Even though Ares (currently trading at $148.64 per share) has gained 20.6% over the last six months, it has lagged the S&P 500’s 34.7% return during that period. This was partly driven by its softer quarterly results and may have investors wondering how to approach the situation.

Taking into account the weaker price action, does ARES warrant a spot on your radar, or is it better left off your list? Find out in our full research report, it’s free for active Edge members.

Why Are We Positive On ARES?

With roots in the leveraged finance group of Apollo Management, Ares Management (NYSE: ARES) is an alternative investment firm that manages private equity, credit, real estate, and infrastructure assets for institutional and high-net-worth clients.

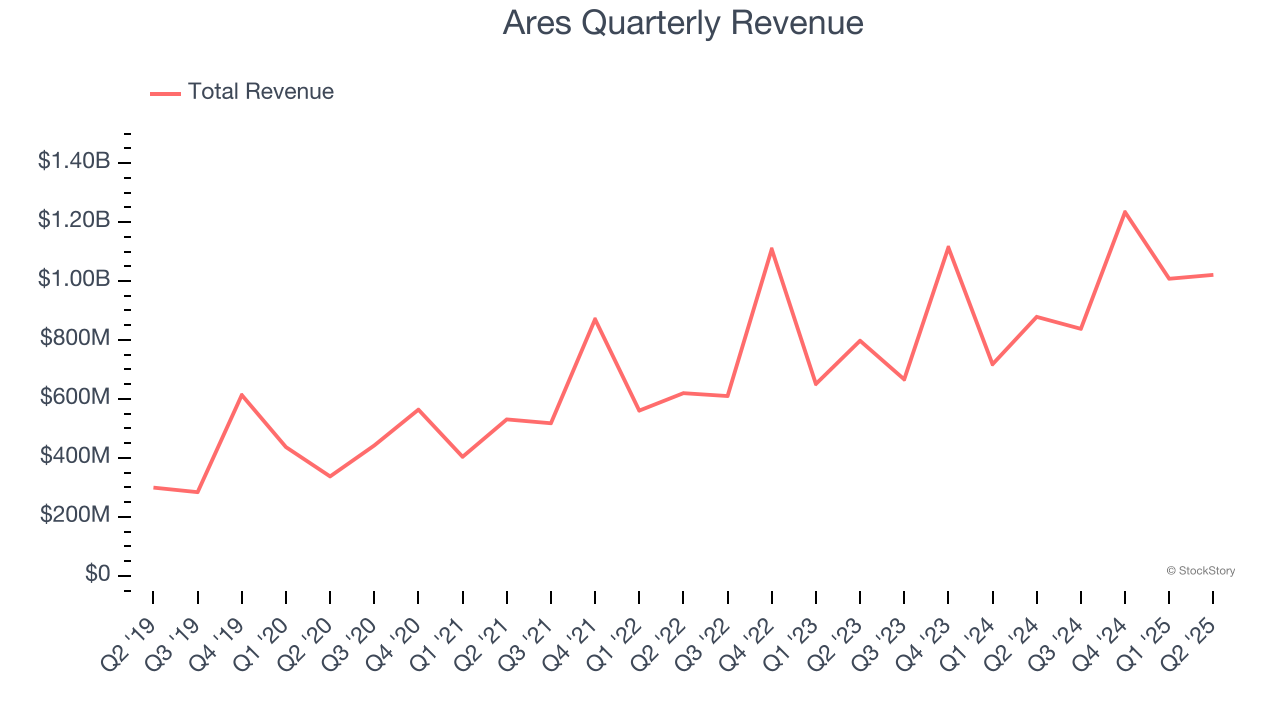

1. Skyrocketing Revenue Shows Strong Momentum

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years.

Luckily, Ares’s revenue grew at an excellent 19.7% compounded annual growth rate over the last five years. Its growth surpassed the average financials company and shows its offerings resonate with customers.

