The artificial intelligence (AI) boom has been dominated by one name for years: the chip giant Nvidia (NVDA). However, the next phase of AI growth is increasingly focusing on the infrastructure that supports these workloads at scale. A company that is clearly benefiting from this trend is CoreWeave (CRWV), a cloud provider designed specifically for AI that is quickly becoming important to the world's most advanced AI organizations.

In fact, with its rapid surge of 63% year-to-date (YTD), CRWV stock has outperformed Nvidia’s YTD gain of 27% and the overall market gain of 15%. Nonetheless, Wall Street expects this under-$100 stock to surge close to 187% over the next year.

Let’s find out why.

Explosive Growth Fueled by AI Demand

Unlike traditional cloud providers, CoreWeave is a specialized cloud computing company built specifically for AI workloads. It serves AI labs, enterprises, and governments that require vast computing power for machine learning, generative AI, and data-intensive applications.

CoreWeave’s third quarter revealed how high demand has gotten for specialist AI cloud infrastructure. Revenue reached $1.4 billion, an increase of 134% year-over-year (YoY), as customer demand continued to far exceed available capacity. The company operates in a supply-constrained environment, yet it managed to outperform expectations, highlighting both operational strength and pricing power.

Even more impressive is the company’s backlog. CoreWeave added over $25 billion in revenue backlog in Q3 alone, ending the quarter with more than $55 billion in total backlog, approaching four times YTD levels. The company also reached $50 billion in remaining performance obligations (RPO), signaling extraordinary customer confidence in its long-term platform. While the company still reported a GAAP net loss of $110 million, this represented a dramatic improvement from the $360 million loss in the prior-year quarter.

During the quarter, the company signed large-scale compute contracts with Meta (META) and OpenAI, broadening its connections and minimizing reliance on a single customer. Nine of its ten top clients have now signed multiple agreements, highlighting the platform's stickiness.

Heavy Investment to Defend Long-Term Moats

AI infrastructure expansion is ultimately restricted by power and data center availability, which is where CoreWeave's strategy stands out. The company increased its active power footprint to around 590 megawatts, while contractual power capacity grew to 2.9 gigawatts. More than 1 gigawatt of contractual capacity is likely to come online during the next 12 to 24 months, enabling CoreWeave for long-term growth as capacity becomes available.

Importantly, the company has diversified its data center footprint across geographies and developers. No single provider accounts for more than about 20% of contractual power, which increases resilience and flexibility. Expansion is underway not only across the U.S. but also in Europe, including a significant new presence in Scotland built in collaboration with the UK government.

CoreWeave continues to reinvest aggressively to fulfill rising AI demand. Capital expenditures totaled $1.9 billion in the third quarter, with construction in progress reaching $6.9 billion, showing infrastructure that has already been funded but is not yet operational. Looking ahead, the company anticipates a total capital expenditure of $12 billion to $14 billion in 2025, with investments more than double that amount in 2026. These significant expenditures aim to strengthen CoreWeave's competitive advantage by increasing capacity, enhancing performance, and ensuring it can satisfy demand as AI usage spreads across industries.

CoreWeave has prioritized access to big, flexible funding pools while scaling AI infrastructure. At the end of Q3, the company had nearly $3 billion in cash and liquid assets, indicating a strong liquidity cushion. Most importantly, the company's major debt maturities do not occur until 2028, allowing it to enhance its capital structure as cash flows increase. Despite near-term delivery delays, CoreWeave reaffirmed that it expects 2025 revenue of $5.05 billion to $5.15 billion, in line with the consensus projections, and adjusted operating income between $690 million and $720 million. The active power capacity is expected to approach 850 megawatts by the end of the year, paving the way for some of the largest deployments in the company's history. Analysts estimate a 136% growth in revenue to $12.1 billion by 2026.

While margins could fluctuate in the short term as new capacity comes online, management emphasized that these investments are critical to maintaining long-term hypergrowth and extending CoreWeave's addressable market.

With explosive revenue growth, a massive and diversified backlog, and deep relationships with the world’s top AI innovators, CoreWeave is positioning itself as the essential cloud for AI.

What Does Wall Street Say About CRWV Stock?

