Intuit (Nasdaq: INTU), the global technology platform that makes Intuit QuickBooks, TurboTax, Credit Karma, and Mailchimp, today unveiled QuickBooks Money, a new all-in-one payments and banking solution with no monthly fees or minimum balance requirements that gives small businesses complete control of their money from anywhere. QuickBooks Money builds on QuickBooks’ earlier fintech innovation to deliver the platform’s powerful payments and money management capabilities to small businesses in a streamlined mobile and web-enabled experience without a subscription.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20230913571479/en/

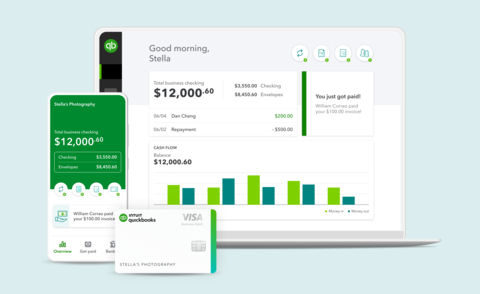

QuickBooks Money, a New Subscription-Free Payments and Banking Solution for Small Businesses (Graphic: Business Wire)

QuickBooks Money brings Intuit’s expertise in financial services to an even wider audience of small business owners who may not initially need the QuickBooks platform’s full range of financial management and accounting capabilities but are still seeking one simple tool to get paid and manage their money end-to-end. As these businesses grow and require additional tools to help manage their business, they’ll have a seamless path to access the full range of solutions the QuickBooks platform offers such as accounting, payroll, workforce management, and more.

“QuickBooks Money represents an incredible opportunity to expand the reach of our fintech platform and give more small businesses access to powerful cash flow management tools,” said David Talach, senior vice president of the QuickBooks Money Platform at Intuit. “We believe this is a true front door to the future of small business success.”

Small businesses can open a QuickBooks Money account* in just a few minutes and access it via mobile app or web. It has no monthly fees or minimum balance requirements, and empowers business owners with the ability to:

- Send a personalized invoice or quick payment request and let customers choose a payment method that’s convenient for them—credit or debit, ACH bank transfer, Apple Pay®, Google Pay, PayPal, or Venmo*.

- Have eligible payments land in your bank account the same day—nights, weekends, and holidays—so you can access cash fast at no additional cost. Businesses can also use the free QuickBooks Visa® business debit card, which enables access to over 19,000 Allpoint ATMs nationwide.**

- Use envelopes in QuickBooks Money to save for expenses and earn 1.75% APY** on envelope balances, 25X the national average rate1.

- Know their money is covered with FDIC insurance of up to $5,000,000*. QuickBooks Money works with partners to offer this enhanced FDIC insurance limit via a deposit sweep feature which works seamlessly in the background to automatically sweep balances above $250,000 to a network of FDIC insured banks.

- Easily track business income and expenses in one place to have a full view of how their business is doing and to make smart financial decisions.

QuickBooks Money currently combines two industry-leading financial services - QuickBooks Checking and QuickBooks Payments. QuickBooks Checking delivers a business banking hub through a purpose-built bank account provided by our partner Green Dot Bank. Processing more than $125 billion in volume annually, QuickBooks Payments allows small businesses to manage all of their payments in one place.

Initially introduced as Money by QuickBooks, a free mobile app which launched on iOS and Android in 2021, QuickBooks Money is the new expanded offering that includes a web experience, additional invoicing and banking capabilities, and has been tailored to meet the needs of small businesses based on insights from thousands of Money by QuickBooks customers. Future planned enhancements to QuickBooks Money include subscription-free access to other QuickBooks small business solutions such as bill pay, in-person payments, and lending. QuickBooks Money customers can also seamlessly upgrade to QuickBooks’ ecosystem of subscription-based services such as accounting, payroll, and more at any time.

For more information on QuickBooks Money, please visit here.

About Intuit

Intuit is the global financial technology platform that powers prosperity for the people and communities we serve. With 100 million customers worldwide using TurboTax, Credit Karma, QuickBooks, and Mailchimp, we believe that everyone should have the opportunity to prosper. We never stop working to find new, innovative ways to make that possible. Please visit us at Intuit.com and find us on social for the latest information about Intuit and our products and services.

QuickBooks and Intuit are a technology company, not a bank. Banking services provided by our partner, Green Dot Bank, Member FDIC.

*Product Information:

Money movement services are provided by Intuit Payments Inc., licensed as a Money Transmitter by the New York State Department of Financial Services.

