All News about Magellan Midstream Partners LP

Cathie Wood's ARKK Sinks Nearly 8% On The Week- ETF Winners And Losers: Mid-Cap Returns

September 26, 2023

Via Benzinga

Topics

ETFs

TortoiseEcofin Announces Constituent Changes Due to Corporate Action

September 22, 2023

Via ACCESSWIRE

Magellan Midstream Partners LP (NYSE: MMP) Sets New 52-Week High in Friday Session

September 22, 2023

Topics

Energy

Exposures

Fossil Fuels

Via Benzinga

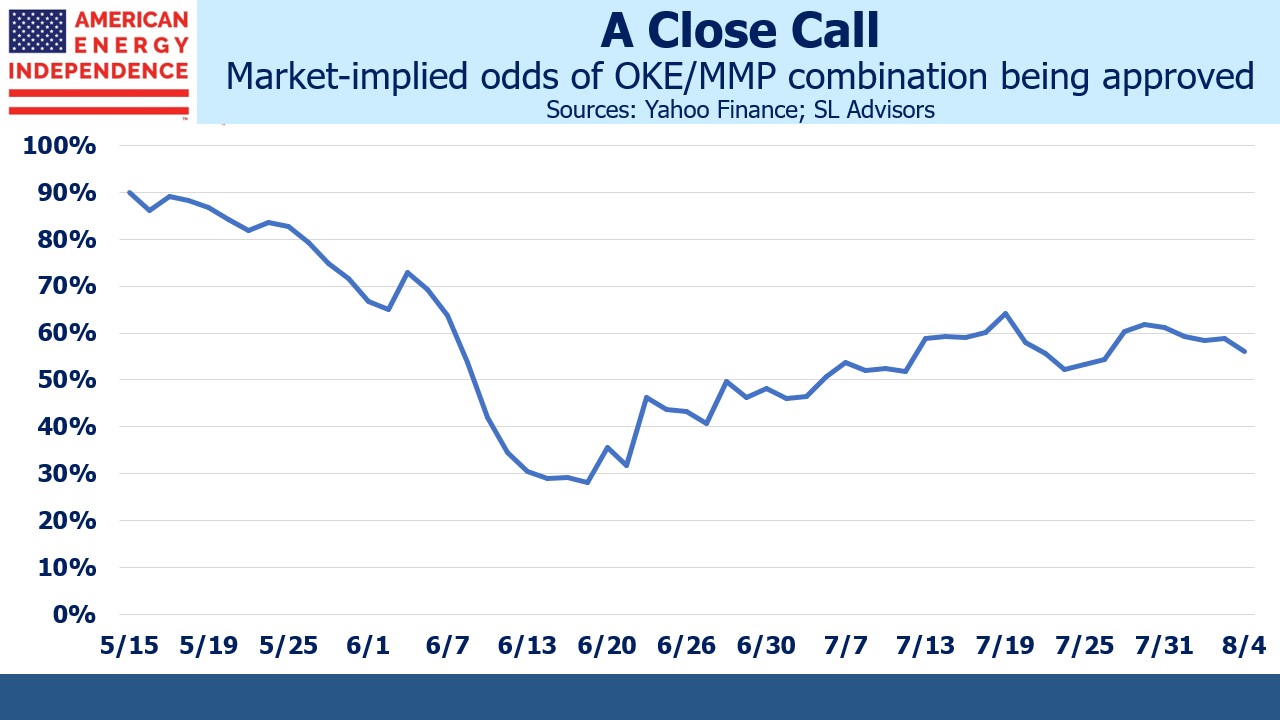

Situations We’re Following

June 11, 2023

Via Talk Markets

Energy MLPs Beat The Market, China And Home Building Down Big - ETF Winners And Losers: Mid-Cap Returns

August 22, 2023

Via Benzinga

Topics

ETFs

Benzinga's Top Ratings Upgrades, Downgrades For August 16, 2023

August 16, 2023

Via Benzinga

Data & News supplied by www.cloudquote.io

Stock quotes supplied by Barchart

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms and Conditions.

Stock quotes supplied by Barchart

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms and Conditions.