With a market cap of $22.9 billion, KeyCorp (KEY) is a U.S.-based bank holding company for KeyBank National Association, providing a wide range of retail and commercial banking products and services through its Consumer Bank and Commercial Bank segments. The company serves individuals, businesses, and institutional clients with offerings that include deposits, lending, investment banking, wealth management, and capital markets services.

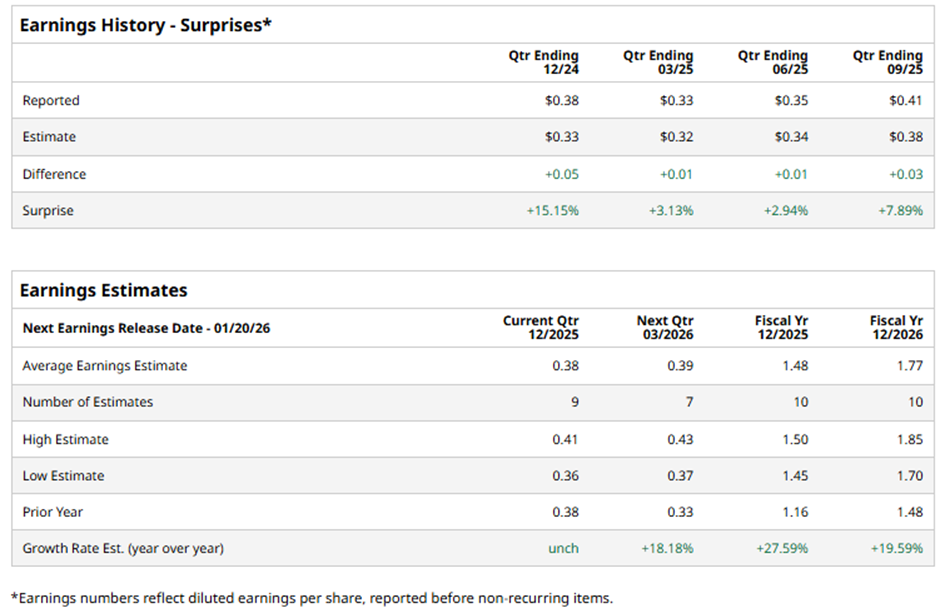

The Cleveland, Ohio-based company is scheduled to announce its fiscal Q4 2025 results soon. Ahead of this event, analysts forecast KeyCorp to report an EPS of $0.38, in line with the year-ago quarter. It has surpassed Wall Street's earnings estimates in the last four quarters.

For fiscal 2025, analysts expect the bank to report an EPS of $1.48, a growth of 27.6% from $1.16 in fiscal 2024.

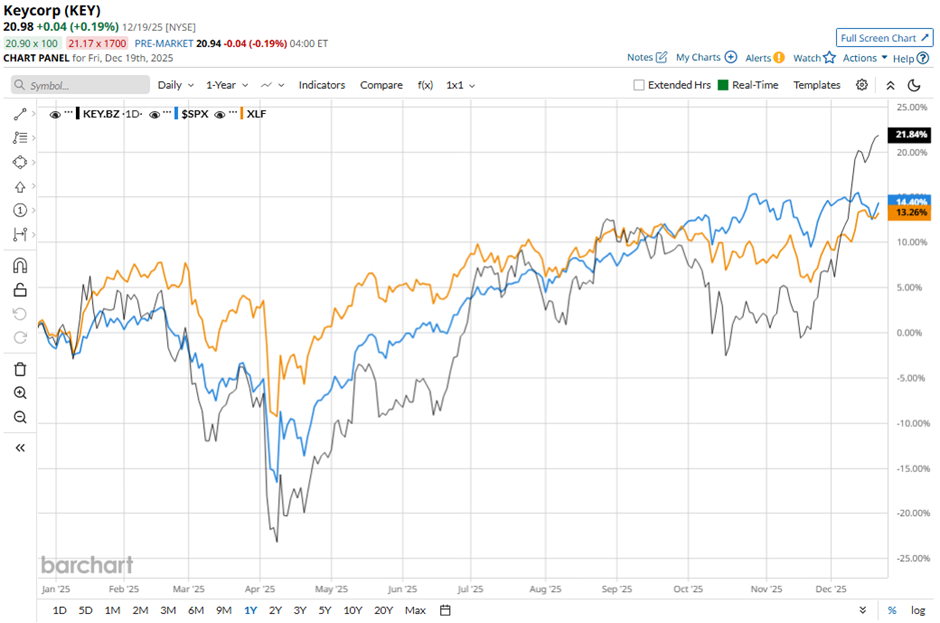

Shares of KeyCorp have increased 24.8% over the past 52 weeks, outperforming both the S&P 500 Index's ($SPX) 16.5% gain and the Financial Select Sector SPDR Fund’s (XLF) 14.7% return over the same period.

KeyCorp reported strong Q3 2025 results on Oct. 16, highlighted by a 23.8% jump in net interest income to $1.19 billion, driven by lower deposit costs and a shift toward higher-yielding assets. Revenue also climbed 17% to $1.9 billion, while investment banking and debt placement fees increased 7.6%. However, the stock tumbled 5.4% on that day.

Analysts' consensus view on KEY stock is cautiously optimistic, with a "Moderate Buy" rating overall. Among 23 analysts covering the stock, 11 suggest a "Strong Buy," two give a "Moderate Buy," and 10 "Holds." The average analyst price target for KeyCorp is $21.31, indicating a potential upside of 1.6% from the current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart