Berwyn, Pennsylvania-based AMETEK, Inc. (AME) manufactures and sells electronic instruments and electromechanical devices. With a market cap of $45.4 billion, AMETEK operates through the Electronic Instruments Group (EIG) and the Electromechanical Group (EMG) segments.

Companies worth $10 billion or more are generally described as "large-cap stocks." AMETEK fits right into that category, with its market cap exceeding this threshold, reflecting its substantial size, influence, and dominance in the industrial sector.

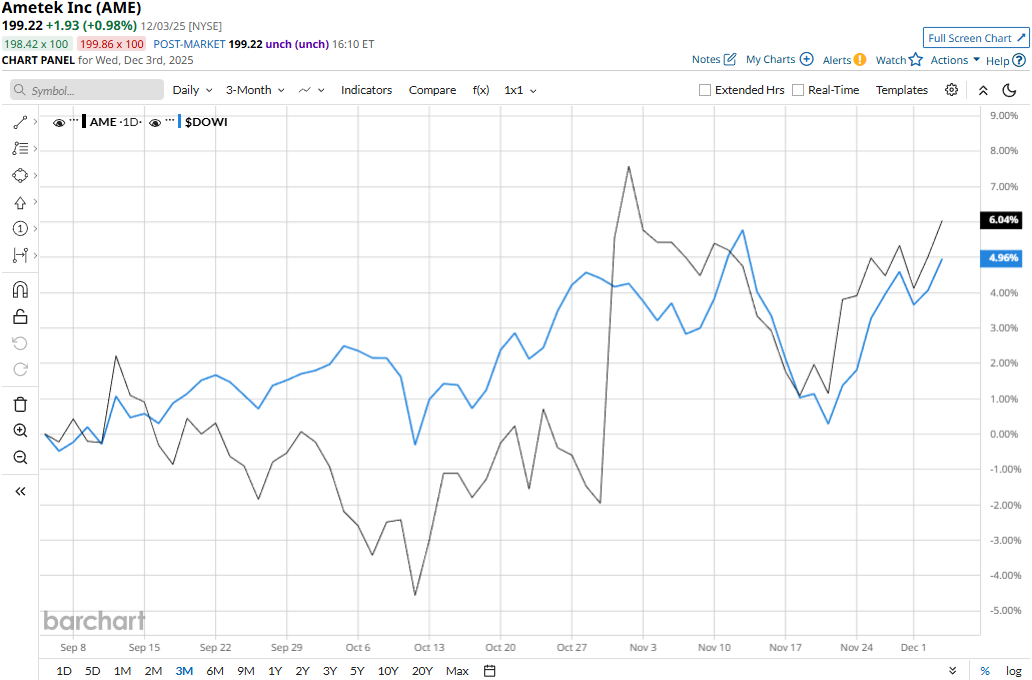

AME stock has dropped 2.4% from its all-time high of $204.15 touched on Oct. 31. Meanwhile, AME stock prices have gained 8.1% over the past three months, outpacing the Dow Jones Industrial Average’s ($DOWI) 5.8% uptick during the same time frame.

AMETEK has underperformed the broader market over the longer term. AME stock prices have gained 10.5% on a YTD basis and observed a 2.5% uptick over the past 52 weeks, compared to the Dow’s 12.6% surge in 2025 and 7.1% gains over the past year.

AME stock has traded mostly above its 50-day and 200-day moving averages since May, underscoring its bullish trend.

AMETEK’s stock prices soared 7.7% in a single trading session following the release of its impressive Q3 results on Oct. 30. The company delivered solid financials and registered double-digit growth in sales, orders, and earnings, along with notable improvement in margins. Its net sales for the quarter surged 10.8% year-over-year to $1.9 billion, surpassing the Street’s expectations by 4.2%. Further, its adjusted EPS of $1.89 exceeded the consensus estimates by 7.4%.

Meanwhile, AMETEK has notably outperformed its peer, Eaton Corporation plc’s (ETN) 1.1 uptick on a YTD basis and 10.2% plunge over the past year.

Among the 18 analysts covering the AME stock, the consensus rating is a “Moderate Buy.” Its mean price target of $220.56 suggests a 10.7% upside potential from current price levels.

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Grain Market Update: Where are Corn and Soybean Prices Headed?

- This High-Yield Utility Stock Is a Top AI Buy

- Is the Wheel the Best Options Strategy for Income? Here’s How to Trade Options Like Warren Buffett

- Ford Just Reported an Absolute Collapse in Its EV Sales. That Could Be a Key Warning for Tesla Stock.