Online study and academic help platform Chegg (NYSE:CHGG) reported Q3 CY2024 results beating Wall Street’s revenue expectations, but sales fell 13.5% year on year to $136.6 million. On the other hand, next quarter’s revenue guidance of $142 million was less impressive, coming in 11.8% below analysts’ estimates. Its non-GAAP profit of $0.09 per share was also 27.2% above analysts’ consensus estimates.

Is now the time to buy Chegg? Find out by accessing our full research report, it’s free.

Chegg (CHGG) Q3 CY2024 Highlights:

- Revenue: $136.6 million vs analyst estimates of $134.1 million (1.9% beat)

- Adjusted EPS: $0.09 vs analyst estimates of $0.07 (27.2% beat)

- EBITDA: $22.27 million vs analyst estimates of $20.12 million (10.7% beat)

- Revenue Guidance for Q4 CY2024 is $142 million at the midpoint, below analyst estimates of $161 million

- EBITDA guidance for Q4 CY2024 is $33 million at the midpoint, below analyst estimates of $46.07 million

- Gross Margin (GAAP): 68.2%, up from 47.1% in the same quarter last year

- Operating Margin: -163%, down from -36.7% in the same quarter last year

- EBITDA Margin: 16.3%, down from 24.6% in the same quarter last year

- Free Cash Flow was $23.69 million, up from -$3.57 million in the previous quarter

- Services Subscribers: 3.8 million, down 598,000 year on year

- Market Capitalization: $192.8 million

“While the global education industry continues to experience tremendous change, in Q3, we showed early progress against our strategic plan and delivered better-than-expected revenue and adjusted EBITDA. However, recent technology shifts and generative AI have created significant headwinds, and as a result, we are undertaking an additional restructuring,” said Nathan Schultz, Chief Executive Officer & President of Chegg, Inc.

Company Overview

Started as a physical textbook rental service, Chegg (NYSE:CHGG) is now a digital platform addressing student pain points by providing study and academic assistance.

Consumer Subscription

Consumers today expect goods and services to be hyper-personalized and on demand. Whether it be what music they listen to, what movie they watch, or even finding a date, online consumer businesses are expected to delight their customers with simple user interfaces that magically fulfill demand. Subscription models have further increased usage and stickiness of many online consumer services.

