Internet security and content delivery network Cloudflare (NYSE: NET) reported Q1 CY2025 results topping the market’s revenue expectations, with sales up 26.5% year on year to $479.1 million. The company expects next quarter’s revenue to be around $500.5 million, close to analysts’ estimates. Its non-GAAP profit of $0.16 per share was in line with analysts’ consensus estimates.

Is now the time to buy Cloudflare? Find out by accessing our full research report, it’s free.

Cloudflare (NET) Q1 CY2025 Highlights:

- Revenue: $479.1 million vs analyst estimates of $469.1 million (26.5% year-on-year growth, 2.1% beat)

- Adjusted EPS: $0.16 vs analyst estimates of $0.16 (in line)

- Adjusted Operating Income: $56 million vs analyst estimates of $55.14 million (11.7% margin, 1.6% beat)

- The company reconfirmed its revenue guidance for the full year of $2.09 billion at the midpoint

- Management reiterated its full-year Adjusted EPS guidance of $0.80 at the midpoint

- Operating Margin: -11.1%, up from -14.4% in the same quarter last year

- Free Cash Flow Margin: 11%, similar to the previous quarter

- Billings: $514.9 million at quarter end, up 32.8% year on year

- Market Capitalization: $42.18 billion

Company Overview

Founded by two grad students of Harvard Business School, Cloudflare (NYSE: NET) is a software-as-a-service platform that helps improve the security, reliability, and loading times of internet applications.

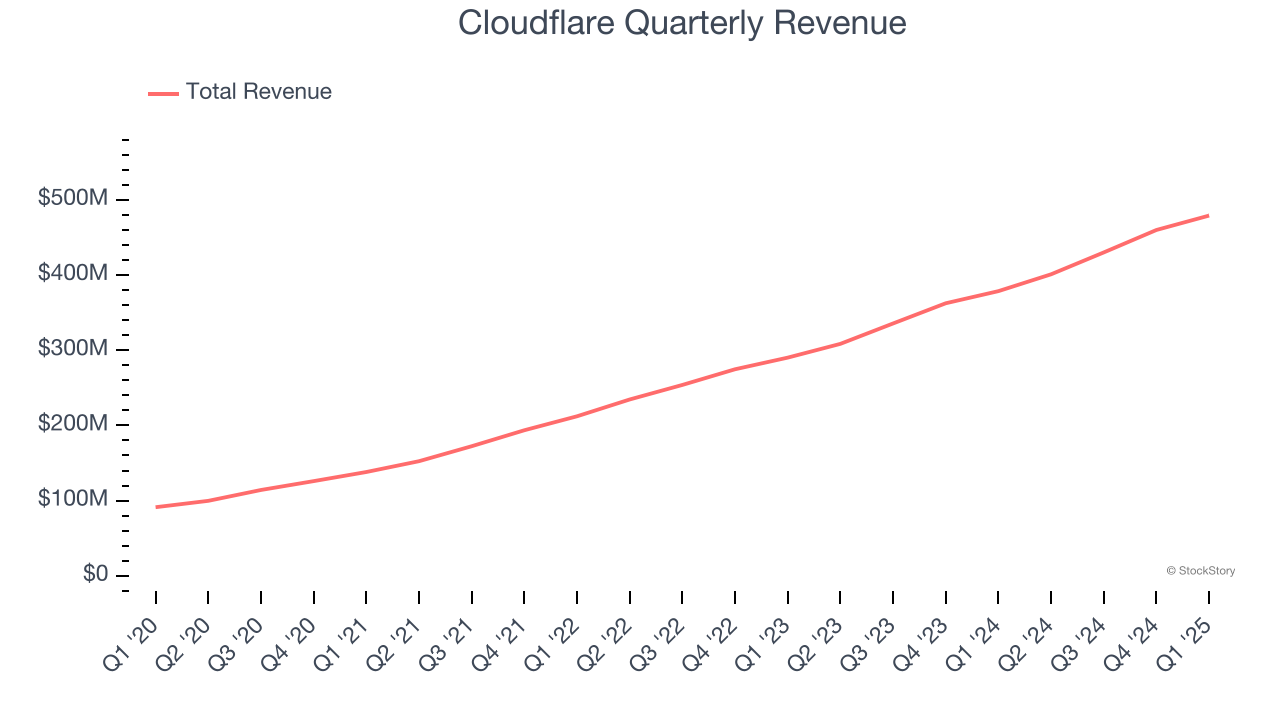

Sales Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Luckily, Cloudflare’s sales grew at an excellent 34.3% compounded annual growth rate over the last three years. Its growth surpassed the average software company and shows its offerings resonate with customers, a great starting point for our analysis.

