Software giant Salesforce (CRM) has found itself under pressure on Wall Street this year, even as it races to tap into the artificial intelligence (AI) boom alongside its peers. But despite the hype, its flagship AI push, Agentforce, has yet to ignite the instant enthusiasm many investors were hoping for, leaving the stock vulnerable to broader concerns.

Worries around a potential AI bubble, intensifying competition in the enterprise software space, slowing revenue growth, and even fears that powerful AI tools could one day replace the very software platforms Salesforce builds have all weighed heavily on the stock. Still, the narrative around Salesforce is starting to improve. The company’s latest earnings report has helped restore a measure of investor confidence, and analysts are beginning to warm up again.

In fact, Salesforce now ranks among Mizuho’s top enterprise software stocks for 2026, with the investment firm noting that management is “systematically addressing” the hurdles that previously hindered broader Agentforce adoption. So, with sentiment beginning to turn, let's take a closer look at this software stock.

About Salesforce Stock

Headquartered in San Francisco, Salesforce is the world’s dominant customer relationship management (CRM) platform, designed to help businesses build, manage, and deepen customer connections. A pioneer of cloud-based CRM since 1999, the company has consistently reshaped how organisations operate and is now steering customers into the next phase of digital transformation powered by AI.

At the center of that shift is Agentforce, Salesforce’s most ambitious AI offering, which introduces autonomous AI agents capable of handling tasks on behalf of both employees and customers. By unifying data from across an organization’s systems, Salesforce gives teams a complete, 360-degree view of every customer. Its suite of tools spanning sales, service, marketing, commerce, and IT enables businesses to work smarter, faster, and in sync.

Taken together, Salesforce delivers a more intelligent and intuitive approach to managing customer relationships in a rapidly evolving digital landscape. Its ecosystem also includes well-known platforms such as Slack, Tableau, and MuleSoft. But even with its scale and influence in enterprise software, the company’s ride on Wall Street hasn’t been entirely smooth sailing in 2025.

