Rocket Companies’s 36.6% return over the past six months has outpaced the S&P 500 by 18.2%, and its stock price has climbed to $18.93 per share. This was partly due to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Is now still a good time to buy RKT? Or are investors being too optimistic? Find out in our full research report, it’s free.

Why Does RKT Stock Spark Debate?

Born in Detroit during the 1980s and evolving into a tech-driven financial powerhouse, Rocket Companies (NYSE: RKT) is a fintech company that provides digital mortgage lending, real estate services, and personal finance solutions through its technology platform.

Two Positive Attributes:

1. Projected Net Interest Income Growth Is Remarkable

Forecasted net interest income by Wall Street analysts signals a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite, though some deceleration is natural as businesses become larger.

Over the next 12 months, sell-side analysts expect Rocket Companies’s net interest income to rise by 47.8%

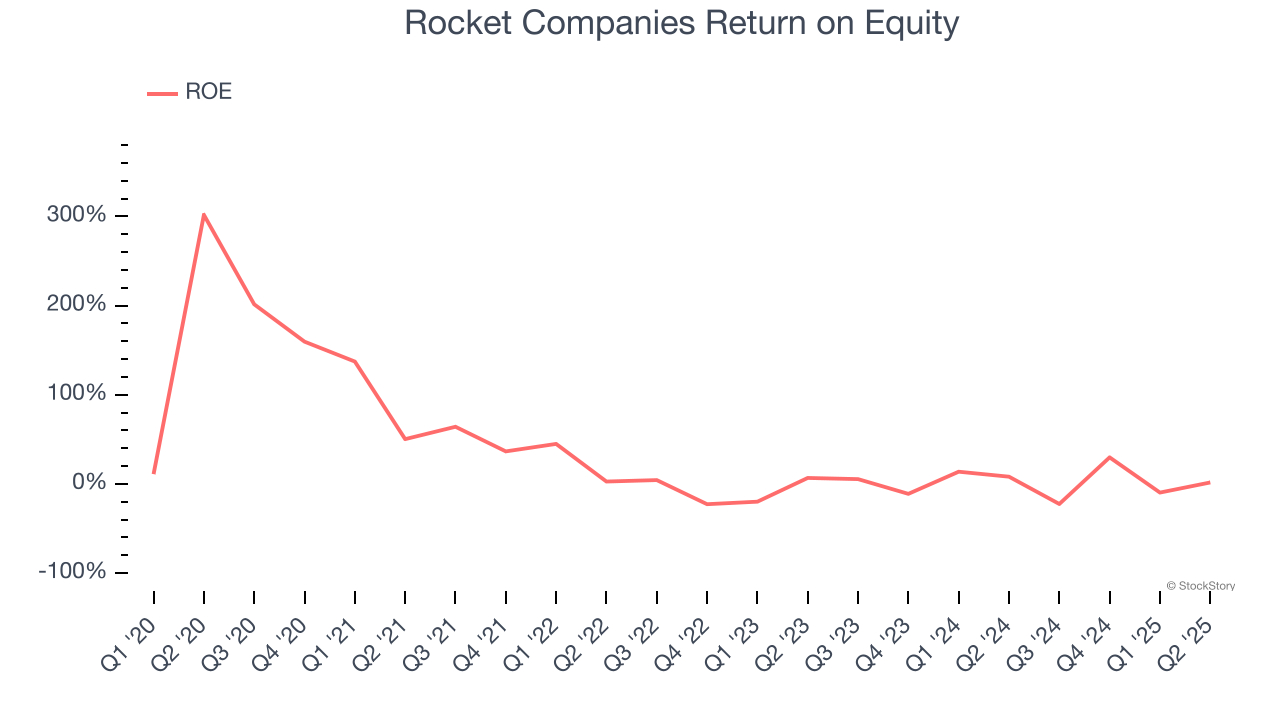

2. Stellar ROE Showcases Lucrative Growth Opportunities

Return on equity (ROE) measures how effectively banks generate profit from each dollar of shareholder equity - a critical funding source. High-ROE institutions typically compound shareholder wealth faster over time through retained earnings, share repurchases, and dividend payments.