Sales Growth

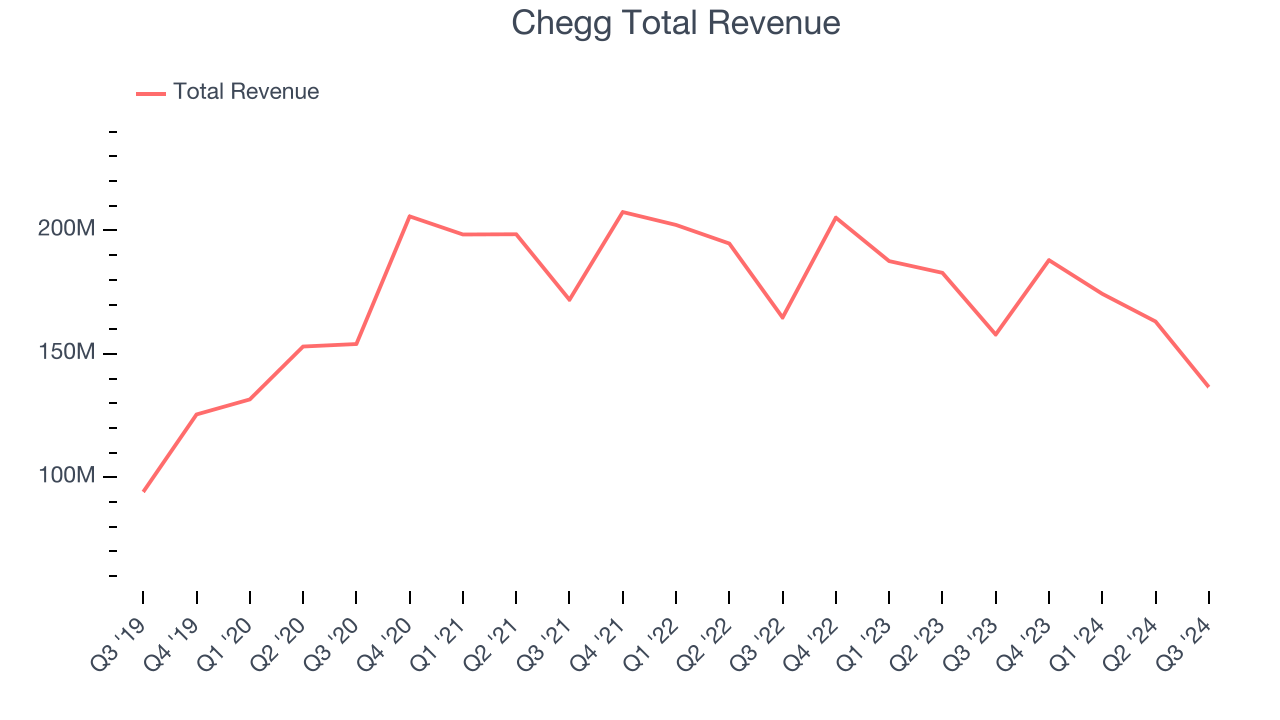

A company’s long-term performance can give signals about its business quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Chegg struggled to generate demand over the last three years as its sales dropped by 5.1% annually, a rough starting point for our analysis.

This quarter, Chegg’s revenue fell 13.5% year on year to $136.6 million but beat Wall Street’s estimates by 1.9%. Company management is currently guiding for a 24.5% year-on-year decline next quarter.

Looking further ahead, sell-side analysts expect revenue to decline 10.4% over the next 12 months, a deceleration versus the last three years. This projection is underwhelming and implies its products and services will face some demand challenges.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

Services Subscribers

User Growth

As a subscription-based app, Chegg generates revenue growth by expanding both its subscriber base and the amount each subscriber spends over time.

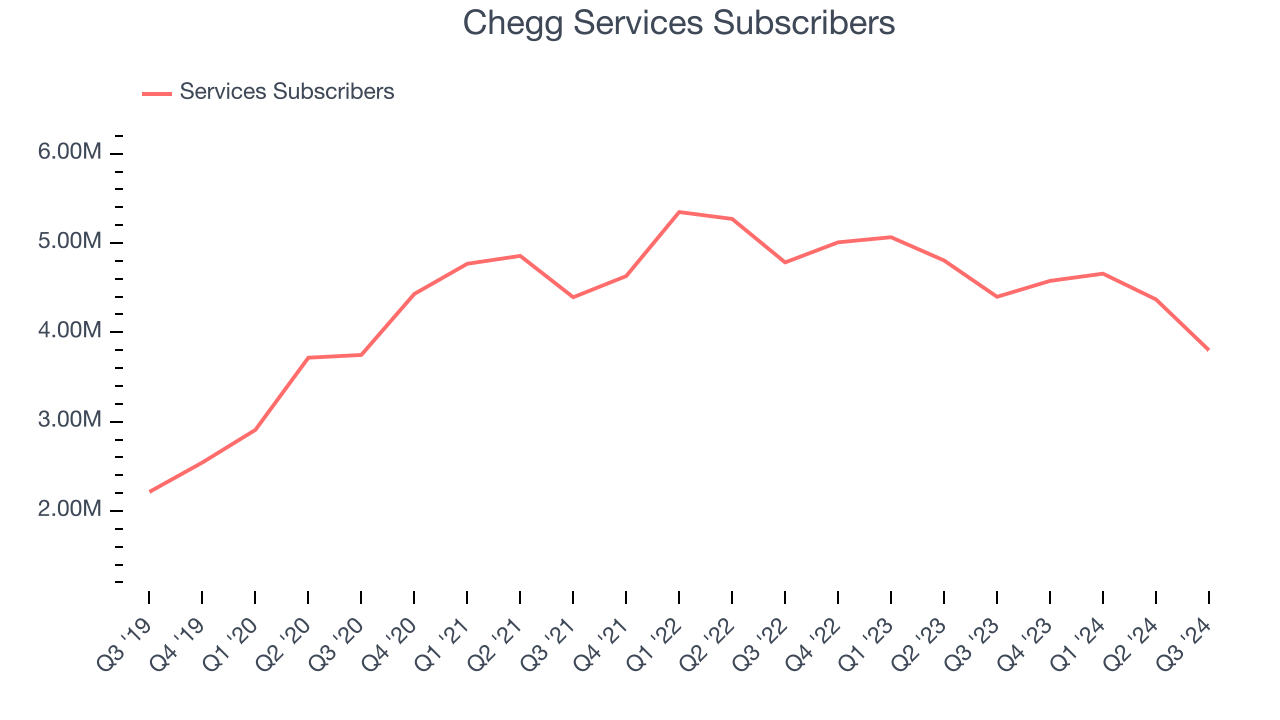

Chegg struggled to engage its services subscribers over the last two years as they have declined by 6.7% annually to 3.8 million in the latest quarter. This performance isn't ideal because internet usage is secular. If Chegg wants to accelerate growth, it must enhance the appeal of its current offerings or innovate with new products.