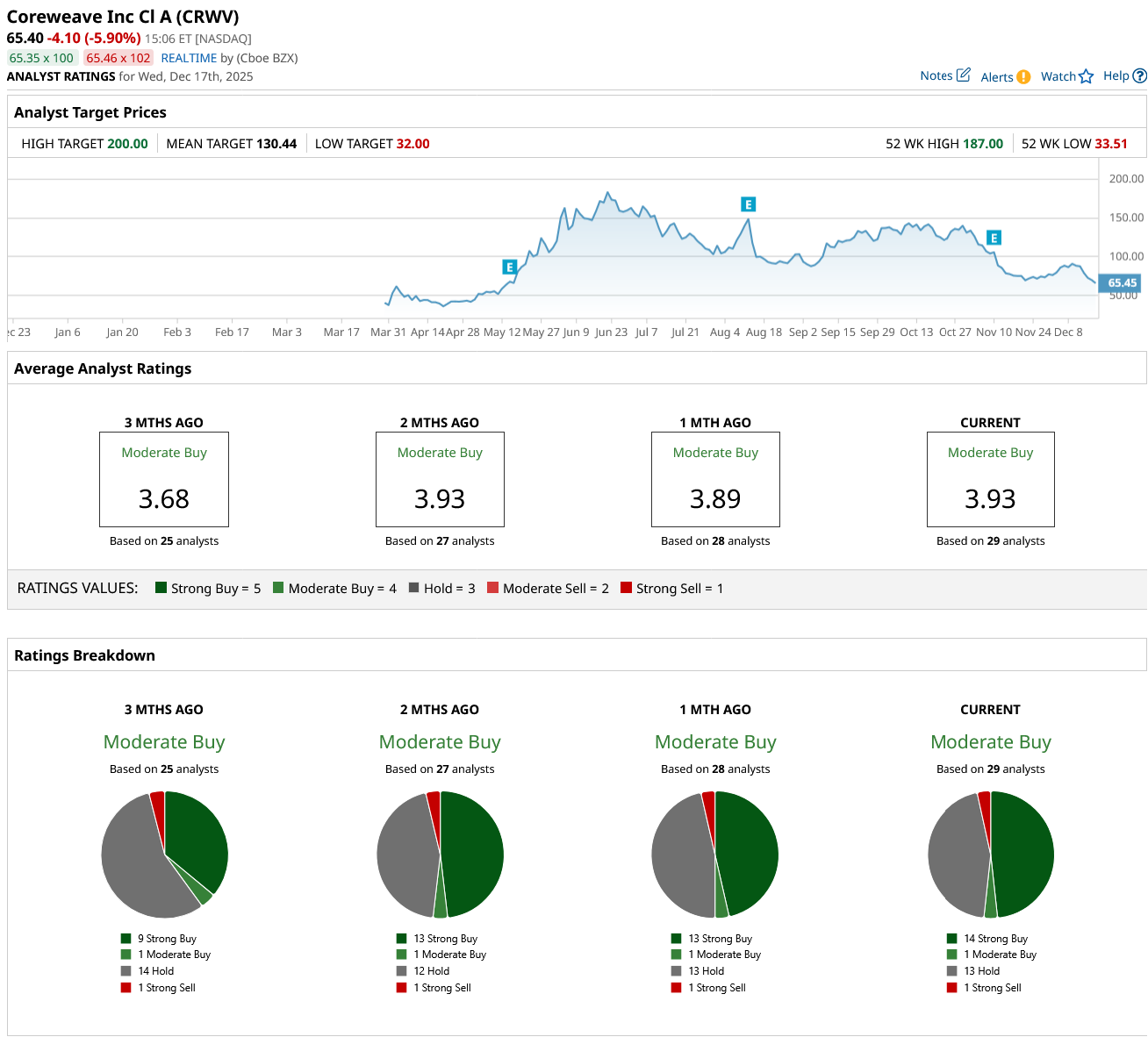

Overall, Wall Street rates CRWV stock a consensus “Moderate Buy.” Out of the 29 analysts covering the stock, 14 have a “Strong Buy” recommendation, one rates it a “Moderate Buy,” 13 rate it a “Hold,” and one says it is a “Strong Sell.” The average analyst target price of $130.44 for CRWV implies a 99% increase over current levels. Furthermore, analysts have set a high price target of $200, implying that the stock could rise as much as 205% over the next year.

On the date of publication, Sushree Mohanty did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart