percentage points higher than in the same quarter last year, but we wouldn’t read too much into the short term because investment needs can be seasonal, causing temporary swings. Long-term trends are more important.

Key Takeaways from Post’s Q3 Results

We enjoyed seeing Post beat analysts’ EBITDA expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. On the other hand, its gross margin missed and its full-year EBITDA guidance fell short of Wall Street’s estimates. Zooming out, we think this was a mixed quarter. Investors were likely hoping for more, and shares traded down 3.8% to $103.00 immediately after reporting.

So do we think Post is an attractive buy at the current price? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.