Transparency: A Fundamental Right of Finance

Over the past decade, the vast majority of global crypto trading has remained in the hands of centralized exchanges (CEX):

User assets are custodial

Matching and liquidation logic is opaque

Forced-liquidation behavior in volatility is hard to understand

The next black swan is always around the corner (Mt. Gox, FTX, Bitzlato…)

The CEX golden age built market scale — and also the largest single-point-of-trust risk.

More and more professional traders and capital allocators have realized:

*** Transparency isn’t optional — it’s a fundamental right in finance.***

And the only way to achieve it is to bring derivatives trading truly on-chain.

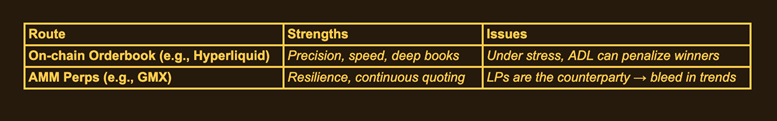

We’ve since seen a strong cohort of on-chain perp DEXes — dYdX, Hyperliquid, Aster, GMX. Broadly, on-chain perp DEXes follow two mainstream approaches: Orderbook Perp DEX and AMM Perp DEX. Today, orderbooks dominate, and in our view both designs have distinct strengths and weaknesses.

Two Roads That Ultimately Converge

On-chain perps are defined by two technical routes:

On-chain Perp DEX Models

They represent:

*** Performance & precision vs. resilience & sustainability.***

The endgame is a market order that fuses both. And the recently funded Honeypot Finance — an integrated, all-terrain liquidity hub, backed by notable investors such as Mask Network at a $35M valuation — is building the missing piece.

What Honeypot Aims to Do (Simply)

We don’t chase flashy derivatives constructs. With three modules, we fill the core gap AMM perps have long lacked:

*** A market that remains controllable, predictable, and executable in storms.***

I. The Structural Fragility of Order Books: They Fail When You Need Them Most

Order-book (LOB) liquidity isn’t algorithmically guaranteed — it depends on market-maker willingness.

In calm regimes, risk is contained, spreads are razor-thin, and depth is plentiful. But once the market turns volatile:

Willingness Liquidity Collapses

Volatility spikes → risk rises non-linearly → makers pull quotes or widen drastically.

Effect: liquidity voids beyond narrow bands:

→ Price doesn’t “slide,” it jumps

→ Liquidations print into thin air

→ Execution and reference prices get severely distorted

On-Chain Latency & Ordering Power → An “Exploitable Market”

Maker quotes face block latency, MEV front-running, and latency arbitrage. Each time quotes are picked off, the next quotes become thinner, wider, or absent, degrading effective in-depth reflexively.

Hedging constraints magnify inventory risk

During stress, external hedging costs surge and routes clog. Inventory skew worsens; costs are pushed onto traders at the worst possible times—liquidation impact peaks. Bottom line: Order books are the fastest highway—until the downpour. AMMs exist precisely for that moment.

II. Why AMM Perps Still Haven’t Scaled

AMMs should be “always-open stalls” that handle volatility. In practice, three structural issues persist:

LPs vs. Traders is zero-sum: When trends persist, the pool bleeds.

Stale quoting → arbitrage feast: AMM price follows pool ratios; external markets move first. Arbitrageurs “fix” the price and carry LP value out the door.

Capital layers are mixed: Conservative and yield-seeking LPs share the same bucket; loss waterfall is undefined. Conservative capital won’t stick—TVL erodes.

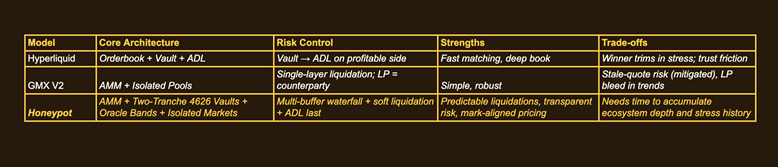

III. The Two Kings of Design: Hyperliquid and GMX

Hyperliquid — The Edge of Speed (and the Cost of ADL)

A benchmark on-chain orderbook: a custom L1 (HyperCore) delivers high-frequency matching with low latency, near-CEX UX.

