What a fantastic six months it’s been for Popular. Shares of the company have skyrocketed 53.9%, hitting $125.93. This was partly due to its solid quarterly results, and the run-up might have investors contemplating their next move.

Is now still a good time to buy BPOP? Or is this a case of a company fueled by heightened investor enthusiasm? Find out in our full research report, it’s free for active Edge members.

Why Are We Positive On BPOP?

Founded in 1893 as the first bank in Puerto Rico to serve the working class, Popular (NASDAQ: BPOP) is a financial holding company that provides retail, mortgage, and commercial banking services primarily in Puerto Rico and the mainland United States.

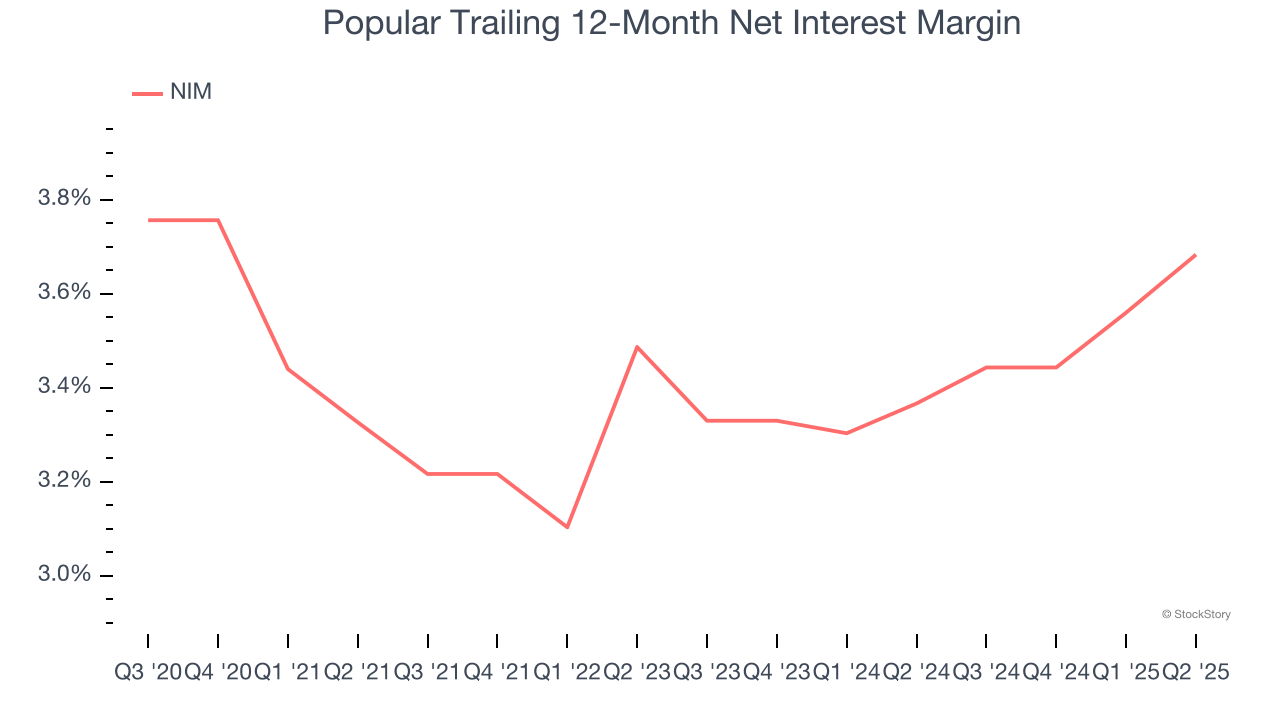

1. Increasing Net Interest Margin Juices Financials

The net interest margin (NIM) is a key profitability indicator that measures the difference between what a bank earns on its loans and what it pays on its deposits. This metric measures how efficiently one can generate income from its core lending activities.

Over the past two years, Popular’s net interest margin averaged 3.5%, climbing by 19.7 basis points (100 basis points = 1 percentage point) over that period.

This expansion was a tailwind for its net interest income, and while prevailing interest rates matter the most for industry net interest margins, banks that consistently increase this figure generally boast higher-earning loan books (all else equal such as the risk of those loans) or provide differentiated services that give them the ability to charge higher rates (pricing power).

