In today’s artificial Intelligence (AI) boom, the chips behind the scenes matter just as much as the models everyone talks about. Companies are now racing to build custom processors that can run AI faster and cheaper, giving them an edge in a market where every second and every dollar count. Amazon (AMZN) has quietly been preparing for this moment, and now it is stepping forward.

Far beyond its retail roots, Amazon has evolved into a diversified digital powerhouse, spanning cloud computing, digital advertising, and AI. That momentum continued this week after AWS rolled out a wave of AI announcements at re:Invent 2025, including the debut of its new Trainium3 chip, a significant upgrade built to tackle intensive AI workloads at a lower cost.

Amazon says servers powered by Trainium3 are four times faster and more energy-efficient than the previous version. According to AWS vice president of compute and machine learning Dave Brown, developers using these chips can save 30% to 40% on costs, a clear win for AWS customers who want more performance without higher bills. This launch follows Amazon’s significant AI investments, including Project Rainier and its deep partnership with Anthropic, which plans to use a million Amazon chips by the end of 2025.

With Amazon now directly challenging AI chip giants like Nvidia (NVDA) and even preparing its next Trainium4 chip, the stock has reacted positively. So, should investors buy, take chips off the table, or wait and see with AMZN?

About Amazon Stock

Amazon has transformed from a humble online bookstore into a $2.5 trillion tech behemoth, dominating the U.S. e-commerce market. It runs the backbone of the internet through AWS, and disrupts everything from entertainment to logistics. With ventures in AI, healthcare, and digital ads, Amazon shapes global commerce, entertainment, data infrastructure, and the future of connected technology.

Amazon’s growth into a digital powerhouse has been matched by the mega-cap stock’s remarkable climb. AMZN has jumped 592% over the past decade, firmly earning its spot in the “Magnificent Seven.”

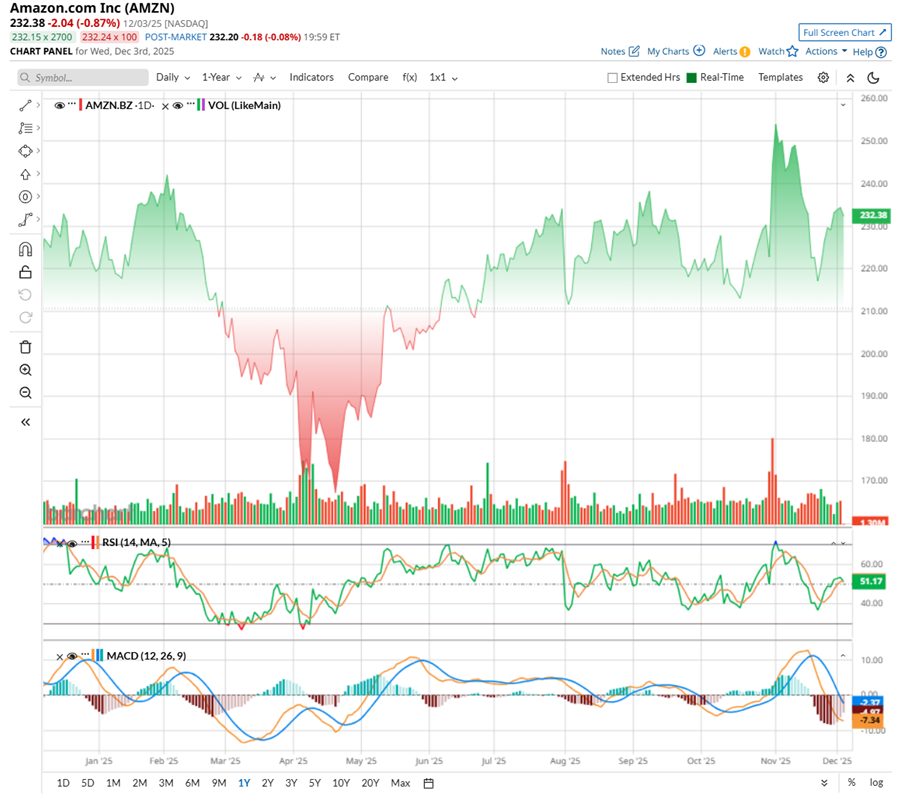

But 2025 has not been a straight shot upward. Earlier this year, doubts crept in as Amazon ceded some cloud momentum to rivals, and rising tariffs squeezed sellers across its marketplace. Those pressures showed up in sentiment, and the stock lost steam.

Then came the turnaround spark. A powerful quarterly update, paired with Amazon’s aggressive push into custom AI silicon, pushed shares to a fresh record high in early November at $258.60. Yet the victory was short-lived as a broader cooldown in AI stocks erased most of that momentum. Today, AMZN is up just 3.89% year-to-date (YTD) and still trades roughly 12% off that November peak.

