- Heritage Commerce (HTBK) is trading at new two-year highs.

- Shares are up more than 30% over the past year and demonstrate strong momentum.

- HTBK maintains a 100% “Buy” opinion from Barchart.

- The stock has strong fundamentals, but caution is advised to its volatility.

Today’s Featured Stock

Valued at $761 million, Heritage Commerce (HTBK) is the holding company of Heritage Bank of Commerce. The company offers a range of loans, primarily commercial, including real estate, construction, Small Business Administration, inventory and accounts receivable, and equipment loans.

The company also accepts checking, savings, and time deposits; NOW and money market deposit accounts; and provides travelers’ checks, safe deposit, and other customary non-deposit banking services.

What I’m Watching

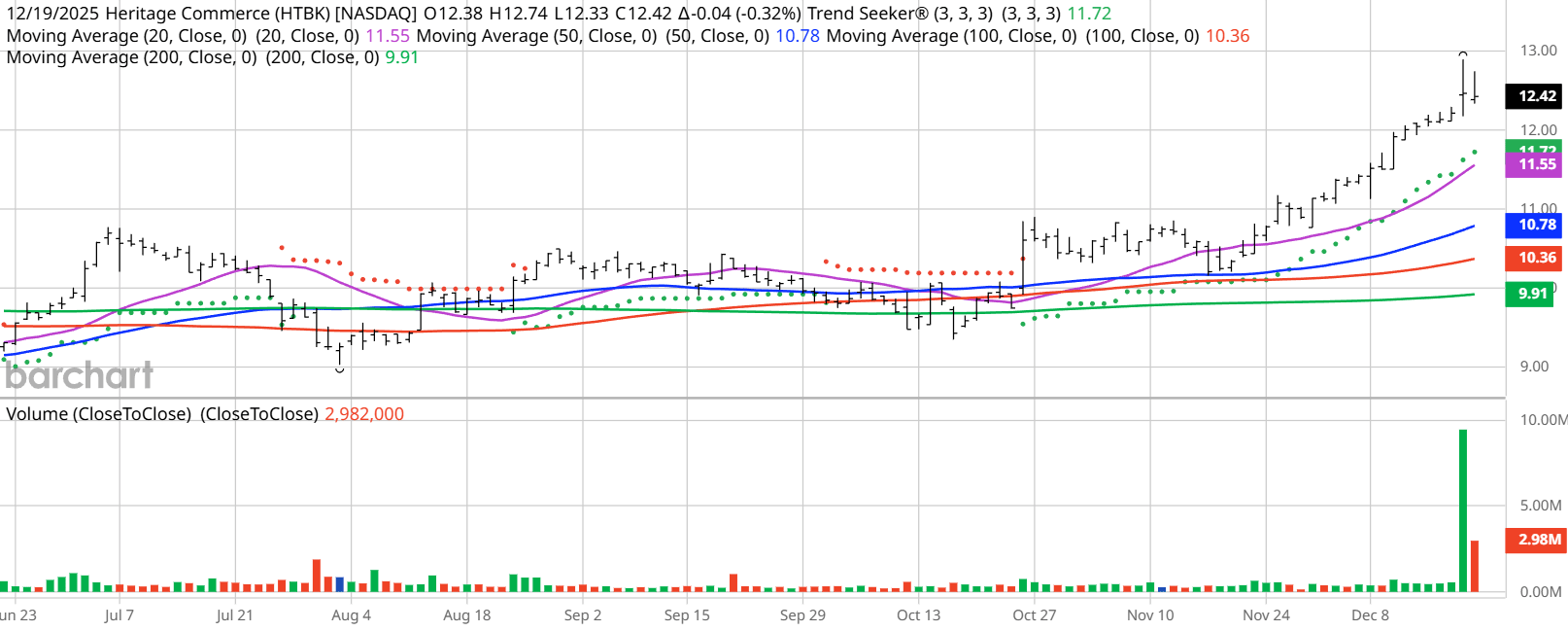

I found today’s Chart of the Day by using Barchart’s powerful screening functions to sort for stocks with the highest technical buy signals; superior current momentum in both strength and direction; and a Trend Seeker “buy” signal. I then used Barchart’s Flipcharts feature to review the charts for consistent price appreciation. HTBK checks those boxes. Since the Trend Seeker signaled a new “Buy” on Oct. 27, the stock has gained 19.11%.

Barchart Technical Indicators for Heritage Commerce

Editor’s Note: The technical indicators below are updated live during the session every 20 minutes and can therefore change each day as the market fluctuates. The indicator numbers shown below therefore may not match what you see live on the Barchart.com website when you read this report. These technical indicators form the Barchart Opinion on a particular stock.

Heritage Commerce hit a 2-year high of $12.89 on Dec. 18.

- HTBK has a Weighted Alpha of +43.69.

- Heritage Commerce has a 100% “Buy” opinion from Barchart.

- The stock gained 31.28% over the past year.

- HTBK has its Trend Seeker “Buy” signal intact.

- The stock recently traded at $12.59 with a 50-day moving average of $10.85.

- Heritage Commerce made 15 new highs and gained 18.11% in the last month.

- Relative Strength Index (RSI) is at 82.64.

- There’s a technical support level around $12.25.

Don’t Forget the Fundamentals

- $761 million market capitalization.

- 15.33x trailing price-earnings ratio.

- 4.12% dividend yield.

- Revenue is expected to grow 12.81% this year and another 6.88% next year.

- Earnings are estimated to increase 31.82% this year and an additional 8.05% next year.

Analysts and Investor Sentiment on Heritage Commerce

Wall Street likes this stock, but individual investors are split.

- Wall Street analysts tracked by Barchart have given 2 “Strong Buy,” 2 “Moderate Buy” and 2 “Hold” opinions on the stock.

- Value Line gives the stock an “Above Average” rating.

- CFRA’s MarketScope Advisor rates it a “Buy.”

- Morningstar thinks even with the stock’s recent runup, it’s fairly valued at $12.64.

- 705 investors following the stock on Motley Fool think it will beat the market, while 64 think it won’t.

- 1,270 investors are monitoring the stock on Seeking Alpha, which rates the stock as a “Hold.”

- Short interest is low at 1.91% of the float.

The Bottom Line on Heritage Commerce

I realize that Wall Street analysts and individual investors are split on this stock, but it is predicted that both revenue and earnings will increase next year. That, coupled with a very low short interest of 1.91% of the float, gives me positive signals. You can ride the tide for a little bit more but keep your stop losses in place for when the party ends.

Additional disclosure: The Barchart Chart of the Day highlights stocks that are experiencing exceptional current price appreciation. They are not intended to be buy recommendations as these stocks are extremely volatile and speculative. Should you decide to add one of these stocks to your investment portfolio it is highly suggested you follow a predetermined diversification and moving stop loss discipline that is consistent with your personal investment risk tolerance.

On the date of publication, Jim Van Meerten did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart