Opendoor Technologies (OPEN) is best known for trying to rewire how homes are bought and sold, using technology, data, and instant offers to strip friction out of a process that has long felt slow and opaque. But the road has not been smooth. A brutal housing slowdown, rising interest rates, and volatile home prices have forced the company into survival mode, squeezing margins and testing investor patience. Opendoor has spent the past year fighting to stabilize its model and rebuild confidence.

Now, the company is signaling that the next chapter may finally be taking shape. Opendoor recently grabbed headlines with a leadership shake-up aimed squarely at growth and discipline. The company announced that it will welcome Lucas Matheson as President on Dec. 22, bringing in a seasoned operator from the fintech and e-commerce world. Alongside that move, Opendoor promoted Christy Schwartz to CFO, effective Jan. 1, following a wide-ranging external search.

For OPEN stock fans, Dec. 22 now stands out as more than just a date — it marks a potential turning point.

About Opendoor Stock

Founded in 2014, San Francisco-based Opendoor was established to modernize the housing market by reimagining the process of buying and selling homes. The company became a pioneer in the iBuying model, offering homeowners instant, data-driven purchase offers and replacing traditional real-estate hurdles with a streamlined digital experience.

Since then, the digital real estate disruptor has expanded nationwide, serving tens of thousands of buyers and sellers through its tech-enabled platform. In 2020, it went public via a special purpose acquisition company (SPAC) merger, marking a major milestone in its growth story. Today, Opendoor is a prominent player in the digital real estate, with a market capitalization of approximately $4.9 billion.

Earlier this year, Opendoor was trading below $1, a zone usually reserved for broken stories and Nasdaq delisting anxiety. Sentiment was washed out, volume was thin, and confidence was scarce. Then the mood flipped. A mix of meme-stock enthusiasm, insider buying signals, and renewed speculative interest turned the stock from forgotten to fiercely debated almost overnight.

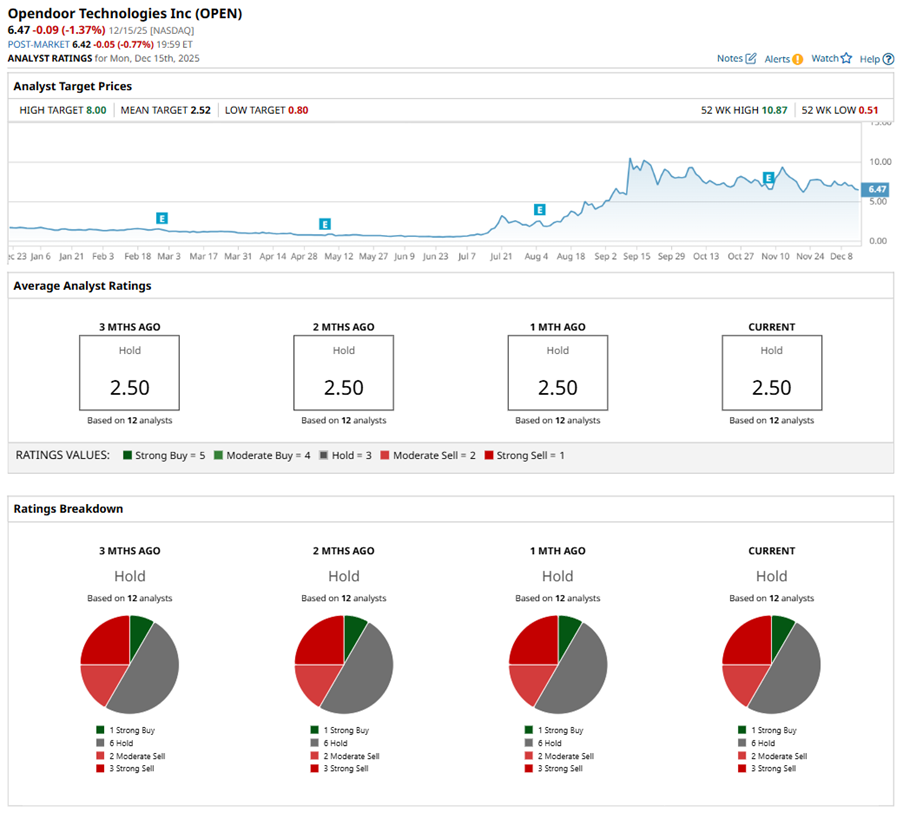

From its June low of $0.51, OPEN staged a breathtaking rally, surging to a peak of $10.87 by mid-September. On a year-to-date (YTD) basis, the stock is still up over 300%, while the six-month run tells an even wilder tale, with gains north of 1,100%. That vertical move, however, came at a cost. Over the last three months, shares have cooled meaningfully, sliding about 12%. The past month alone shows a decline of roughly 4%, signaling that the easy momentum phase has passed.

