Carnival (CCL) shares closed about 10% higher on Friday after the world’s largest cruise company reinstated its dividend as Q4 earnings more than doubled on a year-over-year basis to $0.34 a share.

Investors cheered CCL today also because the management issued impressive full-year guidance, with net yields seen coming in up 2.5% (at least) in the company’s fiscal 2026.

Including the post-earnings surge, Carnival stock is up an exceptional 89% versus its year-to-date low.

Why Is the Reinstated Dividend Super Positive for Carnival Stock?

CCL’s decision to reinstate its dividend after a six-year suspension is a powerful signal to investors that the company’s operations have regained stability.

While dividends provide income, their broader significance lies in what they represent, a vote of confidence from insiders that cash flow is sufficiently strong to support shareholder returns while funding growth.

For the Miami-headquartered cruise giant, the announcement marks a turning point from years of pandemic-driven losses and debt restructuring.

It reassures markets that Carnival isn’t just recovering, but is well-positioned to sustain profitability and reward investors going forward as well.

It’s this narrative primarily that drove CCL shares higher on Dec. 19.

Technicals Favor Owning CCL Shares Heading Into 2026

Carnival’s “phenomenal year” marked with “new records and investment grade leverage metrics,” as chief executive Josh Weinstein put it, warrants buying its stock heading into 2026.

At the time of writing, CCL stock is going for a price-to-sales (P/S) multiple of 1.51 only – which makes it relatively cheaper to own than peers like Royal Caribbean (RCL).

From a technical perspective as well, the cruise giant looks just as attractive. On Friday, it pushed past its 100-day moving average (MA), signaling the bulls will likely remain in control in the near- to medium term.

What’s the Consensus Rating on Carnival?

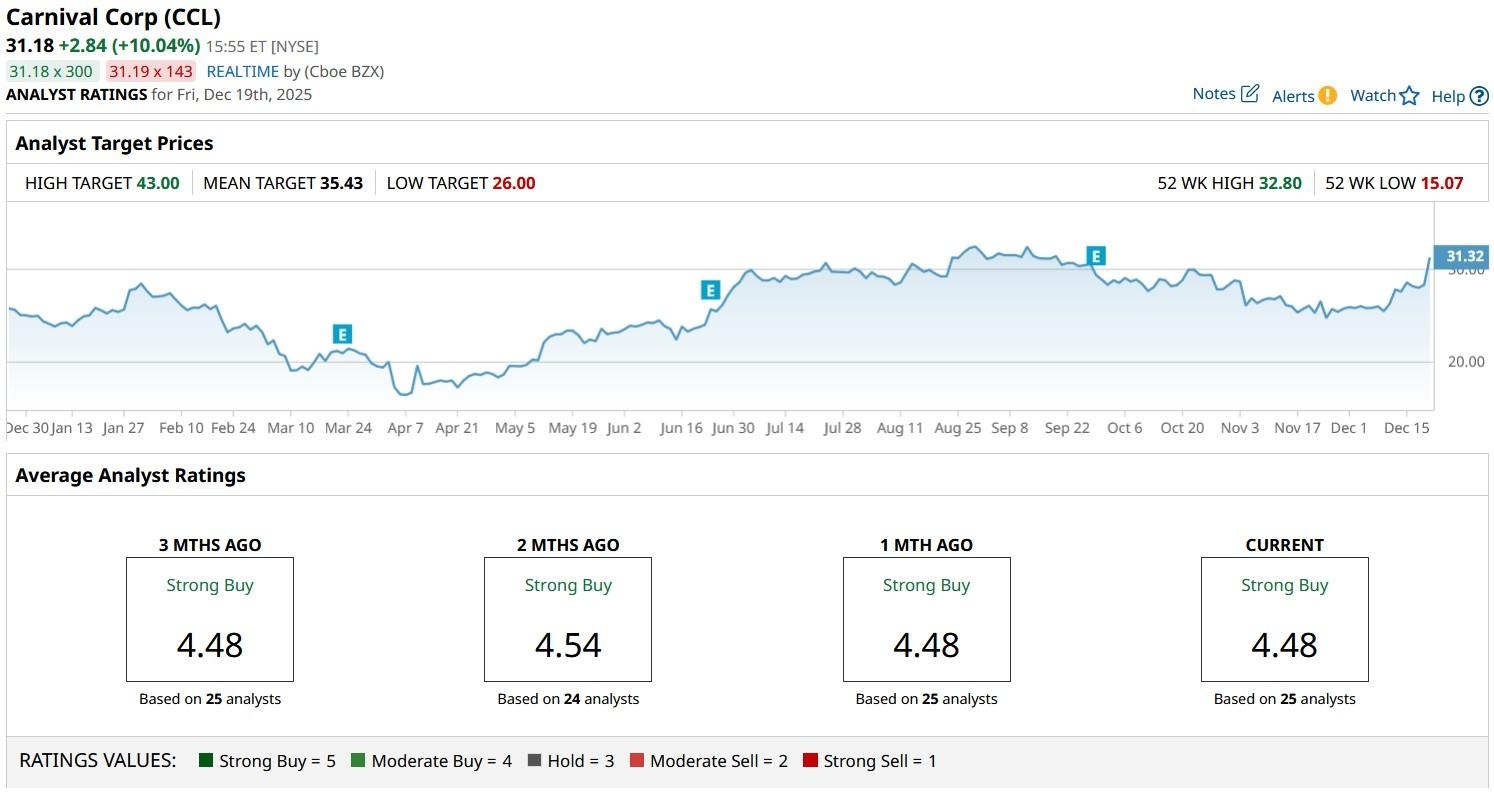

Wall Street analysts also recommend sticking with CCL shares heading into 2026.

The consensus rating on Carnival stock currently sits at “Strong Buy” with price targets going as high as $43 indicating potential upside of nearly 40% from here.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart