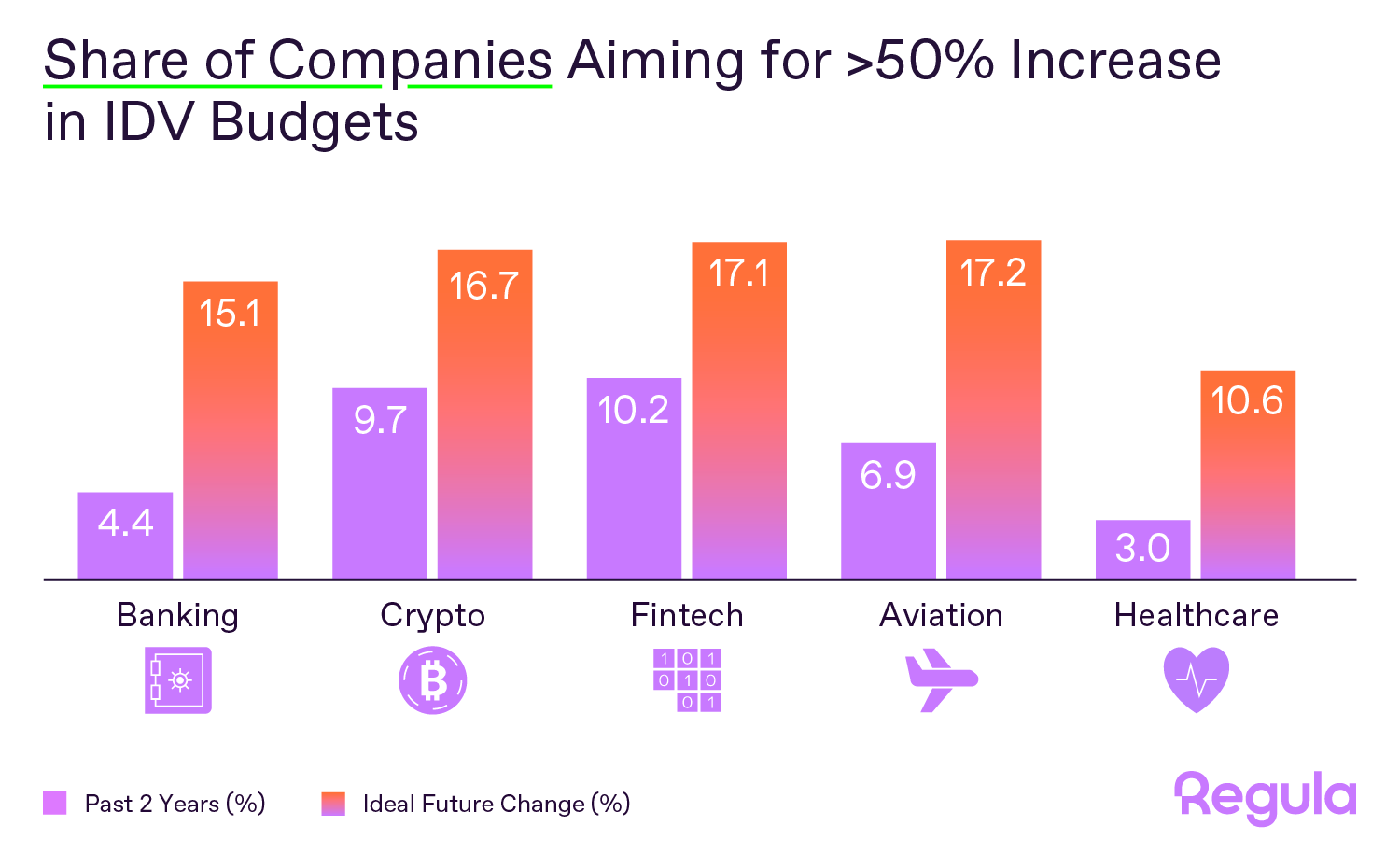

RESTON, Va., Nov. 11, 2025 (GLOBE NEWSWIRE) -- Banks, fintechs, and crypto platforms are ramping up investment in fraud prevention and identity verification (IDV), positioning it as the next layer of cyber defense. According to Regula’s global survey, The Future of Identity Verification: 5 Threats and 5 Opportunities, banks are leading this trend: the share of institutions intending to increase IDV budgets by more than 50% is nearly tripling—from 4.4% to 15% in just two years.

