Yelp trades at $38.97 and has moved in lockstep with the market. Its shares have returned 6.3% over the last six months while the S&P 500 has gained 10.4%.

Is now the time to buy YELP? Find out in our full research report, it’s free.

Why Does YELP Stock Spark Debate?

Founded by PayPal alumni Jeremy Stoppelman and Russel Simmons, Yelp (NYSE:YELP) is an online platform that helps people discover local businesses through crowd-sourced reviews.

Two Things to Like:

1. Elite Gross Margin Powers Best-In-Class Business Model

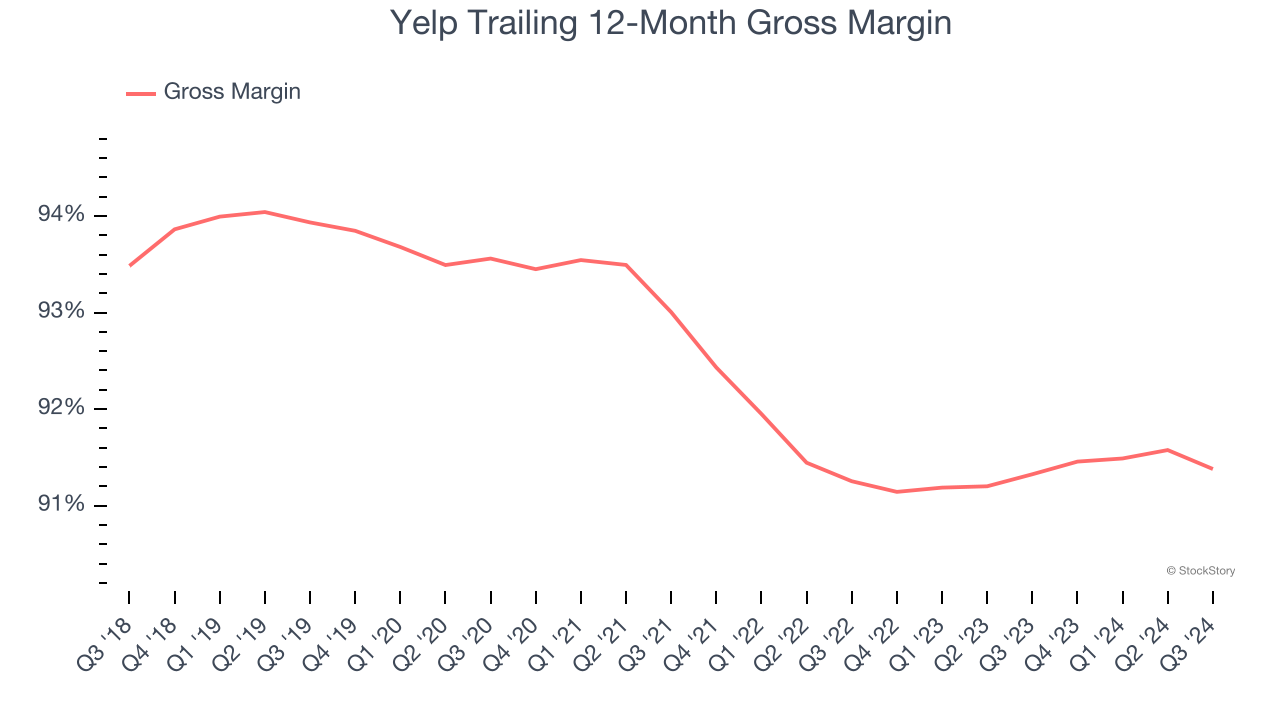

A company’s gross profit margin has a significant impact on its ability to exert pricing power, develop new products, and invest in marketing. These factors can determine the winner in a competitive market.

For social network businesses like Yelp, gross profit tells us how much money the company gets to keep after covering the base cost of its products and services, which typically include customer service, data center, and other infrastructure expenses.

Yelp’s gross margin is one of the highest in the consumer internet sector, an output of its asset-lite business model and strong pricing power. It also enables the company to fund large investments in product and marketing during periods of rapid growth to achieve higher profits in the future. As you can see below, it averaged an elite 91.4% gross margin over the last two years. That means Yelp only paid its providers $8.65 for every $100 in revenue.

