On Dec. 15, Nvidia (NVDA) announced the launch of its Nemotron 3 family of open models, built to support transparent, efficient, and specialized agentic artificial intelligence (AI) development across industries.

The Nemotron 3 Nano model delivers four times the throughput of the Nemotron 2 Nano, making it a more compute-cost-efficient open model for practical work, such as software debugging, content summarization, and AI assistant tasks.

This launch comes at a tricky moment for the stock. Nvidia is currently valued at a market capitalization of approximately $4.15 trillion, but shares have also fallen more than 17% from recent highs. That pullback shows investors are still debating how long hyper-scalers can continue heavy spending on AI, especially with growing competition from chipmakers, like Advanced Micro Devices (AMD) and Broadcom (AVGO), and the push by Amazon (AMZN) and Alphabet (GOOG) (GOOGL) to build more custom chips in-house.

At the same time, Nemotron 3 points to Nvidia’s continued move into agentic AI, and early adopters already include ServiceNow (NOW), Palantir (PLTR), Perplexity, and Oracle Cloud Infrastructure. So for investors, the question is simple: Does Nemotron 3 strengthen Nvidia’s moat enough to support buying at current valuations? Or do valuation pressures and the macro risks justify a more cautious stance? Let’s find out.

Nvidia’s Financial Pulse in 2025

Nvidia is an AI infrastructure company. It sells high-performance graphics processing units (GPUs) and closely integrated software that customers use to train and run AI in data centers, while also serving gaming and professional visualization markets on the side.

Over the past 52 weeks, the stock is up about 40%, so the bigger trend remains positive, although sentiment has cooled. Over the past month, shares have declined by about 8%, which appears more like a normal reset after a strong run than a sign that the story has fallen apart.

The valuation indicates that investors are willing to pay a premium. NVDA’s forward price-to-earnings (P/E) ratio is 40x versus the sector’s 24.34x, which means the market is pricing in faster growth and stronger long-term earnings power than the average stock in the group.

Income is still a small part of the picture. Nvidia’s annual dividend yield is 0.02%, well below the average technology yield of 1.37%.

What really supports Nvidia's case is financial performance. For Q3, Nvidia reported record revenue of $57 billion, up 22% quarter-over-quarter and 62% year-over-year. That growth was driven by record data center revenue of $51.2 billion. Gross margins stayed high at 73.4% GAAP and 73.6% non-GAAP, and earnings per share (EPS) came in at $1.30 on both GAAP and non-GAAP results. During the first nine months of fiscal 2026, Nvidia returned $37 billion through buybacks and dividends, and it still had $62.2 billion authorized for repurchases, which continues to support shareholder returns.

The Growth Engines Driving Nvidia’s AI Empire

Nvidia’s newly expanded collaboration with Synopsys (SNPS) is a direct move into the design and engineering work that sits behind many major industries. By combining Nvidia’s AI and accelerated computing with Synopsys’s market-leading data analysis tools, the goal is to help research and development teams design, simulate, and verify complex intelligent systems faster, with lower costs, and under tighter time-to-market pressure.

Nvidia also backed this partnership financially, investing $2 billion in Synopsys common stock at $414.79 per share, which underlies its seriousness about AI becoming part of core engineering workflows.

In addition, Nvidia’s tie-up with HUMAIN, a PIF-backed full-stack AI firm, is focused on scaling real infrastructure and supporting sovereign computers. HUMAIN plans to deploy up to 600,000 Nvidia GB300 platforms over the next three years and will use Nemotron open models to train its own HUMAIN Chat models.

The partnership also includes the building of Nvidia-powered data centers in Saudi Arabia and expanding to AI data centers in the United States, which broadens Nvidia’s reach as agentic AI moves from testing to wider rollout across regions.

Meanwhile, Nvidia’s collaboration with Upwind focuses on securing AI workloads where they run. Upwind is bringing its runtime-first cloud security platform onto Nvidia’s AI compute and inference stack, using Nvidia NIM microservices to boost its own AI-driven security operations while also adding dedicated protection for Nvidia GPU-based infrastructure, like DGX and Blackwell.

What Analysts See Ahead for NVDA Stock

For the fourth quarter of fiscal 2026, the company expects revenue of about $65 billion. Earnings expectations are strong, too. The average EPS estimate is $1.44 versus $0.85 a year ago, and the next quarter is projected at $1.51 versus $0.77, which suggests year-over-year growth of 69.41% and 96.10%, respectively.

Those numbers help explain why several major firms remain upbeat. Morgan Stanley analyst Joe Moore recently raised his price target to $250, citing Nvidia’s visibility into roughly $500 billion of data center infrastructure revenue between 2025 and 2026 as companies continue building out AI and agentic AI capacity. Loop Capital is even more aggressive with a Street-high $350 target, which would imply a market cap of about $8.5 trillion.