In Q3, Chegg’s services subscribers once again decreased by 598,000, a 13.6% drop since last year. The quarterly print was lower than its two-year result, suggesting its new initiatives aren’t moving the needle for users yet.

Revenue Per User

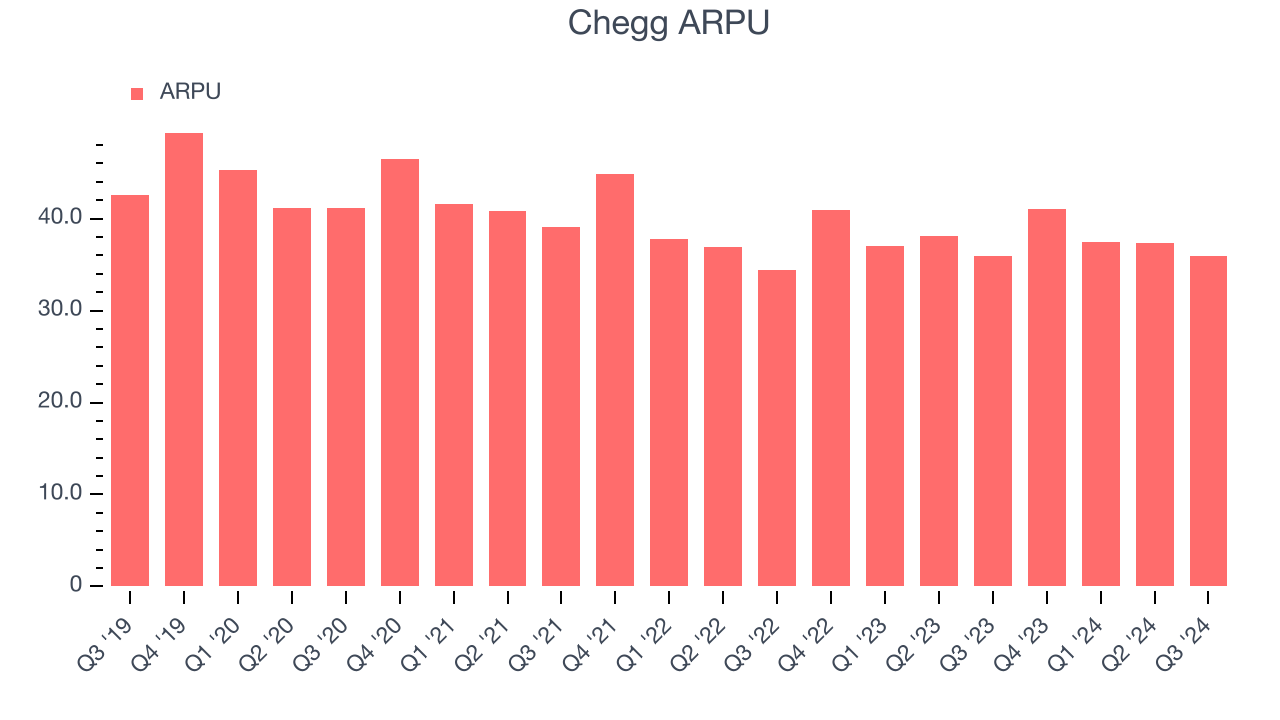

Average revenue per user (ARPU) is a critical metric to track for consumer internet businesses like Chegg because it measures how much the average user spends. ARPU is also a key indicator of how valuable its users are (and can be over time).

Chegg’s ARPU has been roughly flat over the last two years. This raises questions about its platform’s health when paired with its declining services subscribers. If Chegg wants to increase its users, it must either develop new features or provide some existing ones for free.

This quarter, Chegg’s ARPU clocked in at $35.95. It was flat year on year but outperformed the change in its services subscribers.

Key Takeaways from Chegg’s Q3 Results

We liked that Chegg beat analysts’ revenue and EBITDA expectations this quarter. On the other hand, its number of users declined and this figure fell short of Wall Street’s estimates. Looking ahead, revenue and EBITDA guidance for next quarter also missed. Overall, this quarter was mediocre, and with the market thinking that Chegg's business will be decimated by AI, the company needs much better quarters to convince investors otherwise and get the stock up. Shares traded down 10.1% to $1.60 immediately after reporting.

Chegg didn’t show it’s best hand this quarter, but does that create an opportunity to buy the stock right now? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.