The latest lift came this week, after Amazon officially rolled out its new Trainium3 chip, a move that reignited optimism in its AI roadmap.

Technically, though, the chart shows a market which is still undecided. The 14-day RSI sits at a relatively neutral 46.57, signaling neither overbought nor oversold conditions. The MACD is flashing caution. The yellow MACD line has slipped below the blue signal line, showing a loss of short-term momentum. Both lines are drifting downward, signaling weakening bullish pressure. Meanwhile, the histogram remains in negative territory, confirming that bearish momentum is still in play. Together, the setup suggests Amazon’s recent rally is struggling to sustain strength.

AMZN is priced at 33.70 times forward adjusted earnings, a level that looks unusually discounted relative to its long-term averages, suggesting the stock may be offering a rare moment of value despite its mega-cap stature and ongoing growth drivers.

Amazon Rises After Stronger-Than-Expected Q3 Earnings

Amazon’s Q3 results, announced on Oct. 30, surpassed expectations and reminded Wall Street that Amazon remains one of the market’s most formidable enterprises. Traders wasted no time responding, and AMZN stock surged nearly 14% over the following two sessions, marking a fresh YTD high by Nov. 3 and reigniting optimism around the company’s long-term trajectory.

Total net sales came in at $180.2 billion, up 13.4% year-over-year (YOY), comfortably above both management’s guidance and analysts’ projections. EPS rose an impressive 36.4% annually to $1.95, reinforcing the narrative of a company reclaiming operating leverage. Among the three major segments of Amazon, the spotlight once again fell on AWS. The cloud division expanded 9.4% annually to $11.4 billion, prompting CEO Andy Jassy to emphasize that AWS is accelerating at a rate “we haven’t seen since 2022,” a signal that cloud demand, once feared to be slowing, is re-intensifying.

Operationally, the company continued to exhibit formidable discipline. Operating cash flow climbed 16% to $130.7 billion over the trailing twelve months, up from $112.7 billion a year earlier. Amazon has spent the past year fortifying its infrastructure, adding more than 3.8 gigawatts of capacity to support both cloud expansion and its swelling AI ambitions.

In its core retail business, fulfillment innovations continue to pay dividends. The company is on track to deliver at the fastest Prime speeds yet again this year, broaden same-day grocery delivery to over 2,300 communities, and double the number of rural regions receiving Next-Day and Same-Day service.

However, Amazon’s ambitions are brightest with AI. The company reported strong uptake of Trainium2, its custom AI chip, now fully subscribed and growing at a blistering 150% sequentially. Project Rainier – a massive compute cluster powered by nearly 500,000 Trainium2 chips – was launched to help scale Anthropic’s Claude models, underscoring Amazon’s determination to own the AI stack end-to-end.

Looking ahead to Q4, management anticipates net sales between $206 billion and $213 billion, representing 10% to 13% annual growth, with foreign exchange rates providing a modest boost. Operating income is projected to land between $21 billion and $26 billion.

For fiscal 2025, Wall Street analysts expect EPS to be $7.17, indicating a 29.7% YOY surge, followed by 9.3% annual growth to $7.84 in the following year.

What Trainium3 Really Means for Amazon’s Power Play

Amazon’s Trainium3 debut marks a strategic shift from simply buying high-end AI chips to shaping the battlefield itself. The chip expands AWS’s custom hardware lineup with a focus on efficiency, scalability, and most importantly, control. By offering a lower-cost alternative for training and inference workloads, Amazon positions itself to chip away at the premium margins that Nvidia and other leaders command.

For Amazon, owning more of the silicon stack means fewer pricey GPU purchases, tighter integration with its cloud platform, and a clearer path to lure AI players like Anthropic. As hyperscalers increasingly design their own chips, Trainium3 becomes Amazon’s lever to stay competitive, reduce dependency, and meet soaring AI demand.

What Do Analysts Expect for Amazon Stock?

Analysts have not just stayed bullish on Amazon, but doubled down. Far from cooling, enthusiasm has only intensified through 2025. Oppenheimer’s latest move set the tone, lifting its price target to $305 and spotlighting AWS as the engine of Amazon’s next phase of growth. The firm sees accelerating capacity, stronger cloud demand, and AI-driven efficiencies fueling years of runway.

Bank of America's (BAC) Justin Post struck a measured tone, noting that the latest AWS keynote did not deliver the kind of blockbuster hardware reveal or major LLM alliance that could instantly shift market sentiment. Still, he emphasized that Amazon’s expanding AI toolkit – spanning hardware, models, and agent capabilities – strengthens AWS’s position to capture accelerating demand. Post remains constructive, expecting AWS revenue growth to climb toward 25% as Amazon continues layering on new capacity.

Wedbush’s Scott Devitt, meanwhile, took a more overtly upbeat stance. He said the rapid cadence of innovation showcased at the event reinforces Amazon’s momentum and sets the stage for a powerful re-acceleration. Devitt believes 2026 could be a breakout year for AWS, potentially acting as a major catalyst that drives Amazon shares toward his $340 price target.