But its three-step liquidation path is:

Market liquidations on the book

Vault intervention (HLP) when depth is insufficient

ADL (Auto-Deleveraging) when vault capacity is exceeded

This makes protocol insolvency unlikely—but at a cost: even winners can be trimmed. The recent “10/11” episode highlighted how prioritizing system fairness can sacrifice individual fairness.

GMX — The AMM Perp Standard-Bearer

AMM perps truly entered center stage with GMX—it’s the GOAT and a trailblazer.

GMX V2 delivered decisive structural innovations:

Isolated GM Pools: BTC risk stays with BTC; ETH risk stays with ETH; meme volatility won’t sink blue-chip vaults → no more “one pool, all suffer.”

Oracle-Mark Pricing: Stop believing pool ratios; align with external markets → no free arbitrage against LPs.

Continuous Availability: When orderbooks go dark, AMM becomes the final execution backstop.

GMX gave AMM perps legitimacy and a place, proving they can be infrastructure, not a backup.

Remaining challenges we believe must be solved to scale:

LPs are the counterparty → persistent bleed in trends; TVL shrinks when needed most.

No risk tranching → conservative and aggressive capital share the same loss priority; institutions ask, “Why must we underwrite global market behavior?”

Hence, structural upgrades are the next phase — that’s where Honeypot Finance steps in.

IV. Honeypot’s Innovation: Structurally Fixing AMM Perps

We focus on three principles:

Risk must be tiered

Trading & liquidation must be predictable

Shocks must be isolated

To do that, we introduce a complete structural upgrade:

LPs don’t face the AMM directly.

They deposit into ERC-4626 vaults at self-selected risk tiers:

→ Senior Vault: fee-priority, last-loss (institutions/conservative capital)

→ Junior Vault: first-loss, higher yield (crypto-native risk takers)

Vaults supply the AMM’s oracle-anchored bands.

Senior capital biases inner (safer) bands; Junior capital biases outer (risk-priced) bands.

Traders execute against vault-backed liquidity.

Larger orders cross more bands → slippage scales linearly with size and stays centered on the oracle mark.

Funding & utilization adjust by the minute.

The crowded side pays more, nudging open interest back toward balance.

Per-market isolation.

Every pair has its own AMM, vaults, limits, and liquidation logic — no cross-asset contagion.

Liquidation, Re-ordered for Process Fairness

When volatility spikes and liquidations cluster, Hyperliquid’s path secures the system but can trim winners at peak success.

Honeypot’s sequence is pre-agreed and visible:

Partial Deleverage → reduce leverage to safety rather than nuke positions

Micro-Auctions → marketize the residual risk in small batches

Junior First-Loss → risk is borne by the tranche paid to take it

Insurance Pool → protocol-level buffer for tail events

ADL (small & last) → only after all above, in limited scope, fully auditable

In Honeypot’s system: risk is volunteered, and victory can be retained. We defend the system with structure — and protect winners with process.

V. Three Systems, Side-by-Side: Speed, Resilience, Trust

Three-System Comparison: Hyperliquid, GMX V2, Honeypot

VII. How Honeypot Balances Every Participant

Crypto-native yield seekers

→ Junior Vault = monetize volatility; risk is priced, not hidden.

Institutions & compliant capital

→ Clear drawdown limits; auditable ERC-4626 accounting; confidence to deploy.

Traders

→ CEX-like experience in calm regimes; predictable slippage and liquidation logic in chaos; profits aren’t arbitrarily clawed.

Epilogue: Performance Wins the Day; Predictability Wins the Cycle

Hyperliquid → frontier performance

GMX → structural pioneer

Honeypot → the new baseline for resilience and trust

We don’t optimize for “faster.” We optimize for “won’t break.”

When the market truly cares, it won’t ask who has the tightest spreads, but:

When everything is selling off, can you still get filled and do you know what will happen?

On that day, the new baseline for AMM perps will be rewritten — by Honeypot’s design.

Join the Honeypot community and follow us on socials for the latest exciting updates - the future of finance is here.

Join our pre-TGE Pot Points Campaign

Stay up to date on Twitter

Say gm on Discord

Visit our Website

Join Pot Community Telegram

This article first appeared on Rankovate Newsroom. View original post