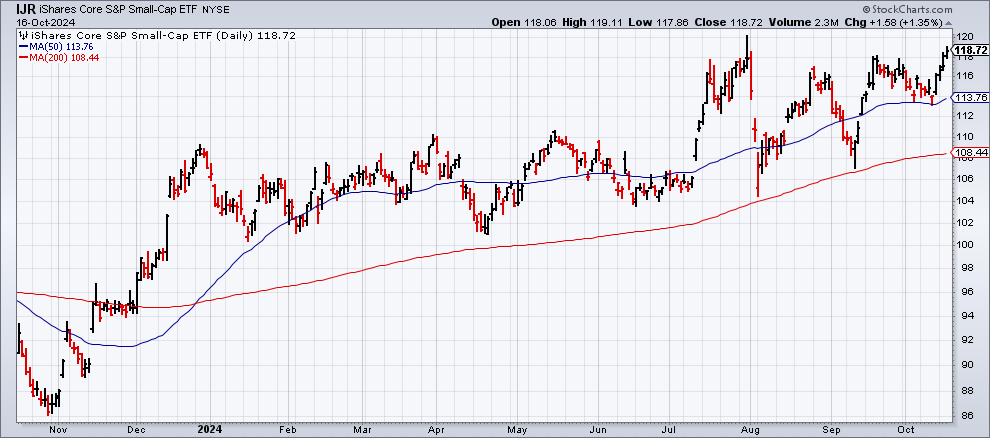

iShares Core S&P Small-Cap ETF (NY:IJR)

All News about iShares Core S&P Small-Cap ETF

5 Top ETFs to Buy in 2025 ↗

December 27, 2024

Via The Motley Fool

Topics

ETFs

CrowdStrike, Nasdaq, D.R. Horton And More On CNBC's 'Final Trades' ↗

November 20, 2024

6 Exchange Traded Funds for Every Investor ↗

November 19, 2024

Via The Motley Fool

Topics

ETFs

Via Benzinga

4 ETFs to Buy That Aren't the Schwab US Dividend ETF ↗

October 15, 2024

Via The Motley Fool

Topics

ETFs

2 ETFs That Could DOUBLE in the Next Few Years ↗

September 17, 2024

Via The Motley Fool

Topics

ETFs

Why Impinj Stock Was Soaring Today ↗

September 09, 2024

Via The Motley Fool

Topics

Stocks

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.