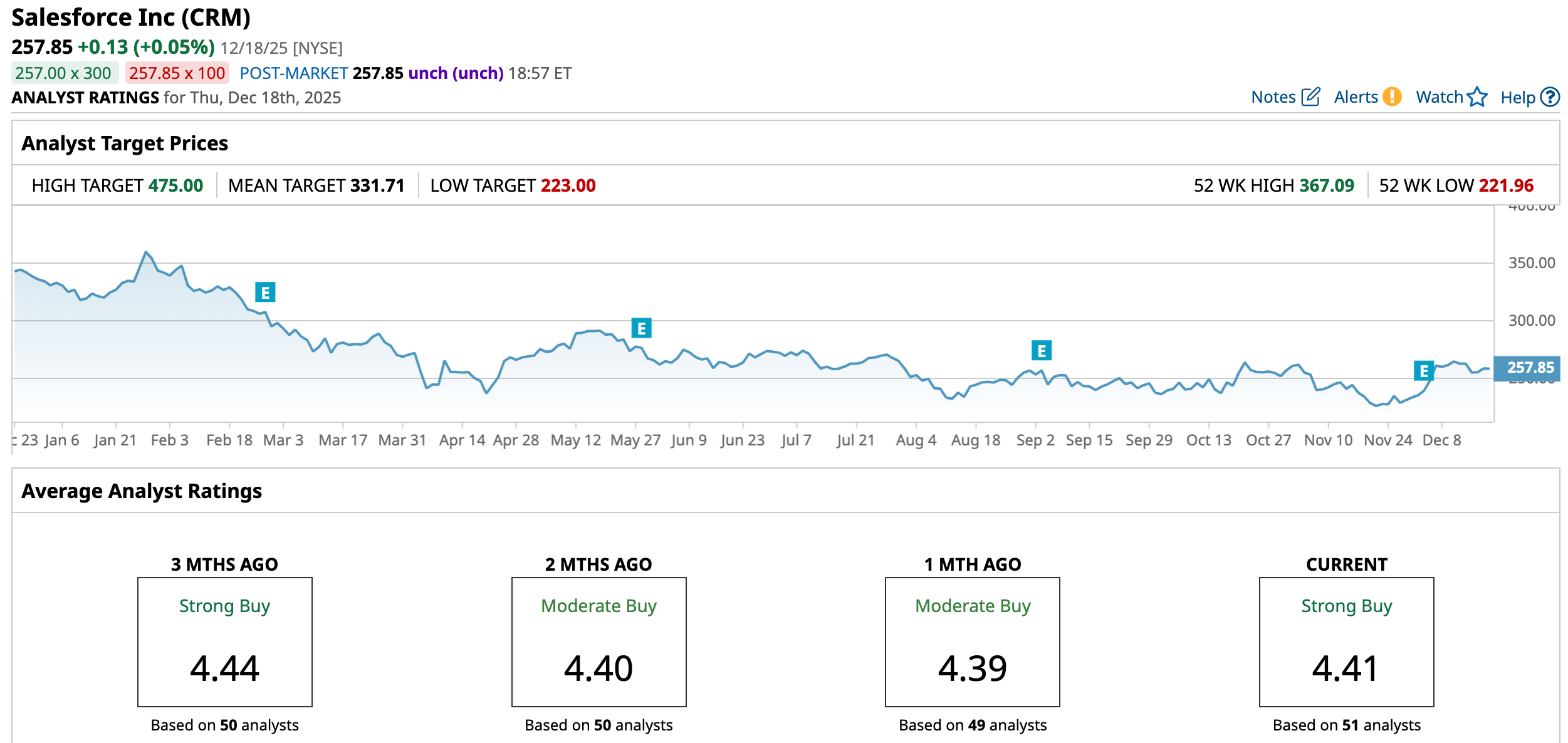

Salesforce shares have been stuck in a deep slump, extending last year’s 23.54% sell-off with another sharp 22.88% decline so far this year. The underperformance looks even starker against the broader market, with the broader S&P 500 Index ($SPX) up 15.37% over the past year and rising 15.19% in 2025. After peaking at $367.09 in January, Salesforce shares have slid about 42.37% from that high, highlighting the stock’s prolonged struggle to regain momentum.

After the recent pullback, Salesforce’s valuation appears far less stretched than it has historically been. CRM is currently valued at 21.93 times forward earnings and 5.83 times sales, a clear discount to its five-year averages of 36.3x and 6.9x, respectively, signaling a more balanced entry point if the growth story regains momentum.

Salesforce’s Q3 Earnings Snapshot

Even after a difficult stretch for the stock, Salesforce caught investors’ attention on Dec. 3 with a stronger fiscal 2026 third-quarter earnings update, triggering a quick shift in sentiment. Management’s decision to lift its full-year outlook further helped propel shares up 3.7% on Dec. 4, offering CRM a welcome rebound following months of muted performance. The quarterly results reflected a mix of encouraging strengths and a few areas that narrowly missed expectations.

Revenue totaled $10.26 billion, marking a 9% year-over-year (YOY) increase, though it came in just below Wall Street’s estimates. Earnings, however, told a far more compelling story. Adjusted EPS surged 35% YOY to $3.25, comfortably beating the Street’s $2.86 forecast. Salesforce also reported solid backlog expansion, with current remaining performance obligation (cRPO) rising 11% to $29.4 billion, while total RPO increased 12% to $59.5 billion, signaling sustained demand across the business.

The company’s subscription and support segment continued to anchor results, with revenue climbing 10% YOY to $9.7 billion, highlighting the resilience of its recurring-revenue model. CEO Marc Benioff emphasized growing traction in Agentforce, Salesforce’s AI platform for building custom autonomous agents, positioning it as a key growth engine alongside the firm’s expanding data portfolio.

That momentum was clearly reflected in recurring revenue metrics. Annual recurring revenue (ARR) from Agentforce and Data 360 more than doubled, soaring 114% YOY to $1.4 billion. Agentforce on its own surpassed $500 million in ARR during the quarter, posting an extraordinary 330% YOY increase. Since launch, Salesforce has signed over 18,500 Agentforce deals, including more than 9,500 paid contracts, a 50% jump from the prior quarter.

Looking ahead, management struck an optimistic tone by lifting its fiscal 2026 guidance. Salesforce now expects full-year adjusted EPS in the range of $11.75 to $11.77, with revenue projected between $41.45 billion and $41.55 billion. Both outlooks exceed the company’s prior forecast of $11.33 to $11.37 in EPS on revenue of $41.1 billion to $41.3 billion.

What Do Analysts Think About Salesforce Stock?

In a recent investment note, Mizuho included Salesforce among its top enterprise software picks for 2026, signaling rising confidence in the company’s outlook. In addition to highlighting that Salesforce is “systematically addressing” the challenges that once limited wider Agentforce adoption, the firm underscored improving execution across the business.

Additionally, Mizuho analyst Gregg Moskowitz pointed to Salesforce’s entrenched position as the system of record for front-office sales, marketing, and customer support, noting that this gives CRM a solid base to further centralize enterprise data through Data 360. “We reiterate that CY26 should be a much better year for CRM than CY25, with legitimate potential for organic re-acceleration,” Moskowitz wrote. The analyst maintains an “Outperform” rating on Salesforce and a $360 price target.