This quarter, Cloudflare reported robust year-on-year revenue growth of 26.5%, and its $479.1 million of revenue topped Wall Street estimates by 2.1%. Company management is currently guiding for a 24.8% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 25.6% over the next 12 months, a deceleration versus the last three years. Despite the slowdown, this projection is noteworthy and implies the market is baking in success for its products and services.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

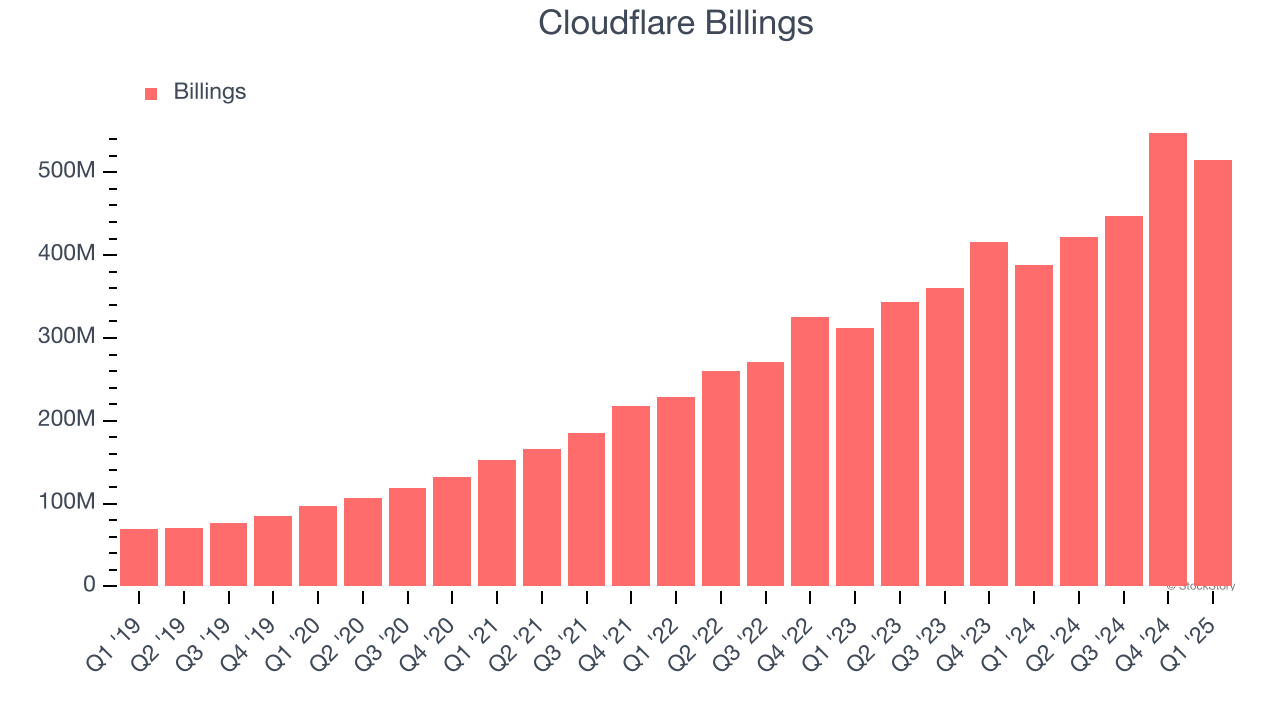

Billings

Billings is a non-GAAP metric that is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

Cloudflare’s billings punched in at $514.9 million in Q1, and over the last four quarters, its growth was fantastic as it averaged 27.9% year-on-year increases. This performance aligned with its total sales growth, indicating robust customer demand. The high level of cash collected from customers also enhances liquidity and provides a solid foundation for future investments and growth.