Image. Banks lead the IDV investment surge, but fintech, crypto, and aviation sectors are catching up fast, with roughly one in six companies planning to expand IDV budgets by more than 50%. Even healthcare is joining the trend, signaling how essential verification has become beyond finance.

Moderate increases in identity verification budgets are becoming common across all financial services. Roughly a third of banks and crypto firms and a fifth of fintechs expect 10-20% increases. Meanwhile, at least every third organization in the wider financial services ecosystem is considering more substantial growth of 20-50%.

At the same time, the share of companies aiming at major budget hikes—over 50%—has nearly doubled in both crypto and fintech, reaching about 17% of organizations in each sector today.

The trend is spreading

This recognition is no longer confined to the financial sector. Aviation companies are close behind, with 17% now considering 50%+ budget hikes, while healthcare organizations are beginning to follow suit, though at a more moderate pace, with around 10% expecting such major increases. Across all industries, two-thirds of businesses have already increased IDV spending, and nearly half are preparing for further double-digit growth.

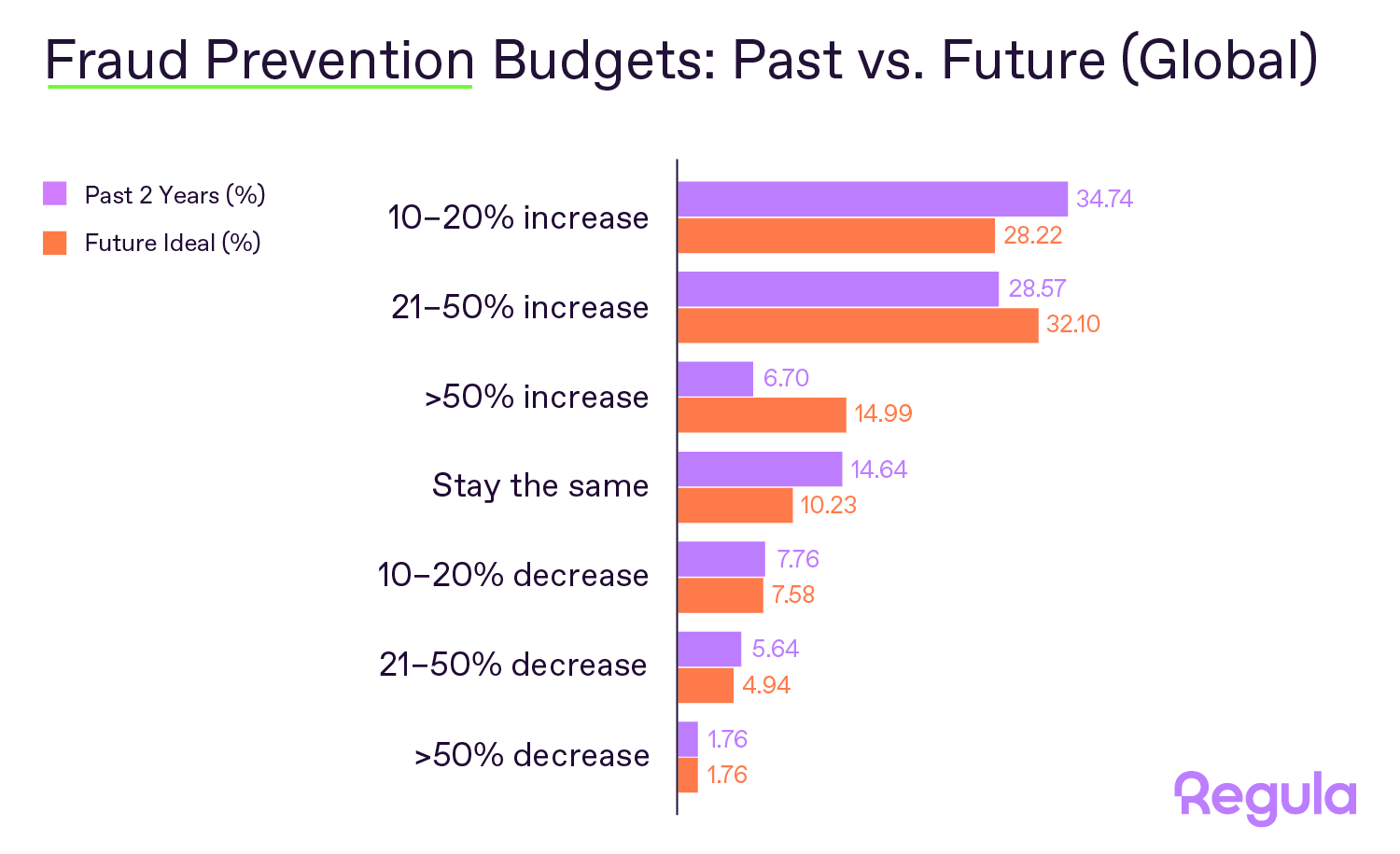

Image. Across industries, organizations are shifting from modest to ambitious fraud-prevention investments. The share of companies targeting 50%+ budget growth more than doubles, reflecting an accelerating commitment to identity verification and fraud defense.

An important shift is also happening in the boardroom: C-suite leaders are taking direct ownership of identity verification, making it a pillar of enterprise resilience. Nearly one in five are now looking forward to increasing their fraud prevention and IDV budgets by 50% or more.

“Executives have finally woken up to the deepfake economy,” said Henry Patishman, Executive Vice President of Identity Verification Solutions at Regula. “They’re realizing that identity verification isn’t a cost of doing business anymore, but a growth engine. Just as cybersecurity became non-negotiable a decade ago, identity verification is now core infrastructure for trust in the AI era.”