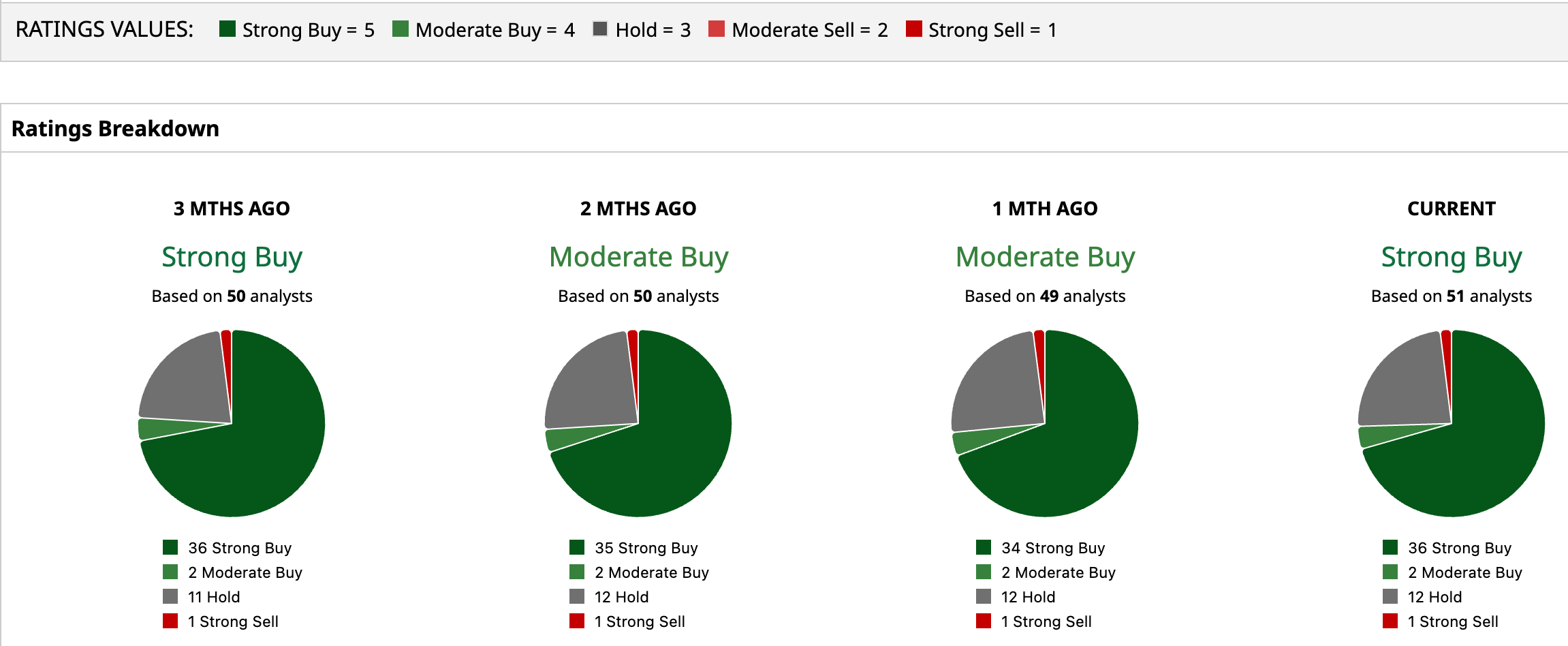

Overall, Wall Street remains optimistic on Salesforce. Among the 51 analysts tracking CRM, the consensus rating stands at a “Strong Buy.” A closer look shows 36 analysts calling it a “Strong Buy,” two recommending a “Moderate Buy,” 12 sitting on “Hold,” and just one issuing a “Strong Sell.”

Furthermore, that confidence is reflected in price targets. The average target of $331.71 points to roughly 28.65% upside from current levels. Meanwhile, the most bullish forecast on the Street sits at $475, implying Salesforce shares could rally nearly 84.22% if momentum continues to rebuild.

On the date of publication, Anushka Mukherji did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Mizuho Says This 1 Agentic AI Company Is the Top Software Stock to Buy in 2026

- Broadcom Stock Just Raised Its Dividend by 10%. Should You Buy AVGO Stock Now?

- Weight Watchers Is Going All In on GLP-1 Drugs. Should You Buy WW Stock Here?

- This Analyst Just Raised Their Micron Stock Price Target by 50%. Should You Buy Shares Here?