2. EBITDA Margin Reveals a Well-Run Organization

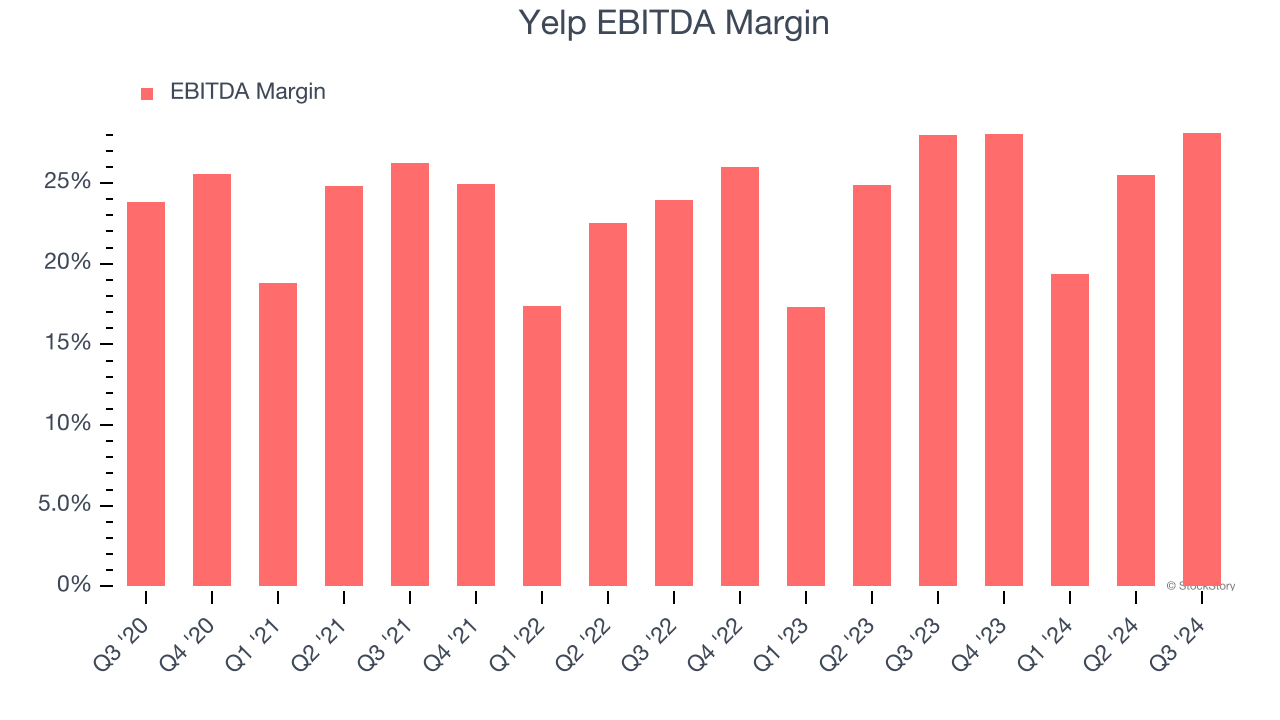

Operating income is often evaluated to assess a company’s underlying profitability. In a similar vein, EBITDA is used to analyze consumer internet companies because it excludes various one-time or non-cash expenses (depreciation), providing a clearer view of the business’s profit potential.

Yelp has been a well-oiled machine over the last two years. It demonstrated elite profitability for a consumer internet business, boasting an average EBITDA margin of 24.8%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

One Reason to be Careful:

Growth in Customer Spending Lags Peers

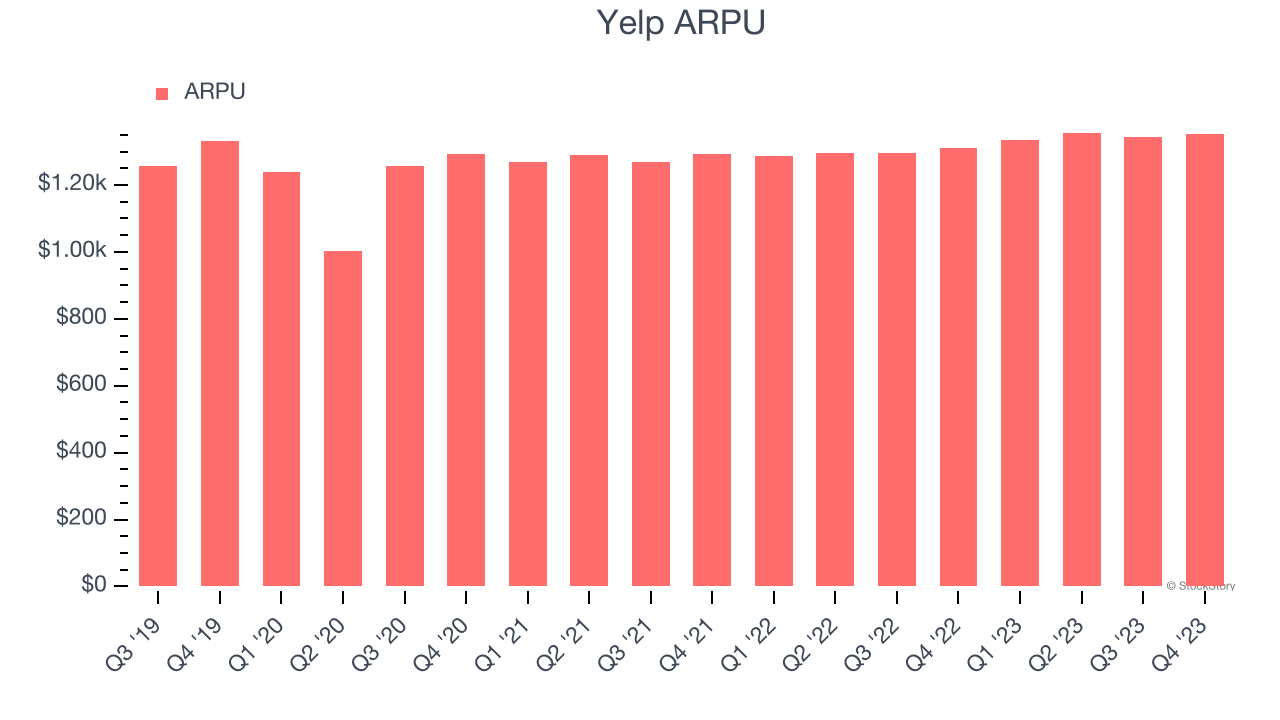

Average revenue per user (ARPU) is a critical metric to track for social networking businesses like Yelp because it measures how much the company earns from the ads shown to its users. ARPU can also be a proxy for how valuable advertisers find Yelp’s audience and its ad-targeting capabilities.

Yelp’s ARPU growth has been mediocre over the last two years, averaging 3.4%. This raises questions about its platform’s health and ability to engage its users effectively.

Final Judgment

Yelp has huge potential even though it has some open questions, but at $38.97 per share (or 7.7× forward EV-to-EBITDA), is now the time to initiate a position? See for yourself in our full research report, it’s free.

Stocks We Like Even More Than Yelp

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market to cap off the year - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.