Geographically, the US leads the surge, with 22% of American companies aspiring 50%+ budget increases—the highest share worldwide. The UAE, Singapore, and Germany are also showing strong mid-range growth, with about a third of organizations aiming to raise spending by 21–50%.

From box-checking to trust infrastructure

Behind this acceleration is a shift in mindset: identity verification has evolved from a tactical compliance step into a strategic enabler of digital trust.

- 24% of companies now say IDV must become the core of their trust management strategy.

- 27% want it fully integrated across departments—from onboarding and fraud prevention to marketing and customer support.

As businesses build AI-driven ecosystems, the cost of weak identity controls is skyrocketing—from regulatory fines to reputational damage and fraud losses. The new wave of investment reflects a broader realization: trust has become an infrastructure challenge.

About the Report

The Future of Identity Verification: 5 Threats and 5 Opportunities is a global survey commissioned by Regula and conducted by Censuswide, a global market research consultancy, covering enterprises in the banking, fintech, aviation, healthcare, telecom, and crypto sectors. It explores how organizations are reallocating budgets, addressing deepfake-driven fraud, and building cohesive identity frameworks to support growth and compliance.

About Regula

Regula is a global developer of forensic devices and identity verification solutions. With our 30+ years of experience in forensic research and the most comprehensive library of document templates in the world, we create breakthrough technologies for document and biometric verification. Our hardware and software solutions allow over 1,000 organizations and 80 border control authorities globally to provide top-notch client service without compromising safety, security, or speed. Regula has been recognized in the 2025 Gartner® Magic Quadrant™ for Identity Verification.

Learn more at www.regulaforensics.com.

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/e12297fe-b099-4af4-8733-429db763a0ba

https://www.globenewswire.com/NewsRoom/AttachmentNg/45c9ce63-3cd3-4939-ba31-e37e29632a2c

Contact: Kristina – ks@regula.us