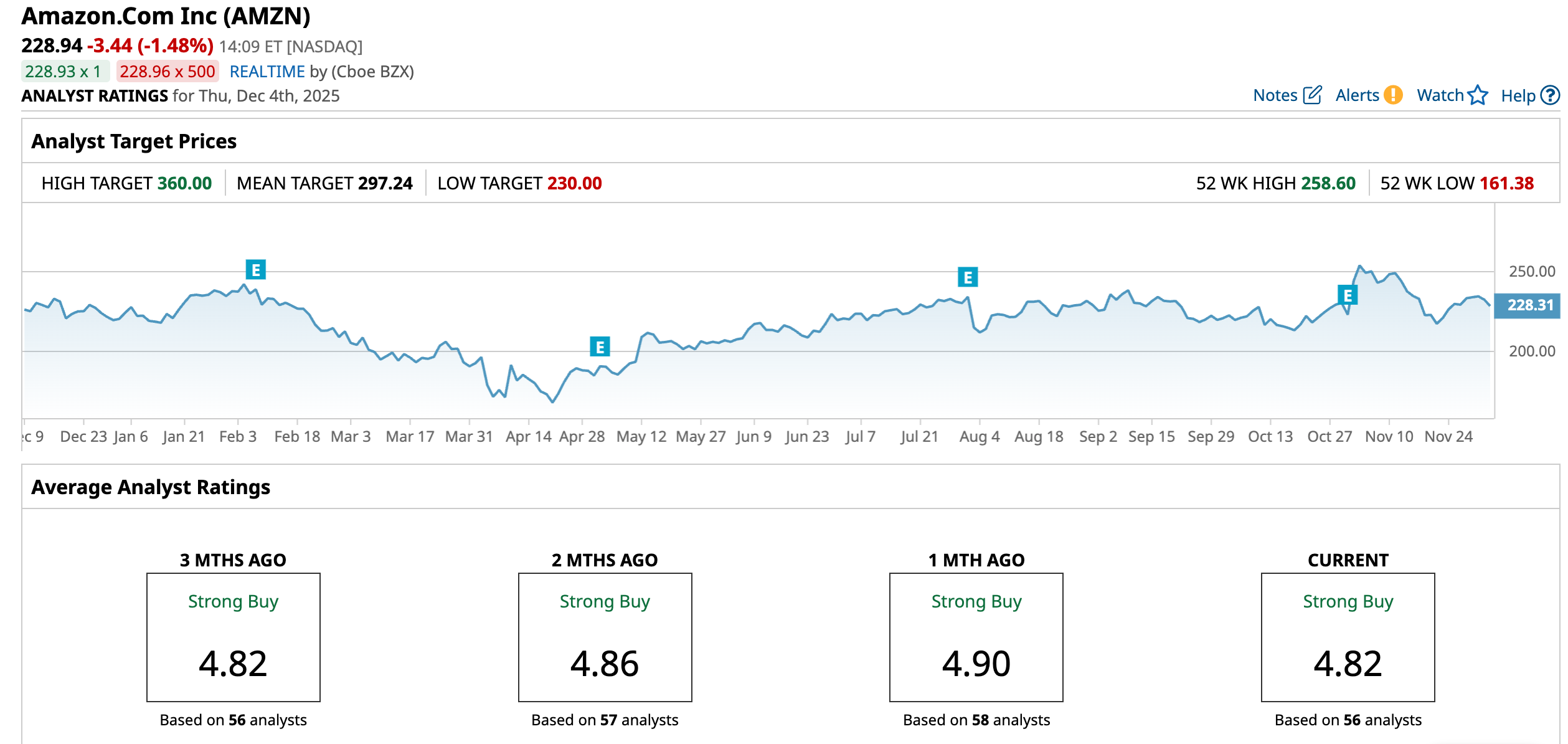

Analysts tracking AMZN are upbeat, with consensus leaning heavily toward a “Strong Buy.” Out of 56 analysts, 48 recommend a “Strong Buy,” six suggest a “Moderate Buy,” and two advise a “Hold.”

The average price target of $297.24 suggests a 30% upside potential from here. Meanwhile, Loop Capital’s Street-high target of $360 suggests AMZN stock could rise nearly 57.5%.

On the date of publication, Sristi Suman Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Sam Altman Declares ‘Code Red’ as Google’s Gemini 3 Becomes the Top-Ranked AI LLM. How Should You Invest in AI Stocks Here?

- Dear MicroStrategy Stock Fans, Mark Your Calendars for January 15

- TD Cowen Says This Chip Stock (Not Nvidia) Is the Best Idea for 2026

- Trump Is Doubling Down on Robotics. Does That Make Tesla Stock a Buy Here?