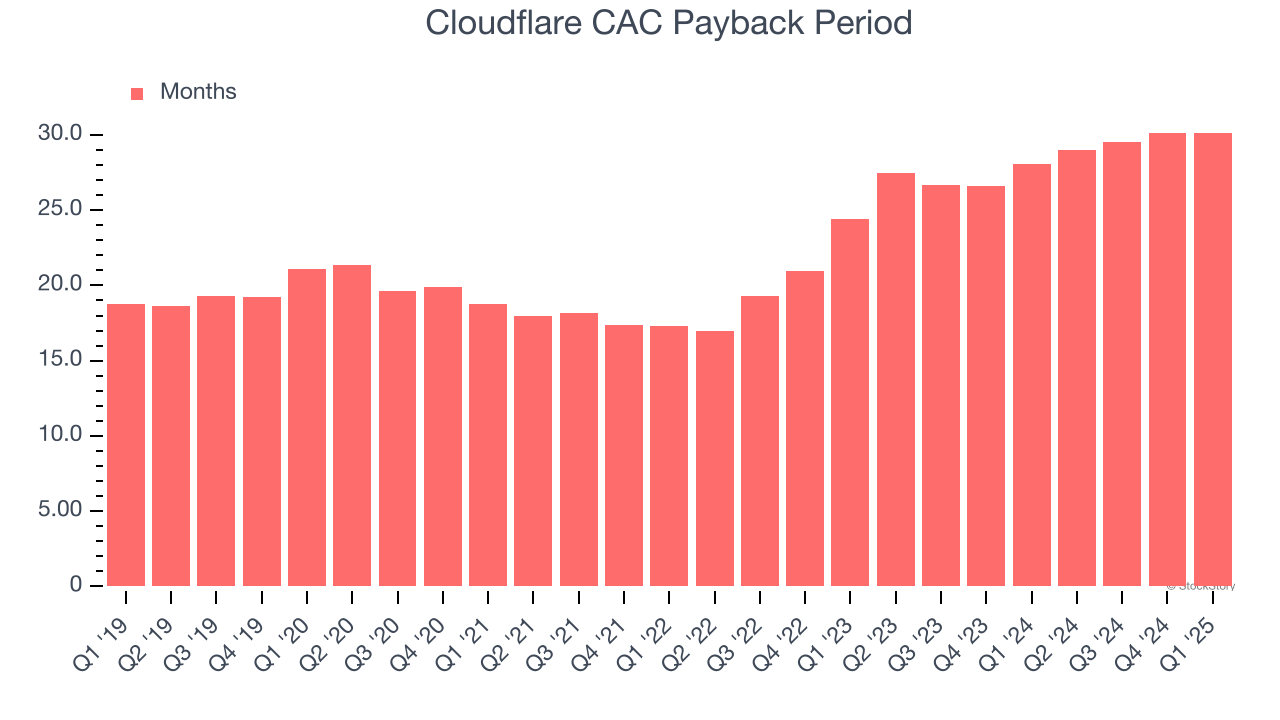

Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period represents the months required to recover the cost of acquiring a new customer. Essentially, it’s the break-even point for sales and marketing investments. A shorter CAC payback period is ideal, as it implies better returns on investment and business scalability.

Cloudflare is quite efficient at acquiring new customers, and its CAC payback period checked in at 30.2 months this quarter. The company’s rapid recovery of its customer acquisition costs indicates it has a strong brand reputation, giving it more resources pursue new product initiatives while maintaining the flexibility to increase its sales and marketing investments.

Key Takeaways from Cloudflare’s Q1 Results

We were impressed by how significantly Cloudflare blew past analysts’ billings expectations this quarter. We were also happy its revenue outperformed Wall Street’s estimates. On the other hand, its EPS guidance for next quarter missed although full-year EPS guidance was maintained from previous. Overall, this was a mixed quarter. The stock traded up 2.9% to $128.17 immediately following the results.

Big picture, is Cloudflare a buy here and now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.