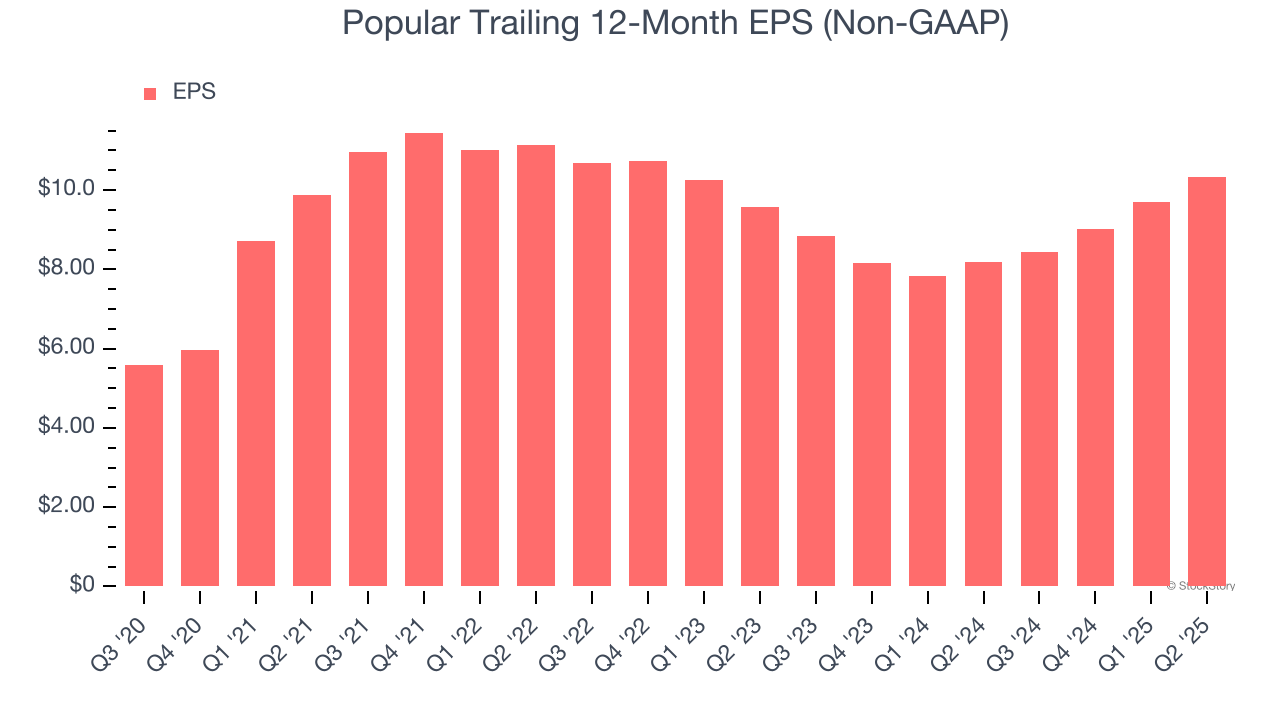

2. Outstanding Long-Term EPS Growth

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Popular’s EPS grew at an astounding 18% compounded annual growth rate over the last five years, higher than its 4.9% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

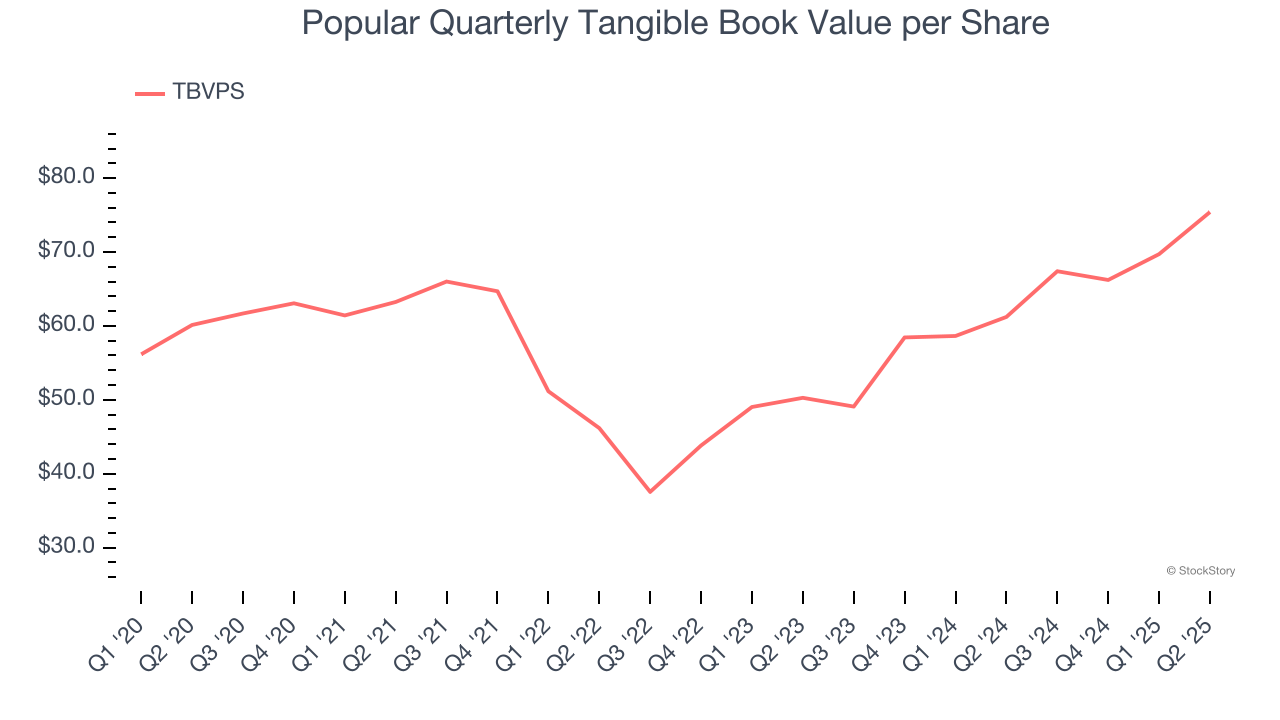

3. Growing TBVPS Reflects Strong Asset Base

We consider tangible book value per share (TBVPS) the most important metric to track for banks. TBVPS represents the real, liquid net worth per share of a bank, excluding intangible assets that have debatable value upon liquidation.

Although Popular’s TBVPS increased by a meager 4.6% annually over the last five years, the good news is that its growth has recently accelerated as TBVPS grew at an incredible 22.5% annual clip over the past two years (from $50.28 to $75.41 per share).

Final Judgment

These are just a few reasons Popular is a rock-solid business worth owning, and after the recent surge, the stock trades at 1.4× forward P/B (or $125.93 per share). Is now the time to initiate a position? See for yourself in our in-depth research report, it’s free for active Edge members.

Stocks We Like Even More Than Popular

Trump’s April 2025 tariff bombshell triggered a massive market selloff, but stocks have since staged an impressive recovery, leaving those who panic sold on the sidelines.

Take advantage of the rebound by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.