Over the last five years, Rocket Companies has averaged an ROE of 34.1%, exceptional for a company operating in a sector where the average shakes out around 7.5% and those putting up 15%+ are greatly admired. This shows Rocket Companies has a strong competitive moat.

One Reason to be Careful:

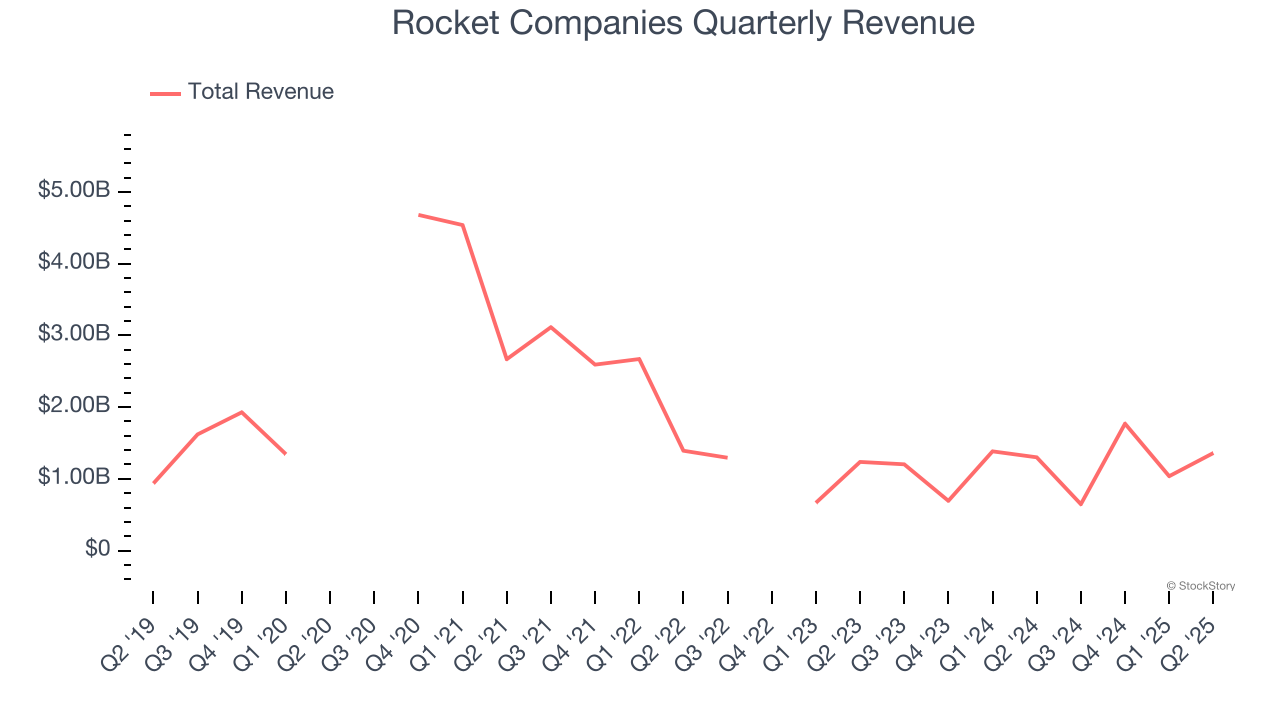

Revenue Spiraling Downwards

In general, banks make money from two primary sources. The first is net interest income, which is interest earned on loans, mortgages, and investments in securities minus interest paid out on deposits. The second source is non-interest income, which can come from bank account, credit card, wealth management, investing banking, and trading fees.

Rocket Companies struggled to consistently generate demand over the last five years as its revenue dropped at a 13.4% annual rate. This wasn’t a great result, but there are still things to like about Rocket Companies.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.Final Judgment

Rocket Companies’s positive characteristics outweigh the negatives, and with its shares outperforming the market lately, the stock trades at 3.7× forward P/B (or $18.93 per share). Is now the right time to buy? See for yourself in our comprehensive research report, it’s free.

High-Quality Stocks for All Market Conditions

Trump’s April 2025 tariff bombshell triggered a massive market selloff, but stocks have since staged an impressive recovery, leaving those who panic sold on the sidelines.

Take advantage of the rebound by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.