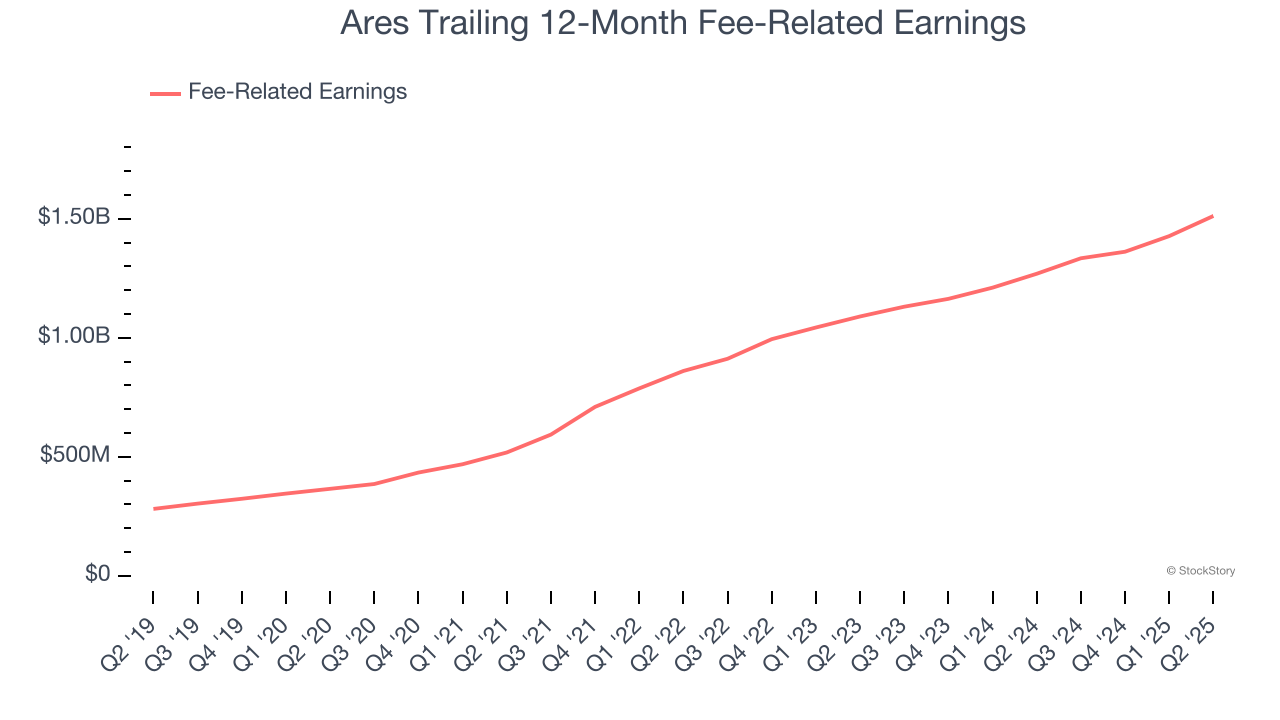

2. Fee-Related Earnings Jumped Higher

Revenue trends matter, but the durability of profits is what separates winners from losers. For asset managers, fee-related earnings strip away the noise of performance fees and investment income to reveal the core profitability of their fee-based business model. This represents the steady, predictable earnings that investors can count on.

Ares’s annual fee-related earnings growth over the last five years was 32.8%, an elite result.

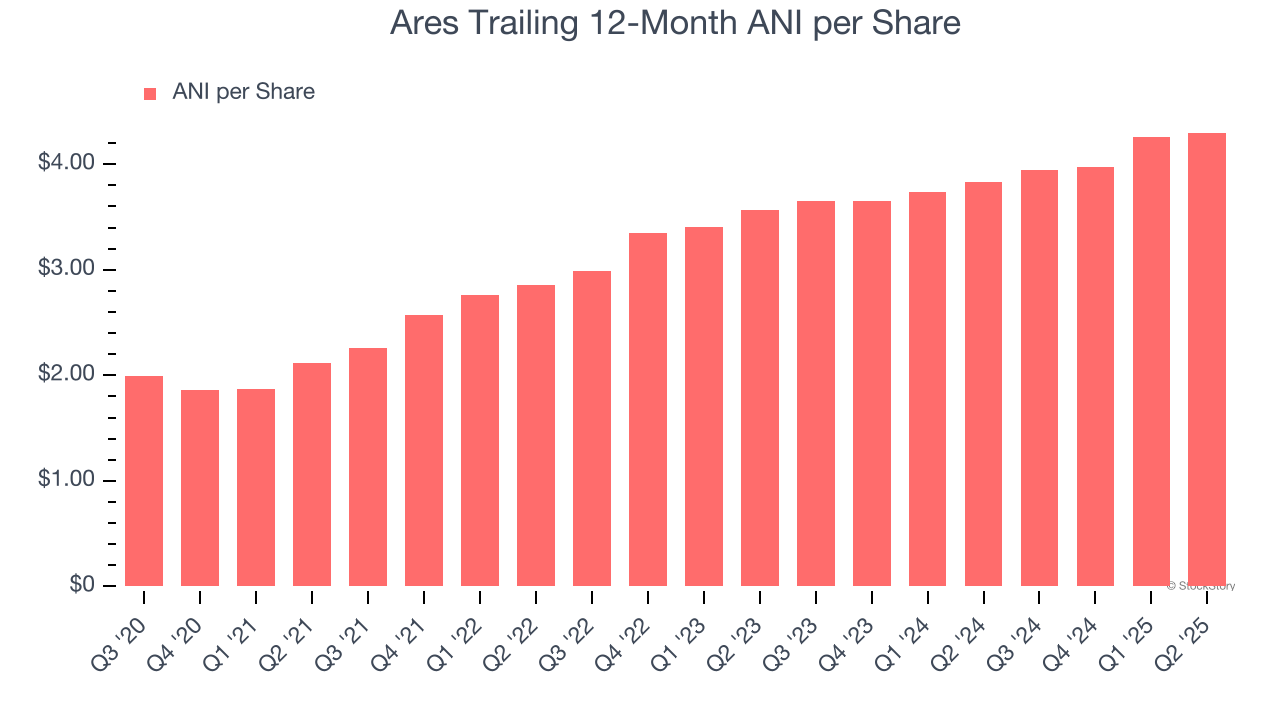

3. Outstanding Long-Term EPS Growth

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Ares’s EPS grew at a remarkable 17.3% compounded annual growth rate over the last five years. This performance was better than most financials businesses.

Final Judgment

These are just a few reasons Ares is a rock-solid business worth owning. With its shares underperforming the market lately, the stock trades at 26.2× forward P/E (or $148.64 per share). Is now the time to initiate a position? See for yourself in our full research report, it’s free for active Edge members.

Stocks We Like Even More Than Ares

Trump’s April 2025 tariff bombshell triggered a massive market selloff, but stocks have since staged an impressive recovery, leaving those who panic sold on the sidelines.

Take advantage of the rebound by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.