QuickBooks Money: QuickBooks Money is a standalone Intuit offering that includes QuickBooks Payments and QuickBooks Checking. Intuit accounts are subject to eligibility criteria, credit, and application approval. Banking services provided by and QuickBooks Visa Debit Card are issued by Green Dot Bank, Member FDIC, pursuant to a license from Visa U.S.A. Inc. Visa is a registered trademark of Visa International Service Association. QuickBooks Checking Deposit Account Agreement applies. Banking services and debit card opening are subject to identity verification and approval by Green Dot Bank. Money movement services are provided by Intuit Payments Inc., licensed as a Money Transmitter by the New York State Department of Financial Services. No subscription cost or monthly fees. Other fees and limits, including transaction-based fees, apply.

FDIC Insurance: QuickBooks Money (or “QB checking” depending on brand) account balances are FDIC-insured up to the allowable limits through Green Dot Bank, Member FDIC. Coverage limit is subject to aggregation of all of Cardholder’s funds held on deposit at Green Dot Bank. Green Dot Bank also operates under the following registered trade names: GO2bank, GoBank and Bonneville Bank. All of these registered trade names are used by, and refer to, a single FDIC-insured bank, Green Dot Bank. Deposits under any of these trade names are deposits with Green Dot Bank and are aggregated for deposit insurance coverage up to the allowable limits. Additionally, with Green Dot Bank’s Deposit Sweep Program you are provided up to $5 million in FDIC insurance coverage on your account balances.

Deposit Sweep Program: Account balances above $250,000 will be automatically swept from Green Dot Bank and equally spread across our participating financial institutions, providing you with up to $5 million in FDIC insurance coverage. Customers are responsible for monitoring their total assets at each institution. Learn more and see a list of participating institutions here.

Apple Pay: Apple Pay is a registered trademark of Apple Inc.

Google Pay: Google Pay is a trademark of Google LLC.

PayPal and Venmo: Not currently available on invoicing through QuickBooks Online Advanced subscription.

**Features

No minimum balances or monthly fees: There are no minimum balance requirements to open or maintain this account or obtain the listed APY. Other fees and limits apply. See Deposit Account Agreement for details.

Same Day Deposit: Same Day Deposit allows you to have near-real time deposits sent to you on a predetermined daily schedule (up to 3x a day, Monday through Sunday, including holidays). Subject to eligibility criteria, eligible deposits will be available in up to 30 minutes. Payment request fees apply for ACH and card transactions. Transactions between 2:15-3:00 pm PST are excluded and transactions after 9:00 pm PST will be available for deposit the following morning. Deposit times may vary for third party delays.

Fee-free ATM withdrawals: Fee-free ATM access applies to in-network AllPoint ATMs only (up to 4 withdrawals per statement cycle). For out-of-network ATMs and bank tellers, a $3 fee will apply, plus any additional fees charged by the ATM owner or bank. See app for fee-free ATM locations.

Annual percentage yield: Annual percentage yield: The annual percentage yield ("APY") is accurate as of July 31, 2023, and may change at our discretion at any time. The listed APY will be paid on the average daily available balances distributed across your created envelopes within your primary QuickBooks Checking account. Balances held outside an envelope will not earn interest. See Deposit Account Agreement for terms and conditions.

Envelopes: You can create up to 9 Envelopes within your primary QuickBooks Checking account. Money in Envelopes must be moved to the available balance in your primary QuickBooks Checking account before it can be used. Envelopes within your primary QuickBooks Checking account will automatically earn interest once created. At the close of each statement cycle, the interest earned on funds in your Envelopes will be credited to each Envelope in proportion to the average daily balance of each Envelope. See Deposit Account Agreement for terms and conditions.

# Claims

1 25x U.S. average APY. Average interest rate: The average interest rate is based on the Federal Deposit Insurance Corporation's national rate published the week of July 17, 2023. Learn more.

Terms, conditions, pricing, special features, and service and support options subject to change without notice.

This information is intended to outline our general product direction, but represents no obligation and should not be relied on in making a purchasing decision. Additional terms, conditions and fees may apply with certain features and functionality. Eligibility criteria may apply. Product offers, features, functionality are subject to change without notice.

View source version on businesswire.com: https://www.businesswire.com/news/home/20230913571479/en/

Contacts

Intuit QuickBooks:

Dan Mahoney

Dan_Mahoney@intuit.com

Jen Garcia

Jeng@accesstheagency.com