Not everyone is on board, though. Seaport Research analyst Jay Goldberg has a “Sell” rating on NVDA, pointing to what he calls potential “circular financing” risks in the AI ecosystem.

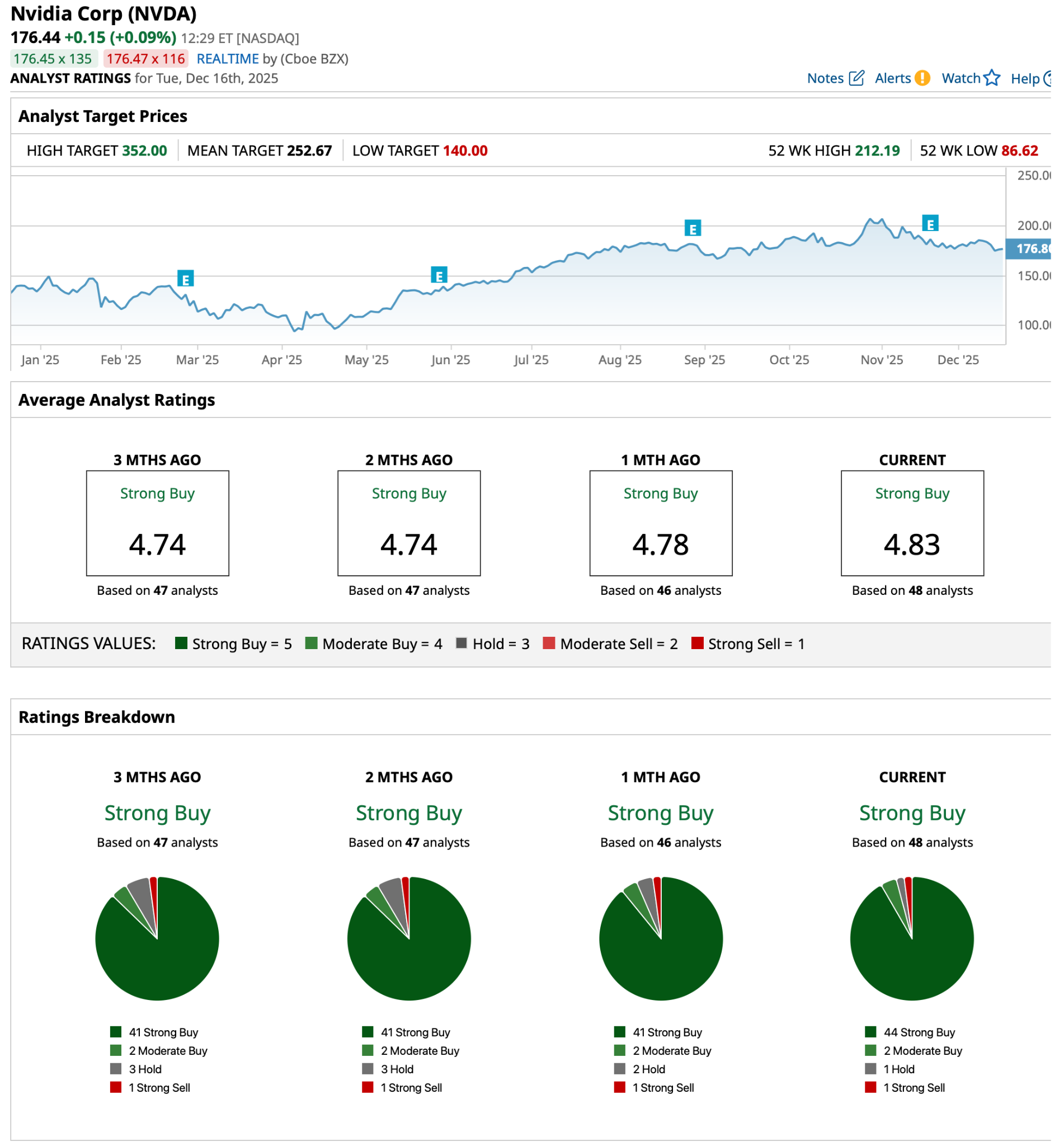

Even with that pushback, among 48 analysts, the consensus rating for Nvidia is a “Strong Buy,” and the average price target of $252.67 implies roughly 43.33% upside from the current price.

In Conclusion

In my opinion, Nvidia looks like a “Hold” with a buy-on-the-dip bias, because Nemotron 3 strengthens Nvidia’s position in agentic AI while the company is still putting up elite revenue growth, margins, and shareholder returns. The stock’s recent pullback suggests the market is wrestling with valuation and fears regarding the spending cycle, not a breakdown in execution. If guidance stays on track and the next couple of earnings prints confirm the demand curve, shares are more likely to grind higher than roll over, even if the ride stays volatile. A clean break is highly likely to need another upside surprise or clearer visibility into 2026 demand.

On the date of publication, Ebube Jones did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart