ASIC mining remains the primary method for efficiently mining Bitcoin in 2026. This guide provides a comprehensive, factual overview for new miners on selecting ASIC hardware, understanding profit drivers, setting up mining operations, and managing risks with precision. The insights reflect current market conditions, including network difficulty, hardware innovations, and power cost considerations.

Understanding ASIC Mining Fundamentals

Bitcoin mining verifies transactions and secures the blockchain using proof-of-work: miners solve tough math puzzles with special ASIC hardware built just for Bitcoin's SHA-256 algorithm. These ASICs beat regular computers or GPUs by delivering way more hashing power (guesses per second) while using less electricity, so they're key for making any profit today.

Network difficulty, the puzzle hardness, has jumped to 149.3 trillion in December 2025, making old or weak gear unprofitable as more miners compete. Check your miner's real-time stats like hash rate (TH/s for power) and temperature on OneMiners' Active Miners dashboard to stay efficient and spot issues fast. Use their charts for past performance and money stats to match against current hashprice around $0.038/TH/day at Bitcoin prices near $92,000.

Selecting ASIC Miners in 2026

Key factors to consider:

- Hash Rate (TH/s): Higher hash rate increases block-solving probability.

- Power Consumption (Watts): Directly affects operational cost.

- Efficiency (Joules per TH): Critical for cost-effectiveness under electric rates.

- Price: Capital investment balanced against potential return.

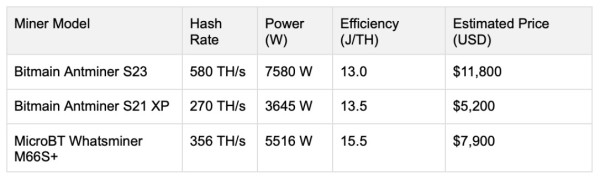

Notable miners in 2026 include:

Acquisition from verified providers such as OneMiners ensures hardware legitimacy, warranty support, and technical assistance.

Acquisition from verified providers such as OneMiners ensures hardware legitimacy, warranty support, and technical assistance.

Operational Setup Essentials

- Electric Infrastructure: Stable 220V power supply, circuit breakers rated for your miner count, and appropriate surge protection.

- Network Connectivity: Secure, low-latency internet critical for efficient mining.

- Mining Software: Use manufacturer-recommended or open-source options like CGMiner or BFGMiner, configured with reliable mining pool credentials.

- Mining Pools: Joining established pools like F2Pool or AntPool optimizes consistent payouts by pooling hash power.

- Wallets: Use secure Bitcoin wallets, preferably hardware-based (Ledger, Trezor), for storage of mining rewards.

Professional installation and configuration minimize downtime and maximize miner throughput.

Profitability Drivers and Forecasts

Profitability depends on:

- Hash Rate & Network Difficulty: Hash rate determines rewards while difficulty adjusts approximately biweekly affecting competition.

- Electricity Costs: Rates below $0.06/kWh significantly impact margins.

- Bitcoin Market Price: Market fluctuations influence return on mined coins.

- Hardware Efficiency and Depreciation

Profitability example for Antminer S23 at $0.06/kWh and BTC trading at $120,000:

- Daily revenue: ~$84

- Daily electricity cost: ~$10.90

- Estimated daily profit: ~$73.10

ROI estimation typically ranges from 4 to 7 months, influenced by difficulty adjustments and power pricing.

For quick comparisons, miners can also check profitability on external platforms such as ASICProfit, which provides real-time earnings estimates across a wide range of ASIC models.

Risk Mitigation & Operational Best Practices

- Cooling: Effective air conditioning or immersion cooling extends miner lifespan and maintains efficiency.

- Firmware Maintenance: Regular updates reduce security vulnerabilities and improve miner performance.

- Security: Physical security, network segmentation, and secure wallet management prevent asset loss.

- Legal Compliance: Miners must comply with local regulatory frameworks including tax reporting and electrical codes.

Continuous monitoring with remote management tools (HiveOS, Braiins) enhances operational control.

Home Mining vs. Hosting: Choosing the Best Path for Beginners

One of the first decisions new miners face is whether to run ASICs at home or place them in a professional hosting facility. Each option offers advantages depending on budget, electricity rates, living environment, and long-term goals.

Home Mining

Home mining provides full ownership and complete control over your equipment. It allows beginners to learn how ASICs operate, experiment with configurations, and monitor performance directly. Because there are no hosting fees, all operating costs are tied solely to electricity and maintenance.

However, ASICs generate significant heat and noise—often comparable to industrial equipment—making them unsuitable for apartments or densely populated areas. Residential electricity rates are typically higher than commercial or industrial power pricing, which can severely reduce or eliminate profitability. Home setups also face more downtime risks due to household breakers, internet interruptions, and limited cooling capacity.

Hosting Facilities

Hosting facilities offer an environment built specifically for ASIC mining. They supply low-cost power, specialized cooling systems, industrial airflow, and high-uptime electrical infrastructure that keeps miners running consistently. For many beginners, hosting eliminates the need to manage wiring, ventilation, noise control, or maintenance. These facilities also provide monitoring and quick repairs, improving operational stability.

The trade-off is that hosting involves recurring monthly fees and less physical access to your equipment. While miners still retain ownership, all hands-on service is performed by the hosting provider, and access may require scheduling or remote authorization.

For new miners, choosing between home mining and hosting has a major impact on long-term profitability and overall experience. Home mining is ideal for learning and small-scale experimentation, while hosting offers the efficiency, power pricing, and scalability needed for competitive operations in 2026. Understanding these differences early helps miners avoid unnecessary costs and choose the setup that aligns best with their goals and environment.

Understanding Noise, Heat, and Space Requirements

Before purchasing an ASIC, beginners should understand the practical realities of operating mining hardware. ASIC miners are industrial machines, and their noise, heat output, and space demands often surprise new users.

Noise Levels

Most modern ASICs operate between 75 and 90 decibels, comparable to a vacuum cleaner or lawn mower running continuously. This noise level is far too loud for living rooms, bedrooms, or apartments, and even garages may require sound insulation to remain tolerable. Because ASIC fans run at high RPM to cool the chips, noise cannot be reduced without impacting performance unless using specialized setups like custom enclosures or immersion systems.

Heat Output

ASICs release a significant amount of heat, with many units generating 20,000–30,000 BTU/hr depending on model and power draw. This is equivalent to the output of a powerful space heater running nonstop. Without adequate ventilation, a room can overheat within minutes. Home miners typically need additional exhaust fans, ducting, or dedicated cooling solutions to maintain safe operating temperatures.

Space Requirements

Although individual ASICs are compact, miners must account for airflow clearance, power cabling, shelving, and safe access for maintenance. A small home setup can quickly overwhelm a room if proper spacing is not planned. Hot air must be directed out of the room efficiently, and miners should avoid placing units near flammable materials or in enclosed spaces with restricted ventilation.

Ventilation and Home Setup Considerations

Successful home mining requires a clear path for both intake and exhaust airflow. Many miners use window ducts, inline fans, or insulated venting systems to push hot air outside. Without adequate ventilation, ASICs will throttle performance, shut down, or cause room temperatures to climb to unsafe levels. These requirements make home mining feasible only in well-ventilated spaces such as garages, basements with exhaust windows, or dedicated hobby rooms.

Understanding noise and heat levels prevents beginners from making costly mistakes—such as attempting to run an S21 or S23 in a bedroom or small apartment environment. Planning for physical space and ventilation ensures miners operate safely, perform at full efficiency, and avoid unexpected shutdowns or overheating issues.

Understanding Hashprice and Why It Matters in 2026

Hashprice is one of the most important metrics for miners in 2026. It represents the daily revenue generated per terahash of mining power and is usually expressed as $/TH/day. Hashprice fluctuates based on network difficulty, Bitcoin transaction fees, and the market price of Bitcoin. When difficulty rises or Bitcoin’s price drops, hashprice typically declines, reducing miner earnings.

Miners use hashprice to forecast profitability, estimate ROI, and compare hardware options. Because every ASIC consumes different amounts of power to produce each terahash, efficiency becomes a critical factor—more efficient miners have less exposure to low hashprice periods and remain profitable at lower revenue levels. Understanding hashprice helps beginners evaluate mining opportunities more accurately and avoid relying on overly optimistic calculators.

Common Beginner Mistakes to Avoid

New miners often face challenges that can be avoided with proper planning. One common mistake is purchasing used miners without testing or verification, which can lead to costly repairs and lost revenue. Operating miners at home with high electricity rates is another pitfall, as residential power costs can quickly exceed daily earnings.

Ignoring cooling requirements can cause machines to overheat, throttle performance, or fail prematurely. Selecting the wrong mining pool also affects payout consistency and overall profitability. Finally, falling for fake sellers or online scams remains a significant risk in the ASIC market. Beginners should always verify hardware authenticity and calculate true ROI—including electricity costs and hosting fees—before making any purchase.

How to Calculate Profitability Correctly (Now With OneMiners’ Multi-Coin Calculator)

Proper profitability analysis involves more than estimating daily revenue. Thanks to OneMiners’ built-in mining calculators — which support Bitcoin and a variety of altcoins — miners can model earnings under realistic conditions before committing capital.

Use the Calculator to Set Baseline Assumptions

With the calculator, you can input hashrate, power consumption, electricity cost, pool fees, and even exchange rates (for coins other than Bitcoin). The tool then estimates daily, monthly or annual revenue based on current network difficulty and coin price. This lets you project returns before hardware purchase or deployment.

Calculate Breakeven Points & Factor in Depreciation

After obtaining projected revenue, compute your break-even electricity price — i.e. the maximum power cost at which mining remains profitable. Also determine a breakeven hashprice (effective coin revenue per TH per day) to understand how low coin value or high difficulty can drop while still covering expenses. Include expected hardware depreciation (often 6–18 months, depending on efficiency and market conditions) to estimate long-term viability.