Volume tells a similar story. The explosive spike seen during the summer breakout has faded, with trading activity now thinning out, a sign that speculative heat is no longer driving every move. On the momentum front, the 14-day RSI once screamed excess, pushing deep into overbought territory during September’s peak. Since then, it has steadily cooled and now sits around 41, drifting lower and edging closer to oversold levels, reflecting waning bullish pressure rather than outright panic.

The MACD oscillator reinforces this more cautious tone. While the yellow MACD line is attempting to stay above the blue signal line, its downward slope hints at weakening momentum. The histogram remains negative, suggesting that bears still have a grip in the short term.

Opendoor’s rally grabs attention, yet its valuation speaks more softly. Priced at 1 times sales, well below sector peers, OPEN tempts bargain hunters. But that discount also reflects doubt. After uneven execution and a fragile housing market, investors are fueling momentum, not fully endorsing a lasting turnaround just yet.

Opendoor’s Mixed Q3 Earnings Snapshot

Opendoor’s third-quarter report, released on Nov. 6, showed progress in some corners and pressure in others. Revenue declined 33.6% year-over-year (YOY) to $915 million, yet it still cleared Wall Street’s expectations. Home sales slowed to 2,568 units from 3,615 a year ago, reflecting lighter acquisition activity and the deliberate clearing of older inventory.

Meanwhile, adjusted loss per share came in at -$0.08, a touch worse than the -$0.07 analysts had penciled in. Margins told a similar mixed story. Adjusted gross profit fell 35% YOY to $64 million, while gross margin slipped to 7% from 7.2%. Contribution profit dropped sharply to $20 million from $52 million, with contribution margin compressing to 2.2% from 3.8%, highlighting ongoing margin pressure across the model.

Yet the quarter was not without bright spots. Cash flow flipped decisively into the black, with $979 million generated from operations over the first nine months of 2025, a dramatic reversal from last year’s outflows. Debt levels eased, liquidity remained solid at $1.45 billion in cash and equivalents, including restricted cash, and Opendoor retired most of its 2030 convertible notes through equity conversion.

Management acknowledged near-term pain but pointed investors toward a longer arc: sharper pricing automation, deeper AI-driven decisions, and healthier unit economics. The outlook reflects that tradeoff. Fourth-quarter revenue is expected to fall about 35% sequentially, even as acquisitions ramp 35% in Q4 2025, with a target of 6,000 home purchases by Q4 2026. Contribution margins are guided between 5% and 7%, alongside leaner operating expenses at 3% to 4% of revenue.

Wall Street is not calling it a comeback just yet, but the math is starting to lean Opendoor’s way. Analysts expect losses to narrow steadily through 2026, signaling a slow, deliberate march toward stability. They anticipate fiscal 2025 losses to shrink 41% YOY to $0.31 per share, with another 35% improvement foreseen in fiscal 2026 to a $0.20 per-share loss. Profitability may still be out of reach, but Opendoor is tightening the screws, plugging leaks, and inching closer to a firmer financial footing.

What Do Analysts Expect for Opendoor Stock?

Wall Street’s overall view on OPEN stock remains cautious, with ratings that paint a restrained picture. The stock holds a consensus “Hold,” and among the 12 analysts covering shares, only one is firmly bullish with a “Strong Buy.” The majority lean neutral with six “Hold” ratings, while sentiment tilts bearish with two “Moderate Sell” and three “Strong Sell” ratings.

OPEN stock has blown past its $2.52 average price target, trading at about triple that level. The Street's most optimistic target of $8 suggests that OPEN stock has rebound potential of 24%.

Final Thoughts on Opendoor

Put together, Opendoor’s leadership changes feel purposeful rather than cosmetic. Lucas Matheson arrives with a fintech mindset shaped by scale, discipline, and smart capital use, skills that matter as Opendoor looks beyond survival and toward reinvention. Christy Schwartz provides continuity and financial steadiness, bringing deep institutional knowledge at a time when execution matters more than experimentation.

Plus, with Shrisha Radhakrishna continuing to lead product and technology, the company is keeping its technical backbone intact while sharpening its strategic edge. The message from the top is simple and direct — move with speed, stay focused, and deliver real progress. If Opendoor is to turn stability into momentum, this leadership mix gives it a credible shot at doing just that.

On the date of publication, Sristi Suman Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Should You Buy the Bad News for This Michael Burry Stock Pick?

- Analysts Are Betting Big on Rivian Stock Ahead of 2026. Should You Get In on RIVN Here Too?

- DraftKings Just Launched Its Prediction Market App. Should You Make a Bet on DKNG Stock Here?

- Dear Opendoor Stock Fans, Mark Your Calendars for December 22