Forecast Full Cost Structure (Revenue, Costs & Net Profit)

Use the calculator alongside your real-world costs: electricity, maintenance, pool fees, and hosting or infrastructure expenses. Estimate daily, weekly, and monthly net profit (revenue minus all costs). This reveals a realistic profit/loss window — far more informative than headline revenue alone.

Stress-Test for Different Scenarios

Because coin prices and network difficulty fluctuate, run several scenarios: e.g. conservative (low coin price + high electricity), moderate, and optimistic. This helps you understand how resilient your setup is under worst-case conditions, especially important for altcoins with volatile prices.

ASIC Maintenance Guide for Longevity and Efficiency

Routine maintenance is essential for maximizing the lifespan and performance of ASIC miners. Units should be cleaned regularly to remove dust buildup, which restricts airflow and increases temperatures. Fans may need replacement after extended use, especially in dusty environments. High-performance miners may require periodic repasting of heat sinks to maintain optimal thermal contact.

Firmware should be updated as needed to improve stability, efficiency, and security. Monitoring tools with alarms, such as temperature alerts or hash rate notifications—help detect early signs of issues before they become costly failures. Consistent maintenance can extend ASIC lifespan by one to two years, significantly improving overall return on investment.

Buying ASICs Safely and Avoiding Scams

The ASIC market has many reputable sellers—but also many scammers. Buyers should always request proof of purchase or ownership when buying used equipment. Video verification showing the miner powered on, hashing, and displaying its serial number is essential for confirming functionality. Payments should be made through secure, traceable methods rather than irreversible transfers.

Checking seller reviews, business history, and community reputation helps avoid fraudulent transactions. New miners should be cautious of prices that seem too good to be true, as counterfeit or nonfunctional hardware is common. Safe buying practices protect miners from financial loss and ensure they receive legitimate, working equipment.

When and How to Scale Up a Mining Operation

Scaling a mining operation requires strategic planning rather than simply buying more hardware. Many beginners start with one or two miners, then reinvest mining rewards into additional units as profitability allows. Hosting facilities often provide an easier path to scaling because they handle power, cooling, and maintenance.

Miners should consider upgrading to more efficient hardware during periods of low hash price or after major network difficulty increases. Planning around halving cycles is also important, as earnings typically decrease unless Bitcoin’s price rises significantly. Successful scaling involves balancing reinvestment, hardware refresh cycles, and long-term operational costs.

Market Outlook and Industry Trends

2026 introduces:

- Greater adoption of energy-efficient miners with modular designs.

- AI-assisted management optimizing miner parameters.

- Increasing importance of renewable and low-cost energy contracts.

- Competitive pressure demanding periodic hardware upgrades.

Smaller miners remain viable when leveraging strategic locations, efficient equipment, and professional hosting services such as those provided by OneMiners, which offers transparency, technical support, and AI-optimized mining operations.

Why New Miners Should Consider OneMiners for Energy-Efficient, Scalable Mining

For anyone entering ASIC mining for the first time, OneMiners provides one of the most beginner-friendly and reliable paths into the industry. Their hosting platform handles the most complex elements of mining—power infrastructure, cooling systems, deployment, monitoring, and ongoing maintenance—allowing new miners to learn and scale without technical barriers. Transparent pricing, renewable-energy options, AI-assisted optimization, and a Buy Now, Pay Later hardware program make the mining process both accessible and profitable from day one.

Beyond accessibility, OneMiners has established itself as a global leader in high-performance, energy-efficient mining. Operating at 80 EH/s and targeting 220 EH/s by 2027, the company continues to expand rapidly with energy capacity set to grow from 1,200 MW to 3,500 MW. Its data centers are strategically located in regions with some of the lowest electricity costs worldwide and increasingly powered by renewable sources, reducing environmental impact while maximizing long-term cost stability.

At the center of its operations is AI Smart Mining 2.0, proprietary technology that dynamically optimizes miner performance for maximum efficiency and uptime. Coupled with advanced dry cooling and immersion-cooling systems, OneMiners is able to extend hardware lifespan, minimize downtime, and boost overall profitability.

The company’s Buy Now, Pay Later financing, combined with 98%+ uptime, fast maintenance response, and long-term warranties, lowers entry barriers while offering enterprise-grade reliability. Whether you are an individual miner starting out or an institutional operator seeking large-scale hosting, OneMiners delivers a sustainable, transparent, and technologically advanced environment.

As the mining industry becomes increasingly competitive and energy-intensive in 2026, OneMiners stands as a benchmark for professional hosting, supporting miners with efficiency, innovation, and long-term operational resilience.

Conclusion

Entering the Bitcoin ASIC mining sector in 2026 demands careful planning, strategic investment, and operational diligence. Success hinges on selecting the right hardware, optimizing energy consumption, and implementing robust operational protocols. Given the significant capital commitments, forging partnerships with reputable providers and strictly following industry best practices are essential for long-term profitability and regulatory compliance.

For aspiring miners, this guide offers a professional roadmap to confidently launch, manage, and scale ASIC mining operations in an increasingly competitive and evolving market.